PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910469

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910469

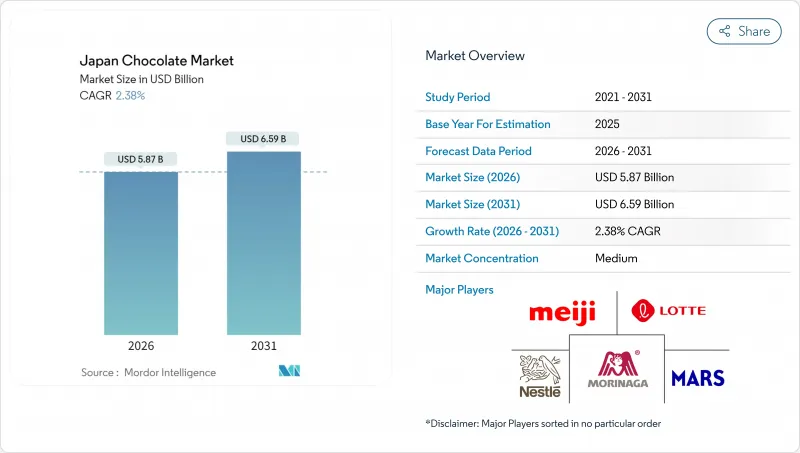

Japan Chocolate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan chocolate market is expected to grow from USD 5.73 billion in 2025 to USD 5.87 billion in 2026 and is forecast to reach USD 6.59 billion by 2031 at 2.38% CAGR over 2026-2031.

In 2024, cocoa prices tripled, prompting major manufacturers such as Meiji, Morinaga, and Lotte to raise their product prices. Despite these price hikes, companies managed to maintain sales volumes by introducing limited-edition product lines, aligning launches with popular cultural trends, and discontinuing less profitable product ranges. Retail chocolate prices are rising, and this price increase has temporarily reduced demand for high-cacao chocolates, while encouraging the growth of premium and gifting segments. Functional chocolates gained popularity after Japanese studies highlighted the health benefits of high-polyphenol dark chocolate, such as improved cognitive function and gut health. This trend particularly appealed to active seniors and office workers. The market remains moderately consolidated, with key players driving innovation and adapting to changing consumer preferences.

Japan Chocolate Market Trends and Insights

Growth of convenience snacking among office workers

Japan's chocolate market is heavily influenced by the growing demand for convenient snacking, particularly among the country's highly employed urban population. As of May 2024, Japan had an employment rate of 97.4%, according to the Organisation for Economic Co-operation and Development, resulting in consistent commuter activity. This has increased the popularity of quick stops at convenience stores, locally known as konbini, where busy individuals often pick up small treats to fit into their hectic schedules. Leading brands such as Lotte Corporation, Morinaga Co., Ltd., and Nestle SA have capitalized on this trend by offering compact, portable, and diverse chocolate options that cater to on-the-go consumption. Retailers are also playing a significant role in promoting these products through digital marketing campaigns and introducing premium high-cacao chocolate ranges.

Preference for health-oriented and functional chocolates

Japan's chocolate market is being shaped by a growing preference for healthier and functional products, as more people focus on improving their overall well-being. The World Health Organization predicts that by 2025, an additional 6.5 million people in Japan will achieve better health, leading to a rising demand for chocolates that offer both enjoyment and health benefits. To cater to this trend, Meiji introduced a new chocolate line in July 2024, which uses fructooligosaccharides (FOS) instead of regular sugar. FOS is a prebiotic ingredient that supports gut health, making the product appealing to health-conscious consumers. This move highlights a shift in the market, where leading brands are redefining chocolate as more than just a sweet indulgence. By incorporating functional ingredients, companies are aligning their products with the growing interest in healthier lifestyles, while also expanding their appeal to a broader audience.

Consumer shift toward low-sugar and low-calorie lifestyles

Japan's chocolate market is facing challenges as more consumers adopt low-sugar and low-calorie diets due to growing health concerns. In 2024, the International Diabetes Federation reported that 8.1% of adults in Japan are living with diabetes, which has further encouraged the population to reduce sugar consumption. This shift in consumer behavior has led to a decline in demand for traditional chocolate products. Even high-cacao chocolate, which is often marketed as a healthier option, has seen lower sales volumes as its higher price deters many consumers. To address these changes, manufacturers are introducing lighter and reduced-sugar chocolate options. However, consumer adoption of these products has been slow. Additionally, new allergen-labeling regulations set to take effect in 2025 are creating added compliance challenges, particularly for smaller chocolate companies.

Other drivers and restraints analyzed in the detailed report include:

- Influence of anime, pop culture and character branding

- Premiumisation and gifting culture

- Competition from healthier snacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milk and white chocolate are the most preferred types in Japan's chocolate market, together making up 71.92% of the market share in 2025. Their popularity stems from well-known products like Meiji Milk Chocolate and Morinaga Milk Chocolate, which have become staples in Japanese snacking and gifting culture. These chocolates are easily found in convenience stores, supermarkets, and seasonal gift packs, ensuring they remain accessible to consumers. Their timeless flavors and wide appeal make them a favorite for both casual treats and special occasions, maintaining their strong presence in the market.

Dark chocolate is rapidly gaining popularity as the fastest-growing segment, with an expected CAGR of 3.44% from 2026 to 2031. This growth is driven by increasing consumer interest in healthier options, especially among older individuals who are more conscious of their health benefits. To cater to this demand, manufacturers are launching more high-cacao and functional dark chocolate products, promoting them as both healthy and enjoyable. As more people become aware of the benefits of polyphenols and flavanols in dark chocolate, it is shifting from a niche product to a significant part of Japan's chocolate market.

Tablets and bars remained the leading chocolate formats in Japan's market in 2025, capturing a 64.88% share of the total market. Their widespread popularity stems from their convenience and availability in single-serve and multi-pack options, which are perfect for quick and easy purchases at convenience stores. These formats are portable and cater to busy lifestyles, making them a go-to choice for consumers. Manufacturers rely on efficient production methods to ensure consistent quality and affordable pricing, which in turn enhances their appeal across various consumer groups.

Pralines and truffles are anticipated to grow at a CAGR of 3.48% through 2031, making them one of the fastest-growing segments in the market. This growth is driven by increasing demand for premium and indulgent chocolate options, particularly for gifting and special occasions. These products stand out due to their unique flavors, artisanal craftsmanship, and elegant packaging, which attract consumers in specialty and department stores. As more people seek high-quality and luxurious chocolate experiences, pralines and truffles are expected to make a significant contribution to the market's value growth in the coming years.

The Japan Chocolate Market Report is Segmented by Product Type (Dark Chocolate and Milk and White Chocolate), Form (Tablets and Bars, Molded Blocks, and More), Price Range (Mass and Premium), Ingredient Type (Dairy-Based, Plant-Based, and More), and Distribution Channel (Supermarkets/Hypermarkets, Online Retail Stores, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Meiji Holdings Co. Ltd

- Lotte Corporation

- Morinaga & Co. Ltd

- Nestle SA

- Ezaki Glico Co. Ltd

- Mars Inc.

- Ferrero International SA

- Mondelez International Inc.

- The Hershey Company

- Lindt & Sprungli AG

- YIldIz Holding

- ROYCE' Confect Co. Ltd

- Tirol-Choco Co., Ltd.

- LeTAO

- Minimal - Bean to Bar Chocolate

- Bourbon Corporation

- Le Chocolat de H

- Mary Chocolate Co

- Nakamura Chocolat

- Green Bean to Bar Chocolate

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Trend Analysis

- 4.2.1 Ingredient Analysis

- 4.2.2 Consumer Behaviour Analysis

- 4.2.3 Regulatory Framework

- 4.2.4 Value Chain and Distribution Channel Analysis

- 4.3 Market Drivers

- 4.3.1 Rising demand for seasonal and limited-edition products

- 4.3.2 Growth of convenience snacking among office workers

- 4.3.3 Preference for health-oriented and functional chocolates

- 4.3.4 Premiumisation and gifting culture

- 4.3.5 Influence of anime, pop culture and character branding

- 4.3.6 Rise of sustainability and ethical-sourcing preferences

- 4.4 Market Restraints

- 4.4.1 Consumer shift toward low-sugar and low-calorie lifestyles

- 4.4.2 Allergies and rising dietary restrictions

- 4.4.3 Strong competition from healthier snack alternatives

- 4.4.4 Cocoa price volatility and supply-chain disruptions

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Dark Chocolate

- 5.1.2 Milk and White Chocolate

- 5.2 By Form

- 5.2.1 Tablets and Bars

- 5.2.2 Molded Blocks

- 5.2.3 Pralines and Truffles

- 5.2.4 Other Forms

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Ingredient Type

- 5.4.1 Dairy-Based

- 5.4.2 Plant-Based

- 5.4.3 Single Origin

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Online Retail Stores

- 5.5.3 Convenience Stores

- 5.5.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Meiji Holdings Co. Ltd

- 6.4.2 Lotte Corporation

- 6.4.3 Morinaga & Co. Ltd

- 6.4.4 Nestle SA

- 6.4.5 Ezaki Glico Co. Ltd

- 6.4.6 Mars Inc.

- 6.4.7 Ferrero International SA

- 6.4.8 Mondelez International Inc.

- 6.4.9 The Hershey Company

- 6.4.10 Lindt & Sprungli AG

- 6.4.11 YIldIz Holding

- 6.4.12 ROYCE' Confect Co. Ltd

- 6.4.13 Tirol-Choco Co., Ltd.

- 6.4.14 LeTAO

- 6.4.15 Minimal - Bean to Bar Chocolate

- 6.4.16 Bourbon Corporation

- 6.4.17 Le Chocolat de H

- 6.4.18 Mary Chocolate Co

- 6.4.19 Nakamura Chocolat

- 6.4.20 Green Bean to Bar Chocolate

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK