PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910670

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910670

Professional Audio Visual Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

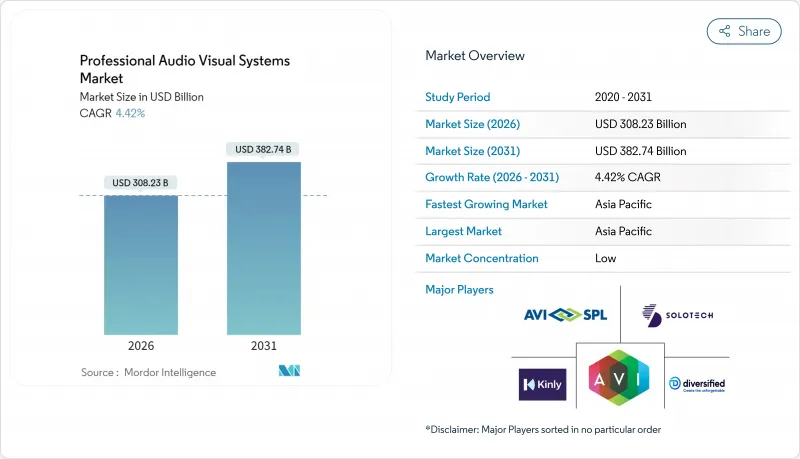

The professional audio visual system market was valued at USD 295.18 billion in 2025 and estimated to grow from USD 308.23 billion in 2026 to reach USD 382.74 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

Hybrid work requirements, investment in digital signage, and the migration of AV processing to cloud and IP networks drive demand resilience. Spending momentum is visible in enterprise collaboration suites, large-format LED displays, and AI-enabled audio that supports inclusive meetings. Vendor competition is intensifying as software-centric newcomers challenge traditional integrators with subscription models and remote device management. Supply-chain pressures related to semiconductors remain a headwind, yet regulatory mandates on accessibility and energy efficiency are opening new revenue avenues for compliance-ready platforms.

Global Professional Audio Visual Systems Market Trends and Insights

Hybrid Work and Learning Surge

Corporate spending shifted from isolated conference-room upgrades to enterprise-wide ecosystems that deliver equitable experiences for on-site and remote staff. Investments span spatial audio arrays, multi-camera tracking, and automated content framing that integrate with leading collaboration platforms. Education is mirroring this demand with lecture capture, campus streaming, and device management that support blended classrooms. The professional audio visual system market benefits because enterprises prefer certified, fully managed solutions that plug into existing IT policies. Rapid refresh cycles are fueled by employee experience benchmarks, leading to multiyear procurement roadmaps. As a result, platform interoperability and cloud dashboards have emerged as critical vendor differentiators.

Experiential Retail and Public-Venue LED Rollouts

Retail chains are turning stores into immersive media venues where fine-pitch LEDs deliver branded storytelling, wayfinding, and real-time promotions. Scheels' USD 11 million national signage rollout underscores capital intensity and scale. Public buildings and transport hubs are installing similar displays to manage passenger flow and safety messaging. Central content management lets operators synchronize campaigns across regions while tailoring local language and offers. The professional audio visual system market is bolstered because display hardware now ships with embedded analytics that feed retailers' CRM tools. Rising foot-traffic expectations keep LED demand elevated despite cyclical retail spending.

High TCO and Compliance Costs

Accessibility, cybersecurity, and energy mandates have transformed procurement math. The FCC rules, effective January 2027, require captioning, sign-language support, and accessible user interfaces within video-conferencing platforms. Parallel energy standards push manufacturers to redesign enclosures and power supplies with higher-efficiency components. Compliance adds testing, certification, and frequent software updates, doubling lifecycle spending for complex deployments. Organizations underestimate ongoing training, monitoring, and audit documentation, leading to budget overruns that temper near-term orders in the professional audio visual system market.

Other drivers and restraints analyzed in the detailed report include:

- Live and Hybrid Events Rebound Post-Pandemic

- Migration to AV-over-IP Architectures

- Skilled-Labor Shortages and Wage Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The professional audio visual system market recorded Capture and Production Equipment at a leading 30.25% share in 2025, underscoring the premium placed on high-quality source content. Camera systems, PTZ controllers, and production switchers move down-market as corporate and educational studios replicate broadcast workflows. Bundled subscription models that wrap hardware, software, and remote support increase annual recurring revenue for vendors. Streaming Media, Storage, and Distribution, the fastest-growing slice at a 5.33% CAGR, reflects demand for scalable cloud encoders and on-demand content libraries. Edge caching reduces latency for globally dispersed viewers, turning media servers into strategic nodes in the professional audio visual system market size discussions.

Traditional Video Projection retains relevance for auditoriums and houses of worship but yields share to direct-view LED in high-brightness settings. Services, including design, monitoring, and break-fix contracts, climb as customers outsource lifecycle management. Emerging types such as holographic displays and spatial computing remain niche yet capture innovation budgets for premium venues. Every sub-segment illustrates a shift where value creation migrates from isolated hardware to integrated ecosystems that monetize analytics and content workflows.

The Professional Audio Visual System Market Report is Segmented by Type (Capture and Production Equipment, Video Projection, and More), Component (Audio Equipment, Display and Projection Systems, Control and Processing, and More), End-User Vertical (Corporate, Venues and Events, Retail, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds the largest 29.55% share and a leading 5.78% CAGR, propelled by mega-projects in transportation, hospitality, and smart cities. National digitization policies funnel funds into campus networks and immersive classrooms in China, India, and Indonesia. Local manufacturing clusters compress lead times and cost structures, allowing rapid adoption of next-generation LED and AI processing. Japan and South Korea supplement volume with research and development breakthroughs in micro-LED packaging and voice AI, enhancing export competitiveness. Mature integrators forge joint ventures to navigate regional procurement and language diversity, a tactic that expands the professional audio visual system market footprint.

North America posts steady upgrades anchored by accessibility mandates and hybrid work normalization. The FCC captioning rule multiplies demand for AI transcription engines and adaptive UI elements. Enterprises revisit refresh cycles every three to five years to maintain parity between in-office and remote experiences. Canada boosts market momentum through investments in broadcast studios and distance-learning infrastructure across dispersed territories. Mexico's maquiladora centers adopt AV-over-IP to coordinate cross-border supply chains, keeping the region integral to the professional audio visual system market.

Europe advances on the back of sustainability legislation requiring lower energy consumption and circular-economy design. Germany and France prioritize passive cooling enclosures and firmware that schedules low-power modes. The United Kingdom accelerates the adoption of AI analytics in transport hubs to manage passenger density. Eastern European countries allocate recovery funds to upgrade civic theatres and regional universities. Pan-European data-privacy laws elevate secure cloud control as a competitive edge among vendors, shaping procurement policies across the professional audio visual system market.

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

- Kinly BV

- Vega Global

- IDNS Ltd.

- Ricoh USA Inc.

- Midwich Group plc

- Wesco Anixter Inc.

- Audinate Group Ltd.

- NMK Electronics Enterprises

- Qvest Group

- ACTLD SA

- Almo Professional A/V (Exertis Almo)

- ClearOne Inc.

- Kramer Electronics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Hybrid work and learning surge

- 4.3.2 Experiential retail and public-venue LED roll-outs

- 4.3.3 Live and hybrid events rebound post-pandemic

- 4.3.4 Migration to AV-over-IP architectures

- 4.3.5 AI-driven real-time accessibility solutions

- 4.3.6 Decarbonization mandates for energy-efficient AV

- 4.4 Market Restraints

- 4.4.1 High TCO and compliance costs

- 4.4.2 Semiconductor and display supply-chain volatility

- 4.4.3 Cyber-insurance premiums on networked AV

- 4.4.4 Skilled-labor shortages and wage inflation

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Intensity of Competitive Rivalry

- 4.9.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Capture and Production Equipment

- 5.1.2 Video Projection

- 5.1.3 Streaming Media, Storage and Distribution

- 5.1.4 Services

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Audio Equipment (mics, mixers, amps)

- 5.2.2 Display and Projection Systems

- 5.2.3 Control and Processing

- 5.2.4 Storage and Distribution Hardware

- 5.3 By End-user Vertical

- 5.3.1 Corporate

- 5.3.2 Venues and Events

- 5.3.3 Retail

- 5.3.4 Media and Entertainment

- 5.3.5 Education

- 5.3.6 Government

- 5.3.7 Healthcare

- 5.3.8 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AVI-SPL Inc.

- 6.4.2 Diversified

- 6.4.3 AVI Systems Inc.

- 6.4.4 Ford Audio-Video LLC

- 6.4.5 CCS Presentation Systems Inc.

- 6.4.6 Solutionz Inc.

- 6.4.7 Electrosonic Group

- 6.4.8 Solotech Inc.

- 6.4.9 Conference Technologies Inc.

- 6.4.10 Vistacom Inc.

- 6.4.11 Kinly BV

- 6.4.12 Vega Global

- 6.4.13 IDNS Ltd.

- 6.4.14 Ricoh USA Inc.

- 6.4.15 Midwich Group plc

- 6.4.16 Wesco Anixter Inc.

- 6.4.17 Audinate Group Ltd.

- 6.4.18 NMK Electronics Enterprises

- 6.4.19 Qvest Group

- 6.4.20 ACTLD SA

- 6.4.21 Almo Professional A/V (Exertis Almo)

- 6.4.22 ClearOne Inc.

- 6.4.23 Kramer Electronics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment