PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910470

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910470

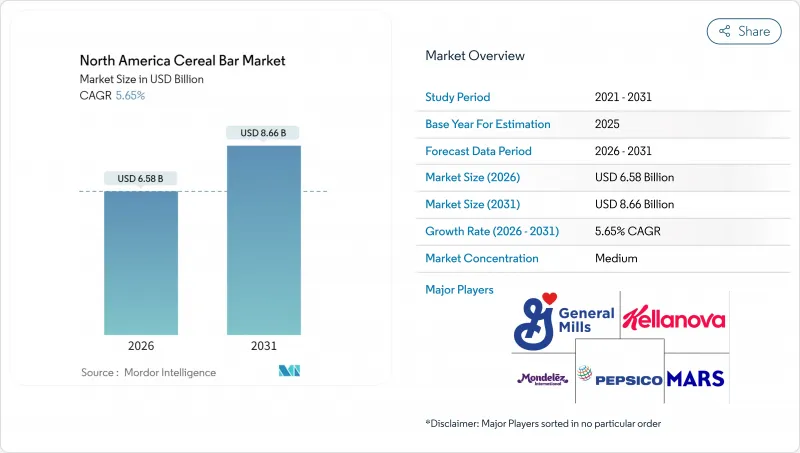

North America Cereal Bar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America cereal bar market is expected to grow from USD 6.23 million in 2025 to USD 6.58 million in 2026 and is forecast to reach USD 8.66 million by 2031 at 5.65% CAGR over 2026-2031.

This growth is driven by increasing health consciousness among consumers, regulatory changes, and rapid product reformulations that are transforming cereal bars from being perceived as discretionary snacks to legitimate meal replacement options. The United States Food and Drug Administration's (FDA) updated definition of "healthy," which will take effect in February 2025, prioritizes recipes that incorporate whole-food ingredients while discouraging those with high levels of added sugars and sodium . Retailers are responding by expanding shelf space for natural and organic products, prompting brands to seek certifications such as USDA Organic (United States Department of Agriculture Organic) and Non-GMO Project (Non-Genetically Modified Organism Project) verification. Furthermore, 71% of North American consumers now express a preference for obtaining protein from whole foods, which is driving the popularity of high-protein, low-sugar cereal bars in mainstream grocery stores. The growth of e-commerce and direct-to-consumer subscription models is also playing a significant role in accelerating the market by reducing customer acquisition costs and enabling the delivery of personalized nutrition bundles.

North America Cereal Bar Market Trends and Insights

Rising Health Consciousness and Focus on Functional Nutrition

North American consumers are increasingly perceiving cereal bars as functional nutrition products rather than indulgent snacks. This trend highlights a growing preference for products emphasizing protein content, gut-health ingredients, and micronutrient fortification over flavor. A significant portion of consumers believes that proper nutrition and regular physical activity can positively influence the aging process. Additionally, many consumers prefer obtaining protein from whole foods rather than relying on dietary supplements. This shift in preferences has driven demand for cereal bars that provide 10 to 15 grams of protein per serving, with ingredient lists that are simple and easy to recognize. Premium product offerings now incorporate prebiotic fibers, such as those sourced from watermelon, honeydew, and mango rinds, catering to health-conscious shoppers who prioritize gut health as a critical component of overall wellness.

Expansion of Clean Label and Non-GMO Product Offerings

Clean-label formulations, defined by short ingredient lists, easily recognizable components, and minimal processing, have evolved from being premium differentiators to becoming essential requirements for achieving mass-market distribution. The sales of organic snack bars have grown significantly, with numerous launches of organic bars recorded in recent years. This growth reflects the increasing allocation of shelf space by retailers to products certified as organic by the United States Department of Agriculture (USDA). Similarly, Non-Genetically Modified Organism (Non-GMO) Project Verification has emerged as a standard expectation for distribution within natural retail channels. Brands that do not carry the butterfly seal, which signifies Non-GMO Project Verification, face the risk of being removed from shelves at major retailers such as Whole Foods Market and Sprouts Farmers Market. At the same time, advancements in sweetener innovation continue to gain momentum. Alternatives such as stevia, monk fruit, tagatose, and allulose are increasingly replacing high-fructose corn syrup and cane sugar, addressing consumer demand for low-glycemic options that help avoid insulin spikes.

Regulatory Changes for Labeling, Health Claims, and Allergens

The United States Food and Drug Administration (FDA)'s January 2025 proposal for a front-of-pack Nutrition Information box requires labels indicating Low, Medium, or High levels of saturated fat, sodium, and added sugars. Companies must comply within 3 to 4 years, with an estimated industry-wide cost of USD 333 million annually. Products displaying "High" added-sugar labels risk losing placement in health-and-wellness sections at major retailers such as Target, Walmart, and Kroger. This forces brands to undergo reformulation processes, which can reduce profit margins and delay product innovation. In Canada, the front-of-pack nutrition symbol, effective January 2026, requires bilingual packaging and warning symbols for products exceeding thresholds for saturated fat, sodium, or sugars. This adds compliance challenges for brands operating across North America. Similarly, Mexico's NOM-051 labeling regulation mandates black octagon warning labels for products with excessive levels of calories, sugars, saturated fat, trans fat, and sodium. This regulation triggered a wave of reformulations in 2024 as brands aimed to avoid the negative perception associated with multiple warning symbols. These overlapping regulatory requirements increase the complexity of stock-keeping units (SKUs). A single product may require three distinct label designs to meet the regulations in the United States, Canada, and Mexico. This raises packaging costs by 15% to 20% and extends time-to-market by 6 to 9 months. Smaller brands, which often lack dedicated regulatory affairs teams, face significant compliance challenges. As a result, there is growing consolidation pressure, with private-equity-backed platforms acquiring smaller brands to distribute legal and labeling costs across larger portfolios.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Plant-Based and Vegan Product Lines

- Increase in Sports, Fitness, and Outdoor Activity Participation

- Consumer Skepticism Over Processed Food Health Benefits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy and nutrition bars are anticipated to grow at a compound annual growth rate (CAGR) of 7.22% through 2031, significantly outpacing the growth of granola/muesli bars. Granola/muesli bars are expected to account for 44.88% of the total volume in 2025, but their growth lags behind by 127 basis points. The faster growth of energy and nutrition bars can be attributed to advancements in product formulations, which now offer 15 grams of protein per serving while maintaining calorie counts below 200. These features cater to the needs of health-conscious consumers, particularly those focused on weight management and endurance activities, making these bars a preferred choice in the market.

In contrast, granola bars are encountering challenges due to the United States Food and Drug Administration's (FDA) updated definition of "healthy." The revised guidelines discourage the use of added sugars and saturated fats, which are integral to the honey-oat-nut clusters that define this subcategory. This regulatory change has created obstacles for granola bars, as manufacturers must now navigate these stricter standards while maintaining the appeal of their products. As a result, granola bars are facing increased pressure to adapt to evolving consumer preferences and regulatory requirements.

Organic bars are anticipated to grow at a compound annual growth rate (CAGR) of 7.45% through 2031, surpassing the growth of conventional formulations. Conventional formulations accounted for 76.95% of the total volume in 2025, but organic bars are projected to outpace them by 182 basis points. This growth reflects the efforts of retailers to expand their natural and organic product offerings, driven by the 427 organic bar launches recorded between 2019 and 2023. Retailers such as Whole Foods Market and Sprouts Farmers Market have implemented policies requiring new stock-keeping units (SKUs) in the cereal-bar aisle to meet USDA (United States Department of Agriculture) Organic or Non-GMO (Genetically Modified Organism) Project Verification standards. These requirements effectively regulate access to the 10% share of the food market represented by natural products, a segment that is growing 38 times faster than conventional categories.

In March 2024, General Mills' Cascadian Farm introduced Organic Granola Bars, emphasizing their commitment to USDA Organic certification, non-GMO ingredients, and the exclusion of artificial additives. This strategic positioning allowed the product to secure placement in Kroger's Simple Truth organic set and Albertsons' O Organics planogram. By aligning with consumer demand for transparency and healthier options, Cascadian Farm has strengthened its presence in the rapidly growing organic food market, catering to the increasing preference for natural and sustainable products.

The North America Cereal Bar Market Report is Segmented by Product Type (Granola/Muesli Bars, Energy and Nutrition Bars and Others), Functional Claim (Organic and Conventional), Price Category (Mass and Premium), Distribution Channel (Supermarkets/Hypermarkets, Online Retail Store and More), and Geography (United States, Canada, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (tonnes).

List of Companies Covered in this Report:

- General Mills Inc.

- Kellanova

- PepsiCo, Inc.

- Mondelez International, Inc.

- Mars, Incorporated

- Post Holdings Inc.

- The Simply Good Foods Company

- McKee Foods Corporation

- Bobo's Oat Bars, LLC

- Nature's Path Foods, Inc.

- Core Foods, LLC

- Probar LLC

- Riverside Natural Foods Ltd

- Kashi Company

- Atkins Nutritionals

- Quaker Oats Company

- Health Warrior

- GoGo Quinoa Inc.

- Freedom Foods Group Limited

- Bariatrix Nutrition Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health consciousness and focus on functional nutrition

- 4.2.2 Expansion of clean label and non-GMO product offerings

- 4.2.3 Growth in plant-based and vegan product lines

- 4.2.4 Increase in sports, fitness, and outdoor activity participation

- 4.2.5 Rise of gluten-free, allergy-friendly, and specialty diet formats

- 4.2.6 E-commerce and direct-to-consumer distribution growth

- 4.3 Market Restraints

- 4.3.1 Regulatory changes for labeling, health claims, and allergens

- 4.3.2 Consumer skepticism over processed food health benefits

- 4.3.3 Challenges in scaling new formulations for mass production

- 4.3.4 Challenges in scaling new formulations for mass production

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Granola/Muesli Bars

- 5.1.2 Energy and Nutrition Bars

- 5.1.3 Others

- 5.2 By Functional Claim

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Price Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarket/Hypermarket

- 5.4.2 Online Retail Store

- 5.4.3 Convenience Store

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 General Mills Inc.

- 6.4.2 Kellanova

- 6.4.3 PepsiCo, Inc.

- 6.4.4 Mondelez International, Inc.

- 6.4.5 Mars, Incorporated

- 6.4.6 Post Holdings Inc.

- 6.4.7 The Simply Good Foods Company

- 6.4.8 McKee Foods Corporation

- 6.4.9 Bobo's Oat Bars, LLC

- 6.4.10 Nature's Path Foods, Inc.

- 6.4.11 Core Foods, LLC

- 6.4.12 Probar LLC

- 6.4.13 Riverside Natural Foods Ltd

- 6.4.14 Kashi Company

- 6.4.15 Atkins Nutritionals

- 6.4.16 Quaker Oats Company

- 6.4.17 Health Warrior

- 6.4.18 GoGo Quinoa Inc.

- 6.4.19 Freedom Foods Group Limited

- 6.4.20 Bariatrix Nutrition Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK