PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910548

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910548

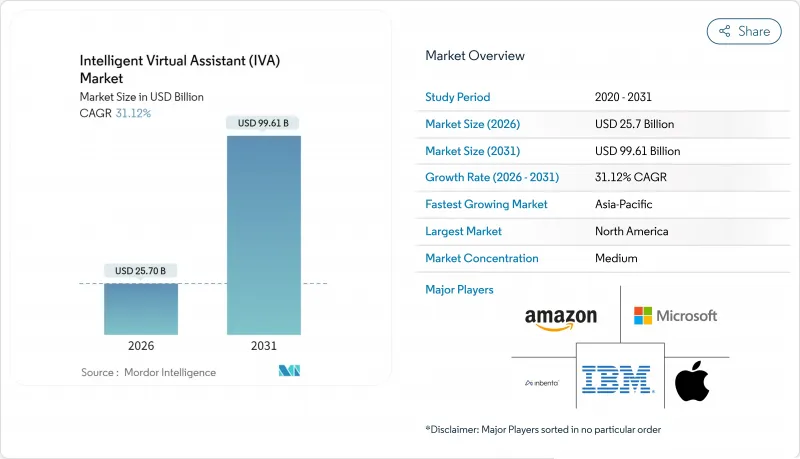

Intelligent Virtual Assistant (IVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The intelligent virtual assistant market is expected to grow from USD 19.60 billion in 2025 to USD 25.7 billion in 2026 and is forecast to reach USD 99.61 billion by 2031 at 31.12% CAGR over 2026-2031.

Multilingual large-language models, on-device inference enabled by specialized AI chips that retail for about USD 40,000 per unit, and corporate pressure to curb expanding cloud costs are the primary forces behind this rapid expansion. Enterprises continue to invest because generative AI deployments are demonstrating clear savings; a major travel company, for example, reports USD 10 million in annual cost reductions after introducing an IVA-led self-service channel. Edge and on-premise options that avoid recurring hyperscale fees are moving up the priority list, even though cloud remains dominant. The momentum is equally visible in consumer hardware, as the popularity of smart speakers and in-car assistants reshapes expectations for always-on conversational services.

Global Intelligent Virtual Assistant (IVA) Market Trends and Insights

Rising Adoption of Omnichannel Customer-Service Chatbots

Global banks expect to invest USD 9.4 billion in chatbot technology by 2025, a sign of how strongly cost-containment needs align with 24/7 service expectations. Autonomous resolution rates of 80-90% are increasingly common, and productivity gains reaching 40% have been logged by early banking adopters. Retailers cite engagement lifts of 40% when text, voice, and visual channels are fused into a single flow, creating smooth hand-offs to human agents when context demands. Memory-based personalization now preserves conversation history across devices, allowing customers to resume interactions without repetition. The result is higher customer-satisfaction scores alongside measurable savings in contact-center workloads.

Proliferation of Smart Speakers and IoT Voice End-Points

Automotive OEMs tap voice platforms from Cerence, Microsoft, and NVIDIA to add ChatGPT-style services directly to infotainment stacks.Volkswagen's European models already ship with a cloud-updated assistant that supports five languages. Beyond cars, appliance makers and wearable brands embed local speech recognition to protect privacy and cut latency. Driver surveys find that 77% would choose in-vehicle voice control when advanced features are available. As vendors port the same core models to embedded silicon, the intelligent virtual assistant market gains new daily-use entry points inside homes, cars, and industrial settings.

Persistent Privacy and Data-Security Concerns

The EU AI Act's privacy-preserving clauses force suppliers to demonstrate data-minimization and encryption by design. In healthcare, U.S. ONC rules demand transparent decision logs for predictive algorithms. Financial institutions add traceable pipelines and differential-privacy techniques, but those investments raise project costs and lengthen deployment cycles. Many chiefs therefore favor on-premise stacks that keep all customer utterances in situ, reporting cost reductions of up to 80% versus equivalent cloud bills while satisfying sovereignty rules.

Other drivers and restraints analyzed in the detailed report include:

- Breakthroughs in Multilingual Large-Language-Model NLP

- Contact-Center Cost-Containment Pressure

- Regulatory Scrutiny on AI Explainability and Dark-Patterns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart speakers generated 45.68% of 2025 revenue, underscoring the sizeable installed base that continues to expand through bundling with music or video services. Although growth moderates in mature markets, vendors are upselling premium tiers that feature high-fidelity microphones and local language-model inference to reduce cloud calls. At the same time, in-car assistants are on track to post 32.58% CAGR through 2031, the fastest among hardware categories. Automakers such as Volkswagen and Renault use white-label offerings from Cerence to deliver conversational navigation, climate control, and e-commerce services on the road.

Wearable and embedded IVA modules for AR headsets and industrial scanners supply a fresh entry path, enabling voice commands that free workers' hands in logistics and field maintenance. These devices often combine voice with gaze, gesture, or haptic feedback, elevating user ergonomics. The intelligent virtual assistant market now spans a continuum from stationary speakers to fully mobile endpoints, and suppliers are tailoring neural-network footprints to the computational limits of each form factor.

Cloud deployment still accounts for 67.35% of current spend because of easy scaling, model updates, and integration with enterprise software. Yet, cost predictability and data-localization laws are driving a decisive turn to on-prem and edge deployments that are growing 33.72% annually. Enterprises deploying generative AI chips on site report overall inference expenses as low as one-fifth of comparable cloud bills. The intelligent virtual assistant market size for on-prem projects is forecast to expand sharply as regulated verticals move sensitive voice logs inside the firewall.

Edge-native IVAs support real-time workloads in automotive, aerospace, and healthcare devices where sub-100-millisecond latency is mandatory. Suppliers are now shipping neural-processing-unit cores that host quantized LLMs with less than 8 GB of memory. This specialization lowers energy draw while keeping conversational context intact, a key requirement for uninterrupted driving or surgical assistance scenarios.

The AI Virtual Assistant Market Report is Segmented by Product (Chatbot, Smart Speaker, and More), Deployment Mode (Cloud and On-Premise), User Interface Technology (Text-Based (Text-To-Text), Voice-Based (ASR + TTS), and More), End-User (BFSI, Healthcare, Telecom and IT, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 36.55% share on the strength of early enterprise investment, a deep venture capital pool, and a maturing vendor ecosystem. State-level laws in Utah, Colorado, and California emphasize transparency, while the federal NIST framework offers a common risk-management vocabulary. Healthcare IVAs must log explainability evidence to meet ONC standards, prompting providers to choose platforms that expose full decision traces. Canada's accessibility mandate EN 301 549:2024 further cements demand for inclusive voice technologies that work for users with disabilities. The region's R&D capability combined with a robust compliance culture maintains a lead in commercial deployments.

Asia Pacific is the fastest-expanding region at 34.05% CAGR. Government AI strategies, such as China's national roadmap and Singapore's SGD 1 billion allocation, underwrite talent development and pilot programs. Conversational AI adoption in India's banking arena demonstrates how multilingual IVAs extend branch reach at lower cost. Japanese automakers push in-car assistants as brand differentiators, integrating edge AI chips to overcome patchy cellular coverage. Linguistic diversity remains a hurdle, but recent multilingual LLM breakthroughs shrink development timelines and open the intelligent virtual assistant market to mid-tier enterprises.

Europe occupies a pivotal role, balancing innovation with stringent governance. The EU AI Act imposes harmonized rules that cover classification, documentation, and human oversight, nudging suppliers toward transparent model architectures. Automotive firms collaborate with AI specialists to comply with both functional safety norms and new explainability clauses. Accessibility guidance in EN 301 549 ensures inclusive design, while healthcare institutions adopt IVA tools only after rigorous bias audits. Vendors that can certify privacy and fairness gain preferred status in public-sector tenders, shaping competitive dynamics across the continent.

- Amazon.com Inc.

- Google LLC (Alphabet)

- Apple Inc.

- Microsoft Corp.

- IBM Corp.

- Meta Platforms Inc.

- Alibaba Group

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Inc.

- OpenAI

- Anthropic

- Harman International

- Nuance Communications Inc.

- Avaamo Inc.

- EdgeVerve Systems Ltd.

- Ipsoft Inc. (Amelia)

- Kore.ai Inc.

- Inbenta Technologies Inc.

- Creative Virtual Ltd.

- Serviceaide Inc.

- Rasa Technologies GmbH

- SoundHound AI Inc.

- Tencent Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of omnichannel customer-service chatbots

- 4.2.2 Proliferation of smart speakers and IoT voice end-points

- 4.2.3 Breakthroughs in multilingual large-language-model NLP

- 4.2.4 Contact-center cost-containment pressure

- 4.2.5 Emotion-aware IVA uptake in elder-care and digital therapeutics

- 4.2.6 Accessibility mandates for public-sector digital services

- 4.3 Market Restraints

- 4.3.1 Persistent privacy and data-security concerns

- 4.3.2 Customer preference for human agents in complex queries

- 4.3.3 Regulatory scrutiny on AI explainability and dark-patterns

- 4.3.4 Hallucination-driven brand-reputation risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product (Value)

- 5.1.1 Chatbots

- 5.1.2 Smart Speakers

- 5.1.3 In-Car IVAs

- 5.1.4 Wearable / Embedded Devices

- 5.2 By Deployment Mode (Value)

- 5.2.1 Cloud

- 5.2.2 On-premise / Edge

- 5.3 By User Interface Technology (Value)

- 5.3.1 Text-based (Text-to-Text)

- 5.3.2 Voice-based (ASR + TTS)

- 5.3.3 Multimodal (Voice + Visual)

- 5.4 By End-User

- 5.4.1 Retail and eCommerce

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Telecom and IT

- 5.4.5 Travel and Hospitality

- 5.4.6 Other Industries

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Netherlands

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon.com Inc.

- 6.4.2 Google LLC (Alphabet)

- 6.4.3 Apple Inc.

- 6.4.4 Microsoft Corp.

- 6.4.5 IBM Corp.

- 6.4.6 Meta Platforms Inc.

- 6.4.7 Alibaba Group

- 6.4.8 Baidu Inc.

- 6.4.9 Samsung Electronics Co. Ltd.

- 6.4.10 Xiaomi Inc.

- 6.4.11 OpenAI

- 6.4.12 Anthropic

- 6.4.13 Harman International

- 6.4.14 Nuance Communications Inc.

- 6.4.15 Avaamo Inc.

- 6.4.16 EdgeVerve Systems Ltd.

- 6.4.17 Ipsoft Inc. (Amelia)

- 6.4.18 Kore.ai Inc.

- 6.4.19 Inbenta Technologies Inc.

- 6.4.20 Creative Virtual Ltd.

- 6.4.21 Serviceaide Inc.

- 6.4.22 Rasa Technologies GmbH

- 6.4.23 SoundHound AI Inc.

- 6.4.24 Tencent Holdings Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment