PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907238

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907238

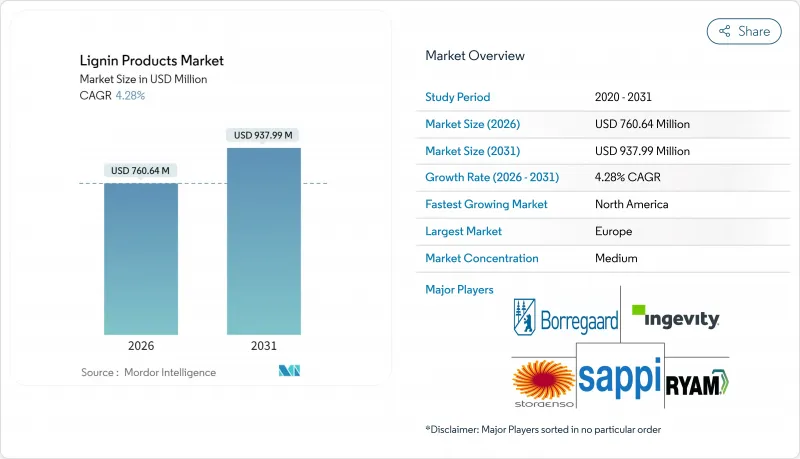

Lignin Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Lignin Products market is expected to grow from USD 729.42 million in 2025 to USD 760.64 million in 2026 and is forecast to reach USD 937.99 million by 2031 at 4.28% CAGR over 2026-2031.

Performance gains stem from rising demand for low-carbon construction chemicals, stricter sustainability regulations across mature economies, and continuing breakthroughs in bioconversion pathways that open high-value outlets for lignin-based aromatics. The shift from waste-stream disposal toward value-added biorefinery integration reinforces pricing power, especially for high-purity grades supplied to the pharmaceutical and electronics value chains. Europe preserves first-mover advantage thanks to long-standing pulp-mill infrastructure, while North America records the fastest growth on the back of cellulosic ethanol mandates and automotive lightweighting programs. Competitive intensity remains moderate, with integrated pulp producers leveraging scale to protect margins against smaller specialty processors

Global Lignin Products Market Trends and Insights

Rising Demand for High-Performance Concrete Admixtures

Infrastructure expansion across Asia-Pacific and Latin America raises the need for superplasticizers that improve flow while lowering cement consumption. Lignin-based admixtures reduce water-cement ratios, boosting compressive strength by 15-20% and cutting cement use by 8-12%. Construction firms pursuing LEED certification favor these bio-based solutions because they lower embodied carbon in high-rise and transportation projects. Green-building codes in China and India now endorse natural admixtures, providing a regulatory pull that accelerates commercialization. Producers scale up capacity to keep pace with large metro and highway contracts that specify performance concrete. Steady gains in smart-city investments anticipate durable demand for lignin superplasticizers through the medium term.

Uptake of Lignin-Based Feed Binders in Animal Nutrition

European regulations that restrict antibiotic growth promoters have moved feed formulators toward lignosulfonate binders. Studies show 25-30% better pellet durability versus molasses systems, translating into lower feed dust and reduced transport losses. Specific lignin fractions exhibit prebiotic activity that enhances ruminant gut microbiota, allowing feed companies to price at a premium. Danish and Dutch manufacturers report 12-15% logistics cost savings after sourcing local lignin derivatives from regional pulp mills. North American producers adopt similar strategies as large integrators target antibiotic-free supply chains. The long-term outlook remains strong as Asia-Pacific livestock operators shift toward higher-value protein and require efficiency gains in compound feed.

Quality Variability Across Extraction Processes

Differences in sulfur content and molecular weight between kraft, sulfite, and soda lignin complicate procurement for users that require consistent specifications. Sulfite variants carry 20-30% higher sulfur, impacting resin cure kinetics and demanding tailored processing protocols. Downstream firms maintain parallel inventories and dual qualification programs, inflating supply-chain spending by 8-12%. Smaller mills rarely possess analytical labs to certify each batch, restricting market access to low-margin outlets. Near-term uncertainty remains until shared testing standards emerge and cloud-based traceability platforms mature. Quality harmonization is therefore pivotal for broader adoption in specialty segments.

Other drivers and restraints analyzed in the detailed report include:

- Valorisation of Pulp-Mill Side-Streams for Circular Revenue

- Breakthrough Lignin-to-Vanillin Bioconversion Routes

- Competition from Sugar-Derived Bio-Aromatics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The lignin products market size linked to sulfite pulping totaled the bulk of global value, securing 76.62% in 2025 on the back of abundant volumes and well-known performance in dispersants. Cellulosic ethanol plants offer much smaller but higher-margin flows, and their 4.95% CAGR makes them the most dynamic source category to 2031. Production incentives under the U.S. Renewable Fuel Standard and EU RED-II encourage biorefineries to integrate lignin separation units, adding revenue equal to 12-15% of ethanol sales. Sulfite operators, chiefly in Europe and China, defend position by optimizing recovery yields and launching tailor-made grades for concrete and feed. Soda pulping keeps niche importance in India and Southeast Asia, processing agricultural residues into low-ash lignin for regional textile chemicals.

Cellulosic ethanol lignin typically displays lower ash and narrower molecular-weight distribution than kraft material, granting it a premium in specialty polymers. Pilot users in automotive composites value the predictable rheology that aids continuous fiber spinning. As ethanol producers scale capacity, supply of this high-quality lignin grows, tightening integration between biofuel and specialty chemical chains. Although sulfite volumes dwarf other sources, competitive dynamics hinge on value per ton rather than tonnage alone, especially as carbon revenue streams influence profitability.

The Lignin Products Market Report is Segmented by Source (Sulfite Pulping, Cellulosic Ethanol, Kraft Pulping, and Soda Pulping), Product Type (Lignosulfonate, Kraft Lignin, and Other Product Types), Application (Dispersant, Concrete Additive, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe held 33.55% of global value in 2025 because integrated forest industries and strict climate policies foster early lignin valorization. Pulp mills in Finland and Sweden retrofit extraction lines to capture new revenue, while German concrete and automotive sectors absorb steady volumes. REACH chemicals regulation nudges formulators toward bio-derived inputs, improving demand visibility. Horizon Europe research grants accelerate pilot deployments in vanillin and carbon-fibre, solidifying the region's innovation leadership.

North America posts the fastest 5.08% CAGR through 2031 as federal cellulosic fuel mandates widen lignin supply and automotive lightweighting efforts raise the bar on sustainable composites. The lignin products market size for concrete admixtures climbs in the United States on the back of the Bipartisan Infrastructure Law, which modernizes bridges and transit. Canadian forestry companies leverage abundant boreal resources to diversify beyond pulp into specialty lignin, supported by provincial carbon-pricing mechanisms that favor low-emission materials. Mexico's construction boom also creates room for admixture imports, rounding out continental demand.

Asia-Pacific stands at an earlier adoption curve yet offers vast upside. China's rapid urbanization elevates concrete consumption, and state standards begin to recognize lignin superplasticizers. India scales soda pulping for agri-residue, producing cost-competitive lignin for local feed and dye dispersants. Japan exploits lignin's aromatic backbone in electronics resins, while South Korea includes lignin-based chemicals in green-procurement lists. Ongoing ASEAN infrastructure initiatives and growing meat production foster multipronged demand, though standards harmonization will be critical for cross-border trade.

- Borregaard AS

- Burgo Group S.p.A.

- Domsjo Fabriker AB

- Ingevity

- Lignin Industries AB

- MetGen

- Metsa Group

- NIPPON PAPER INDUSTRIES CO., LTD.

- RYAM

- Sappi Ltd

- Stora Enso

- Suzano S/A

- UPM Biochemicals

- Valmet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for High-Performance Concrete Admixtures

- 4.2.2 Uptake of Lignin-Based Feed Binders in Animal Nutrition

- 4.2.3 Valorisation of Pulp-Mill Side-Streams for Circular Revenue

- 4.2.4 Breakthrough Lignin-To-Vanillin Bioconversion Routes

- 4.2.5 Automotive Push for Lignin-Derived Bio-Carbon Fibre

- 4.3 Market Restraints

- 4.3.1 Quality Variability Across Extraction Processes

- 4.3.2 Competition from Sugar-Derived Bio-Aromatics

- 4.3.3 Lack of International Lignin Product Standards

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Source

- 5.1.1 Sulfite Pulping

- 5.1.2 Cellulosic Ethanol

- 5.1.3 Kraft Pulping

- 5.1.4 Soda Pulping

- 5.2 By Product Type

- 5.2.1 Lignosulfonate

- 5.2.2 Kraft Lignin

- 5.2.3 High-Purity Lignin

- 5.2.4 Soda Lignin

- 5.2.5 Other Product Types

- 5.3 By Application

- 5.3.1 Dispersant

- 5.3.2 Concrete Additive

- 5.3.3 Animal Feed

- 5.3.4 Resins

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Borregaard AS

- 6.4.2 Burgo Group S.p.A.

- 6.4.3 Domsjo Fabriker AB

- 6.4.4 Ingevity

- 6.4.5 Lignin Industries AB

- 6.4.6 MetGen

- 6.4.7 Metsa Group

- 6.4.8 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.9 RYAM

- 6.4.10 Sappi Ltd

- 6.4.11 Stora Enso

- 6.4.12 Suzano S/A

- 6.4.13 UPM Biochemicals

- 6.4.14 Valmet

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment