PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910579

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910579

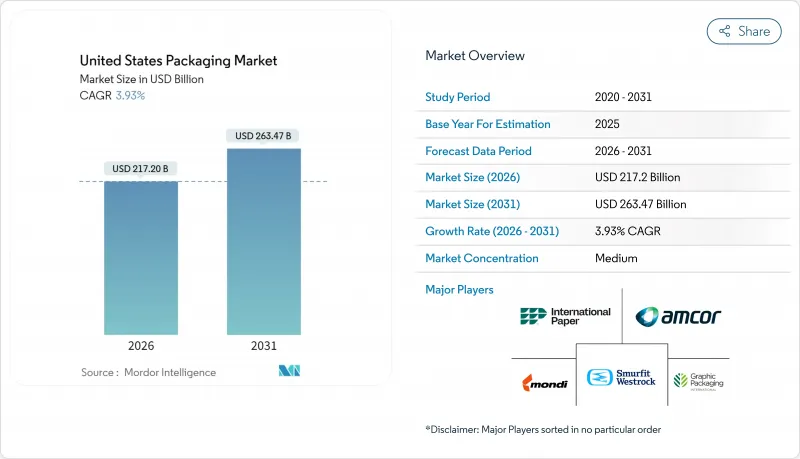

United States Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Packaging market is expected to grow from USD 208.98 billion in 2025 to USD 217.2 billion in 2026 and is forecast to reach USD 263.47 billion by 2031 at 3.93% CAGR over 2026-2031.

Strong links to the country's USD 940.8 billion trucking sector keep the US packaging market resilient, because packaging design and weight directly shape freight costs. E-commerce proliferation, regulatory shifts such as state-level Extended Producer Responsibility statutes, and accelerated on-shoring of pharmaceutical capacity are steering capital toward automation-ready lines and higher-barrier materials. The US market continues to benefit from premiumization in food and beverage segments, while cost pressures from PFAS-free mandates and polymer capacity additions squeeze margins for converters. Large, integrated suppliers leverage scale and R&D depth to absorb regulatory compliance costs and preserve pricing power as smaller firms seek niche differentiation.

United States Packaging Market Trends and Insights

E-commerce Boom Driving Small-Parcel Packaging Demand

Investments in automation-ready secondary lines allow consumer packaged goods firms to manage labor shortages and SKU proliferation efficiently, with Mary Kay trimming line labor by 85% after a USD 2 million upgrade while maintaining 50-60 units per minute. Dimensional-weight pricing by major carriers rewards smaller, lighter parcel formats, stimulating demand for right-sized corrugated inserts and cushioning. As the US packaging market aligns with omnichannel fulfillment, converters that offer integrated protective, branded, and data-rich solutions capture volume from retailers seeking to cut last-mile costs. Automation helps distributors minimize pick-pack errors and meet one-day delivery promises, making reliable secondary packaging a competitive necessity. Supply chain risk mitigation encourages multisourcing of substrates, benefiting converters with diversified material portfolios.

Premiumization in Food and Beverage Accelerating Demand for High-Barrier Flexibles

Premium brands are shifting to multilayer high-barrier films that extend shelf life and support clean-label formulas, a move that lifts average price per unit in the US packaging market. Advanced coatings block oxygen, light, and moisture, safeguarding natural flavors without additives and reducing food waste. Consumers favor pouches with resealable spouts and transparent windows, pushing converters to balance barrier performance with shelf appeal. FDA food contact clearances add compliance complexity, limiting the entry of low-capex competitors. Brand owners justify higher pack costs through margin-expansion strategies centered on consumer willingness to pay for perceived quality. As sales of organic snacks and ready-to-drink coffees climb, demand for premium flexible formats strengthens long-term order books for film extruders.

California's SB-54 Extended Producer Responsibility Cost Pass-Through

Governor Newsom delayed initial regulations, citing business burden, yet the 25% plastic reduction mandate by 2032 and the USD 5 billion waste fund remain in force. Producers must finance recycling infrastructure and redesign packages or pay modulated fees. Larger players in the US packaging market spread costs across wider portfolios, whereas small converters face margin erosion and reduced capex capacity. Uncertainty stalls new-product launches and complicates interstate logistics as companies debate California-only SKUs versus national harmonization. Cost pass-through to brand owners pressures shelf pricing, potentially dampening volume growth in discretionary categories.

Other drivers and restraints analyzed in the detailed report include:

- On-shoring of Pharmaceutical Fill-Finish Capacity Boosting Sterile Packaging

- Automation-Ready Secondary Packaging Lines at CPGs

- PFAS-Free Mandates Raising Formulation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 35.88% of the US packaging market share in 2025, thanks to versatility and cost efficiency. Paper and paperboard, however, grew at a 5.33% CAGR and are expected to erode some plastic volume by 2031 as retailers pledge fiber-based alternatives. The Department of Energy's USD 52 million fund toward cellulose-based films signals public-sector backing for next-gen substrates. Natural HDPE scarcity pushed recycled resin to 96 cents per pound in March 2025, challenging bottle-to-bottle projects.

Plastic converters in the US packaging market face dual pressure from carbon accounting demands and resin oversupply risks. Investments shift to mono-material PE films engineered for recyclability, while multi-layer nylon structures migrate to high-barrier paper. Metal packaging maintains demand as beverage makers lock in alloy cans to meet infinitely recyclable claims. Overall, material selection now balances cost, circularity metrics, and regulatory exposure more than basic performance.

Paper and paperboard products commanded 28.70% of the US packaging market share in 2025 due to high corrugated volumes. Metal products are forecast to grow at a 6.64% CAGR as carbonated soft drinks and hard seltzers choose aluminum cans for lightweighting and recycling benefits. Crown Holdings' beverage can income rose 17% in 2024, underscoring secular demand. Silgan's 50% hold on metal food cans shows the resilience of shelf-stable products.

Digital print adoption empowers converters to serve seasonal SKU spikes, while rigid plastics such as HDPE jugs retain grocery loyalty for value packs. Yet metal's infinite-recycle narrative resonates with climate-conscious shoppers, shifting promotional budgets toward can-centric formats. Price swings in LME aluminum could temper volume gains, but brand owners hedge through multiyear take-or-pay deals, stabilizing orders for can-makers.

The United States Packaging Market Report is Segmented by Material Type (Paper and Paperboard, Plastic, Metal, and Container Glass), Product Type (Paper and Paperboard Product Type, Plastic Product Type, and More), Packaging Format (Rigid Packaging Format, and Flexible Packaging Format), and End-User (Food, Beverage, Personal Care and Cosmetics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Sealed Air Corporation

- Ball Corporation

- Crown Holdings, Inc.

- Sonoco Products Company

- American Packaging Corporation

- International Paper Company

- Graphic Packaging Holding Company

- Novolex Holdings, LLC

- ProAmpac Holdings Inc.

- Silgan Holdings Inc.

- AptarGroup, Inc.

- Huhtamaki Oyj

- Printpack, Inc.

- Packaging Corporation of America

- CCL Industries Inc.

- Ardagh Group S.A.

- Smurfit WestRock plc

- Mondi plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving small-parcel packaging demand

- 4.2.2 Premiumisation in food and beverage accelerating demand for high-barrier flexibles

- 4.2.3 On-shoring of pharmaceutical fill-finish capacity boosting sterile packaging

- 4.2.4 Automation-ready secondary packaging lines at CPGs

- 4.2.5 Retail media networks favouring shelf-ready formats

- 4.2.6 USDA and DOE grants for biopolymer pilot plants (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 California's SB-54 "Extended Producer Responsibility" cost pass-through

- 4.3.2 PFAS-free mandates raising formulation costs

- 4.3.3 2028-2029 PE and PP cracker capacity overhang depressing converter margins (under-reported)

- 4.3.4 Rising freight rates on corrugated due to chassis shortages (under-reported)

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic

- 5.1.2.1 Polyethylene Polypropylene (PP)

- 5.1.2.2 High-density Polyethylene (HDPE) and Low-density Polyethylene (LDPE)

- 5.1.2.3 Polyethylene Terephthalate (PET)

- 5.1.2.4 Polyvinyl Chloride (PVC)

- 5.1.2.5 Polystyrene (PS)

- 5.1.2.6 Other Plastics

- 5.1.3 Metal

- 5.1.4 Container Glass

- 5.2 By Product Type

- 5.2.1 Paper and Paperboard Product Type

- 5.2.1.1 Folding Carton and Rigid Boxes

- 5.2.1.2 Corrugated Boxes and Containers

- 5.2.1.3 Single-use Paper Products

- 5.2.1.4 Other Paper and Paperboard Product Types

- 5.2.2 Plastic Product Type

- 5.2.2.1 Rigid Plastics

- 5.2.2.1.1 Bottles and Jars

- 5.2.2.1.2 Caps and Closures

- 5.2.2.1.3 Bulk-Grade Products

- 5.2.2.1.4 Other Rigid Plastics Product Types

- 5.2.2.2 Flexible Plastics

- 5.2.2.2.1 Pouches

- 5.2.2.2.2 Bags

- 5.2.2.2.3 Films and Wraps

- 5.2.2.2.4 Other Flexible Plastics Product Types

- 5.2.2.1 Rigid Plastics

- 5.2.3 Metal Product Type

- 5.2.3.1 Cans

- 5.2.3.2 Caps and Closures

- 5.2.3.3 Aerosol Containers

- 5.2.3.4 Other Metal Product Types

- 5.2.4 Container Glass Product Type

- 5.2.4.1 Bottles

- 5.2.4.2 Jars

- 5.2.1 Paper and Paperboard Product Type

- 5.3 By Packaging Format

- 5.3.1 Rigid Packaging Format

- 5.3.2 Flexible Packaging Format

- 5.4 By End-user

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Pharmaceutical and Medical

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Industrial and Chemical

- 5.4.6 Agriculture

- 5.4.7 Automotive

- 5.4.8 Other End-users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Ball Corporation

- 6.4.4 Crown Holdings, Inc.

- 6.4.5 Sonoco Products Company

- 6.4.6 American Packaging Corporation

- 6.4.7 International Paper Company

- 6.4.8 Graphic Packaging Holding Company

- 6.4.9 Novolex Holdings, LLC

- 6.4.10 ProAmpac Holdings Inc.

- 6.4.11 Silgan Holdings Inc.

- 6.4.12 AptarGroup, Inc.

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Printpack, Inc.

- 6.4.15 Packaging Corporation of America

- 6.4.16 CCL Industries Inc.

- 6.4.17 Ardagh Group S.A.

- 6.4.18 Smurfit WestRock plc

- 6.4.19 Mondi plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment