PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910428

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910428

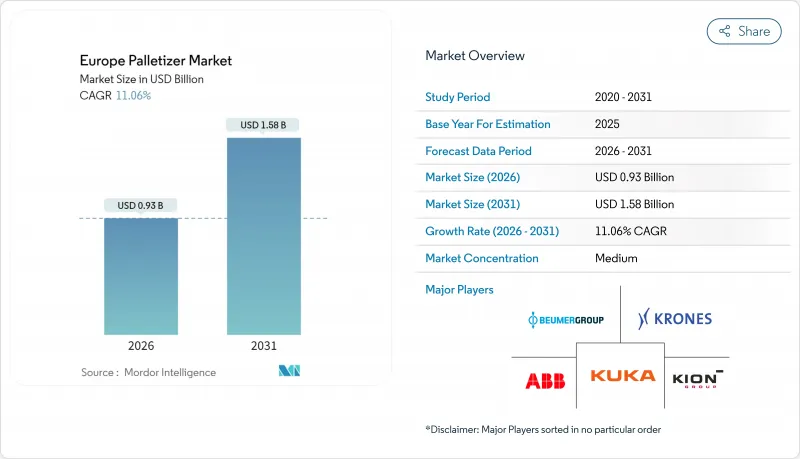

Europe Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Palletizer market is expected to grow from USD 0.84 billion in 2025 to USD 0.93 billion in 2026 and is forecast to reach USD 1.58 billion by 2031 at 11.06% CAGR over 2026-2031.

This double-digit trajectory mirrors the region's decisive shift toward automated packaging, which addresses acute labor shortages, rising wages, and tighter safety regulations that favor robotic over manual handling. Energy-efficient automation that aligns with carbon-neutral logistics goals further accelerates purchasing decisions, especially when governments link incentives to sustainability outcomes. Manufacturers also view palletizing as a gateway technology for broader Industry 4.0 rollouts because the machines collect production data, feed predictive maintenance models, and integrate easily with warehouse execution systems. Competitive intensity is rising as global robot makers, European specialist integrators, and new rental-model disruptors all target mid-sized factories that historically relied on manual stacking. Finally, e-commerce fulfillment hubs and temperature-controlled pharmaceutical chains create high-throughput requirements that expand the Europe Palletizer market into logistics environments beyond the traditional factory floor.

Europe Palletizer Market Trends and Insights

Expansion of Automated Packaging Lines in Food and Beverage Processing

Food and beverage producers now treat palletizing as an integrated step rather than a downstream add-on. Lines link directly to upstream fillers, so throughput rises without extra human touches, an approach that protects product hygiene and matches retailer demand for high-volume mixed packs. Equipment builders respond with stainless-steel hygienic grippers and easy-wash surfaces that meet sanitation codes. Vision modules add traceability by capturing case codes before loads leave the plant. Data captured at the palletizer also supports recall management, providing factories with a compliance advantage. Operators report fewer bottlenecks because pallets exit in rhythm with real-time orders, rather than fixed batch windows.

Labor Cost Escalation and Scarcity Across Western Europe

Western Europe's aging workforce is pushing vacancy rates in repetitive packaging roles to record highs, forcing plants to compete for scarce labor at rapidly rising wages. Managers now factor lost production into payback calculations, revealing that robotic palletizers recoup their costs in 18-24 months, instead of the earlier three-year norm. Early adopters enjoy higher uptime and stable output, which translates into better customer delivery scores. The labor gap also shifts board-level conversations from "whether" to "how fast" to automate, shortening decision cycles. Vendors who bundle training help buyers overcome talent gaps and secure repeat orders.

High Capital Expenditure for Fully Automatic Systems

Full-line palletizers with conveyor in-feed, stretch wrapping, and labeling can exceed the price of an entire filling line, which places them out of reach for many small plants. Eastern European firms face higher borrowing costs, widening the gap with Western peers. In response, suppliers launch rental and equipment-as-a-service models that shift spend from capex to opex. Collaborative units that share space with workers also lower project costs because they avoid the costs of guarding and civil works. These options broaden access, yet cannot match the raw throughput of top-tier systems, leaving a trade-off at higher-volume sites.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Workplace Safety Regulations Favouring Robotic Palletizers

- E-Commerce Boom Driving High-Throughput Warehousing Needs

- Downtime Risk Due to Complex Mechatronic Integrations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Robotic palletizers accounted for 50.85% of the European palletizer market size in 2025 and are expected to grow at a 12.89% CAGR, driven by advances in safe human-robot collaboration and simplified coding tools. The flexibility to switch SKUs without mechanical changes suits plants with varied product portfolios. Conventional machines stay relevant in ultra-high-volume beverage lines where mechanical actuators deliver unmatched cycles per hour. Hybrid platforms now merge mechanical layer formers with robotic corner posts to meet stability demands while preserving flexibility. Second-generation cobots, tested in 2025, can lift to 25 kg, opening up new use cases that once required larger, fenced robots. As service models mature, robot suppliers bundle uptime guarantees that lower operational risk and expand the European Palletizer market among cautious buyers.

Implementation speed is another drawback. Pre-engineered cells arrive as plug-and-play skids, enabling commissioning within days instead of months. Smart safety scanners often replace hard fences, freeing up valuable floor space. Robot operating software also feeds line supervisors with live OEE analytics. Vendors now differentiate through OT-IT convergence by linking pallets to ERP dispatch data for traceability. These digital hooks make robotic systems a Trojan horse for wider factory digitalization, reinforcing their leadership in the European Palletizer industry.

Pharmaceutical plants have pivoted to automation after the pandemic exposed bottlenecks in manual handling. The segment is expected to advance at a 12.95% CAGR to 2031, driven by cold-chain regulations that mandate controlled handling from vial to pallet. Robots operate reliably in chilled rooms and integrate serialization cameras that record every carton ID. Food and beverage retained the largest 32.70% share of the European palletizer market size in 2025, as high-volume bottlers and snack makers require continuous output for retail shelves. Cross-contamination rules in the meat and dairy industries also favor stainless-steel robotic grippers that can withstand aggressive washdowns.

Personal care and cosmetics firms adopt palletizers to handle seasonal variety packs driven by e-commerce promotions. Their premium products justify investment in gentle vacuum tooling that prevents carton scuffing. The chemicals sector adds explosive-proof enclosures and antistatic components to meet safety codes, creating niche demand for specialized integrators. With each use case, suppliers tailor turnkey cells that reduce validation complexity and expand the addressable European palletizer market.

The Europe Palletizer Market Report is Segmented by Type (Conventional, Robotic), End-User Industry (Food and Beverages, Pharmaceuticals, and More), System Configuration (Inline, Layer, Gantry/Robotic Arm), Load Capacity (Up To 10 Kg, 11-30 Kg, Above 30 Kg), Automation Level (Semi-Automatic, Fully Automatic), and Geography (Germany, United Kingdom, Italy, Spain, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd

- Beumer Group GmbH and Co. KG

- KION Group AG (Dematic)

- Krones AG

- Kuka AG

- Honeywell International Inc.

- AetnaGroup SpA

- Concetti SpA

- Fuji Robotics Americas Inc.

- FANUC Europe Corporation S.A.

- Yaskawa Europe GmbH

- Sidel Group

- Ocme S.r.l.

- Gebo Cermex

- Kawasaki Robotics GmbH

- Premier Tech Systems and Automation

- Columbia Machine Inc.

- MSK Verpackungs-Systeme GmbH

- Scott Automation NV

- Ehcolo A/S

- Bastian Solutions LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of automated packaging lines in food and beverage processing

- 4.2.2 Labour cost escalation and scarcity across Western Europe

- 4.2.3 Heightened workplace safety regulations favouring robotic palletizers

- 4.2.4 E-commerce boom driving high-throughput warehousing needs

- 4.2.5 Adoption of collaborative palletizing cells in mid-sized plants

- 4.2.6 Carbon-neutral logistics hubs demanding energy-efficient palletizers

- 4.3 Market Restraints

- 4.3.1 High capital expenditure for fully automatic systems

- 4.3.2 Downtime risk due to complex mechatronic integrations

- 4.3.3 Shortage of skilled programmers for multi-axis robots

- 4.3.4 Rising pallet size diversity complicating standard cell design

- 4.4 Industry Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Conventional

- 5.1.2 Robotic

- 5.2 By End-user Industry

- 5.2.1 Food and Beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Chemicals

- 5.3 By System Configuration

- 5.3.1 Inline Palletizers

- 5.3.2 Layer Palletizers

- 5.3.3 Gantry / Robotic Arm Palletizers

- 5.4 By Load Capacity

- 5.4.1 Up to 10 kg

- 5.4.2 11 - 30 kg

- 5.4.3 Above 30 kg

- 5.5 By Automation Level

- 5.5.1 Semi-automatic

- 5.5.2 Fully Automatic

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 France

- 5.6.3 United Kingdom

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Russia

- 5.6.7 Netherlands

- 5.6.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Beumer Group GmbH and Co. KG

- 6.4.3 KION Group AG (Dematic)

- 6.4.4 Krones AG

- 6.4.5 Kuka AG

- 6.4.6 Honeywell International Inc.

- 6.4.7 AetnaGroup SpA

- 6.4.8 Concetti SpA

- 6.4.9 Fuji Robotics Americas Inc.

- 6.4.10 FANUC Europe Corporation S.A.

- 6.4.11 Yaskawa Europe GmbH

- 6.4.12 Sidel Group

- 6.4.13 Ocme S.r.l.

- 6.4.14 Gebo Cermex

- 6.4.15 Kawasaki Robotics GmbH

- 6.4.16 Premier Tech Systems and Automation

- 6.4.17 Columbia Machine Inc.

- 6.4.18 MSK Verpackungs-Systeme GmbH

- 6.4.19 Scott Automation NV

- 6.4.20 Ehcolo A/S

- 6.4.21 Bastian Solutions LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment