PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907343

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907343

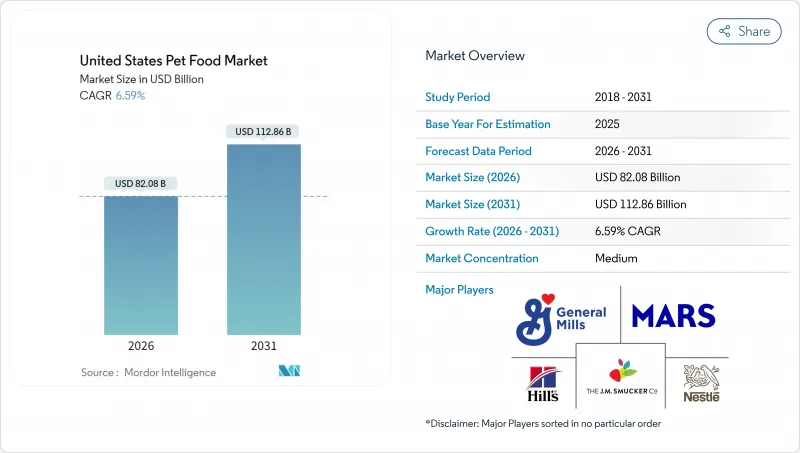

United States Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States pet food market was valued at USD 77.01 billion in 2025 and estimated to grow from USD 82.08 billion in 2026 to reach USD 112.86 billion by 2031, at a CAGR of 6.59% during the forecast period (2026-2031).

Rising disposable incomes and the continued humanization of pets drive demand for premium and functional formulations across urban and suburban households. Fresh and minimally processed foods are gaining traction as owners equate diet quality with preventive healthcare, prompting manufacturers to invest in cold-chain logistics and human-grade production lines. E-commerce adoption accelerates the adoption of subscription services that lock in repeat purchases and facilitate personalized diet plans. At the same time, sustained R&D around gut health additives and alternative proteins positions ingredient suppliers for incremental growth through 2030.

United States Pet Food Market Trends and Insights

Premiumization and Human-Grade Formulations

The shift toward human-grade pet food formulations represents a fundamental recalibration of consumer expectations, with pet owners increasingly viewing nutrition as a form of preventive healthcare rather than merely basic sustenance. This trend drives margin expansion across the value chain, as human-grade products command price premiums of 40-60% over conventional kibble formulations[1]. The regulatory framework surrounding human-grade claims has tightened significantly, with AAFCO (Association of American Feed Control Officials) establishing stricter guidelines for ingredient sourcing and processing standards that mirror human food safety protocols. The trend particularly benefits smaller, specialized brands that can navigate regulatory compliance more efficiently than large-scale manufacturers, who are often constrained by existing infrastructure investments.

Functional Ingredients Targeting Gut and Immune Health

Functional ingredient integration transforms pet food from basic nutrition to targeted health intervention, with probiotics, prebiotics, and omega-3 fatty acids becoming standard inclusions rather than premium add-ons. Research on the gut-brain axis in companion animals mirrors human nutrition science, creating opportunities for cross-pollination between ingredient suppliers serving both markets. Regulatory influence from the FDA's Center for Veterinary Medicine ensures ingredient safety while allowing health claims that support premium positioning. This trend particularly benefits ingredient suppliers with dual human-pet portfolios, creating economies of scale and shared R&D investments across market segments.

Supply-Side Pressure from Meat Protein Inflation

Protein cost volatility creates margin compression, forcing manufacturers to balance ingredient quality with pricing competitiveness, particularly for premium products that emphasize high meat content. Chicken prices increased 23% year-over-year in 2024, while beef costs rose 18%, creating significant input cost pressures for manufacturers heavily reliant on animal proteins . Supply chain diversification becomes increasingly critical as companies seek alternative protein sources, including insect-based and plant-based formulations, that offer both cost stability and sustainability benefits. The constraint particularly impacts smaller manufacturers with limited purchasing power and supply chain flexibility compared to large-scale producers with global sourcing capabilities and long-term supplier contracts.

Other drivers and restraints analyzed in the detailed report include:

- Direct-to-Consumer (DTC) Fresh-Frozen Meal Services

- Subscription-Based Automatic Replenishment Models

- FTC's Scrutiny of Natural and Human-Grade Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products maintain a dominant market position, with a 68.35% share in 2025, encompassing both traditional dry and wet formulations that serve as the foundation for the market. his accelerated growth is primarily driven by the increasing prevalence of health issues in pets, particularly pet obesity and dental problems, coupled with growing awareness among pet owners about preventive healthcare. The segment's growth is supported by the rising demand for premium and specialized pet food ingredients, including grain-free and organic options. Major manufacturers are continuously expanding their production capabilities and introducing innovative products to meet the evolving nutritional requirements of pets.

Pet veterinary diets are emerging as the fastest-growing segment, with an 7.62% CAGR through 2031, reflecting the medicalization of pet nutrition as veterinarians increasingly prescribe therapeutic formulations for specific health conditions. The segment's expansion is further supported by veterinarians' increasing recommendations for specialized diets to manage various health conditions. The market is witnessing a significant shift towards customized veterinary diets, with manufacturers developing specialized formulations for specific health conditions such as diabetes, digestive sensitivity, and urinary tract diseases. The rise of e-commerce channels has also contributed to the segment's growth by improving accessibility to these specialized products.

The United States Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and More), by Pets (Cats, Dogs, and More), and by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Mars, Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- The J.M. Smucker Company

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- PLB International

- ADM

- Virbac

- Schell & Kampeter, Inc.

- PLB International Inc.

- Freshpet, Inc

- The Farmers Dog, Inc.

- BrightPet Nutrition Group, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Premiumization and human-grade formulations

- 5.5.2 Functional ingredients targeting gut and immune health

- 5.5.3 Direct-to-consumer (DTC) fresh-frozen meal services

- 5.5.4 Subscription-based automatic replenishment models

- 5.5.5 Veterinary channel endorsement of life-stage diets

- 5.5.6 Corporate ESG commitments driving sustainable packaging

- 5.6 Market Restraints

- 5.6.1 Supply-side pressure from meat protein inflation

- 5.6.2 Direct-to-consumer (DTC) fresh-frozen meal services

- 5.6.3 Growing consumer skepticism toward ultra-processed kibbles

- 5.6.4 Protein-source volatility from insect farming scale-ups

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft & Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Diabetes

- 6.1.4.1.2 Digestive Sensitivity

- 6.1.4.1.3 Oral Care Diets

- 6.1.4.1.4 Renal

- 6.1.4.1.5 Urinary tract disease

- 6.1.4.1.6 Obesity Diets

- 6.1.4.1.7 Derma Diets

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 Nestle (Purina)

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.4 General Mills Inc.

- 7.6.5 Schell & Kampeter, Inc. (Diamond Pet Foods)

- 7.6.6 The J.M. Smucker Company

- 7.6.7 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.8 PLB International

- 7.6.9 ADM

- 7.6.10 Virbac

- 7.6.11 Schell & Kampeter, Inc.

- 7.6.12 PLB International Inc.

- 7.6.13 Freshpet, Inc

- 7.6.14 The Farmers Dog, Inc.

- 7.6.15 BrightPet Nutrition Group, LLC

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS