PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907214

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907214

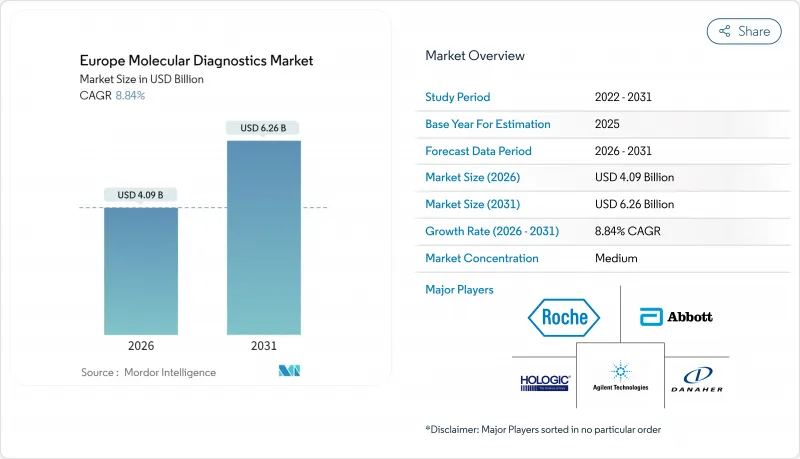

Europe Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe molecular diagnostics market size in 2026 is estimated at USD 4.09 billion, growing from 2025 value of USD 3.76 billion with 2031 projections showing USD 6.26 billion, growing at 8.84% CAGR over 2026-2031.

Adoption of precision-medicine protocols, full enforcement of the In Vitro Diagnostic Regulation (IVDR), and stable funding for antimicrobial-resistance surveillance shape this outlook. Point-of-care (POC) platforms reduce diagnostic turnaround to under an hour, while next-generation sequencing (NGS) moves routine testing from single-gene PCR toward comprehensive genomic profiling. NGS run costs, now below USD 500 per whole exome, make high-throughput sequencing affordable for mid-tier laboratories. Artificial-intelligence (AI) engines that optimize primer and probe design shorten assay-development cycles, attracting venture funding in Germany, the Netherlands, and France. Together, these factors reinforce the Europe molecular diagnostics market as a cornerstone of hospital modernization programs across the region.

Europe Molecular Diagnostics Market Trends and Insights

Rising Adoption of Point-of-Care Molecular Assays

Europe's hospitals now place cartridge-based PCR and isothermal devices in emergency and outpatient units, cutting respiratory-pathogen turnaround from 24 hours to 45 minutes. German tertiary centers report that 60% of emergency departments use POC molecular panels for sepsis triage by 2024. Integrated analyzers upload results directly to electronic records, enabling antibiotic stewardship teams to adjust therapy within a single shift. Scandinavian primary-care clinics pilot near-patient multiplex panels for influenza, RSV, and SARS-CoV-2, reinforcing epidemiologic surveillance. Vendors respond with ruggedized instruments validated for bedside operation, barcoded reagent tracking, and secure cloud dashboards that meet GDPR requirements.

Advances in NGS & Pharmacogenomics Platforms

Sequencing consumable prices dropped 38% between 2023 and 2025, enabling mid-tier labs to offer 500-gene oncology panels under EUR 450 per sample (USD 489). Liquid-biopsy assays detect minimal residual disease months before imaging, prompting therapy adjustments without invasive tissue sampling. The European Medicines Agency now lists 28 companion diagnostics requiring NGS-double the 2022 count-which accelerates test-menu expansion. French payers reimburse CYP450 and DPYD panels, improving antidepressant and fluoropyrimidine safety. Eastern European reference labs outsource bioinformatics to cloud pipelines hosted in Frankfurt and Dublin, bypassing local skill shortages while meeting data-residency rules. Collectively, these factors propel the Europe molecular diagnostics market toward data-rich oncology workflows.

Requirement for High-Complexity Testing Infrastructure

Advanced workflows need ISO 15189 accreditation, biosafety cabinets, and precision thermocyclers-assets scarce outside Western Europe. In 2024, demand for clinical bioinformaticians exceeded supply by 40%, delaying report sign-off in many Eastern European labs. Limited broadband hampers cloud pipelines in rural districts. EU cohesion funds finance upgrades, yet disbursement cycles stretch to five years. These infrastructure gaps temper near-term uptake, moderating the Europe molecular diagnostics market's reach in less-resourced regions.

Other drivers and restraints analyzed in the detailed report include:

- Surge in EU-wide Antimicrobial-Resistance Surveillance Mandates

- IVDR-Driven Demand for CE-IVD Companion Diagnostics

- Fragmented Payer Reimbursement Across EU-27

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PCR platforms generated USD 1.47 billion in 2025, equal to 39.12% of the Europe molecular diagnostics market size. Syndromic respiratory and sepsis panels remain anchored in qPCR due to mature workflows. Sequencing outpaces all technologies at a 9.45% CAGR, capturing oncology and infectious-disease tie-outs. Oxford Nanopore's portable sequencers type meningitis pathogens in 45 minutes, encouraging hybrid strategies in which rapid PCR rules out common infections and on-demand NGS clarifies resistance profiles. Mass spectrometry and microarrays retain niches, but AI-enabled reagent design increasingly blurs platform borders, deepening vendor competition across the Europe molecular diagnostics market.

Infectious disease assays produced USD 1.73 billion in 2025, or 46.10% of the Europe molecular diagnostics market size. Multiplex panels detect 20+ pathogens per sample, reducing sequential testing. Whole-genome sequencing traces hospital outbreaks, feeding infection-control dashboards. Oncology assays grow at 9.52% CAGR, driven by liquid biopsy and targeted therapy selection. Pharmacogenomics panels cross into psychiatry and cardiology, though payer support lags in Southern Europe. Expanded newborn-screening programs push genetic-disease testing, while antimicrobial-resistance assays integrate qPCR with sequencing to oversee surveillance.

The Europe Molecular Diagnostics Market Report is Segmented by Technology (In Situ Hybridization, and More), Application (Infectious Disease Diagnostics, and More), Product (Instruments & Analysers, and More), End-User (Hospitals, and More), Sample Type (Blood, and More), Test Setting (Centralised Laboratories, and More), and Geography (Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Agilent Technologies

- Beckton Dickinson

- bioMerieux

- Biocartis NV

- Cepheid (Danaher)

- Danaher Corporation (Beckman, Leica, Cepheid)

- Eurofins

- Roche

- GenMark Diagnostics

- Hologic

- Illumina

- Luminex (DiaSorin)

- Myriad Genetics

- Oxford Nanopore Technologies

- QIAGEN

- Seegene

- Siemens Healthineers

- Sysmex

- Thermo Fisher Scientific

- T2 Biosystems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Point-of-care (POC) Molecular Assays

- 4.2.2 Advances in NGS & Pharmacogenomics Platforms

- 4.2.3 Surge in EU-wide Antimicrobial-resistance Surveillance Mandates

- 4.2.4 IVDR-driven Demand for CE-IVD Companion Diagnostics

- 4.2.5 Growth of AI-assisted Primer/probe Design Startups

- 4.3 Market Restraints

- 4.3.1 Requirement for High-complexity Testing Infrastructure

- 4.3.2 Fragmented Payer Reimbursement Across EU-27

- 4.3.3 Shortage of Certified Molecular-bioinformaticians

- 4.3.4 GDPR-related Restrictions on Cross-border Sample Transfer

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD)

- 5.1 By Technology

- 5.1.1 In Situ Hybridization

- 5.1.2 Chips and Microarrays

- 5.1.3 Mass Spectrometry (MS)

- 5.1.4 Sequencing

- 5.1.5 PCR

- 5.1.6 Other Technologies

- 5.2 By Application

- 5.2.1 Infectious Disease Diagnostics

- 5.2.2 Oncology & Liquid Biopsy

- 5.2.3 Pharmacogenomics

- 5.2.4 Genetic Disease Testing

- 5.2.5 Microbiology & Antimicrobial-Resistance

- 5.2.6 Other Applications

- 5.3 By Product

- 5.3.1 Instruments & Analysers

- 5.3.2 Reagents & Kits

- 5.3.3 Software & Services

- 5.4 By End-user

- 5.4.1 Hospitals & Hospital Labs

- 5.4.2 Independent Reference Laboratories

- 5.4.3 Point-of-Care / Near-Patient Settings

- 5.4.4 Academic & Research Institutes

- 5.5 By Sample Type

- 5.5.1 Blood / Plasma

- 5.5.2 Tissue / FFPE

- 5.5.3 Saliva & Buccal Swab

- 5.5.4 Urine & Other Body Fluids

- 5.6 By Test Setting

- 5.6.1 Centralised Laboratories

- 5.6.2 Decentralised / POC Sites

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Spain

- 5.7.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Agilent Technologies

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 bioMerieux SA

- 6.3.5 Biocartis NV

- 6.3.6 Cepheid (Danaher)

- 6.3.7 Danaher Corporation (Beckman, Leica, Cepheid)

- 6.3.8 Eurofins Scientific

- 6.3.9 F. Hoffmann-La Roche Ltd

- 6.3.10 GenMark Diagnostics

- 6.3.11 Hologic Inc.

- 6.3.12 Illumina Inc.

- 6.3.13 Luminex (DiaSorin)

- 6.3.14 Myriad Genetics

- 6.3.15 Oxford Nanopore Technologies

- 6.3.16 QIAGEN N.V.

- 6.3.17 Seegene Inc.

- 6.3.18 Siemens Healthineers

- 6.3.19 Sysmex Corporation

- 6.3.20 Thermo Fisher Scientific

- 6.3.21 T2 Biosystems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment