PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910631

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910631

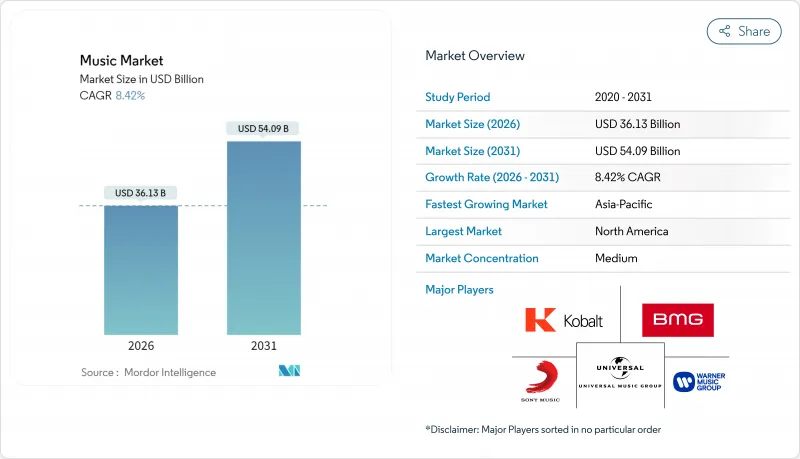

Music - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Music market size in 2026 is estimated at USD 36.13 billion, growing from 2025 value of USD 33.32 billion with 2031 projections showing USD 54.09 billion, growing at 8.42% CAGR over 2026-2031.

Streaming commands 67.73% music market share in 2025, reaffirming the sector's ongoing shift from physical formats toward access-based consumption. Parallel expansion in performance rights, live experiences, and commercial licensing adds depth to overall revenue growth. Smartphone penetration, better bandwidth, and rising disposable incomes in emerging economies amplify demand momentum, while catalog acquisitions and immersive audio formats reinforce premium-tier monetization. Competitive strategies prioritize vertical integration and data-driven A&R, and opportunities arise in B2B licensing, localized content, and direct-to-fan ecosystems.

Global Music Market Trends and Insights

Accelerated Adoption of Music-Streaming Subscriptions

Premium-tier optimization now outweighs basic subscriber acquisition. Spotify's USD 4.5 billion payout to independent labels and publishers in 2024 illustrates elevated royalty throughput, yet the platform's emphasis has shifted toward lossless codecs, exclusive drops, and bundled virtual events that lift ARPU. High-value tiers foster richer data analytics, shaping artist discovery and marketing spend efficiency. Developed markets focus on price segmentation, while emerging regions deliver sheer volume growth backed by mobile payment integration. The driver elevates total streams, boosts performance rights, and underpins cross-channel bundling for live-streamed concerts.

Rising Smartphone and Internet Penetration in Emerging Markets

Infrastructure upgrades across India, Indonesia, and Brazil unlock new listener cohorts, establishing mobile-first consumption norms that bypass physical retail constraints. India's recorded-music revenue climbed to USD 1.9 billion (INR 24 billion) in 2024 and is poised to hit USD 2.9 billion (INR 37 billion) by 2026, a 14.7% CAGR, propelled by regional-language catalogs and low-cost data plans. Monetization remains skewed toward ad-supported tiers, yet localized content commands higher engagement and advertising premiums. Embedded micro-payment options empower direct artist-to-fan transactions, shrinking intermediary margins and reshaping value distribution.

Persistent Copyright Infringement and Digital Piracy

The Recording Industry Association of America estimated USD 12.5 billion in U.S. revenue losses from illicit consumption in 2024. Stream-ripping tools undermine legitimate platforms, particularly where enforcement is weak and ad-supported options remain scarce. Decentralized distribution channels leveraging peer-to-peer protocols complicate takedown actions. Rights holders divert resources to legal measures and watermarking technology that could otherwise fund artist development. The macro impact depresses ROI expectations in high-piracy territories and slows premium service rollouts.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Social Media and Short-Form Video Platforms Fuelling Music Discovery

- Strong Investment and Catalog Acquisitions by Record Labels and Private Equity

- Growing Bargaining Power of Top Creators Driving Royalty Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Streaming represented 67.95% of the music market in 2025 and is projected to rise modestly as premium tiers widen and regional penetration deepens. Performance rights contribute the fastest incremental revenue at a 9.07% CAGR, reflecting renewed emphasis on live experiences and background-music licensing. Digital downloads contract sharply, reducing their share of the music market size, while vinyl's niche revival adds boutique value for collectors. Synchronization revenues expand alongside film and gaming output, offering non-linear growth uncoupled from subscriber totals.

Merchandising and licensing captured USD 5.09 billion in 2024, up 16.4% year-over-year, supported by global brand-licensing momentum. Concert attendees' merchandise purchase incidence climbed to 19%, signaling a durable appetite for experiential memorabilia. Platforms diversify into ticketing, livestreaming, and merch fulfillment within a single app environment, cementing higher lifetime value per user and mitigating reliance on any single income source.

Pop maintained 27.65% music market share in 2025, yet Latin music delivered the highest trajectory with an 8.70% CAGR through 2031, buoyed by cross-border collaborations and rhythmic suitability for social-video virality. Hip-hop and rap sustain heavy stream counts, while electronic subgenres benefit from festival circuits and immersive audiovisual staging. Rock regains touring momentum, capitalizing on nostalgic fan bases willing to purchase premium vinyl editions.

Genre blending accelerates as DSP curation emphasizes mood over traditional classification. Regional Mexican and K-pop illustrate localized content ascending to global charts through algorithmic discovery. Classical and jazz remain niche but enjoy high per-capita spend and synchronization appeal for luxury advertising. Diversification across genres hedges revenue against cyclical popularity swings, stabilizing aggregate music market performance.

The Music Market Report is Segmented by Revenue Generation Format (Streaming, Digital Downloads, and More), Genre (Pop, Rock, Hip-Hop/Rap, Electronic/Dance, and More), Distribution Channel (Online Platforms, and Offline/Brick-and-Mortar Retail), End User (Individual Consumers, Commercial Establishments, Media and Entertainment Producers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.21% of the music market in 2025, anchored by high ARPU and mature premium-tier penetration. Advanced rights-management structures and a robust live circuit lift blended monetization. Government-supported content funds in Canada strengthen domestic artist export capacity, while U.S. tech hubs pioneer immersive audio and AI-powered recommendation engines. Regulatory debate shifts toward AI-generated content ownership, prompting proactive licensing frameworks across DSPs and major labels.

Asia Pacific is the fastest-growing region at a 9.02% CAGR through 2031. China's ecosystem remains domestically oriented, yet Tencent-backed platforms extend international licensing outreach. India's rapid rise stems from local language catalogs, short-form video tie-ins, and frictionless micro-payments. Japan and South Korea demonstrate premium-content monetization via bundled entertainment packages that combine music, drama, and gaming subscriptions. Regional growth relies on continued infrastructure deployments and harmonized rights regimes.

Europe leverages consumer-protection regulations and carbon targets to influence global platform standards. The Digital Services Act introduces heightened liability for unlicensed uploads, encouraging proactive content-ID systems. Latin America benefits from genre-specific acceleration, notably reggaeton's mainstream adoption. However, currency volatility complicates royalty repatriation. The Middle East and Africa region exhibits rapid user growth but revenue lags due to ad-supported dominance and payment-gateway limitations. Cross-border licensing consortia seek to streamline deals and unlock latent spend as economic development lifts disposable incomes.

- Universal Music Group N.V.

- Sony Music Entertainment (Sony Corporation of America)

- Warner Music Group Corp.

- BMG Rights Management GmbH

- Kobalt Music Group Ltd.

- Spotify Technology S.A.

- Apple Inc. (Apple Music)

- Amazon.com, Inc. (Amazon Music)

- Alphabet Inc. (YouTube Music)

- Tencent Music Entertainment Group

- Deezer S.A.

- Tidal Music AS

- SoundCloud Global Limited and Co. KG

- Pandora Media, LLC (Sirius XM Holdings Inc.)

- NetEase Cloud Music (NetEase, Inc.)

- Anghami Inc.

- Melon Company (Kakao Entertainment)

- Yandex Music LLC

- Boomplay Music Group Limited

- JioSaavn LLC

- KKBOX Inc.

- Curb Records, Inc.

- Believe S.A.

- CD Baby, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of music-streaming subscriptions

- 4.2.2 Rising smartphone and internet penetration in emerging markets

- 4.2.3 Growth of social media and short-form video platforms fuelling music discovery

- 4.2.4 Strong investment and catalog acquisitions by record labels and private equity

- 4.2.5 Proliferation of immersive audio formats (Dolby Atmos, Sony 360RA) boosting ARPU

- 4.2.6 Blockchain-enabled direct-to-fan monetization models (NFTs, fractional ownership)

- 4.3 Market Restraints

- 4.3.1 Persistent copyright infringement and digital piracy

- 4.3.2 Growing bargaining power of top creators driving royalty costs

- 4.3.3 Fragmentation of licensing regimes in emerging markets delaying service launches

- 4.3.4 Rising carbon scrutiny of data-center energy use for streaming

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Stakeholder Analysis

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Revenue Generation Format

- 5.1.1 Streaming

- 5.1.2 Digital Downloads (ex-Streaming)

- 5.1.3 Physical Products

- 5.1.4 Performance Rights

- 5.1.5 Synchronization Revenues

- 5.1.6 Merchandising and Licensing

- 5.2 By Genre

- 5.2.1 Pop

- 5.2.2 Rock

- 5.2.3 Hip-Hop / Rap

- 5.2.4 Electronic / Dance

- 5.2.5 Classical

- 5.2.6 Jazz

- 5.2.7 Country

- 5.2.8 Latin

- 5.3 By Distribution Channel

- 5.3.1 Online Platforms

- 5.3.2 Offline / Brick-and-Mortar Retail

- 5.4 By End User

- 5.4.1 Individual Consumers

- 5.4.2 Commercial Establishments (bars, hotels, retail)

- 5.4.3 Media and Entertainment Producers (film, TV, gaming)

- 5.4.4 Brands and Advertisers

- 5.4.5 Event and Concert Organizers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Universal Music Group N.V.

- 6.4.2 Sony Music Entertainment (Sony Corporation of America)

- 6.4.3 Warner Music Group Corp.

- 6.4.4 BMG Rights Management GmbH

- 6.4.5 Kobalt Music Group Ltd.

- 6.4.6 Spotify Technology S.A.

- 6.4.7 Apple Inc. (Apple Music)

- 6.4.8 Amazon.com, Inc. (Amazon Music)

- 6.4.9 Alphabet Inc. (YouTube Music)

- 6.4.10 Tencent Music Entertainment Group

- 6.4.11 Deezer S.A.

- 6.4.12 Tidal Music AS

- 6.4.13 SoundCloud Global Limited and Co. KG

- 6.4.14 Pandora Media, LLC (Sirius XM Holdings Inc.)

- 6.4.15 NetEase Cloud Music (NetEase, Inc.)

- 6.4.16 Anghami Inc.

- 6.4.17 Melon Company (Kakao Entertainment)

- 6.4.18 Yandex Music LLC

- 6.4.19 Boomplay Music Group Limited

- 6.4.20 JioSaavn LLC

- 6.4.21 KKBOX Inc.

- 6.4.22 Curb Records, Inc.

- 6.4.23 Believe S.A.

- 6.4.24 CD Baby, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment