PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910487

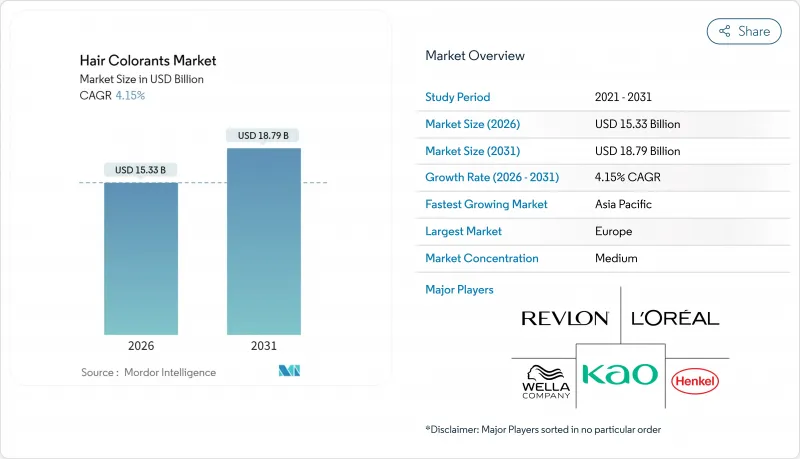

Hair Colorants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Hair colorants market size in 2026 is estimated at USD 15.33 billion, growing from 2025 value of USD 14.72 billion with 2031 projections showing USD 18.79 billion, growing at 4.15% CAGR over 2026-2031.

Two distinct consumer demands are shaping this trend: older consumers are focusing on grey coverage, while younger ones are leaning towards bold, short-cycle styles. Innovations like ammonia-free products, quick shade turnovers influenced by social media, and a blend of online and offline retailing are driving both volume and value growth. Europe sees a consistent rise in premium products, supported by a strong preference for high-quality formulations and brand loyalty among consumers. Meanwhile, Asia Pacific benefits from a growing salon infrastructure, increasing disposable incomes, and a surge in digital commerce, leading to even higher gains. While established players bolster their advantages in research, regulatory matters, and salon distribution, niche newcomers are successfully drawing in a digitally-savvy audience by leveraging targeted marketing strategies and unique product offerings, resulting in a moderate competitive intensity.

Global Hair Colorants Market Trends and Insights

Demographic shift - grey-coverage demand surge

By 2040, projections indicate that 22.7% of Canada's residents will be aged 65 and older. This demographic increasingly favors professional services and premium at-home kits, seeking assurances of full coverage, longevity, and scalp safety. In response, formulators are incorporating bond-building agents to mitigate chemical stress, ensuring that products cater to the specific needs of aging hair, such as reduced elasticity and increased fragility. Hairdressers are championing subscription-based touch-up services, offering convenience and consistent results to maintain customer satisfaction. Amid intensified safety scrutiny, compliance with ISO 22716 emerges as a trust signal, reinforcing consumer confidence and bolstering brand loyalty among older buyers. As a result, while niche color trends may waver, permanent oxidative systems continue to hold steady in volume due to their reliability and effectiveness. Manufacturers adept at harmonizing low-odor chemistry with deep penetration technology stand poised to tap into this structurally expanding and increasingly discerning user base.

Social-media fueled fashion experimentation

Platforms like TikTok have accelerated color fads, shrinking their timelines from seasons to mere weeks. This shift has intensified the demand for semi-permanent and highlight formats, which allow for quicker changes and align with the fast-paced preferences of younger consumers. In the U.S., 40% of adults aged 18-22 show a keen interest in gender-neutral color cosmetics, underscoring a wider trend towards inclusive beauty that resonates with evolving societal values. Generative AI-driven virtual try-on tools are alleviating user hesitations by enabling them to visualize results before making a commitment, thereby enhancing consumer confidence and driving purchase decisions. The swift rise of digital trends is pushing supply chains to adapt, leading to smaller batch runs with a wider shade variety to meet diverse consumer demands. This agility is especially beneficial for firms that utilize flexible manufacturing cells, allowing them to respond quickly to market shifts. Retailers are capitalizing on these rapid cycles, rolling out limited-edition drops that transition from social media previews to checkouts in just days, creating a sense of urgency and exclusivity among consumers.

Health and allergy concerns over dye chemicals

PPD, a recognized sensitizer, has been flagged by the nonprofit MADE SAFE as a primary allergen responsible for contact dermatitis. This chemical is commonly used in hair dyes and other cosmetic products, making its regulation critical for consumer safety. In the United Arab Emirates, regulatory inspections discovered multiple retail products surpassing permissible PPD limits, highlighting oversight deficiencies and the need for stricter enforcement. Meanwhile, New York State's revelation of counterfeit cosmetics laced with heavy metals has further eroded consumer confidence, raising concerns about the safety of unregulated products. As a result, consumers are increasingly gravitating towards certified PPD-free products and botanical-based kits, which are perceived as safer alternatives. However, the transition is tempered by premium pricing and a restricted range of shades, limiting the pace of adoption despite growing awareness of potential health risks.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in ammonia-free and natural dyes

- Expansion of salon networks in emerging markets

- Stringent global ingredient regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Permanent colorants dominate the global hair color market, maintaining a commanding share of 48.62% in 2025, underscoring consumers' consistent preference for long-lasting color solutions that reduce the need for frequent maintenance. This category remains the backbone of the industry, especially as demographic aging trends continue to increase demand for reliable grey coverage. Innovation in formulations has strengthened its position, with brands like CHI Color Express introducing ammonia-free systems that deliver 100% grey coverage in just 10 minutes, catering to consumers seeking both efficiency and gentler chemistry. The segment is further bolstered by the fact that permanent oxidative dyes account for nearly 70-80% of hair coloring products sold in European markets as regulated under Regulation (EC) No 1223/2009. Despite its stronghold, the category faces growing scrutiny from health-conscious consumers who are cautious about conventional chemical systems, pressuring manufacturers to develop safer and more natural alternatives. Nevertheless, the durability and effectiveness of permanent colorants continue to secure their leading role in the hair coloring landscape.

Highlighters stand out as the fastest-growing segment, projected to expand at a 9.29% CAGR through 2031, driven by changing consumer behavior and evolving beauty trends. Social media has been instrumental in fueling experimentation, with younger demographics embracing bold, unconventional looks that temporary color solutions can provide. Unlike permanent products, highlighters appeal to consumers who do not want long-term commitments and instead seek playful options that align with fast-moving fashion and cultural trends. This trend resonates particularly well during festivals, lifestyle events, and casual experimentation, reflecting the demand for spontaneity in beauty routines. The rise of digital influencers and viral beauty trends has created a strong pull for these products, making them highly visible and aspirational. As a result, highlighters are expected to sustain robust growth, carving out a dynamic space in the market by addressing the need for creative self-expression without the permanence of chemical-intensive systems.

The Global Hair Colorants Market Report is Segmented by Product Type (Bleachers, Highlighters, Permanent Colorants, and More), Category (Mass, Premium), Distribution Channel (Supermarkets/Hypermarkets, Health and Beauty Stores, Online Retail Stores, Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, Europe commanded a dominant 32.45% share of the hair colorants market, underscoring the deep-rooted salon traditions in nations like Germany, France, Italy, and the UK. Brands, responding to stringent EU cosmetic regulations, are continuously refining formulations, often eliminating contentious additives and shifting towards eco-friendly packaging. With rising disposable incomes and a cultural focus on appearance, there's a steadfast demand for premium products. Notably, Eastern Europe, with countries like Poland and Romania, is witnessing a shift as consumers transition from natural dyes to oxidative systems. However, this growth is tempered by economic fluctuations that heighten price sensitivity.

Asia Pacific is on a rapid ascent, boasting a projected CAGR of 7.85% through 2031. Urbanization in China and India is driving more frequent salon visits. Meanwhile, the rise of digital commerce is enabling brands to launch directly to consumers, sidestepping traditional distributors. Platforms like Chinese livestream shopping are not just showcasing trends but are also bolstering repeat purchases, especially for temporary and semi-permanent products. In Vietnam and Indonesia, government-backed vocational programs are broadening the pool of certified stylists, inadvertently boosting the demand for professional coloring services. Yet, brands must navigate challenges like currency volatility and fluctuating import tariffs, necessitating nimble pricing strategies to fend off competition from local brands.

North America, while mature, is a hotbed of innovation, with product development increasingly leaning towards inclusivity and clean-label narratives. The region's hair colorants market is buoyed by a surge in subscription services, delivering tailored kits every six weeks. Regulatory shifts, particularly under MoCRA in Canada and the U.S., are pushing for transparent labeling. Major multinationals are seizing this as an opportunity to bolster consumer trust. Meanwhile, Latin America and the Middle East and Africa are emerging markets, characterized by youthful populations and a burgeoning influencer culture. While certain Sub-Saharan markets grapple with infrastructure challenges that hinder penetration, the Gulf Cooperation Council countries are witnessing a surge in organized retail, paving the way for premium product opportunities.

- L'Oreal S.A.

- Henkel AG & Co. KGaA

- Coty Inc. (Wella)

- Kao Corporation

- Revlon Inc.

- Unilever PLC

- Procter & Gamble (Clairol)

- Shiseido Co. Ltd.

- Godrej Consumer Products Ltd.

- Hoyu Co. Ltd.

- Estee Lauder Companies Inc.

- Combe Inc.

- Nature & Co

- Hygienic Research Inst. Pvt. Ltd.

- Honasa Consumer Ltd

- Heena Industries Pvt Ltd

- Wella Company

- Madison Reed, Inc.

- OJYA Natural

- Impressions Cosmetic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demographic shift grey-coverage demand surge

- 4.2.2 Social-media fueled fashion experimentation

- 4.2.3 Innovation in ammonia-free and natural dyes

- 4.2.4 Expansion of salon networks in emerging markets

- 4.2.5 At-home AI shade-matching adoption

- 4.2.6 Rise of gender-neutral inclusive color lines

- 4.3 Market Restraints

- 4.3.1 Health and allergy concerns over dye chemicals

- 4.3.2 Stringent global ingredient regulations

- 4.3.3 Supply-chain risk for key dye intermediates

- 4.3.4 Counterfeit/return fraud on e-commerce channels

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bleachers

- 5.1.2 Highlighters

- 5.1.3 Permanent Colorants

- 5.1.4 Semi-Permanent Colorants

- 5.1.5 Temporary Colorants

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.1.1 Health and Beauty Stores

- 5.3.1.2 Online Retail Stores

- 5.3.1.3 Other Distribution Channels

- 5.3.1 Supermarkets/Hypermarkets

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Netherlands

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Sweden

- 5.4.2.11 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Morocco

- 5.4.5.6 Turkey

- 5.4.5.7 South Africa

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Henkel AG & Co. KGaA

- 6.4.3 Coty Inc. (Wella)

- 6.4.4 Kao Corporation

- 6.4.5 Revlon Inc.

- 6.4.6 Unilever PLC

- 6.4.7 Procter & Gamble (Clairol)

- 6.4.8 Shiseido Co. Ltd.

- 6.4.9 Godrej Consumer Products Ltd.

- 6.4.10 Hoyu Co. Ltd.

- 6.4.11 Estee Lauder Companies Inc.

- 6.4.12 Combe Inc.

- 6.4.13 Nature & Co

- 6.4.14 Hygienic Research Inst. Pvt. Ltd.

- 6.4.15 Honasa Consumer Ltd

- 6.4.16 Heena Industries Pvt Ltd

- 6.4.17 Wella Company

- 6.4.18 Madison Reed, Inc.

- 6.4.19 OJYA Natural

- 6.4.20 Impressions Cosmetic

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK