PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907223

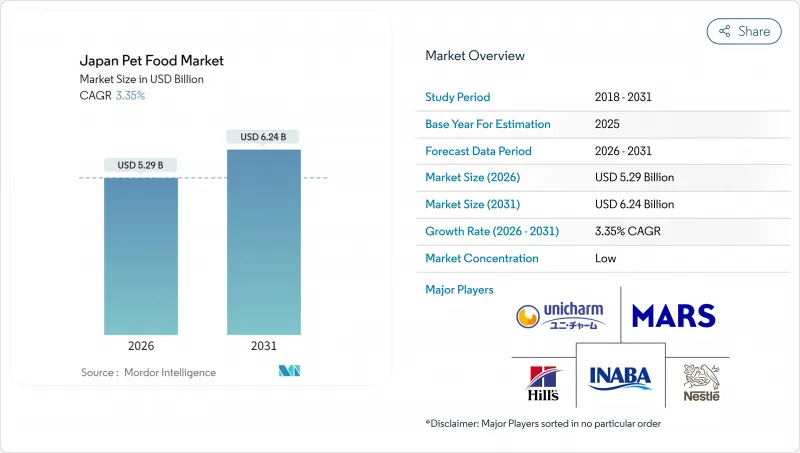

Japan Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan pet food market size in 2026 is estimated at USD 5.29 billion, growing from 2025 value of USD 5.12 billion with 2031 projections showing USD 6.24 billion, growing at 3.35% CAGR over 2026-2031.

This growth is driven by a mature pet ownership base, with 38.1% of households being single-person units increasingly relying on pets for companionship. Premiumization remains a key factor, as pet owners prioritize functional ingredients, organic formulations, and veterinary-prescribed therapeutic diets to ensure the health and well-being of their pets. Additional growth drivers include the rise of digital commerce, which provides convenience and access to a wider range of products, disaster-preparedness stockpiling due to Japan's vulnerability to natural disasters, and a shift toward smaller pets that are better suited for urban apartments with limited space. However, trends such as home-cooked pet meals, which appeal to owners seeking greater control over their pets' diets, and periodic import restrictions, which can disrupt supply chains, slightly constrain volume growth. The market remains fragmented, enabling competition among global leaders and domestic players based on quality, safety, and brand trust, with companies focusing on innovation and tailored offerings to meet evolving consumer preferences.

Japan Pet Food Market Trends and Insights

Humanization of Pets Driving Premiumization

Japanese owners increasingly treat pets as family members, pushing demand for human-grade nutrition. Organic and natural formulations are rising rapidly, far outpacing the broader Japan pet food market. Clean-label requirements, single-protein recipes, and transparent sourcing dominate new product launches, while revised additive standards tighten compliance . Brands that offer human-grade processing and traceable ingredients command 20-30% price premiums without deterring purchase intent. Growing veterinary endorsement of functional ingredients and the rise of pet cafes featuring organic menus further accelerate this trend, signaling a structural shift toward wellness-oriented pet diets in Japan.

Aging Pet Population Requiring Functional Diets

Senior pets now mirror Japan's aging human demographic, prompting owners to prioritize therapeutic nutrition over reactive care. Veterinary diets are expanding rapidly, with standard formulations now featuring omega-3s, probiotics, and joint-support nutrients. Companies investing in age-specific research, clinical validation, and collaborations with veterinary clinics are capturing stronger brand loyalty among health-conscious households. Rising awareness of preventive health, coupled with increased veterinary visits and insurance adoption, is reinforcing the long-term shift toward specialized senior pet nutrition in Japan.

Declining Birthrate Limiting Long-Term Pet Additions

Japan's fertility rate fell to 1.26 births per woman in 2024, shrinking the pool of first-time pet owners typically aged 25-35 . Rural depopulation accelerates the trend, tightening the future customer base even as existing owners spend more per pet. Long-term growth, therefore, rests on premiumization, not headcount expansion. The demographic imbalance shifts the Japan pet food market toward high-value, low-volume dynamics.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Penetration Expanding Accessibility

- Rise in Single-Person Households Boosting Ownership

- Stringent Ingredient Regulations Raising Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food accounted for 73.55% of Japan pet food market share in 2025, far ahead of treats, supplements, and veterinary diets. Dry kibble remains the volume anchor, while wet food gains share among premium brands emphasizing palatability and hydration. Treats rank second in revenue and show the fastest expansion due to indulgence trends. Nutraceuticals and veterinary diets remain smaller but premium-priced niches supported by professional endorsement and insurance coverage.

Pet treats are projected to post the highest 5.86% CAGR through 2031, outpacing the 3.35% baseline for the overall Japan pet food market. Veterinary diets represent a specialized but growing segment, benefiting from increased veterinary recommendations and pet insurance coverage that reduces cost barriers for therapeutic nutrition. The segment's growth reflects Japan's sophisticated veterinary care infrastructure and pet owners' willingness to invest in medically prescribed solutions.

The Japan Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and More), by Pets (Cats, Dogs, and More), and by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Unicharm Corporation

- Mars, Incorporated

- Inaba-Petfood Co., Ltd.

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- ADM

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- Virbac S.A.

- Spectrum Brands, Inc.,

- Nippon Pet Food Co., Ltd.

- DoggyMan H.A.Co.,Ltd.

- Petio Corp.

- Earth Pet Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 EXECUTIVE SUMMARY AND KEY FINDINGS

3 REPORT OFFERS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Humanization of Pets Driving Premiumization

- 5.5.2 Aging Pet Population Requiring Functional Diets

- 5.5.3 E-commerce Penetration Expanding Accessibility

- 5.5.4 Rise in Single-Person Households Boosting Ownership

- 5.5.5 Government Disaster-Prep Policies Spurring Stockpiling

- 5.5.6 Pet-Friendly Offices Increasing Weekday Treat Demand

- 5.6 Market Restraints

- 5.6.1 Declining Birthrate Limiting Long-Term Pet Additions

- 5.6.2 Stringent Ingredient Regulations Raising Costs

- 5.6.3 Home-Cooked Pet Meals Cannibalizing Packaged Sales

- 5.6.4 Zoonotic-Scare Import Bans Causing Supply Shocks

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary Tract Disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 7.6.1 Unicharm Corporation

- 7.6.2 Mars, Incorporated

- 7.6.3 Inaba-Petfood Co., Ltd.

- 7.6.4 Nestle (Purina)

- 7.6.5 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.6 General Mills Inc.

- 7.6.7 ADM

- 7.6.8 Schell & Kampeter, Inc. (Diamond Pet Foods)

- 7.6.9 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.10 Virbac S.A.

- 7.6.11 Spectrum Brands, Inc.,

- 7.6.12 Nippon Pet Food Co., Ltd.

- 7.6.13 DoggyMan H.A.Co.,Ltd.

- 7.6.14 Petio Corp.

- 7.6.15 Earth Pet Co.,Ltd.

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS