PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907324

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907324

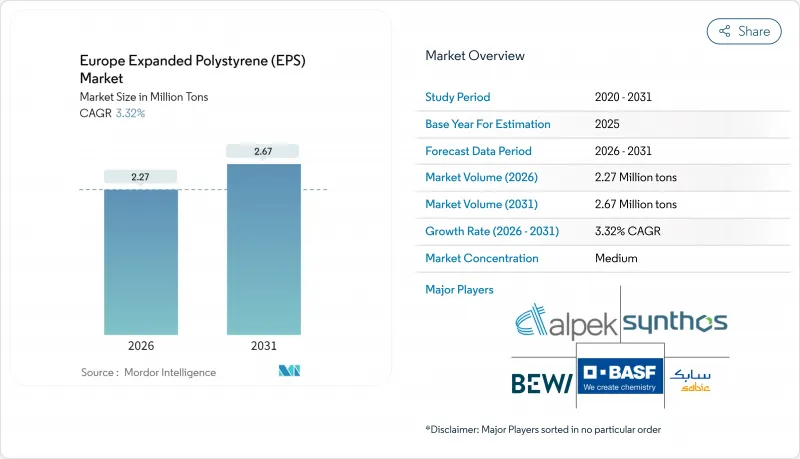

Europe Expanded Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Expanded Polystyrene Market was valued at 2.20 million tons in 2025 and estimated to grow from 2.27 million tons in 2026 to reach 2.67 million tons by 2031, at a CAGR of 3.32% during the forecast period (2026-2031).

Demand flows primarily from building insulation upgrades and protective packaging for sensitive goods, while sector resilience is reinforced by robust domestic supply chains, incremental recycling gains, and technology upgrades that lower embodied carbon footprints. Regulatory drivers such as the EU Energy Performance of Buildings Directive, effective from 2025, compel higher R-values across new builds and retrofits, keeping insulation volumes stable even as substitutes gain share. Simultaneously, the surge in mRNA biologic logistics and appliance reshoring sustains packaging volumes, helping buffer commodity segments against margin compression from styrene volatility. Nevertheless, the Europe Expanded Polystyrene market negotiates mounting headline risk tied to feedstock price swings, fire-safety regulations in dense urban cores, and customer trials of paper-, pulp-, and mycelium-based alternatives.

Europe Expanded Polystyrene (EPS) Market Trends and Insights

Building Energy Codes Drive Thermal Performance Requirements

Stricter national and EU-wide energy codes compel developers to design walls, roofs, and floors with lower U-values, lifting insulation thickness requirements and supporting steady volume demand for Europe's Expanded Polystyrene market solutions. Germany's Gebaudeenergiegesetz already specifies exterior wall U-values near 0.20 W/(m2K), which typically necessitates 12-16 cm of EPS, cementing roughly 40% share for the foam in German facade systems despite height-based fire-safety limits. France and the Nordics extend similar performance stipulations, and the 2024 recast of the Energy Performance of Buildings Directive sets a net-zero mandate for new structures from 2030, locking in long-range insulation demand. Retrofit volumes also rise under the EU Renovation Wave, with grants steering homeowners toward thermally efficient yet affordable systems. Producers broaden their Neopor and graphite-enriched lines in this compliance-driven landscape to deliver superior R-values without costly structural modifications.

mRNA Biologics Cold Chain Expansion

Rapid commercialization of mRNA vaccines and advanced therapeutics requires 2 °C-to-8 °C stability from factory to clinic. EPS shippers dominate this lane because the material's closed-cell matrix provides predictable insulation and cushioning over long-haul flights and last-mile parcels. Manufacturers such as Cold Chain Technologies have added European capacity in Breda, Netherlands, specifically to serve pharma corridors reaching 80% of EU GDP centers within a six-hour drive. Regulatory tightening under European Pharmacopoeia Supplement 11.7 pushes packaging suppliers to validate extractables and leachables, favoring incumbent EPS formulations with proven compliance records. The cold-chain opportunity carries premium margins that partially offset styrene spread volatility in commodity construction foam.

Feedstock Cost Volatility Pressures Margins

Styrene accounts for up to 70% of EPS cash costs, making profitability sensitive to benzene-and naphtha swings. January 2025 contract hikes of EUR 55 per ton announced by Trinseo illustrate producer attempts to defend margins. Structural tightness deepens as Versalis shutters its Brindisi cracker in April 2025, widening the region's import dependency and magnifying freight and currency risks. The mismatch between volatile raw-material outlays and fixed-price construction contracts squeezes converter cash flows, challenging smaller plants across Northwest Europe.

Other drivers and restraints analyzed in the detailed report include:

- Appliance Manufacturing Reshoring Momentum

- EU Renovation Wave Accelerates Gray EPS Adoption

- Sustainable Alternatives Gain Market Traction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Europe's Expanded Polystyrene market size for white grades accounted for 70.86% share of overall consumption. White EPS persists in cavity walls, slab-on-grade floors, and perimeter drainage boards where cost remains the critical selector and modest panel thicknesses suffice for code compliance. However, gray and silver grades register the fastest 3.74% CAGR to 2031 as graphite's infrared-reflective particles lower λ-values to around 0.030 W/(m*K). In external thermal insulation composite systems, gray EPS reduces layer thickness from 16 cm to 12 cm for the same U-value, unlocking facade renovation in urban districts with tight lot lines. BEWI's CIRCULUM line couples the performance edge with recycled bead content, helping architects reconcile energy and circularity targets. Producers invest in in-line blowing-agent recovery and continuous block molding to embed more reclaim without sacrificing mechanical properties, positioning gray EPS as a technical and eco-credential upgrade within the Europe Expanded Polystyrene market.

The Europe Expanded Polystyrene (EPS) Market Report is Segmented by Product Type (White EPS, Gray and Silver EPS), End-User Industry (Building and Construction, Electrical and Electronics, Packaging, Other End-User Industries), and Geography (Germany, United Kingdom, France, Italy, Spain, Norway, Sweden, Denmark, Finland, Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Alpek SAB de CV

- Austrotherm

- BASF

- BEWi

- Epsilyte LLC

- Ineos

- Kaneka Corporation

- Ravago

- SABIC

- SIBUR International GmbH

- Sunde Group

- Sunpor

- Synthos

- TotalEnergies

- Versalis S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Building-energy codes mandating higher R-values from 2025

- 4.2.2 Mandatory cold-chain capacity additions for mRNA-class biologics

- 4.2.3 Re-shoring of appliance production boosting domestic protective packaging

- 4.2.4 Grey-EPS adoption in EU "Renovation Wave" retrofit projects

- 4.2.5 Low-cost modular housing programmes

- 4.3 Market Restraints

- 4.3.1 Styrene monomer price volatility tracking crude-oil spreads

- 4.3.2 Commercialisation of mycelium and moulded-pulp substitutes

- 4.3.3 Carbon-pricing schemes inflating Scope-3 footprints of petro-polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 White EPS

- 5.1.2 Gray and Silver EPS

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Other End-user Industries (Agriculture and Automotive)

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Norway

- 5.3.7 Sweden

- 5.3.8 Denmark

- 5.3.9 Finland

- 5.3.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpek SAB de CV

- 6.4.2 Austrotherm

- 6.4.3 BASF

- 6.4.4 BEWi

- 6.4.5 Epsilyte LLC

- 6.4.6 Ineos

- 6.4.7 Kaneka Corporation

- 6.4.8 Ravago

- 6.4.9 SABIC

- 6.4.10 SIBUR International GmbH

- 6.4.11 Sunde Group

- 6.4.12 Sunpor

- 6.4.13 Synthos

- 6.4.14 TotalEnergies

- 6.4.15 Versalis S.p.A.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment