PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910520

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910520

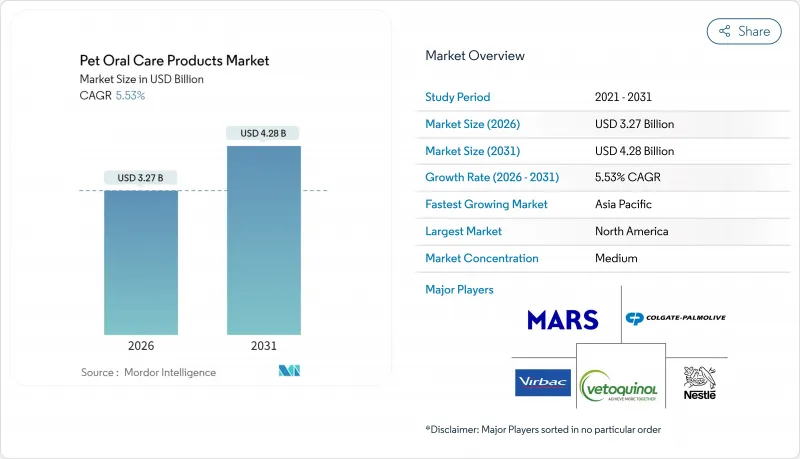

Pet Oral Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pet oral care products market size in 2026 is estimated at USD 3.27 billion, growing from 2025 value of USD 3.1 billion with 2031 projections showing USD 4.28 billion, growing at 5.53% CAGR over 2026-2031.

Growth is fueled by widespread periodontal disease, rising pet humanization that prioritizes preventive wellness, and the proliferation of veterinary tele-dentistry that brings professional guidance to underserved areas. Dental chews dominate revenue because they align with low-compliance households, while water additives accelerate on the back of "set-and-forget" convenience and enzymatic innovations that dissolve plaque without brushing. Rapid e-commerce adoption, subscription programs, and targeted social-media outreach shorten the path from education to purchase, particularly among millennial pet parents. Meanwhile, regulatory scrutiny around xylitol and efficacy claims compels manufacturers to invest in validated ingredients and Veterinary Oral Health Council (VOHC) acceptance, reinforcing barriers to entry for smaller brands.

Global Pet Oral Care Products Market Trends and Insights

High Prevalence of Periodontal Disease in Pets

Periodontal lesions affect at least 44% of dogs and up to 85% of cats by six years of age, turning oral care from a discretionary category into a medical necessity. Cardiac, hepatic, and renal pathologies correlate with oral bacteria translocation, incentivizing owners to choose enzymatic toothpastes, VOHC-accepted chews, and antimicrobial water additives. Small breeds are at higher risk, with Yorkshire terriers showing 98% periodontitis within 37 weeks when untreated as clinical evidence links oral health to systemic wellness, spending shifts from aesthetic grooming to preventive therapeutics.

Rising Pet Humanization and Premium Spend

Eighty-five percent of pet owners equate supplements for their animals with their own nutritional needs, fueling demand for human-grade formulations and transparent labels. Ingredient quality now outweighs pricing for 78% of supplement purchasers, especially in China, where premium pet spending climbs alongside a rising middle class. Brands respond with postbiotic powders and marine-algae chews that mirror trends in human functional foods.

Low Owner Compliance with Tooth-Brushing Regimens

Owner compliance with daily tooth-brushing protocols remains critically low, with Yorkshire terrier studies showing average brushing success rates of only 3.99% per week despite professional guidance and product provision. This compliance barrier constrains market growth for traditional toothpaste and brush combinations, forcing manufacturers to develop alternative delivery mechanisms like water additives, dental chews, and spray applications that require minimal owner intervention.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Expansion Boosting DTC oral-care Subscriptions

- Novel Functional Ingredients Driving Product Differentiation

- Regulatory Ambiguity on Product Efficacy Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental chews maintain commanding market leadership with 41.92% of the pet oral care market share in 2025, driven by convenience and pet acceptance factors that align with low owner compliance for active brushing interventions. Water additives emerge as the fastest-growing segment at 6.05% CAGR through 2031, representing a paradigm shift toward passive oral care delivery that requires minimal owner intervention. Products like Oratene Water Additive leverage enzyme systems including dextranase, glucose oxidase, and lactoperoxidase to dissolve plaque biofilm while remaining alcohol-, xylitol-, and chlorhexidine-free for daily safety. Toothpaste and toothbrush segments face headwinds from compliance challenges, while mouthwash and rinses gain traction through spray applications that bypass brushing resistance.

Veterinary prescription products command premium pricing but face distribution constraints from veterinary workforce shortages, particularly in emerging markets where Nigeria reports only 3,500 actively practicing veterinarians against recommended minimums of 3,870. Other product types, including dental wipes and oral probiotic tablets, capture niche segments through specialized applications, with probiotic formulations targeting oral microbiome modulation gaining scientific validation. The segment benefits from cold-extrusion manufacturing processes that preserve active ingredient efficacy, addressing historical challenges where high-heat processing degraded functional compounds like probiotics and enzymes.

The Pet Oral Care Products Market Report is Segmented by Product Type (Toothpaste, Toothbrush, Mouthwash and Rinses, Dental Chews/Treats, and More), Animal Type (Dogs, Cats, and Other Companion Animals), Distribution Channel (Supermarkets and Hypermarkets, Online Channels, Specialized Pet Shops, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 39.35% of the pet oral care products market share in 2025, supported by 69% household pet penetration and Mars Incorporated's extensive network of roughly 3,000 clinics that influence purchasing through bundled wellness plans. Subscription adoption is highest in the United States as owners embrace auto-delivery for consumables.

Asia-Pacific represents the fastest expanding territory at a 6.63% CAGR, driven by China's pet sector, which is on track to climb to RMB 756.5 billion (USD 105.1 billion) by 2030 as young, single urbanites lavish premium care on companion animals. E-commerce penetration surpasses traditional channels, and domestic platforms cultivate live-stream education sessions that convert viewers into high-frequency buyers. Japan and South Korea favor science-backed functional treats, while India's telehealth-enabled sites pair remote veterinary consultations with last-mile delivery.

Europe maintains steady growth as formulators lean into natural ingredients and sustainable packaging. Strict labeling rules reward companies that invest early in cross-regional compliance.

Brazil anchors South America's opportunity set with an 87% sector growth outlook by 2029, although a 51% composite tax rate on pet products raises pricing hurdles. The Middle East and Africa remain nascent, yet urbanization and rising disposable incomes hint at latent demand once veterinary infrastructure matures.

- Mars, Incorporated

- Colgate-Palmolive Company (Hill's Pet Nutrition)

- Nestle Purina Petcare

- Virbac S.A.

- Elanco Animal Health Incorporated

- Vetoquinol S.A.

- Ceva Sante Animale

- Central Garden & Pet Company

- TropiClean Pet Products (Cosmos Corporation)

- Swedencare AB

- Sentry Pet Care (Perrigo Company plc)

- HealthyMouth LLC

- Ark Naturals Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High prevalence of periodontal disease in pets

- 4.2.2 Rising pet humanization and premium spend

- 4.2.3 E-commerce expansion boosting DTC oral-care subscriptions

- 4.2.4 Novel functional ingredients driving product differentiation

- 4.2.5 Veterinary tele-dentistry adoption widening access

- 4.2.6 AI-enabled chew design improving dental efficacy and owner engagement

- 4.3 Market Restraints

- 4.3.1 Low owner compliance with tooth-brushing regimens

- 4.3.2 Regulatory ambiguity on product efficacy claims

- 4.3.3 Shortage of board-certified veterinary dentists in emerging markets

- 4.3.4 Ingredient-safety concerns amid surge of natural/DIY remedies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Toothpaste

- 5.1.2 Toothbrush

- 5.1.3 Mouthwash and Rinses

- 5.1.4 Dental Chews/Treats

- 5.1.5 Water Additives and Sprays

- 5.1.6 Veterinary Prescription Products

- 5.1.7 Other Product Types (Dental Wipes, Oral Probiotic Tablets, etc.)

- 5.2 By Animal Type

- 5.2.1 Dogs

- 5.2.2 Cats

- 5.2.3 Other Companion Animals (Rabbits, Ferrets, etc.)

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets and Hypermarkets

- 5.3.2 Online Channels

- 5.3.3 Specialized Pet Shops

- 5.3.4 Veterinary Channels

- 5.3.5 Other Channels (Subscription Boxes, Grooming Salons, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Mars, Incorporated

- 6.4.2 Colgate-Palmolive Company (Hill's Pet Nutrition)

- 6.4.3 Nestle Purina Petcare

- 6.4.4 Virbac S.A.

- 6.4.5 Elanco Animal Health Incorporated

- 6.4.6 Vetoquinol S.A.

- 6.4.7 Ceva Sante Animale

- 6.4.8 Central Garden & Pet Company

- 6.4.9 TropiClean Pet Products (Cosmos Corporation)

- 6.4.10 Swedencare AB

- 6.4.11 Sentry Pet Care (Perrigo Company plc)

- 6.4.12 HealthyMouth LLC

- 6.4.13 Ark Naturals Company

7 Market Opportunities and Future Outlook