PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907310

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907310

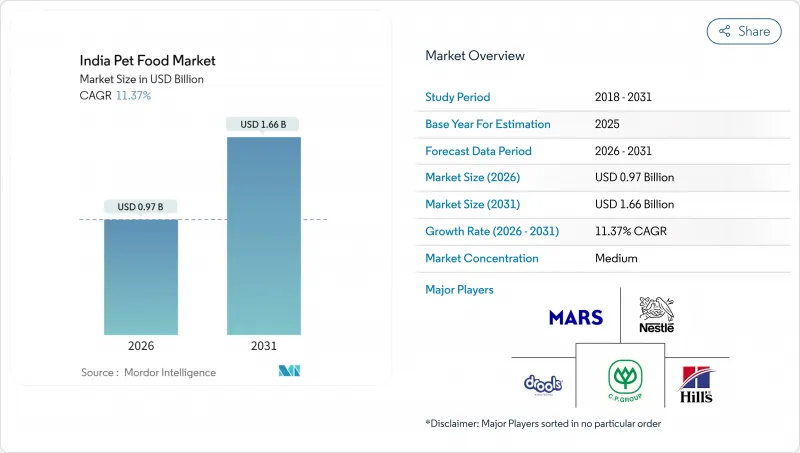

India Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indian pet food market size in 2026 is estimated at USD 0.97 billion, growing from 2025 value of USD 0.87 billion with 2031 projections showing USD 1.66 billion, growing at 11.37% CAGR over 2026-2031.

The market captures the steady shift from homemade diets toward branded nutrition as urbanization increases disposable income, household convenience needs, and awareness of balanced nutrition. Uptake accelerates, even though only 10% of owners feed their pets packaged food exclusively, meaning most households remain addressable customers. Volume gains are amplified by strong digital channel momentum, domestic manufacturing scale, and growing demand for life-stage formulations that mirror human wellness trends. Cost efficiencies from local extrusion plants are steadily reducing retail prices, making premium nutrition accessible to mid-income households while protecting manufacturer margins.

India Pet Food Market Trends and Insights

Surging Pet Ownership in Urban Households

Post-pandemic pet adoption has fundamentally altered household dynamics in Indian metros, where shrinking family sizes and apartment living create ideal conditions for companion animal ownership. In 2024, the pet population has grown to over 31 million dogs and 2.44 million cats, with urban households driving the majority of this expansion. Nuclear families increasingly treat pets as family members, leading to higher per-pet spending on nutrition and healthcare. This demographic shift creates a compounding effect where each new pet owner becomes a long-term customer with predictable purchasing patterns. Urban pet ownership density has reached levels where veterinary services and pet retail infrastructure can achieve profitable scale, creating a self-reinforcing ecosystem that supports continued market expansion.

Rising Disposable Income and Pet Humanization

India's expanding middle class, with rising per-capita disposable income, has transformed pet care from basic sustenance to comprehensive wellness programs that mirror human health trends. Pet humanization is evident in purchasing decisions, where owners seek products with human-grade ingredients, organic certifications, and specialized formulations tailored to life stages and health conditions. This behavioral shift drives premiumization across categories, with gourmet offerings including Atlantic salmon, boneless duck, and even pet-safe bakery items gaining acceptance. The willingness to spend on pet nutrition correlates directly with household income levels, creating distinct market segments where premium brands can command higher margins.

High Price Sensitivity in Tier-2/3 Cities

Value-focused consumers in smaller cities impose natural ceiling effects on premium product penetration, constraining market expansion beyond metropolitan areas where disposable income levels support higher per-unit spending. Price elasticity remains high in these markets, where pet ownership exists but purchasing power limits adoption of packaged nutrition solutions. The challenge intensifies as distribution costs to tier-2/3 cities often exceed metropolitan delivery expenses, creating margin pressure that prevents aggressive pricing strategies. This geographic constraint forces manufacturers to develop India-specific value propositions that balance nutritional adequacy with affordability, often requiring reformulation and packaging innovations to achieve target price points while maintaining profitability.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce and Quick-Commerce Delivery

- Domestic Extrusion Capacity Expansion Lowers Retail Prices

- Low Packaged-Food Penetration vs Homemade Diets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products maintain a 76.05% market share in 2025, reflecting their essential nature and repeat-purchase characteristics that create predictable revenue streams for manufacturers. Dry pet food represents the largest sub-segment within food products, benefiting from extended shelf life and cost-effective distribution models that enable mass market penetration. Wet pet food commands premium pricing but faces supply constraints due to import dependency and cold chain requirements.

Food products emerge as the fastest-growing segment, with a 12.18% CAGR through 2031. The segment's growth is further supported by the rising awareness among pet owners regarding the importance of proper pet nutrition and the shift towards premium and specialized food options. Kibbles remain the most popular choice within dry pet food due to their affordability, convenience, and ability to meet pets' dietary requirements, while wet pet food maintains its appeal due to its high moisture content and palatability.

The India Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), by Pets (Cats, Dogs, and Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons)

List of Companies Covered in this Report:

- Mars, Incorporated

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- Nestle S.A. (Purina)

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- Archer Daniels Midland

- Drools Pet Food Pvt. Ltd.

- Farmina Pet Foods

- Charoen Pokphand Group.

- Virbac S.A.

- Heads Up For Tails

- Godrej Pet Care

- Allana Group (Bowler's Nutrimax)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Surging pet ownership in urban households

- 5.5.2 Rising disposable income and pet humanization

- 5.5.3 Expansion of e-commerce and quick-commerce delivery

- 5.5.4 Domestic extrusion capacity expansion lowers retail prices

- 5.5.5 Veterinary telehealth boosts prescription-diet adoption

- 5.5.6 Prospective GST reclassification cuts effective tax burden

- 5.6 Market Restraints

- 5.6.1 High price sensitivity in Tier 2/3 cities

- 5.6.2 Low packaged-food penetration vs homemade diets

- 5.6.3 Dependence on imported wet food and specialty ingredients

- 5.6.4 Fragmented regulatory oversight slows feed-standard rollout

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft & Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Diabetes

- 6.1.4.1.2 Digestive Sensitivity

- 6.1.4.1.3 Oral Care Diets

- 6.1.4.1.4 Renal

- 6.1.4.1.5 Urinary tract disease

- 6.1.4.1.6 Obesity Diets

- 6.1.4.1.7 Derma Diets

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.3 General Mills Inc.

- 7.6.4 Nestle S.A. (Purina)

- 7.6.5 Schell & Kampeter, Inc. (Diamond Pet Foods)

- 7.6.6 Archer Daniels Midland

- 7.6.7 Drools Pet Food Pvt. Ltd.

- 7.6.8 Farmina Pet Foods

- 7.6.9 Charoen Pokphand Group.

- 7.6.10 Virbac S.A.

- 7.6.11 Heads Up For Tails

- 7.6.12 Godrej Pet Care

- 7.6.13 Allana Group (Bowler's Nutrimax)

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS