PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907321

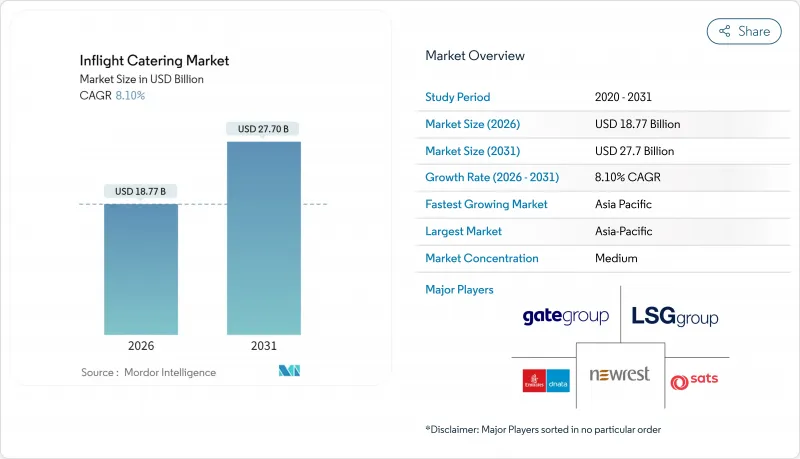

Inflight Catering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The inflight catering market is expected to grow from USD 17.36 billion in 2025 to USD 18.77 billion in 2026 and is forecast to reach USD 27.7 billion by 2031 at 8.10% CAGR over 2026-2031.

Recorded passenger volumes, a premium-cabin refresh cycle, and digital pre-order platforms collectively increase per-passenger spend and sustain pricing power for caterers. Airlines are modernizing galleys, rolling out chef-curated menus, and embedding retail mechanics that monetize ancillary demand. Investments in AI-driven menu planning and cold-chain automation reduce waste, defend margins against food commodity inflation, and shorten the time to introduce new SKUs. Long-haul capacity additions maintain high average meal complexity, while low-cost carriers (LCCs) unlock new revenue through tiered, pay-as-you-go menus. Partnerships that align with halal, kosher, and allergen protocols protect incumbents and open avenues for specialized growth across multi-hub networks.

Global Inflight Catering Market Trends and Insights

Rebound in Air Passenger Traffic and Long-Haul Capacity Additions

Global passenger totals reached 4.7 billion in 2024 and are projected to touch 4.96 billion in 2025, surpassing pre-pandemic peaks as wide-body fleets rejoin service. Load factors rose to 83.5%, reducing buffer seats and forcing caterers to uplift closer to booked capacity. Although supply-chain delays curb deliveries, airlines continue to add premium-heavy A350 and B787 aircraft, thereby increasing the value of per-flight catering. Transpacific capacity increased 12% year-over-year in 2024, driven by the resumption of Chinese routes and United's securing of new Tokyo-Haneda slots. Because a 12-hour sector typically loads triple the per-flight spend of a 2-hour hop, caterers prioritize wide-body hubs and invest in multi-leg inventory systems that synchronize outbound and return menus.

Premiumization of Onboard Experience to Differentiate Airline Brands

Airlines invested over USD 2 billion in premium-cabin retrofits during 2024 to serve corporate travelers and high-yield leisure traffic. Delta introduced chef partnerships, Qatar Airways rolled out a la carte dining in Qsuite, and Emirates refreshed Michelin-inspired menus, shifting catering from a cost center to a brand asset. British Airways enhanced its Club World service in 2024 with regional dishes and digital pre-order, boosting satisfaction by eight points within six months. First-class catering now requires small-batch production, dedicated cold-chain logistics, and higher crew engagement. Caterers respond with investment in culinary training, rapid-response quality checks, and premium-ingredient procurement networks that economy-focused rivals cannot match.

High Operating Costs and Inflation Across Food, Labor, and Utilities

Wheat, dairy, and poultry prices increased by 8-12% in 2024 due to climatic disruptions in key producing regions, such as Australia and Argentina. Labor costs for caterers rose by 6-9% across North America and Europe as employers in the hospitality industry faced intensified competition to attract and retain skilled talent. In Europe, utility costs surged by 10-15% following the termination of energy subsidies, adding further pressure on operational expenses. Additionally, dnata staff at major airports, such as Heathrow and Manchester, staged walkouts in November 2024, highlighting vulnerabilities in their cost structures. To mitigate these challenges, operators have turned to automation, implementing tray lines and adopting energy-efficient chillers to recover profit margins. However, smaller players, constrained by limited capital, are increasingly compelled to either merge with larger entities or exit the market entirely.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of LCCs and Hybrids, Scaling Buy-On-Board and Pre-Order Models

- Digitalization: Pre-Order, Data-Driven Menu Planning, Kitchen Automation

- Stringent Multi-Jurisdiction Food Safety and Halal/Kosher Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Meals continue to dominate the inflight catering market, accounting for 50.78% of the revenue in 2025, making it the largest segment. However, snacks and savouries are witnessing significant growth, expanding at a CAGR of 8.52%. This growth reflects changing consumer preferences, with airlines adapting their offerings to meet evolving demands. For instance, Qatar Airways has introduced mezze platters priced between USD 15 and USD 25 for pre-order, catering to travelers seeking lighter meal options. Similarly, Turkish Airlines has increased its onboard sales by 22% by incorporating regional snacks, such as simit and baklava, into its menu. Beverages are also transforming, with the inclusion of craft brews and mocktails that provide higher profit margins without increasing galley workload. These developments highlight the in-flight catering market's efforts to diversify product offerings while addressing operational constraints.

Modularization is emerging as a key trend in the inflight catering market, enabling greater flexibility and efficiency. Caterers are now designing component-level menus that airlines can mix and match based on specific route requirements. This approach not only aligns with retail platforms but also helps in minimizing waste. Airlines that previously faced a binary choice between offering meals or snacks are now deploying mixed stock-keeping units (SKUs), allowing for a more tailored approach to passenger preferences. This flexibility provides caterers with new opportunities to negotiate based on waste reduction and the generation of ancillary revenue. By adopting modularization, airlines can optimize their catering operations, reduce costs, and enhance the overall passenger experience, all while maintaining operational efficiency and sustainability.

Full-service carriers (FSCs) accounted for 56.98% of the market share in 2025, making them the largest segment in the inflight catering market. This dominance is attributed to their extensive network coverage and the demand for multi-cabin services, which cater to a wide range of passenger preferences. FSCs offer a variety of meal options and premium services, including chef-curated menus and sommelier-selected wine pairings, which enhance the overall passenger experience. These offerings are particularly appealing to business and first-class travelers, who prioritize quality and customization. The ability of FSCs to provide such high-touch services has solidified their position as the leading segment in the market.

Meanwhile, low-cost carriers (LCCs) are experiencing the fastest growth in the market, with a CAGR of 9.12%. This growth is driven by their ability to innovate and adapt to the preferences of cost-sensitive passengers. For instance, Ryanair generated EUR 400 million in food sales during fiscal 2024, showcasing the potential of retail offerings to rival traditional catering revenues. Similarly, IndiGo doubled its transaction value through app-based meal boxes, demonstrating that passengers are willing to pay for convenience despite being price-conscious. LCCs focus on efficiency and volume-driven strategies, such as SKU rationalization, to meet the demands of their growing customer base. This dual-track evolution, with FSCs focusing on premium services and LCCs on cost-effective solutions, is expanding the overall inflight catering market rather than redistributing market share.

The Inflight Catering Market Report is Segmented by Food Type (Meals, Bakery and Confectionery, and More), Flight Type (Full-Service Carriers, Low-Cost Carriers, and More), Aircraft Seating Class (Economy, Business, and First), Catering Type (Classic, and More), Flight Duration (Short-Haul, and Long-Haul), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region emerged as the largest segment, contributing 32.12% of the global revenue in 2025. China's domestic market recovery drives the region's dominance, India's extensive airport expansion projects, and the rapid growth of LCCs in Southeast Asia. These factors collectively underpin the significant growth in volume in the region. SATS has invested USD 45 million in a Bengaluru kitchen, increasing its daily capacity to 40,000 kg to cater to India's projected 300 million annual passengers. Vietnam Airlines Caterers has also secured the Long Thanh facility tender, with plans to produce 30,000 meals daily by 2026. The region is expected to grow at a CAGR of 8.71% through 2031. Meanwhile, mature markets like Japan and South Korea are consolidating as larger players absorb smaller competitors unable to meet ISO upgrade requirements.

The Middle East and Africa, while smaller in absolute scale, enjoy higher margins compared to other regions. Emirates Flight Catering reported AED 970 million (USD 264.13 million) in external revenue for fiscal 2023-24, reflecting an 11% year-on-year increase. Qatar Aircraft Catering expanded its operations in Doha by adding 15,000 meals daily in 2024. dnata has entered into a joint venture with Saudia, aiming to achieve a daily production capacity of 50,000 meals by 2026. Despite these advancements, infrastructure gaps persist in certain parts of Africa. However, hub carriers in Ethiopia and Kenya are sustaining nascent growth in the region. The Middle East and Africa markets are poised for steady development, supported by these strategic initiatives and partnerships.

North America and Europe represent steady but slower-growing markets. Lufthansa's sale of LSG to Aurelius in 2023 triggered asset rationalization, leaving gategroup, dnata, and Flying Food Group with approximately half of the regional revenue. Delta Airlines renewed a decade-long contract with gategroup across 50 US stations, focusing on sustainability goals such as compostable packaging and waste diversion. These regions are increasingly prioritizing technology, reliability, and sustainability in bid evaluations, which has created significant entry barriers for low-cost challengers. While growth in these markets remains moderate, the emphasis on innovation and environmental responsibility is shaping the competitive landscape and driving operational improvements.

- gategroup

- LSG Group

- Emirates Group

- DO & CO Aktiengesellschaft

- Newrest Group Services SAS

- SATS Ltd.

- CATRION

- Cathay Pacific Catering Services (H.K.) Limited

- KLM Catering Services

- Qatar Aircraft Catering Company W.L.L.

- GCG

- ANA Catering Service Co., Ltd.

- Air Fayre

- Flying Food Group

- Air Gourmet, Inc.

- Taj SATS Air Catering Limited

- China Eastern Airlines Corporation Limited

- BAC Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rebound in air passenger traffic and long-haul capacity additions

- 4.2.2 Premiumization of onboard experience to differentiate airline brands

- 4.2.3 Expansion of LCCs and hybrids, scaling buy-on-board and pre-order models

- 4.2.4 Digitalization: pre-order, data-driven menu planning, automation in kitchens

- 4.2.5 Underutilized fresh-frozen meal (FFM) networks enabling global SKU standardization

- 4.2.6 Aircraft/engine delivery bottlenecks shift demand toward reliable, waste-aware catering

- 4.3 Market Restraints

- 4.3.1 High operating costs and inflation across food, labor, and utilities

- 4.3.2 Stringent, multi-jurisdiction food safety and halal/kosher compliance

- 4.3.3 Short-haul time constraints and BYOF eroding service scope on domestic routes

- 4.3.4 Contract/retail mix shifts reducing meals uplifted despite revenue growth

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Food Type

- 5.1.1 Meals

- 5.1.2 Bakery and Confectionery

- 5.1.3 Snacks and Savouries

- 5.1.4 Beverages

- 5.2 By Flight Type

- 5.2.1 Full-Service Carriers (FSC)

- 5.2.2 Low-Cost Carriers (LCC)

- 5.2.3 Other Flight Types

- 5.3 By Aircraft Seating Class

- 5.3.1 Economy

- 5.3.2 Business

- 5.3.3 First

- 5.4 By Catering Type

- 5.4.1 Classic (Complimentary and Pre-ordered)

- 5.4.2 Retail On Board (Buy-on-board)

- 5.5 By Flight Duration

- 5.5.1 Short-Haul

- 5.5.2 Long-Haul

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 France

- 5.6.2.3 Germany

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 Israel

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 gategroup

- 6.4.2 LSG Group

- 6.4.3 Emirates Group

- 6.4.4 DO & CO Aktiengesellschaft

- 6.4.5 Newrest Group Services SAS

- 6.4.6 SATS Ltd.

- 6.4.7 CATRION

- 6.4.8 Cathay Pacific Catering Services (H.K.) Limited

- 6.4.9 KLM Catering Services

- 6.4.10 Qatar Aircraft Catering Company W.L.L.

- 6.4.11 GCG

- 6.4.12 ANA Catering Service Co., Ltd.

- 6.4.13 Air Fayre

- 6.4.14 Flying Food Group

- 6.4.15 Air Gourmet, Inc.

- 6.4.16 Taj SATS Air Catering Limited

- 6.4.17 China Eastern Airlines Corporation Limited

- 6.4.18 BAC Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment