PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910574

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910574

Frozen Bakery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

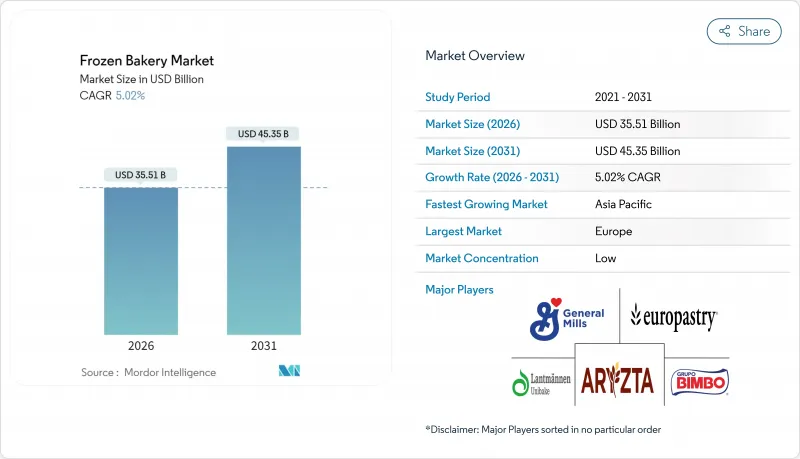

The frozen bakery market was valued at USD 33.81 billion in 2025 and estimated to grow from USD 35.51 billion in 2026 to reach USD 45.35 billion by 2031, at a CAGR of 5.02% during the forecast period (2026-2031).

As modern lifestyles accelerate, consumers are increasingly opting for the convenience of frozen bakery products for both home and foodservice use. This growth is supported by advancements in cold-chain systems, innovative product development, and rising demand for easy-to-prepare meals. Additionally, energy-efficient production technologies and improved e-commerce logistics are strengthening the industry's long-term competitiveness. Health-conscious trends are driving interest in frozen bakery products with healthier attributes, such as gluten-free, whole-grain, and low-fat options. Europe leads the frozen bakery market, supported by strong regulatory frameworks and artisanal baking traditions. Meanwhile, the Asia-Pacific region is experiencing the fastest growth, driven by rapid infrastructure development and changing dietary habits. Bread remains the largest product category, while pizza crusts are emerging as a premium growth segment. Off-trade retail channels dominate the market, although a recovery in foodservice is boosting on-trade demand. As competition intensifies, companies are focusing on portfolio optimization and sustainability initiatives, including strategic acquisitions and renewable energy adoption, to mitigate cost volatility.

Global Frozen Bakery Market Trends and Insights

Demand for convenient On-the-Go frozen snacks

Consumer lifestyle shifts toward mobility and time-pressed meal solutions drive sustained demand for portable frozen bakery products, with breakfast sandwiches alone generating USD 2.3 billion in US sales according to Conagra Brands' 2024 frozen food trends analysis.This growth aligns with a broader consumer preference for mobility and time-saving meal solutions. Health-conscious consumers are also driving interest in bite-sized and mini formats, reflecting a growing focus on portion control. The segment's expansion is further supported by the rising popularity of air fryers, with many frozen food packages now including air-fryer cooking instructions for quick preparation while preserving texture quality. To address labor shortages, foodservice operators, particularly in convenience stores and quick-service restaurants, are incorporating frozen snack options to maintain menu variety. As eating habits shift from structured meals to more frequent, smaller eating occasions, demand for convenient, on-the-go frozen snacks continues to rise. According to the International Food Information Council, 31% of U.S. consumers were snacking twice a day in 2024. This fusion of snacking culture with frozen technology creates opportunities for innovative formats that blend traditional bakery offerings with modern consumption patterns.

Rising demand for convenient bakery preparation

Professional kitchens and retail bakeries are increasingly adopting frozen solutions to address labor shortages and enhance operational efficiency. This shift allows smaller establishments to deliver artisanal-quality products without requiring specialized baking expertise, expanding access to premium bakery items across various retail formats. Advancements in low-temperature fermentation are driving innovations in ready-to-proof technologies, enabling bakeries to optimize production schedules and improve flavor profiles through extended fermentation periods. This trend is accelerating in healthcare and institutional food services, where the demand for consistent quality and food safety favors standardized frozen solutions over inconsistent fresh production. The strategic landscape highlights opportunities for vertical integration, enabling frozen bakery manufacturers to secure high-margin retail partnerships while mitigating the skilled baker shortage impacting traditional operations. Furthermore, the growing consumption of frozen baked goods reflects a rising demand for convenient bakery options, offering consumers easy access to high-quality products with minimal effort. In Germany, frozen baked goods consumption increased from 1,077,815 tons in 2023 to 1,102,606 tons in 2024, according to the German Frozen Food Institute. This market transformation is primarily driven by modern lifestyles, technological advancements, and evolving consumer preferences.

Consumer preference for fresh products

European markets, where artisanal baking is culturally significant and supported by regulatory frameworks favoring local production, exhibit strong resistance to frozen food products. Affluent consumers, who associate freshness with premium quality, further reinforce this preference. Consequently, frozen bakery manufacturers face difficulties in accessing these high-value market segments. This challenge is reflected in pricing pressures, as consumers often demand substantial discounts to choose frozen options over fresh ones. These factors compress profit margins and obstruct premium positioning strategies. However, advancements in freezing technologies and packaging innovations are gradually changing these perceptions, particularly among younger consumers who value convenience. To address this, industry players are implementing strategies such as transparency initiatives to emphasize quality preservation techniques and nutritional studies that highlight the benefits of frozen products in specific applications.

Other drivers and restraints analyzed in the detailed report include:

- Premiumisation of specialty breads and viennoiserie

- Cold-chain E-commerce in emerging markets

- Limited cold storage infrastructure in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, bread products accounted for a significant 41.72% share of the frozen bakery market, driven by their widespread familiarity and adaptability across both retail and foodservice channels. The introduction of premium gluten-free options, such as Lancaster Colony's New York Bakery line, has further strengthened the category's appeal, particularly among health-conscious consumers seeking better-for-you alternatives. This trend underscores the enduring demand for bread products as a staple in the frozen bakery market. Simultaneously, the pizza crust segment is emerging as a key growth driver, registering an impressive 6.28% CAGR (2026-2031). This growth is fueled by the incorporation of upcycled ingredients, which align with sustainability trends, and the recovery of the foodservice sector. Quick-service restaurants are increasingly adopting par-baked and freezer-to-oven pizza crusts, which offer the dual benefits of labor optimization and the ability to deliver artisanal-quality textures, thereby expanding the market size for frozen pizza crusts.

Cakes and pastries continue to experience steady demand, particularly during seasonal celebrations, while morning goods gain traction due to their convenience for breakfast consumption. Viennoiserie and Danish products are capitalizing on the premiumization trend, especially in hotels and cafes that aim to provide an authentic European experience to their customers. The frozen bakery market is also witnessing accelerated consolidation, as evidenced by Furlani Foods' acquisition of Cole's Quality Foods in January 2025. This strategic move strengthens Furlani Foods' leadership position in the frozen garlic bread segment. By diversifying their product portfolio, the company not only achieves greater scale efficiencies but also mitigates the impact of demand fluctuations across various categories, ensuring a more resilient market presence.

The Global Frozen Bakery Market Report is Segmented by Product Type (Bread, Pizza Crust, Cakes and Pastries, Morning Goods, and More), Form (Ready To Cook, Ready To Bake, Ready To Proof, Ready To Eat), Distribution Channel (On-Trade HoReCa, Off-Trade Retail), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

Europe holds a 36.20% market share in 2025, driven by its advanced cold-chain infrastructure and supportive regulatory frameworks. These frameworks encourage frozen food innovations and include the EU's updated contaminant regulations, effective in 2025, which aim to improve food safety standards while maintaining production flexibility. Europe's strong artisanal baking traditions contribute to the premium positioning of its frozen products. Companies like Vandemoortele are leveraging this advantage through strategic acquisitions, such as Lizzi in Italy and Banneton Bakery in North America, to expand their geographic reach and product offerings. Germany and France lead consumption trends, supported by robust foodservice sectors and consumer acceptance of frozen convenience products. Meanwhile, the UK market remains resilient despite economic challenges. European manufacturers adhering to regulatory frameworks, such as ISO food safety standards, gain a competitive edge as they pursue international expansion opportunities.

Asia-Pacific is experiencing rapid growth, with the highest expansion rate at a 6.44% CAGR (2026-2031). This growth is driven by significant infrastructure investments and changing consumption patterns. In China, market growth is accelerating through strategic acquisitions. For example, in September 2024, Mondelez International acquired Evirth, a leading frozen cakes and pastries manufacturer, reflecting multinational confidence in China's long-term growth potential. In India, the market is advancing due to investments in cold-chain infrastructure and urbanization trends that favor convenient food solutions. Southeast Asian countries, including Thailand and Indonesia, are also showing strong growth potential, fueled by rising disposable incomes and the adoption of Western dietary habits.

North America retains a strong market presence, supported by established distribution networks and widespread consumer acceptance of frozen convenience products. In Canada, the bakery sector is showing resilience, with double-digit nominal growth rates driven by inflation. Mexico benefits from its proximity to the US market and its robust manufacturing capabilities. Grupo Bimbo exemplifies this with its extensive operations and sustainability initiatives, such as renewable energy microgrids in its California facilities. In South America, Brazil and Argentina lead growth opportunities, driven by urbanization and rising incomes. Grupo Bimbo's acquisition of Wickbold brands in September 2024 highlights its multinational expansion strategy. Meanwhile, the Middle East and Africa regions show emerging potential, supported by infrastructure development and evolving dietary patterns. However, cold-chain limitations continue to constrain short-term growth prospects.

- Grupo Bimbo SAB de CV

- Aryzta AG

- Lantmannen Unibake International

- Europastry SA

- General Mills Inc.

- Associated British Foods PLC

- Conagra Brands Inc.

- Rich Products Corporation

- Vandemoortele NV

- Dawn Foods Global Inc.

- Tyson Foods Inc. (Sara Lee Frozen Bakery)

- Flowers Foods Inc.

- FGF Brands Inc.

- Alpha Baking Company Inc.

- Sunbulah Group

- Gonnella Frozen Products

- Fuji Baking Co. Ltd.

- Vandemoortele USA LLC

- Rotella's Italian Bakery Inc.

- Europastry USA

- Nestle SA (DiGiorno, Toll House cookie dough)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for convenient on-the-go frozen snacks

- 4.2.2 Longer shelf life and reduced retail waste

- 4.2.3 Rising demand for convenient bakery preparation

- 4.2.4 Cold-chain e-commerce in emerging markets

- 4.2.5 Product innovation and variety

- 4.2.6 Premiumisation of specialty breads and viennoiserie

- 4.3 Market Restraints

- 4.3.1 Consumer preference for fresh products

- 4.3.2 Limited cold storage infrastructure in emerging markets

- 4.3.3 Preference for traditional baking methods

- 4.3.4 Volatile flour/energy prices squeezing margins

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Bread

- 5.1.2 Pizza Crust

- 5.1.3 Cakes and Pastries

- 5.1.4 Morning Goods (Donuts, Muffins, Croissants)

- 5.1.5 Viennoiserie and Danish

- 5.1.6 Other Frozen Bakery

- 5.2 By Form

- 5.2.1 Ready to Cook

- 5.2.2 Ready to Bake

- 5.2.3 Ready to Proof

- 5.2.4 Ready to Eat

- 5.3 By Distribution Channel

- 5.3.1 On-Trade (HoReCa)

- 5.3.2 Off-Trade (Retail)

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Specialty Stores

- 5.3.2.4 Online Retail Stores

- 5.3.2.5 Other Off-Trade Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Sweden

- 5.4.3.8 Belgium

- 5.4.3.9 Poland

- 5.4.3.10 Netherlands

- 5.4.3.11 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Thailand

- 5.4.4.5 Singapore

- 5.4.4.6 Indonesia

- 5.4.4.7 South Korea

- 5.4.4.8 Australia

- 5.4.4.9 New Zealand

- 5.4.4.10 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Grupo Bimbo SAB de CV

- 6.4.2 Aryzta AG

- 6.4.3 Lantmannen Unibake International

- 6.4.4 Europastry SA

- 6.4.5 General Mills Inc.

- 6.4.6 Associated British Foods PLC

- 6.4.7 Conagra Brands Inc.

- 6.4.8 Rich Products Corporation

- 6.4.9 Vandemoortele NV

- 6.4.10 Dawn Foods Global Inc.

- 6.4.11 Tyson Foods Inc. (Sara Lee Frozen Bakery)

- 6.4.12 Flowers Foods Inc.

- 6.4.13 FGF Brands Inc.

- 6.4.14 Alpha Baking Company Inc.

- 6.4.15 Sunbulah Group

- 6.4.16 Gonnella Frozen Products

- 6.4.17 Fuji Baking Co. Ltd.

- 6.4.18 Vandemoortele USA LLC

- 6.4.19 Rotella's Italian Bakery Inc.

- 6.4.20 Europastry USA

- 6.4.21 Nestle SA (DiGiorno, Toll House cookie dough)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK