PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911412

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911412

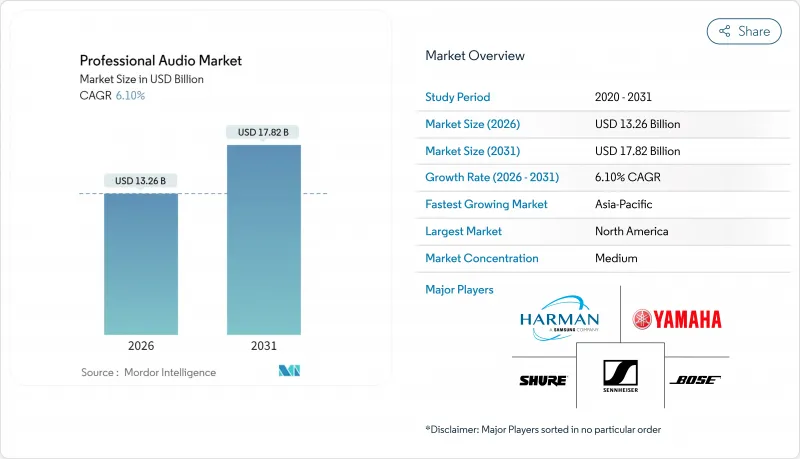

Professional Audio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The professional audio market was valued at USD 12.50 billion in 2025 and estimated to grow from USD 13.26 billion in 2026 to reach USD 17.82 billion by 2031, at a CAGR of 6.1% during the forecast period (2026-2031).

Demand shifts from equipment ownership to experience-driven solutions, live-event resurgence, and enterprise hybrid-work upgrades form the core growth pillars. Networked protocols such as AES67 and Dante reduce interoperability barriers, encouraging facilities to refresh legacy infrastructure.

Supply chain redesigns that minimize semiconductor exposure and a pivot toward software-defined features strengthen recurring revenue streams. Meanwhile, convergence of building systems with audio, evidenced by Acuity Brands' acquisition of QSC, signals new competitive dynamics where lighting, HVAC, and sound platforms interconnect.

Global Professional Audio Market Trends and Insights

Rapid Expansion of Live-Events and Experiential Marketing

Ticket volumes at major concerts increased 26% year over year in 2024, spurring rental firms and venues to replace aging arrays with cardioid sub-array systems that meet stricter noise ordinances while preserving punch. Festival operators monetize premium sound zones that tie experiential marketing to sponsorship revenue, as seen at Ultra Music Festival 2025. Hybrid corporate shows need low-latency bridging between onsite and virtual audiences, driving sales of scalable digital consoles. Sphere Entertainment's 167,000-speaker install illustrates how immersive architecture elevates brand engagement. The professional audio market therefore sees elevated demand for flexible loudspeaker configurations and high-density wireless channels that streamline quick show turnovers.

Surging Creator-Economy Demand for Studio-Grade Gear

China logged 747 million online audio users in 2024, generating a sector worth USD 68.86 billion, underlining how individual content creators influence professional purchasing decisions. Global podcast revenue surpassed USD 30 billion the same year, pushing microphone makers to launch USB-XLR hybrids that combine convenience with expandability. Visual brand aesthetics matter; larger broadcast-style microphones improve on-camera credibility, boosting uptake of units such as Shure's MV7i that integrate real-time voice processing. Mid-tier manufacturers capitalize by bundling software plug-ins alongside hardware, converting first-time buyers into subscription clients. This driver enlarges the addressable professional audio market by expanding the end-user base beyond traditional studios.

Persistent Semiconductor Supply-Chain Volatility

Lead times for DSP cores and RF transceivers extend past 60 weeks, forcing design teams to qualify substitute parts or strip advanced features. U.S. semiconductor imports reached USD 139 billion in 2024 amid tariff hikes that raised landed costs. Smaller audio brands compete against large tech firms for wafer allocation, often paying premiums or shrinking production runs. Component obsolescence accelerates, leading some vendors to sunset digital SKUs in favor of analog lines requiring fewer chips. The professional audio market thus faces margin compression until fab capacity aligns with demand.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Networked-AV and AES67/Dante Interoperability

- Shift to Immersive and Spatial-Audio Formats

- High Total Cost of Ownership for Tour-Grade Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Loudspeakers contributed 38.02% of the professional audio market size in 2025, confirming their centrality across touring, fixed install, and hybrid venues. Replacement cycles accelerated after pandemic-era downtime, with many arenas adopting cardioid sub-arrays that improve low-frequency directionality while complying with municipal noise codes. Meanwhile, wireless microphones advance at an 7.45% CAGR on the back of regulatory spectrum reallocations that compel users to retire analog UHF units. Manufacturers answer with encrypted digital platforms that fit within shrinking frequency bands, safeguarding performance in congested RF environments.

The loudspeaker segment drives value-added demand for amplification, rigging, and control software that elevate system performance through FIR-based beam steering. Vendors unlock software subscriptions that activate prediction modules, converting one-time hardware sales into recurring revenue. Microphone makers explore WMAS-based ecosystems, such as Sennheiser's Spectera, which delivers 64 channels inside a single 6 MHz block and illustrates how advanced modulation counters spectrum scarcity. Accessories like Dante breakout boxes and PoE-powered stage boxes fill integration gaps, rounding out wallet share captured by vendors inside the professional audio market.

Wired solutions retained 56.85% share of the professional audio market size in 2025 thanks to mission-critical applications that resist RF risk, including government chambers and broadcast studios. Cat6a cable and redundant ring topologies guarantee near-zero latency and facilitate power distribution through PoE++. Yet wireless units are forecast to post a 7.22% CAGR to 2031 as Wi-Fi 7 unlocks 6 GHz channels and improves deterministic scheduling. Early Dante-over-Wi-Fi prototypes demonstrate sub-5 ms latency, narrowing the performance gap against Ethernet.

Battery innovation extends runtime to 40 hours at moderate SPL for portable PA boxes, widening addressable outdoor use cases. Managed-frequency coordination apps powered by cloud databases simplify deployment, lowering expertise barriers for volunteer operators. Despite counterfeit RF modules adding complexity, educational initiatives by industry bodies help mitigate interference through standardized scanning protocols. Wired and wireless ecosystems coexist as integrators design fail-over architectures that blend both, ensuring the professional audio market satisfies reliability and flexibility expectations simultaneously.

The Professional Audio Market Report is Segmented by Product (Loudspeakers, Power Amplifiers, Mixing Consoles, Microphones, Headphones, and More), Connectivity (Wired, Wireless), End-User (Corporate, Venues and Events, Retail and Hospitality, Media and Entertainment, and More), Application (Live Sound Reinforcement, Recording Studios, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 33.12% of the professional audio market in 2025, backed by the world's densest concentration of arenas, megachurches, and broadcast facilities requiring rolling technology refreshes. FCC spectrum reallocation compels wireless replacements, while accessibility laws push venues to adopt assistive-listening transmitters. Corporate real-estate teams prioritize conference-room modernization that unifies in-room and remote voices via AES67 networks. Regional resilience is reinforced by local manufacturing clusters in California and Illinois that shorten lead times during global supply disruptions.

Asia-Pacific records the fastest pace, advancing at a 7.22% CAGR through 2031 as national stadium programs in China and India embed Dante-native public-address systems from blueprint stages. China's "ear economy" shapes procurement by requiring consumer-facing venues to adopt premium audio as a competitive differentiator. Indian integrators benefit from government incentives that localize assembly, lowering tariffs on imported components. The region's creative-class boom fuels demand for affordable studio interfaces, expanding the professional audio market base among gig-economy musicians and podcasters. Currency fluctuations remain a planning risk, yet manufacturers hedge by denominating contracts in USD where possible.

Europe demonstrates stable demand across cultural institutions and corporate campuses. Renovation of heritage theaters prioritizes recyclable loudspeaker cabinets and low-power amplifiers to align with EU sustainability targets. Brexit spurs dual-certification costs but also motivates continental distributors to hold buffer stock, maintaining supply continuity. German trade fairs like Prolight + Sound drive product visibility, while the United Kingdom broadcast sector accelerates adoption of ST 2110-compatible consoles. The professional audio market in Europe thus evolves through regulatory compliance and green design, rather than large-scale capacity increases.

- Shure Incorporated

- Sennheiser electronic GmbH & Co. KG

- Harman International Industries Inc. (JBL Professional)

- Yamaha Corporation

- Bose Corporation

- QSC LLC

- Audio-Technica Corporation

- LEWITT GmbH

- RCF Group S.p.A

- Music Tribe (Global Brands Ltd.)

- PreSonus Audio Electronics Inc.

- Mackie (LOUD Audio LLC)

- Allen and Heath Limited

- DiGiCo UK Ltd.

- Focusrite plc

- Avid Technology Inc.

- Powersoft S.p.A

- d&b audiotechnik GmbH

- L-Acoustics Group

- Meyer Sound Laboratories Inc.

- Electro-Voice (Bosch Security Systems Inc.)

- Crown International (Harman)

- TASCAM (TEAC Corporation)

- Rode Microphones (Free-fly Pty Ltd)

- Zoom Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of live-events and experiential marketing

- 4.2.2 Surging creator-economy demand for studio-grade gear

- 4.2.3 Growth of networked-AV and AES67/Dante interoperability

- 4.2.4 Shift to immersive and spatial-audio formats (Dolby Atmos, MPEG-H)

- 4.2.5 Corporate hybrid-work investments in high-fidelity audio

- 4.2.6 Government funding for smart-city public-address upgrades

- 4.3 Market Restraints

- 4.3.1 Persistent semiconductor supply-chain volatility

- 4.3.2 High total-cost-of-ownership for tour-grade systems

- 4.3.3 Proliferation of counterfeit/grey-market components

- 4.3.4 Rising e-waste regulations increasing compliance costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Loudspeakers

- 5.1.2 Power Amplifiers

- 5.1.3 Mixing Consoles

- 5.1.4 Microphones

- 5.1.5 Headphones

- 5.1.6 Accessories and Others

- 5.2 By Connectivity

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By End-User

- 5.3.1 Corporate

- 5.3.2 Venues and Events

- 5.3.3 Retail and Hospitality

- 5.3.4 Media and Entertainment

- 5.3.5 Education and Houses-of-Worship

- 5.4 By Application

- 5.4.1 Live Sound Reinforcement

- 5.4.2 Recording Studios

- 5.4.3 Broadcast and Streaming

- 5.4.4 Installed Sound / Public-Address

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Chile

- 5.5.2.3 Argentina

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Singapore

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shure Incorporated

- 6.4.2 Sennheiser electronic GmbH & Co. KG

- 6.4.3 Harman International Industries Inc. (JBL Professional)

- 6.4.4 Yamaha Corporation

- 6.4.5 Bose Corporation

- 6.4.6 QSC LLC

- 6.4.7 Audio-Technica Corporation

- 6.4.8 LEWITT GmbH

- 6.4.9 RCF Group S.p.A

- 6.4.10 Music Tribe (Global Brands Ltd.)

- 6.4.11 PreSonus Audio Electronics Inc.

- 6.4.12 Mackie (LOUD Audio LLC)

- 6.4.13 Allen and Heath Limited

- 6.4.14 DiGiCo UK Ltd.

- 6.4.15 Focusrite plc

- 6.4.16 Avid Technology Inc.

- 6.4.17 Powersoft S.p.A

- 6.4.18 d&b audiotechnik GmbH

- 6.4.19 L-Acoustics Group

- 6.4.20 Meyer Sound Laboratories Inc.

- 6.4.21 Electro-Voice (Bosch Security Systems Inc.)

- 6.4.22 Crown International (Harman)

- 6.4.23 TASCAM (TEAC Corporation)

- 6.4.24 Rode Microphones (Free-fly Pty Ltd)

- 6.4.25 Zoom Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment