PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910915

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910915

GCC Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

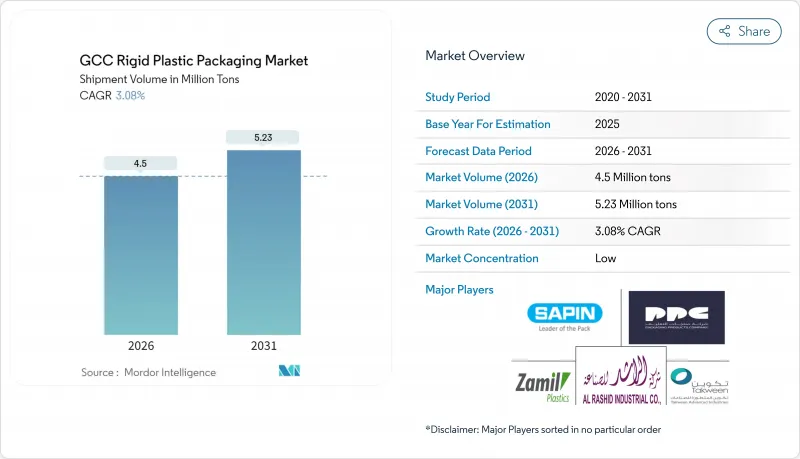

GCC rigid plastic packaging market size in 2026 is estimated at 4.5 million tons, growing from 2025 value of 4.36 million tons with 2031 projections showing 5.23 million tons, growing at 3.08% CAGR over 2026-2031.

The steady uptick reflects policy alignment with circular-economy targets, stable petrochemical feedstock availability, and resilient demand from beverages, food, and healthcare sectors. Saudi Arabia anchors regional growth through abundant resin capacity and a well-established converter base, while the United Arab Emirates (UAE) and Oman accelerate capacity additions next to strategic ports. End-user appetite is reinforced by fast tourism recovery, urban population gains, and a rise in per-capita packaged-food consumption that favors barrier-rich rigid formats. Sustainability mandates, such as United Arab Emirates and Oman single-use-plastic bans, shift demand away from flexible films toward recyclable bottles, jars, and closures. Parallel investment in robotics and vision-inspection systems lowers conversion cost, helping local manufacturers defend margins despite feedstock price swings.

GCC Rigid Plastic Packaging Market Trends and Insights

Regulatory Push for Recyclable Rigid Plastics

Single-use plastic bans in the United Arab Emirates and Oman, effective January 2025, create an immediate uplift for recyclable containers that comply with extended producer responsibility targets. Dubai prohibits plastic straws, stirrers, and Styrofoam foodware, prompting retailers to transition toward rigid polyethylene and PET formats. SABIC's mass-balance certified polyethylene rollout for bakery bags showcases the commercial viability of post-consumer resin that meets food-contact rules. Saudi Investment Recycling Company (SIRC) expands PET flake exports to the United Kingdom, demonstrating a closed-loop pathway that decreases virgin resin use while opening premium export channels. Regulatory clarity accelerates converter investment in wash-and-flake and depolymerization assets that raise recycled-content levels without sacrificing performance. Compliance costs favor large players with capital to integrate recycling, raising entry barriers for small converters.

Expansion of Bottled-Water and Beverage Industries

Hot climate conditions and rising disposable income sustain per-capita bottled-water intake, fueling the largest end-user segment. Alesayi Beverage Corporation installed SIG bag-in-box lines at its 98,000 m2 Jeddah site to serve hotels, restaurants, and catering customers, indicating scale-ups in both rigid and bag-in-box formats. Future Plast processes 32,000 tons of PET preforms and HDPE closures per year in Sharjah, supplying regional bottlers with food-grade packaging. RAFA Water's lightweight 29/25 mm neck reduces PET usage by 15% while preserving carbonation, supporting sustainability goals. Beverage producers prefer rigid bottles over pouches for product integrity under high temperatures, especially in transport across desert corridors. Growth in energy and sports drinks adds premium closures with tamper evidence, benefiting high-margin cap suppliers.

End-of-Life Waste and Landfill Concerns

The UAE aims for 75% landfill diversion by 2030, yet current collection networks fall short, exposing converters to reputational risk if packaging ends in uncontrolled dumps. Advanced facilities such as MASAB's PET-recycling plant still rely on imported bales, underscoring domestic collection gaps. Retail bans on thin shopping bags redirect tonnage toward rigid items without proportionate recycling capacity. Growing landfill levies and gate fees could erode operating margins, particularly for converters lacking closed-loop agreements. Municipalities may cap licenses for new plastic plants until recycling targets are hit, limiting near-term capacity expansion in the GCC rigid plastic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Shelf-Life Extension Needs in Food and Pharma

- Logistics Cost-Down via Lightweight Conversion

- Feedstock and Resin Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene retains leadership with 29.01% share in 2025 within the GCC rigid plastic packaging market; however, PET is forecast to grow at a 6.52% CAGR, propelled by bottle-to-bottle circular schemes. The GCC rigid plastic packaging market size for PET is projected to reach 1.42 million tons by 2031 as chemical-recycling pilots in the United Arab Emirates scale to commercial feedstock streams. PET's transparency, gas-barrier properties, and deposit-scheme compatibility make it the preferred choice for bottled water, juices, and pharmaceutical syrups. R&D ties with Japanese firm JEPLAN bring glycolysis depolymerization to Abu Dhabi, enhancing virgin-grade pellet output that satisfies the food-contact approvals from EFSA and FDA. Conversely, expanded polystyrene faces headwinds following Styrofoam bans that restrict single-use foodware. Low-density polyethylene continues in niche rigid lids yet remains more exposed to flexible-film substitution.

Downstream converters hedge price shocks by diversifying resin slate; some beverage firms trial bio-based PLA bottles that align with zero-carbon pledges. Yet PLA's adoption lags until Emirates Biotech's 2028 plant delivers a local supply. Polypropylene finds renewed interest in closures and thin-wall containers because of higher heat resistance, although volatile propylene pricing forces cautious inventory management across the GCC rigid plastic packaging market.

Bottles and jars dominate at 45.65% share, given the beverage industry scale and pharmaceutical volume growth. Caps and closures, however, show the quickest 6.88% CAGR through 2031 as demand rises for tethered and lightweight designs that comply with export rules to Europe. Tethered solutions ensure cap retention, reducing litter and meeting new EU design guidelines that Gulf exporters must observe. Converters install compression-molding lines capable of 2,000 closures per minute, lifting throughput while cutting energy per unit. Lightweight flip-top systems for dairy drinks reduce resin use by 1.5 grams per unit, translating into 300 tons of annual savings at medium-sized plants.

Intermediate bulk containers gain industrial-chemical traction as Saudi downstream producers diversify beyond fuels into lubricants and detergents. Thermoformed trays cater to quick-service restaurants that accelerate recovery post-pandemic. Drums stay core for oil-field chemicals, where high-density polyethylene resists stress cracking in hot-fill conditions. Modular tooling allows converters to shift rapidly between neck finishes based on fast-moving-consumer-goods promotions, maximizing asset utilization in the GCC rigid plastic packaging market.

The GCC Rigid Plastic Packaging Report is Segmented by Resin Type (Polyethylene, PET, Polypropylene, and More), Product Type (Bottles and Jars, Trays and Containers, Caps and Closures, Ibcs, and More), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), Manufacturing Process (Injection Moulding, Blow Moulding, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Zamil Plastic Industries Co.

- Takween Advanced Industries

- Packaging Products Co.

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Al Bayader International

- ALPLA GCC

- Greif GCC

- Mauser Packaging Solutions

- Schoeller Allibert ME

- Al-Ghandoura Plastic Co.

- Saudi Plastic Factory Company

- Precision Plastic Products LLC

- Al Watania Plastics

- KANR for Plastic Industries

- Sabic Packaging Solutions

- Dubai Plastic Products Co.

- Premier Plastic Company

- Al Rashid Boxes & Plastic Co.

- GEPack

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory push for recyclable rigid plastics

- 4.2.2 Expansion of GCC bottled-water and beverage industries

- 4.2.3 Shelf-life extension needs in F&B and pharma

- 4.2.4 Logistics cost-down via lightweight conversion

- 4.2.5 Industry 4.0 capacity build-out in local converters

- 4.2.6 Low-carbon PP and PET feedstocks from green hydrogen hubs

- 4.3 Market Restraints

- 4.3.1 End-of-life waste and landfill concerns

- 4.3.2 Feedstock / resin price volatility

- 4.3.3 Emerging Extended-Producer-Responsibility (EPR) fees

- 4.3.4 Water-scarcity policies capping petro-expansions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Trend Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Resin Type

- 5.1.1 Polyethylene

- 5.1.1.1 High-Density Polyethylene (HDPE)

- 5.1.1.2 Low-Density Polyethylene (LDPE)

- 5.1.1.3 Linear Low-Density Polyethylene (LLDPE)

- 5.1.2 Polyethylene Terephthalate

- 5.1.3 Polypropylene

- 5.1.4 Polystyrene and EPS

- 5.1.5 Other Resin Type

- 5.1.1 Polyethylene

- 5.2 By Product Type

- 5.2.1 Bottles and Jars

- 5.2.2 Trays and Containers

- 5.2.3 Caps and Closures

- 5.2.4 Intermediate Bulk Containers (IBCs)

- 5.2.5 Drums

- 5.2.6 Other Product Types

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.1.1 Candy and Confectionery

- 5.3.1.2 Dairy and Frozen

- 5.3.1.3 Meat, Poultry and Seafood

- 5.3.1.4 Other Food Types

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial Chemicals

- 5.3.6 Building and Construction

- 5.3.7 Other End-user Industry

- 5.3.1 Food

- 5.4 By Manufacturing Process

- 5.4.1 Injection Moulding

- 5.4.2 Blow Moulding

- 5.4.3 Thermoforming

- 5.4.4 Compression Moulding

- 5.4.5 Extrusion

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Rest of GCC

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Zamil Plastic Industries Co.

- 6.4.2 Takween Advanced Industries

- 6.4.3 Packaging Products Co.

- 6.4.4 Saudi Arabian Packaging Industry WLL (SAPIN)

- 6.4.5 Al Bayader International

- 6.4.6 ALPLA GCC

- 6.4.7 Greif GCC

- 6.4.8 Mauser Packaging Solutions

- 6.4.9 Schoeller Allibert ME

- 6.4.10 Al-Ghandoura Plastic Co.

- 6.4.11 Saudi Plastic Factory Company

- 6.4.12 Precision Plastic Products LLC

- 6.4.13 Al Watania Plastics

- 6.4.14 KANR for Plastic Industries

- 6.4.15 Sabic Packaging Solutions

- 6.4.16 Dubai Plastic Products Co.

- 6.4.17 Premier Plastic Company

- 6.4.18 Al Rashid Boxes & Plastic Co.

- 6.4.19 GEPack

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment