PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907307

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907307

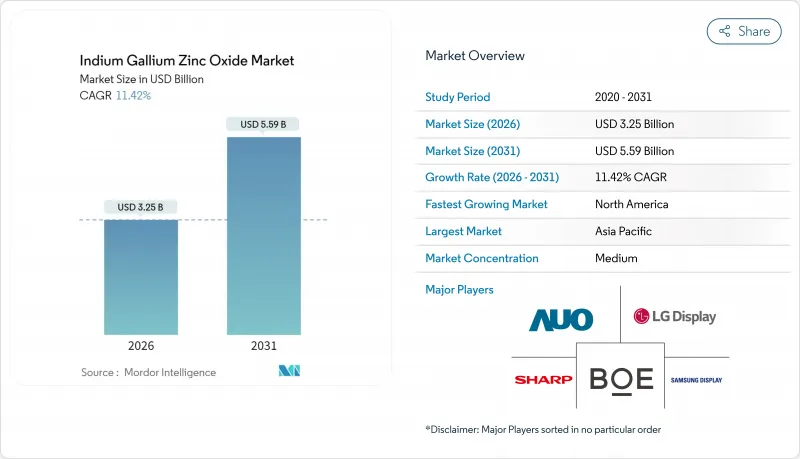

Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indium gallium zinc oxide market was valued at USD 2.92 billion in 2025 and estimated to grow from USD 3.25 billion in 2026 to reach USD 5.59 billion by 2031, at a CAGR of 11.42% during the forecast period (2026-2031).

This momentum comes from display makers migrating to oxide-based thin-film transistors that enable sharper resolution and lower power draw than legacy silicon backplanes. Growing consumer preference for energy-efficient smartphones, laptops, and large-format TVs aligns with the rising supply of oxide TFT capacity across Asia. Indium gallium zinc oxide market adoption also accelerates in foldable and automotive displays, where mechanical flexibility and wide-temperature stability are critical. At the same time, vertical integration by major panel vendors shortens development cycles and brings cost parity with mature silicon technologies.

Global Indium Gallium Zinc Oxide Market Trends and Insights

Surge in High-Resolution OLED and 8K TV Demand

Migration to 8K television panels raises switching-speed requirements that amorphous silicon struggles to meet. IGZO's higher electron mobility enables dense transistor arrays essential for ultra-high-definition content while preserving panel efficiency. LG Display began mass production of 13-inch tandem OLED laptop panels in 2024 that cut power use 40% relative to single-layer stacks, a milestone made possible by oxide TFT backplanes. Samsung is also applying IGZO to transparent TV prototypes, leveraging smaller transistors that transmit more light without sacrificing drive current. As broadcasters and streaming firms promote 8K content, panel makers view oxide TFTs as the only scalable route to maintain brightness headroom without overshooting power budgets.

Requirement for Energy-Efficient Portable Devices

Smartphone and laptop brands seek longer battery life without sacrificing refresh rates. IGZO backplanes allow displays to retain static images at micro-ampere leakage levels, reducing panel power by up to 50%. Imec demonstrated IGZO-based dynamic RAM cells that outperform conventional SRAM in energy efficiency, hinting at wider oxide adoption in low-power computing blocks. Apple moved all drive TFTs in its second-generation LTPO stacks to IGZO, reporting 5-15% efficiency gains in smartwatches. Rising demand for remote work devices keeps display power under scrutiny, securing a long runway for Indium gallium zinc oxide market growth.

Competition from LTPS/LTPO Silicon Backplanes

Panel makers have invested heavily in low-temperature polysilicon lines that already meet flagship smartphone performance targets. LTPS offers higher hole mobility, facilitating complex on-panel circuitry that can reduce driver count. Apple continues to employ LTPO silicon on iPhone displays and adds IGZO selectively, showing a hybrid path rather than a full switch. Process maturity and fabs' established yield curves make silicon variants attractive where cost sensitivity is high. This entrenched capital base tempers near-term upside for the Indium gallium zinc oxide market in certain premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption in Foldable and Flexible Displays

- Proliferation of Wearables Using Low-Leakage IGZO Backplanes

- Supply-Chain Volatility and Pricing of Indium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The smartphone segment captured 43.95% of the Indium gallium zinc oxide market in 2025 owing to oxide TFT adoption that boosts pixel density without draining batteries. Foldable and flexible displays post a 12.63% CAGR to 2031, outpacing all other uses as IGZO's mechanical stability keeps mobility intact across thousands of bends. Tablets and 2-in-1 PCs leverage oxide backplanes to maintain uniform luminance on larger screens, a key spec for creative professionals. Wearables exploit IGZO's ultra-low off-current to multiply battery life in compact housings. TVs and large-format panels apply oxide mobility to unlock 8K and transparent modes that redefine viewing experiences.

Second-tier applications are also scaling. Automotive displays migrate to IGZO for cockpit digitization, where heat and vibration would otherwise degrade silicon. Industrial and medical monitors integrate oxide TFTs for image criticality in surgery and process control. These diverse use cases collectively lift the Indium gallium zinc oxide market size for applications, supporting a balanced demand profile that cushions cyclical shifts in any single end product.

Consumer electronics owned 59.55% of the Indium gallium zinc oxide market size in 2025, reflecting the technology's roots in mobile and TV manufacturing. Automotive and transportation exhibit the fastest climb at 12.44% CAGR as OEMs replace analog gauges with panoramic digital dashboards. Healthcare facilities favor IGZO's image fidelity for diagnostic monitors, while industrial players deploy rugged oxide panels on factory floors. Aerospace and defense adopt oxide TFTs for avionics, where radiation tolerance and thermal stability are mandatory.

Cross-industry momentum brings fresh capital into oxide supply chains. BOE's investment in 45-inch 9K oxide panels for vehicles signals growing confidence that power-efficient backplanes can meet stringent in-car safety and brightness standards. Such diversification strengthens market resilience, reducing reliance on consumer upgrades alone and widening the revenue canvas for the Indium gallium zinc oxide market.

The Indium Gallium Zinc Oxide Report is Segmented by Application (Smartphones and Feature Phones, and More), End-Use Industry (Consumer Electronics, and More), Display Technology (LCD, OLED, and More), Deposition Technology (RF Magnetron Sputtering, and More), Conductivity Phase (Amorphous IGZO, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 65.20% of the Indium gallium zinc oxide market revenue in 2025 as BOE, LG Display, and Samsung Display ramped oxide TFT lines to feed the global appetite for OLED phones and TVs. China alone plans to control 76% of world OLED capacity by 2025, funnelling large orders for IGZO backplanes. Japan maintains research leadership through advances in single-crystal oxide films, while South Korea leverages hybrid LTPO-IGZO stacks to keep flagship devices on the cutting edge.

North America is the fastest-growing region at 12.18% CAGR, thanks to Apple's broadening oxide adoption and the region's push into AR/VR headsets that demand high-resolution, low-latency displays. Applied Materials booked USD 1.58 billion in Q3 2024 display-related revenue and projects USD 2.5 billion from advanced nodes by year-end, underscoring equipment momentum behind regional capacity expansion.

Europe follows with a focus on automotive and industrial deployments where energy efficiency aligns with sustainability mandates. Research institutes there lead gallium and germanium recycling studies aimed at easing raw-material pressure on oxide TFT production. Middle East and Africa plus Latin America show emerging uptake as consumer electronics penetration deepens, creating long-term whitespace for the Indium gallium zinc oxide market.

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS (ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics (Shanghai) Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in high-resolution OLED and 8K TV demand

- 4.2.2 Requirement for energy-efficient portable devices

- 4.2.3 Rapid adoption in foldable and flexible displays

- 4.2.4 Proliferation of wearables using low-leakage IGZO backplanes

- 4.2.5 Integration in spatial-computing headsets (AR/VR/MR)

- 4.2.6 IGZO arrays enabling neuromorphic in-memory computing

- 4.3 Market Restraints

- 4.3.1 Competition from LTPS/LTPO silicon backplanes

- 4.3.2 Supply-chain volatility and pricing of indium

- 4.3.3 Low recycling rates of spent IGZO sputter targets

- 4.3.4 Current drift from sub-gap defects in humid environments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphones and Feature Phones

- 5.1.2 Tablets and 2-in-1 PCs

- 5.1.3 Wearable Devices

- 5.1.4 Televisions and Large-format Displays

- 5.1.5 Automotive Displays

- 5.1.6 Industrial and Medical Displays

- 5.2 By End-use Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and Transportation

- 5.2.3 Healthcare

- 5.2.4 Industrial and Manufacturing

- 5.2.5 Aerospace and Defense

- 5.2.6 Others

- 5.3 By Display Technology

- 5.3.1 LCD

- 5.3.2 OLED

- 5.3.3 MicroLED and MiniLED

- 5.3.4 E-Paper and Other Emerging

- 5.4 By Deposition Technology

- 5.4.1 RF Magnetron Sputtering

- 5.4.2 Pulsed-DC Magnetron Sputtering

- 5.4.3 Atomic Layer Deposition

- 5.4.4 Solution / Ink-jet Printing

- 5.4.5 Other Techniques

- 5.5 By Conductivity Phase

- 5.5.1 Amorphous IGZO

- 5.5.2 Polycrystalline IGZO

- 5.5.3 Single-crystal IGZO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Sharp Corporation

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 Samsung Display Co., Ltd.

- 6.4.4 AU Optronics Corp.

- 6.4.5 BOE Technology Group Co., Ltd.

- 6.4.6 Japan Display Inc.

- 6.4.7 Tianma Microelectronics Co., Ltd.

- 6.4.8 Apple Inc.

- 6.4.9 Sony Group Corporation

- 6.4.10 ASUS (ASUSTeK Computer Inc.)

- 6.4.11 Panasonic Holdings Corporation

- 6.4.12 Innolux Corporation

- 6.4.13 Visionox Technology, Inc.

- 6.4.14 Everdisplay Optronics (Shanghai) Co., Ltd.

- 6.4.15 TCL China Star Optoelectronics Technology Co., Ltd.

- 6.4.16 Kunshan GVO Optoelectronics Co., Ltd.

- 6.4.17 Fujitsu Limited

- 6.4.18 Rohm Semiconductor

- 6.4.19 ULVAC, Inc.

- 6.4.20 Applied Materials, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment