PUBLISHER: Roots Analysis | PRODUCT CODE: 1919796

PUBLISHER: Roots Analysis | PRODUCT CODE: 1919796

North America Molecular Diagnostics Market, till 2035: Distribution by Test Type, Type of Offering, Type of Sample, Type of Technology, Therapeutic Area, End User and Geographical Regions - Industry Trends and Forecast 2026-2035

NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET: OVERVIEW

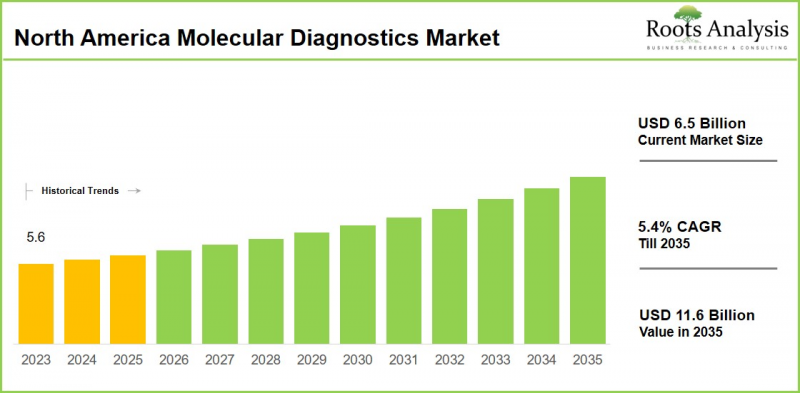

As per Roots Analysis, the North America molecular diagnostics market is estimated to grow from USD 6.5 billion in the current year to USD 11.6 billion by 2035 at a CAGR of 5.6% during the forecast period, 2026-2035.

NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET: GROWTH AND TRENDS

Molecular diagnostic tests are designed to identify specific sequences in human genomic samples, including DNA or RNA, to diagnose a specific disease. Additionally, these tests seek to detect single nucleotide polymorphisms, deletions, rearrangements, and insertions within the genetic sequences.

The World Health Organization (WHO) states that there are more than 40,000 in vitro diagnostic products presently in the market. This extensive range of products emphasizes the essential importance of diagnostics in healthcare. It is important to note that more than 70% of healthcare decisions rely on laboratory test results, since they offer critical information that aids in diagnoses, directs treatment options, tracks disease progression, and evaluates responses to therapy. This highlights the crucial importance of laboratory specialists and diagnostic testing in providing precise, prompt, and efficient patient care.

Molecular diagnostic tests are essential for identifying different diseases, tracking healthcare reactions, and forecasting healthcare results. The growth of the North America molecular diagnostics market is largely propelled by the growing incidence of chronic and infectious illnesses, a higher adoption rate of personalized medicine, and innovations in technology, such as point-of-care testing and next-generation sequencing. Considering the advantages provided by these diagnostic solutions for delivering quick results and enhancing patient outcomes, the North America molecular diagnostics market is expected to expand at a robust CAGR throughout the projected period.

Growth Drivers: Strategic Enablers of Market Expansion

The North America molecular diagnostics market is driven by several important factors, including the increasing incidence of chronic and infectious diseases, such as cancer, heart diseases, and diabetes, which require rapid and precise testing techniques including PCR and next-generation sequencing. Innovations in technology, such as point-of-care testing, the integration of AI, and companion diagnostics, along with rising healthcare spending and an older population, further boost demand, especially in the US where millions of laboratory tests are conducted every year. Government initiatives aimed at early detection, personalized medicine, and pandemic preparedness also contribute to significant market growth.

Market Challenges: Critical Barriers Impeding Progress

The North America molecular diagnostics market encounters several challenges, including the high expenses associated with advanced diagnostic instruments, reagents, and tests, which hinder adoption particularly in smaller laboratories or underserved areas. Further, regulatory challenges are considerable, characterized by complex and rigorous approval procedures that delay market entry and escalate development costs. Furthermore, a lack of skilled laboratory professionals trained in molecular methodologies and bioinformatics also limits test precision. Additionally, concerns over data privacy related to the handling of genetic information and challenges with integrating electronic health records impede the scalability and comprehensive implementation of molecular diagnostic solutions in healthcare systems.

Polymerase Chain Reaction (PCR): Leading Market Segment

Currently, polymerase chain reaction (PCR) segment captures more than 40% of the overall market share, owing to its accuracy, speed, and widespread application in diagnosing infectious diseases, genetic disorders, and cancer. However, the next generation sequencing segment is likely to grow at a higher CAGR of 7.3% during the forecast period, which is most likely to be driven by its ability to provide comprehensive genomic information and advanced personalized medicine.

Blood, Serum and Plasma: Dominating Market Segment

In terms of sample, the North America molecular diagnostics market is segmented across blood, serum and plasma. Currently, majority (~80%) of the market share is held by blood, serum and plasma. This can be attributed to the fact that blood, serum, and plasma are routinely collected in clinical settings, making them convenient for large-scale testing and continuous monitoring. Further, the urine segment is likely to grow at a higher CAGR (7.1%) during the forecast period.

NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET: KEY SEGMENTS

Test Type

- Laboratory

- Point-of-Care Testing

Type of Offering

- Reagents

- Instruments

- Services

Type of Sample

- Blood, Serum and Plasma

- Urine

- Others

Type of Technology

- PCR

- In situ Hybridization

- Isothermal Nucleic Acid Amplification Technology

- Next Generation Sequencing

- Microarrays

- Mass Spectrometry

- Others

Therapeutic Area

- Cardiovascular Diseases

- Genetic Diseases

- Others

End Users

- Hospitals

- Laboratories

- Others

Geographical Regions

- North America

- US

- Canada

Example Players in the North America Molecular Diagnostics Market

- Abbott

- Agilent Technologies

- BD

- Bio-Rad

- Danaher

- Hologic

- Illumina

- Perkin Elmer

- Thermo Fisher Scientific

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many molecular diagnostic service providers are currently engaged in this market?

- Which are the leading companies in this market?

- Which country dominates the North America molecular diagnostics market?

- What are the key trends observed in the North America molecular diagnostics market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by molecular diagnostic service providers in North America?

- What is the current and future North America molecular diagnostics market size?

- What is the CAGR of North America molecular diagnostics market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

COMPLEMENTARY BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Key Technologies Employed in Molecular Diagnostic Solution

- 6.3. Challenges in the Molecular Diagnostics Domain

- 6.4. Recent Developments in the Molecular Diagnostics Domain

- 6.4.1. Future Perspective in the Molecular Diagnostics Domain

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. North America Molecular Diagnostics Market: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

- 7.2.5. Analysis by Type of Technology

- 7.2.6. Analysis by Diagnostic Applications

- 7.2.6.1. Analysis by Type of Technology and Diagnostic Applications

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Molecular Diagnostic Solution Providers in North America: Company Competitiveness Analysis

- 8.4.1. Small Molecular Diagnostic Solution Providers (Peer Group I)

- 8.4.2. Mid-sized Molecular Diagnostic Solution Providers (Peer Group II)

- 8.4.3. Large Molecular Diagnostic Solution Providers (Peer Group III)

- 8.5. Capability Benchmarking of top Molecular Diagnostic Solution Providers

9. COMPANY PROFILES: NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET

- 9.1. Chapter Overview

- 9.2. Abbott

- 9.2.1. Company Overview

- 9.2.2. Product Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Agilent Technologies

- 9.4. BD

- 9.5. Danaher

- 9.6. Thermo Fisher Scientific

- 9.7. Bio-Rad

- 9.8. Illumina

- 9.9. Hologic

- 9.10. PerkinElmer

- 9.11. QuidelOrtho

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Molecular Diagnostic Solution Providers: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Most Active Players: Analysis by Number of Partnerships

- 10.3.4. Analysis by Geography

- 10.3.4.1. Intercontinental and Intracontinental Agreements

- 10.3.4.2. Local and International Agreements

11. MARKET IMPACT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Market Drivers

- 11.3. Market Restraints

- 11.4. Market Opportunities

- 11.5. Market Challenges

- 11.6. Conclusion

12. NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. North America Molecular Diagnostics Market: Historical Trends (Since 2023) and Forecasted Estimates (Till 2035)

- 12.4. Roots Analysis Perspective on Market Growth

- 12.5 Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET, BY TEST TYPE

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. North Market Molecular Diagnostics Market: Distribution by Test Type

- 13.3.1. North Market Molecular Diagnostics Market for Laboratory Testing, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 13.3.2. North Market Molecular Diagnostics Market for Point-of-Care Testing, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 13.4. Data Triangulation and Validation

14. NORTH AMERICA MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. North Market Molecular Diagnostics Market: Distribution by Sample Type

- 14.3.1. North Market Molecular Diagnostics Market for Blood, Serum and Plasma, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.1.1. Molecular Diagnostics Market for Urine, (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.1.2. Molecular Diagnostics Market for Other Samples, (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.2. Molecular Diagnostics Marlet for Reagents, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.3. Molecular Diagnostics Market for Services, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.1. North Market Molecular Diagnostics Market for Blood, Serum and Plasma, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.4. Data Triangulation and Validation

15. MOLECULAR DIAGNOSTICS MARKET, BY TYPE OF TECHNOLOGY

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Molecular Diagnostics Market: Distribution by Type of Technology

- 15.3.1. Molecular Diagnostics Market for PCR, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 15.3.2. Molecular Diagnostics Market for Next Generation Sequencing, (Since 2023) and Forecasted Estimates (Till 2035)

- 15.3.3. Molecular Diagnostics Market for Microarrays, (Since 2023) and Forecasted Estimates (Till 2035)

- 15.3.4. Molecular Diagnostics Market for Mass Spectrometry, (Since 2023) and Forecasted Estimates (Till 2035)

- 15.3.5. Molecular Diagnostics Market for Other Technologies, (Since 2023) and Forecasted Estimates (Till 2035)

- 15.4. Data Triangulation and Validation

16. MOLECULAR DIAGNOSTICS MARKET, BY THERAPEUTIC AREA

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Molecular Diagnostics Market: Distribution by Therapeutic Area

- 16.3.1. Molecular Diagnostics Market for Infectious Diseases, (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.1. Molecular Diagnostics Market for COVID-19, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.2. Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.3. Molecular Diagnostics Market for Healthcare-associated Infections, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.4. Molecular Diagnostics Market for Hepatitis, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.5. Molecular Diagnostics Market for HIV, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.6. Molecular Diagnostics Market for Sexually Transmitted Diseases, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1.7. Molecular Diagnostics Market for Other Infectious Diseases, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2. Molecular Diagnostics Market for Oncological Disorders, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.1. Molecular Diagnostics Market for Lung Cancer, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.2. Molecular Diagnostics Market for Breast Cancer, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.3. Molecular Diagnostics Market for Colorectal Cancer, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.4. Molecular Diagnostics Market for Prostate Cancer, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.5. Molecular Diagnostics Market for Gastric Cancer, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.2.6. Molecular Diagnostics Market for Other Oncological Disorders, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.3. Molecular Diagnostics Market for Cardiovascular Diseases, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.4. Molecular Diagnostics Market for Neurological Diseases, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.5. Molecular Diagnostics Market for Genetic Diseases, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.6. Molecular Diagnostics Market for Other Therapeutic Areas, (Since 2023) and Forecasted Estimates (Till 2035)

- 16.3.1. Molecular Diagnostics Market for Infectious Diseases, (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 16.4. Data Triangulation and Validation

17. MOLECULAR DIAGNOSTICS MARKET, BY END USERS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Molecular Diagnostics Market: Distribution by End Users (Current Year and 2035)

- 17.3.1. Molecular Diagnostics Market for Laboratories, (Since 2023) and Forecasted Estimates (Till 2035)

- 17.3.1.1. Molecular Diagnostics Market for Large Laboratories, (Since 2023) and Forecasted Estimates (Till 2035)

- 17.3.1.2. Molecular Diagnostics Market for Small and Medium-sized Laboratories, (Since 2023) and Forecasted Estimates (Till 2035)

- 17.3.2. Molecular Diagnostics Market for Hospitals, (Since 2023) and Forecasted Estimates (Till 2035)

- 17.3.3. Molecular Diagnostics Market for Other End Users, (Since 2023) and Forecasted Estimates (Till 2035)

- 17.3.4. Data Triangulation and Validation

- 17.3.1. Molecular Diagnostics Market for Laboratories, (Since 2023) and Forecasted Estimates (Till 2035)

18. MOLECULAR DIAGNOSTICS MARKET, BY GEOGRAPHICAL REGIONS

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Molecular Diagnostics Market: Distribution by Geographical Regions (Current Year and 2035)

- 18.3.1. Molecular Diagnostics Market in North America, (Since 2023) and Forecasted Estimates (Till 2035)

- 18.3.1.1. Molecular Diagnostics Market in the US, (Since 2023) and Forecasted Estimates (Till 2035)

- 18.3.1.2. Molecular Diagnostics Market in Canada, (Since 2023) and Forecasted Estimates (Till 2035)

- 18.3.1. Molecular Diagnostics Market in North America, (Since 2023) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. CONCLUDING REMARKS

20. APPENDIX I: TABULATED DATA

21. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS