PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910549

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910549

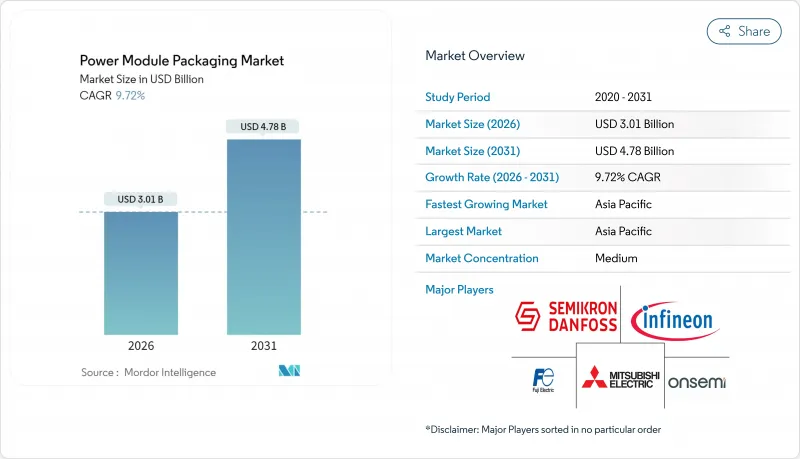

Power Module Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Power Module Packaging market size in 2026 is estimated at USD 3.01 billion, growing from 2025 value of USD 2.74 billion with 2031 projections showing USD 4.78 billion, growing at 9.72% CAGR over 2026-2031.

Demand is accelerating as wide-bandgap semiconductors transition from a niche to a mainstream market, electric vehicles adopt 800V architectures, and industrial motor drives prioritize energy efficiency improvements. Packaging innovation that delivers lower thermal resistance, higher current density, and reliable operation beyond 200°C has become a decisive competitive advantage, especially as automotive OEMs demand smaller footprints without compromising lifetime reliability. Regional diversification, most notably in Malaysia, India, and Indonesia, adds further impetus by expanding the manufacturing footprint and reducing geopolitical risk. Competitive dynamics are shifting as SiC and GaN devices place legacy silicon solutions under margin pressure, while advanced ceramic substrates, such as aluminum nitride, capture market share by enabling double-sided cooling designs.

Global Power Module Packaging Market Trends and Insights

Accelerating Adoption of SiC and GaN Power Devices in EV Traction Inverters

SiC penetration in battery electric vehicles is increasing as OEMs prioritize range extension and fast-charge capability. Early field data from Tesla demonstrated roughly 7% range gain over silicon IGBT alternatives, a benchmark that triggered broad industry replication despite SiC's higher device cost. Fraunhofer's Enhanced Direct-cooling Inverter architecture increased efficiency to 99.5% by eliminating baseplates, demonstrating how packaging advances directly translate into drivetrain gains. Widespread migration to 800V vehicle systems raises insulation and partial discharge challenges that only advanced substrates and low-inductance interconnects can address, thereby boosting premium module demand. As more OEMs unveil 900-V battery packs, suppliers that marry SiC dies with double-sided-cooling packaging are positioned to secure long-term design wins.

Growing Demand for Energy-Efficient Industrial Motor Drives

Electric motors account for approximately 70% of global industrial power consumption, and experts estimate that the universal deployment of variable-speed drives could offset the equivalent output of several mid-sized power stations. Yet only 15% of three-phase motors in developed economies employ electronic speed control, leaving vast untapped potential. SiC-based drive modules deliver 15-40% energy savings across variable-load applications such as HVAC, where compressors seldom operate at full load. Generation 7 automotive-grade IGBT technology increases the permissible junction temperature, enabling smaller heatsinks and more compact cabinet designs, which in turn lower installation costs. Governments' efficiency mandates and rising electricity prices provide a durable tailwind for high-performance packaging that can guarantee reliability over 20-year industrial duty cycles.

High Capex Requirements for Advanced Packaging Equipment

SEMI forecasts that 300 mm fab equipment will increase with a rising slice earmarked for advanced packaging gear such as laser dicing and hybrid-bonding lines. Wide-bandgap devices require sintering ovens capable of profiles exceeding 250 °C and pick-and-place accuracy within +-3 µm, which raises the barrier to entry for newcomers. EV battery plants face parallel capex burdens, illustrating how capital intensity is a systemic hurdle across electrification value chains. Financing obstacles are felt most acutely in regions that lack mature semiconductor clusters, slowing diversification goals and tempering near-term capacity additions in South Asia and Latin America.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Renewable-Energy-Linked High-Power Inverters

- Miniaturisation Mandate from On-Board Chargers in E-Mobility Fleets

- Margin Squeeze Caused by Market Consolidation Among Tier-1 OSATs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Substrates captured 27.85% of 2025 revenue, underscoring their pivotal role in controlling heat and electrical isolation. Die attach is projected to post an 10.96% CAGR, the fastest component trajectory, as silver sintering and transient-liquid-phase bonding enable operation beyond 200 °C without the use of lead-based alloys. Baseplates are steadily displaced by direct-substrate-cooling schemes that collapse thermal paths, while ceramic encapsulants that pare junction temperature by 12 K widen their footprint, especially in high-power wind converters.

Advanced planar interconnects using copper clips eliminate wire-bond reliability weak points and enhance current density, thereby reducing package footprints within EV traction inverters. Thermal interface materials are evolving toward nano-structured carbon networks, nearing the theoretical resistance of 0.1 mm2K/W, which extends mission life under high-cycle stress. Suppliers that vertically integrate substrate pressing, metallization, and sintered attach services are winning contracts as OEMs demand single-source responsibility for thermal stack-up performance. The holistic approach safeguards supplier margins even as commoditization pressures intensify in lower-power consumer segments.

IGBT modules retained 36.88% of the 2025 value within the power module packaging market, buoyed by entrenched manufacturing lines and favorable cost curves for <=1200 V applications. Yet SiC modules will grow at a 10.52% CAGR through 2031, unlocking superior switching speeds and slashing conduction losses in EV drivetrains and fast chargers. GaN modules are witnessing growth in high-frequency telecom rectifier demand, with Infineon's acquisition of GaN Systems amplifying its competitive firepower.

Si-MOSFET modules remain attractive for cost-sensitive appliance and consumer power supplies, while thyristors retain relevance in HVDC links and induction heating, where ruggedness takes precedence over switching speed. The transition to 200 mm SiC wafers promises cost parity with silicon within the decade; however, automotive-grade SiC yields remain the gating factor for volume ramp. Packaging houses offering deep inspection competence and zero-ppm defect targets are, therefore, essential allies to wide-bandgap fab owners.

The Power Module Packaging Market Report is Segmented by Components (Substrate, Baseplate, Die Attach, and More), Power Device Type (IGBT Modules, Si-MOSFET Modules, and More), Power Range (< 600 V, 600 - 1200 V, 1200 - 1700 V, and More), End-User (Automotive, Industrial, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led with 48.35% of 2025 spending and is expected to compound at a 11.37% CAGR as China's OSAT ecosystem benefits from AI server and EV momentum. India's USD 10 billion incentive scheme and Micron's USD 825 million Gujarat plant underscore a policy drive that will add meaningful backend capacity by 2027. Malaysia is bolstered by Intel's USD 7 billion packaging expansion and Micron's investment in Penang, positioning the country as a complementary hub that can mitigate Taiwan Strait risk.

North America's CHIPS Act earmarks USD 52.7 billion and prioritizes advanced packaging to shore up domestic supply; Amkor's USD 2 billion Arizona site will handle AI accelerator modules when it comes online in 2026. Regional share is poised to rise modestly as fabs qualify local OSATs for critical installations. Europe focuses on automotive SiC supply-chain sovereignty, with Wolfspeed planning USD 3 billion for a German epi-wafer and module line that dovetails with OEM electrification targets. The European Chips Act aims to harmonize national incentives, yet it still lags behind U.S. funding levels, prompting companies to enhance cross-border collaboration.

The Middle East and Africa present emerging greenfield opportunities anchored in gigawatt-scale solar and wind projects that require grid-forming inverters. Gulf sovereign funds are exploring joint ventures with experienced module makers to establish local assembly, leveraging abundant renewable energy to power future hydrogen exports.

- Infineon Technologies AG

- Mitsubishi Electric Corporation (Powerex Inc.)

- Fuji Electric Co. Ltd

- Semikron-Danfoss GmbH & Co. KG

- Hitachi Ltd (Power Electronics Systems)

- STMicroelectronics N.V.

- Amkor Technology Inc.

- ON Semiconductor Corporation

- Wolfspeed Inc.

- ROHM Semiconductor

- Texas Instruments Inc.

- Littelfuse Inc. (IXYS)

- Microchip Technology Inc.

- Nexperia B.V.

- Vishay Intertechnology Inc.

- Dynex Semiconductor Ltd

- Danfoss Silicon Power GmbH

- Power Integrations Inc.

- SanRex Corporation

- Alpha & Omega Semiconductor Ltd

- Kyocera Corporation

- Heraeus Electronics GmbH

- TT Electronics plc

- Advanced Power Electronics Corp.

- Shanghai Electric Power Semiconductor Device Co. Ltd

- Cissoid SA

- Celestica Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of SiC and GaN power devices in EV traction inverters

- 4.2.2 Growing demand for energy-efficient industrial motor drives

- 4.2.3 Expansion of renewable-energy-linked high-power inverters

- 4.2.4 Miniaturisation mandate from on-board chargers in e-mobility fleets

- 4.2.5 Emergence of double-sided-cooling substrates lowering thermal resistance

- 4.2.6 Localisation policies in Asia boosting domestic packaging supply chains

- 4.3 Market Restraints

- 4.3.1 High capex requirements for advanced packaging equipment

- 4.3.2 Margin squeeze caused by market consolidation among Tier-1 OSATs

- 4.3.3 Reliability concerns over new lead-free die-attach materials > 200 °C

- 4.3.4 Supply bottlenecks for high-thermal-conductivity ceramics (AlN, Si3N4)

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Components

- 5.1.1 Substrate

- 5.1.2 Baseplate

- 5.1.3 Die Attach

- 5.1.4 Substrate Attach

- 5.1.5 Encapsulations

- 5.1.6 Interconnections

- 5.1.7 Other Components

- 5.2 By Power Device Type

- 5.2.1 IGBT Modules

- 5.2.2 Si-MOSFET Modules

- 5.2.3 SiC Modules

- 5.2.4 GaN Modules

- 5.2.5 Thyristor and Other Modules

- 5.3 By Power Range

- 5.3.1 < 600 V

- 5.3.2 600 - 1200 V

- 5.3.3 1200 - 1700 V

- 5.3.4 > 1700 V

- 5.4 By End-user

- 5.4.1 Automotive

- 5.4.2 Industrial

- 5.4.3 Renewable Energy

- 5.4.4 Consumer Electronics

- 5.4.5 Data Centres and Telecom

- 5.4.6 Rail and Transportation

- 5.4.7 Aerospace and Defence

- 5.4.8 Other End-users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Mitsubishi Electric Corporation (Powerex Inc.)

- 6.4.3 Fuji Electric Co. Ltd

- 6.4.4 Semikron-Danfoss GmbH & Co. KG

- 6.4.5 Hitachi Ltd (Power Electronics Systems)

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 Amkor Technology Inc.

- 6.4.8 ON Semiconductor Corporation

- 6.4.9 Wolfspeed Inc.

- 6.4.10 ROHM Semiconductor

- 6.4.11 Texas Instruments Inc.

- 6.4.12 Littelfuse Inc. (IXYS)

- 6.4.13 Microchip Technology Inc.

- 6.4.14 Nexperia B.V.

- 6.4.15 Vishay Intertechnology Inc.

- 6.4.16 Dynex Semiconductor Ltd

- 6.4.17 Danfoss Silicon Power GmbH

- 6.4.18 Power Integrations Inc.

- 6.4.19 SanRex Corporation

- 6.4.20 Alpha & Omega Semiconductor Ltd

- 6.4.21 Kyocera Corporation

- 6.4.22 Heraeus Electronics GmbH

- 6.4.23 TT Electronics plc

- 6.4.24 Advanced Power Electronics Corp.

- 6.4.25 Shanghai Electric Power Semiconductor Device Co. Ltd

- 6.4.26 Cissoid SA

- 6.4.27 Celestica Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment