PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907333

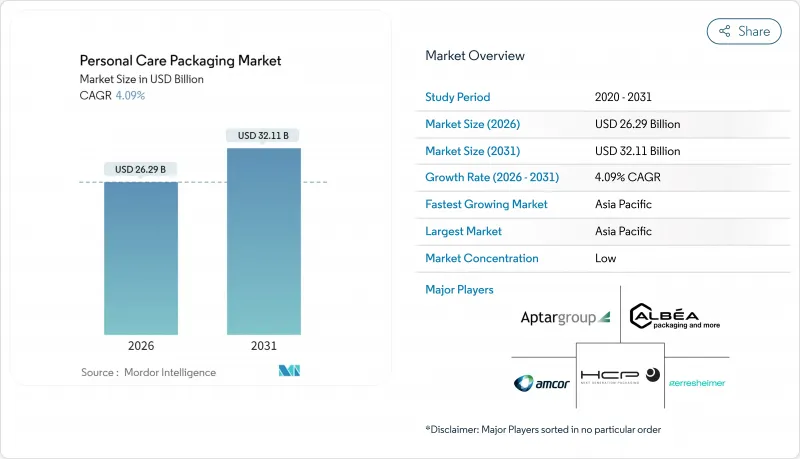

Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The personal care packaging market is expected to grow from USD 25.26 billion in 2025 to USD 26.29 billion in 2026 and is forecast to reach USD 32.11 billion by 2031 at 4.09% CAGR over 2026-2031.

Sustained growth is linked to premiumization in emerging economies, the enforcement of a minimum 30% post-consumer recycled (PCR) content, and omni-channel fulfilment models that require ship-ready packs with high protective performance. Material innovation centered on PCR PET, bio-based polymers, and ocean-plastic feedstock mitigates regulatory risk and fuels product differentiation. Edge-AI filling lines are cutting SKU production costs, while refill-at-home dispensing formats broaden consumer convenience and lower material intensity. Together, these factors strengthen the personal care packaging market's resilience against volatile resin prices and single-use restrictions in North America and Europe.

Global Personal Care Packaging Market Trends and Insights

Premiumization of Beauty SKUs in Emerging Markets

Premiumization elevates local and global brands to aspirational status through metallic finishes, embossed textures, and multi-component assemblies that convey exclusivity to value-oriented consumers. Digital embellishment enables economically viable short runs, encouraging frequent limited-edition launches that command 20-40% price premiums. Success in skin care drives similar strategies in hair care and deodorants, reinforcing consumer perception that package sophistication signals efficacy and safety.

Omni-Channel Fulfillment Driving Protective and Ship-Ready Packs

E-commerce acceleration compels packages to survive single-parcel distribution while projecting shelf-quality branding. Integrated cushioning, tamper-evident closures, and drop-test-rated structures remove secondary boxes and trim material consumption by 30% for some adopters. Automation supports rapid line changeovers between retail and online SKUs, tightening production cycles as category e-commerce penetration exceeds 25% annually.

Volatile Polyolefin and PET Feed-Stock Prices

Resin costs swing more than 40% within a year, compressing converter margins and prompting dynamic pricing and hedging programs. Recycled resin prices fluctuate even more due to limited supply, driving vertically integrated sourcing and long-term contracts to shield profitability.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Rules Mandating More than 30% PCR Content

- Rapid Adoption of Refill-At-Home Dispensing Formats

- Supply-Chain Chokepoints in Aluminium and Glass

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic held 58.22% of the personal care packaging market share in 2025, supported by cost efficiency and adaptable barrier performance. Within the segment, polyethylene and polypropylene led volumes, while PET trailed under scrutiny from single-use restrictions. Bio-based and PCR resins underpin a 4.22% CAGR to 2031, cushioning regulatory impacts on the personal care packaging market size. Glass retained its luxury positioning for prestige fragrances, whereas metal aerosols sustained their niche in hair sprays and deodorants. Paperboard gains traction in secondary packs where moisture barriers are non-critical.

Continued investment in advanced recycling and compatibilizer chemistry allows converters to meet PCR thresholds without sacrificing clarity or shelf life. Brands experiment with colorless masterbatches and additive-free formulations to maximize end-of-life recyclability. These developments keep plastic at the forefront even as policy pressure intensifies, demonstrating how innovation stabilizes the personal care packaging market.

Rigid formats represented 80.96% of the personal care packaging market size in 2025 and are forecast to expand at a 5.51% CAGR, driven by consumer perception of durability and brand prestige. Airless jars, glass droppers, and PET bottles with spray actuators satisfy premium skin and hair care positioning. Flexible pouches penetrate travel sizes and refill pods, but brand owners still rely on rigid primary containers for shelf presence and perceived value.

Light-weighting and modular assemblies help offset material intensity while preserving rigidity. Hybrid solutions pair rigid outer shells with flexible refills, merging user familiarity with sustainability gains. Industry adoption of smart closures capable of NFC authentication keeps rigid packaging relevant in digital consumer engagement strategies.

The Personal Care Packaging Market Report is Segmented by Material Type (Plastic, Glass, Metal, and Paper and Paperboard), Packaging Format (Flexible and Rigid), Product Type (Bottles and Jars, Tubes and Sticks, Pumps and Dispensers, Pouches and Sachets, and More), Application (Skin Care, Hair Care, Oral Care, Make-Up Products, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 41.62% of the personal care packaging market share in 2025 and will expand at a 5.18% CAGR to 2031, lifted by rising disposable incomes, urban migration, and vibrant male grooming uptake. China sustains volume leadership on the back of integrated supply chains and surging e-commerce, while India registers rapid unit growth as modern trade formats multiply. Japan and South Korea steer global smart-packaging trends, embedding NFC tags and heat-sensitive inks for product interaction and authenticity verification.

North America maintains a sizeable personal care packaging market due to premiumization and brand loyalty in skin and hair care. Regulatory emphasis on PCR content pushes converters to scale mechanical and chemical recycling, cementing the region's role as an innovation testbed. The United States drives demand for tamper-resistant, child-safe packs, whereas Canada mirrors these tendencies with an additional focus on bilingual labeling. Mexico offers cost-effective production hubs for export-oriented runs, benefiting from trade agreements and proximity to raw material suppliers.

Europe's profile is shaped by stringent waste-reduction mandates. Germany and France pilot refill stations in mass retail, accelerating uptake of reusable packs. The United Kingdom navigates post-Brexit customs complexities yet retains high-value niche production in luxury fragrance glass. Southern Europe leverages design heritage in premium rigid formats, while Northern European markets advance carton-based secondary packs to satisfy circularity metrics.

- Albea S.A.

- HCP Packaging Group

- Gerresheimer AG

- Amcor plc

- AptarGroup, Inc.

- Cosmopak USA LLC

- Quadpack Industries, S.A.

- Libo Cosmetics Co., Ltd.

- Mpack Poland sp. z o.o.

- POLITECH SP. Z O.O.

- Rieke Corporation (TriMas Corporation)

- Berlin Packaging LLC

- MKTG INDUSTRY SRL

- Silgan Holdings, Inc.

- Stoelzle Oberglas GmbH

- EPL Limited

- Verescence Inc.

- Apackaging Group LLC

- Heinz-Glass GmbH & Ko. KGaA

- Roetell Group

- Vitro SAB De CV

- Vidraria Anchieta Ltda.

- Lumson S.p.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of Beauty SKUs in Emerging Markets

- 4.2.2 Omni-Channel Fulfilment Driving Protective and Ship-Ready Packs

- 4.2.3 Sustainability Rules Mandating more than 30 % PCR Content

- 4.2.4 Rapid Adoption of Refill-At-Home Dispensing Formats

- 4.2.5 Edge-Ai Enabled Filling Lines Cutting SKU Cost

- 4.2.6 Explosive Growth of Male Grooming in Southeast Asia

- 4.3 Market Restraints

- 4.3.1 Volatile Polyolefin and PET Feed-Stock Prices

- 4.3.2 Single-Use-Plastics Bans Across the EU and Select US States

- 4.3.3 Supply-Chain Chokepoints in Aluminium and Glass

- 4.3.4 Rise of Solid-Format Toiletries Replacing Primary Packs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 PET and PVC

- 5.1.1.4 Polystyrene

- 5.1.1.5 Bio-Based Plastics

- 5.1.1.6 Other Plastic Material Types

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.1 Plastic

- 5.2 By Packaging Format

- 5.2.1 Flexible

- 5.2.2 Rigid

- 5.3 By Product Type

- 5.3.1 Bottles and Jars

- 5.3.2 Tubes and Sticks

- 5.3.3 Pumps and Dispensers

- 5.3.4 Pouches and Sachets

- 5.3.5 Caps and Closures

- 5.3.6 Other Product Types

- 5.4 By Application

- 5.4.1 Skin Care

- 5.4.2 Hair Care

- 5.4.3 Oral Care

- 5.4.4 Make-Up Products

- 5.4.5 Deodorants and Fragrances

- 5.4.6 Baby Care

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN Countries

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea S.A.

- 6.4.2 HCP Packaging Group

- 6.4.3 Gerresheimer AG

- 6.4.4 Amcor plc

- 6.4.5 AptarGroup, Inc.

- 6.4.6 Cosmopak USA LLC

- 6.4.7 Quadpack Industries, S.A.

- 6.4.8 Libo Cosmetics Co., Ltd.

- 6.4.9 Mpack Poland sp. z o.o.

- 6.4.10 POLITECH SP. Z O.O.

- 6.4.11 Rieke Corporation (TriMas Corporation)

- 6.4.12 Berlin Packaging LLC

- 6.4.13 MKTG INDUSTRY SRL

- 6.4.14 Silgan Holdings, Inc.

- 6.4.15 Stoelzle Oberglas GmbH

- 6.4.16 EPL Limited

- 6.4.17 Verescence Inc.

- 6.4.18 Apackaging Group LLC

- 6.4.19 Heinz-Glass GmbH & Ko. KGaA

- 6.4.20 Roetell Group

- 6.4.21 Vitro SAB De CV

- 6.4.22 Vidraria Anchieta Ltda.

- 6.4.23 Lumson S.p.A

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment