PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910633

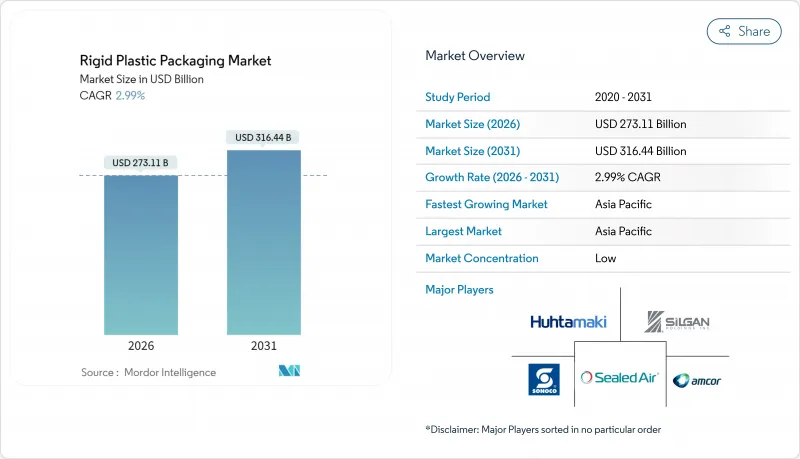

Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Rigid Plastic Packaging Market is expected to grow from USD 265.18 billion in 2025 to USD 273.11 billion in 2026 and is forecast to reach USD 316.44 billion by 2031 at 2.99% CAGR over 2026-2031.

Underscoring a steady expansion phase that balances volume with value creation driven by sustainability mandates and supply-chain resilience needs. The rigid plastic packaging market benefits from e-commerce growth that favors impact-resistant formats, regulatory pressure that rewards monomaterial design, and demographic trends that lift single-serve demand across food and healthcare channels. Producers elevate recycled-content integration to meet Extended Producer Responsibility (EPR) cost curves, while vertical integration into recycling assets secures feedstock visibility and buffers polymer price swings. Asia-Pacific leads with scale, policy incentives, and rapid urban consumption, Europe leverages stringent circular-economy rules to accelerate premium solutions, and North America advances cold-chain logistics that require robust containers. Competitive intensity rises as top converters merge to gain procurement muscle, innovation breadth, and compliance readiness, resetting entry barriers for smaller firms.

Global Rigid Plastic Packaging Market Trends and Insights

Circular-economy mandates driving recycled-content packaging demand

Sixty-three countries now levy EPR fees that scale sharply with recyclability, shifting cost structures in favor of post-consumer recycled (PCR) feedstock and monomaterial design. Premiums of 10-15% for PCR PET over virgin resin invert traditional price hierarchies, prompting converters to lock in recycled supply through acquisitions and long-term contracts. Digital traceability systems emerge as firms comply with Denmark's 2025 data-reporting rules, accelerating end-to-end transparency. As EU recyclability deadlines approach, capital flows toward washing, extrusion, and chemical recycling facilities that can certify food-grade output. This driver underpins scale investment rationales and reinforces the rigid plastic packaging market's pivot from volume metrics to circular-value metrics.

Surge in e-commerce accelerating demand for impact-resistant ship-ready formats

Direct-to-consumer fulfillment exposes primary containers to handling forces 40% higher than traditional retail routes, elevating failure-cost risk for brand owners. Rigid designs- especially injection-molded tubs and thermoformed trays- absorb shock without secondary packaging, reducing dimensional weight fees and damage returns. Retailers mandate "ship-in-own-container" protocols that favor sturdy formats capable of stack loads exceeding 50 kg during automated warehousing. Innovation now focuses on corner-reinforcement geometry and built-in cushioning ribs that protect contents while trimming resin use. This structural requirement aligns with sustainability imperatives because thicker, reusable rigid containers offset single-use corrugated waste in last-mile delivery. These trends are driving growth and innovation in the rigid plastic packaging market.

Escalating polymer price volatility compressing converter margins

Feedstock disruptions lifted polyethylene price swings to 35% within six months during 2024, squeezing converters locked into fixed-price contracts. Smaller firms with limited hedging capability operate at sub-70% plant utilization, risking covenant breaches on working-capital lines. Asian olefin crackers cut run rates to manage negative spreads, constraining resin availability and inflating spot premiums. The rigid plastic packaging market absorbs cost shocks unevenly; global majors leverage scale contracts, whereas regional players delay investments, slowing capacity modernization.

Other drivers and restraints analyzed in the detailed report include:

- Demographic shift toward smaller households fueling single-serve rigid packs

- Adoption of high-barrier monomaterial solutions to meet 2027 EU recyclability targets

- Increasing consumer shift to flexible and paper-based alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bottles and jars accounted for 42.83% of the rigid plastic packaging market size in 2025, reflecting entrenched usage in beverages, personal care, and over-the-counter medicines. Superior clarity, tamper evidence, and label compatibility keep demand steady even as lightweight initiatives trim resin per unit. Innovations include tethered caps that satisfy single-use plastics directives and improve recyclability. Growth remains volume-linked to beverage output rather than disruptive technology shifts, positioning the segment as a stable revenue base for large converters.

Pallets, though a smaller share, are the fastest-rising product at a 4.43% CAGR, powered by e-commerce automation that values RFID-embedded, IoT-ready load carriers. Reusable plastic pallets outperform wood on durability and hygiene, which is critical for cold-chain pharmaceuticals and fresh produce. Standardized footprints facilitate high-bay warehouse robotics, and serialization unlocks asset-tracking data services that generate ancillary revenue. As retailers adopt closed-loop pooling systems, pallet suppliers bundle tracking software with hardware, creating service-driven differentiation within the rigid plastic packaging market.

PET retained 31.05% of the rigid plastic packaging market share in 2025, owing to its strong barrier profile and established bottle-to-bottle recycling loops. Deposit schemes in Europe achieve 76.7% PET recovery, enabling high PCR content that lowers EPR liabilities. Yet bioplastics show a 4.98% CAGR as policy and brand commitments prioritize bio-based feedstocks. Chinese capacity expansions to 700,000 t/y PBAT and 100,000 t/y PLA stabilize supply and chip away at price premiums.

Lifecycle economics shift as carbon-credit schemes monetize greenhouse-gas savings from bio-based resins. Major beverage brands test 100% bio-PET bottles, and cap manufacturer programs move toward plant-derived HDPE. The rigid plastic packaging market, therefore, balances cost efficiencies in legacy petrochemical chains with strategic diversification into low-carbon polymers that future-proof portfolios against regulatory escalation.

The Rigid Plastic Packaging Report is Segmented by Product Type (Bottles and Jars, Trays and Containers, and More), Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, and More), End User Industry (Food, Healthcare, Cosmetics and Personal Care, Industrial, and More), Manufacturing Process (Injection Molding, Extrusion Blow Molding, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 38.85% of 2025 sales in rigid plastic packaging and is forecast to expand at 5.62% CAGR, buoyed by India's USD 1.46 billion PLI-attracted investments and China's biodegradable-plastic build-out that anchors regional supply chains. Local converters scale capacity alongside global brands, locating production near consumers to cut freight emissions. Regulatory pivots toward recyclable or bio-based packaging create first-mover advantages for firms with technology transfer alliances.

North America enjoys steady growth as e-commerce and cold-chain pharmaceuticals escalate demand for robust containers that preserve product integrity across extended logistics routes. State-level EPR proposals prompt design re-evaluation, yet fragmented timelines moderate compliance shocks. High average incomes support premium single-serve formats, reinforcing volume for high-margin rigid segments.

Europe exhibits mature volume but high value density because of aggressive circular-economy directives. The Packaging and Packaging Waste Regulation drives adoption of monomaterial solutions and propels capital into recycling infrastructure, creating a USD 15 billion compliance market. Innovation clusters in Germany, the Netherlands, and France pioneer chemical recycling pilots that secure local PCR supplies and feed export channels into Asia.

South America and the Middle East and Africa present emerging opportunities tempered by collection shortfalls and policy lag. Multinationals deploy modular recycling plants to capture local PCR and fulfill global content pledges. South Africa's EPR law and Kenya's producer-responsibility draft demonstrate policy convergence that will tighten design standards and escalate demand for compliant rigid solutions. Investment incentives and lower labor costs attract extruder and injection-molding line relocations, positioning these regions as future export hubs within the rigid plastic packaging market.

- Amcor plc

- Alpha Packaging Holdings, Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc.

- Sealed Air Corporation

- Plastipak Holdings, Inc.

- Sonoco Products Company

- Resilux NV

- Graham Packaging Company, L.P.

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- Pact Group Holdings Ltd

- Gerresheimer AG

- Huhtamaki Oyj

- Coveris Management GmbH

- Logoplaste Consultores Tecnicos SA

- International Paper Company (DS Smith Plc)

- Weener Plastics Group BV

- Anchor Packaging LLC

- Visy Industries Holdings Pty Ltd

- Altium Packaging LLC

- Serioplast Group SpA

- Mpact Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Circular-economy mandates driving recycled-content packaging demand

- 4.2.2 Surge in e-commerce accelerating demand for impact-resistant ship-ready formats

- 4.2.3 Demographic shift toward smaller households fueling single-serve rigid packs

- 4.2.4 Adoption of high-barrier monomaterial solutions to meet 2027 EU recyclability targets

- 4.2.5 Rapid growth of cold-chain logistics requiring ultra-robust rigid containers

- 4.3 Market Restraints

- 4.3.1 Escalating polymer price volatility compressing converter margins

- 4.3.2 Increasing consumer shift to flexible and paper-based alternatives

- 4.3.3 Extended Producer Responsibility (EPR) fees raising total cost of ownership

- 4.3.4 Recycling-infrastructure gaps in emerging economies limiting PCR supply

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bottles and Jars

- 5.1.2 Trays and Containers

- 5.1.3 Intermediate Bulk Containers (IBCs)

- 5.1.4 Pallets

- 5.1.5 Other Product Types

- 5.2 By Material

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.5 Bioplastics

- 5.2.6 Other Materials

- 5.3 By End User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Building and Construction

- 5.3.7 Automotive

- 5.3.8 Other End-user Industries

- 5.4 By Manufacturing Process

- 5.4.1 Injection Molding

- 5.4.2 Extrusion Blow Molding

- 5.4.3 Injection Blow Molding

- 5.4.4 Stretch Blow Molding

- 5.4.5 Thermoforming

- 5.4.6 Rotational Molding

- 5.4.7 Compression Molding

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Poland

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Thailand

- 5.5.4.5 Australia

- 5.5.4.6 South Korea

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Alpha Packaging Holdings, Inc.

- 6.4.3 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Plastipak Holdings, Inc.

- 6.4.7 Sonoco Products Company

- 6.4.8 Resilux NV

- 6.4.9 Graham Packaging Company, L.P.

- 6.4.10 Greif, Inc.

- 6.4.11 Mauser Packaging Solutions Holding Company

- 6.4.12 Pact Group Holdings Ltd

- 6.4.13 Gerresheimer AG

- 6.4.14 Huhtamaki Oyj

- 6.4.15 Coveris Management GmbH

- 6.4.16 Logoplaste Consultores Tecnicos SA

- 6.4.17 International Paper Company (DS Smith Plc)

- 6.4.18 Weener Plastics Group BV

- 6.4.19 Anchor Packaging LLC

- 6.4.20 Visy Industries Holdings Pty Ltd

- 6.4.21 Altium Packaging LLC

- 6.4.22 Serioplast Group SpA

- 6.4.23 Mpact Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment