PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910542

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910542

E-book - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

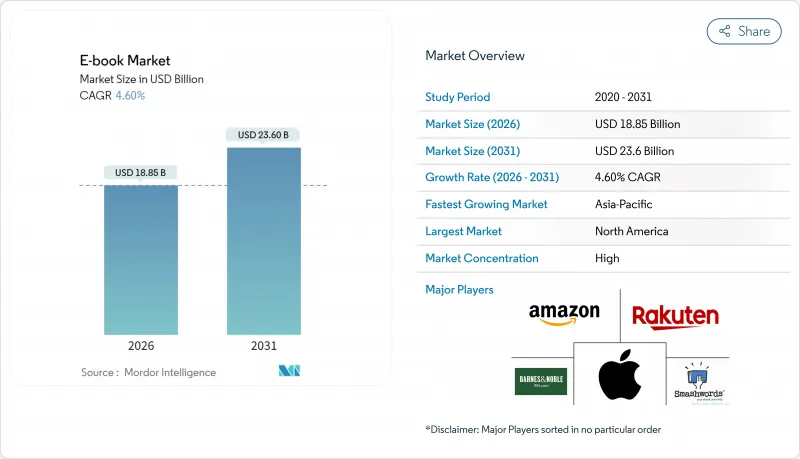

The e-book market is expected to grow from USD 18.02 billion in 2025 to USD 18.85 billion in 2026 and is forecast to reach USD 23.6 billion by 2031 at 4.6% CAGR over 2026-2031.

Subscription-led business models, institutional licensing momentum, and mobile-first reading habits are the three most powerful forces shaping the e-book market. Revenue predictability underpins publisher investment in platform-native experiences such as interactive textbooks and webtoon serialization. Smartphone ubiquity drives microtransaction experimentation and social discovery features that deepen reader engagement. Meanwhile, blockchain-enabled rights management is beginning to streamline author compensation, mitigating long-running disputes over digital royalties. Competitive intensity is moderate: Amazon's Kindle ecosystem remains the anchor platform, but regional disruptors from Asia Pacific and library-centric vendors are eroding any path toward monopoly dominance.

Global E-book Market Trends and Insights

Increasing Penetration of Mobile Devices

Smartphone saturation has shifted the center of gravity for digital reading away from dedicated e-readers and toward always-connected handsets. Publishers capitalize on this reality by releasing bite-sized content episodes, optimizing for vertical scrolling, and layering in gamified achievements that reinforce daily reading streaks. Display manufacturers are refining glare-free OLED screens and adaptive refresh rates that reduce eye strain during extended reading sessions. The rise of AI-driven recommendation engines further personalizes in-app discovery, boosting completion rates and average reading time per session. In Asia Pacific, where handset upgrades occur on rapid cycles, premium devices now ship with pre-installed reading apps that create a default pathway into the e-book market.

Expanding Global Internet Connectivity

Next-generation broadband rollouts and 5G backhaul investments expand addressable audiences in markets historically constrained by bandwidth cost. GSMA's Digital Nations framework shows 18 Asia Pacific governments prioritizing ubiquitous coverage as a pillar of economic competitiveness. Faster, cheaper connections enable publishers to embed high-resolution artwork, audio snippets, and short-form video without incurring intolerable load times. Dynamic pricing tied to regional bandwidth quality is also gaining traction: readers on slower networks can opt for lower-bitrate packages at reduced prices, preserving accessibility while respecting infrastructure realities. Enhanced connectivity likewise removes frictions for cloud synchronization, ensuring seamless progress tracking across multiple devices.

Privacy and Copyright Issues Among E-sellers and Authors

Complexities around digital rights management and data usage threaten to fragment distribution ecosystems. European regulators enforce GDPR penalties that can absorb more than 10% of annual digital revenue for small presses struggling to maintain compliant infrastructure. Controlled digital lending lawsuits underscore lingering ambiguity over fair-use boundaries, delaying institutional purchasing decisions and depressing near-term e-book market growth in library channels. Authors increasingly question whether AI companies scrape full texts without consent, prompting early adopters like Johns Hopkins University Press to craft explicit AI licensing frameworks that guarantee compensation for model training. Forward-looking publishers explore blockchain timestamping of content transactions to record when, where, and how each copy is accessed, enhancing transparency and auditability.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Digital Education and E-learning

- Rising Adoption of Subscription-Based Reading Platforms

- Persistent Preference for Print Books in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Subscription services commanded 55.72% of 2025 revenue and remain the engine behind the e-book market expansion. Their data-rich environments inform algorithmic commissioning of new series, ensuring that titles debut with pre-qualified audiences. Institutional licensing, chiefly libraries and corporate training portals, shows the sharpest momentum, growing at 5.05% CAGR on a base of high per-user spending. That uptrend contributes meaningfully to the e-book market size even though its user count trails consumer subscriptions. Pay-per-download persists for academic monographs and professional references where perpetual access is mandatory, while freemium models gain traction in cost-sensitive territories by monetizing advertising inventory or unlocking chapters after social sharing actions.

Publishers are engineering workflows around "content-as-a-service," refreshing digital backlists with real-time errata fixes and multimedia add-ons. This lifecycle extension smooths revenue recognition and strengthens catalog durability. For platforms, subscription churn management has become a science: predictive analytics flag disengaging readers so that curated push notifications or loyalty rewards arrive before cancellation risk peaks. Integrated payment rails simplify tier upgrades, nudging heavy readers toward premium plans that bundle audiobooks or graphic content. These measures reinforce a virtuous loop wherein higher engagement elevates the e-book market share of subscription formats year over year.

The E-Book Market Report is Segmented by Revenue Model (Subscription, Pay-Per-Download, Freemium/Ad-supported, and Institutional Licensing), Genre (Fiction, Non-Fiction, Education and Academic, Comics and Graphic Novels, and Professional and Technical), End-User (Individual Consumers, and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained its 39.45% share in 2025 owing to entrenched e-reader habits, high broadband penetration, and a dense ecosystem of library and academic buyers. Leading platforms invest in AI-generated reading companions that summarize chapters and translate passages on the fly, raising engagement among time-pressed professionals. Regulatory inquiries into platform exclusivity have not yet produced structural remedies, but they do temper acquisition strategies, pushing incumbents to focus on customer-centric feature upgrades rather than aggressive content hoarding.

Asia Pacific charts the fastest regional expansion at a 4.72% CAGR through 2031, propelled by smartphone ubiquity and flexible mobile payment systems. Japanese digital manga revenue has doubled since 2020, while Korean webtoons add recurring IP value thanks to drama and gaming adaptations that rebound consumers back into source titles. GSMA notes that Singapore, South Korea, and Australia achieve near-total 5G coverage, creating fertile ground for bandwidth-heavy interactive books. South-East Asian start-ups experiment with sachet-pricing, selling single chapters for cents, thereby broadening affordability and bolstering the e-book market.

Europe grows steadily on the back of institutional digitization mandates and cross-border content regulation. GDPR compliance engenders consumer trust, elevating subscription conversion rates though it imposes costly data-handling safeguards. Multilingual requirements spur publishers to invest in AI-translation pipelines that reduce localization timelines. Blockchain pilots in Germany and the Netherlands test transparent royalty disbursement, aiming to shorten payment cycles from months to days. In parallel, the UK navigates post-Brexit licensing complexities, leveraging its robust independent press scene to experiment with direct-to-reader bundles that integrate print-on-demand add-ons.

- Amazon.com, Inc.

- Rakuten Kobo Inc.

- Apple Inc.

- Barnes and Noble, LLC

- Smashwords, Inc.

- Blurb, Inc.

- DIY Media Group, Inc.

- Lulu Press, Inc.

- Macmillan Publishers Ltd

- Scribd, Inc.

- Google LLC

- Hachette Livre SA

- HarperCollins Publishers LLC

- Penguin Random House LLC

- Draft2Digital, LLC

- OverDrive, Inc.

- Storytel AB

- Wattpad Corp.

- Inkitt GmbH

- John Wiley and Sons, Inc.

- Pearson plc

- Cengage Learning, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing penetration of mobile devices

- 4.2.2 Expanding global internet connectivity

- 4.2.3 Growth of digital education and e-learning

- 4.2.4 Rising adoption of subscription-based reading platforms

- 4.2.5 Blockchain-enabled rights management and micropayments

- 4.2.6 Publisher D2C storefront integration with CRM data

- 4.3 Market Restraints

- 4.3.1 Privacy and copyright issues among e-sellers and authors

- 4.3.2 Persistent preference for print books in emerging markets

- 4.3.3 Interoperability limitations across e-reader ecosystems

- 4.3.4 Digital fatigue driving screen-time reduction initiatives

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Revenue Model

- 5.1.1 Subscription (all-you-can-read)

- 5.1.2 Pay-per-download

- 5.1.3 Freemium / Ad-supported

- 5.1.4 Institutional licensing

- 5.2 By Genre

- 5.2.1 Fiction

- 5.2.2 Non-fiction

- 5.2.3 Education and Academic

- 5.2.4 Comics and Graphic Novels

- 5.2.5 Professional and Technical

- 5.3 By End-user

- 5.3.1 Individual Consumers

- 5.3.1.1 Adults

- 5.3.1.2 Children and Young Adults

- 5.3.2 Institutional

- 5.3.2.1 K-12 Schools

- 5.3.2.2 Higher Education

- 5.3.2.3 Corporate / Professional Training

- 5.3.2.4 Public Libraries

- 5.3.1 Individual Consumers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Indonesia

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amazon.com, Inc.

- 6.4.2 Rakuten Kobo Inc.

- 6.4.3 Apple Inc.

- 6.4.4 Barnes and Noble, LLC

- 6.4.5 Smashwords, Inc.

- 6.4.6 Blurb, Inc.

- 6.4.7 DIY Media Group, Inc.

- 6.4.8 Lulu Press, Inc.

- 6.4.9 Macmillan Publishers Ltd

- 6.4.10 Scribd, Inc.

- 6.4.11 Google LLC

- 6.4.12 Hachette Livre SA

- 6.4.13 HarperCollins Publishers LLC

- 6.4.14 Penguin Random House LLC

- 6.4.15 Draft2Digital, LLC

- 6.4.16 OverDrive, Inc.

- 6.4.17 Storytel AB

- 6.4.18 Wattpad Corp.

- 6.4.19 Inkitt GmbH

- 6.4.20 John Wiley and Sons, Inc.

- 6.4.21 Pearson plc

- 6.4.22 Cengage Learning, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment