PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910714

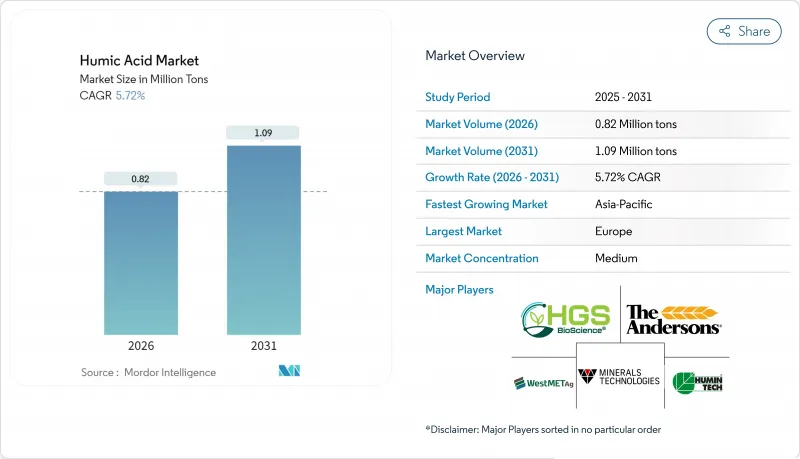

Humic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Humic Acid market is expected to grow from 0.78 million tons in 2025 to 0.82 million tons in 2026 and is forecast to reach 1.09 million tons by 2031 at 5.72% CAGR over 2026-2031.

This trajectory reflects broadening acceptance of biologically derived soil-health solutions as governments tighten fertilizer regulations and carbon markets monetize soil organic carbon gains. Expansion of regenerative farming, coupled with demand from controlled-environment agriculture, reshapes procurement strategies across the agricultural value chain. Manufacturers that prove quality consistency and integrate with precision-application technology capture early-mover advantages in high-value crop segments. Meanwhile, climate-linked finance mechanisms fuel farmers' willingness to invest in inputs that boost soil carbon, elevating humic products from discretionary soil conditioners to revenue-generating climate assets.

Global Humic Acid Market Trends and Insights

Soil-health Regulations and Carbon-credit Incentives

Government agencies now quantify soil organic carbon as a tradable metric, shifting humic inputs from cost centers to revenue drivers. The USDA introduced Practice Code 336 in 2024, reimbursing growers who apply compost or biochar that lifts soil organic matter. European carbon programs similarly assign credits to measurable gains in soil carbon stocks, turning humic products into tools that meet compliance while earning farmers additional income streams. Financial institutions bundle these credits into green-finance products, broadening access to capital for input purchases. As verification protocols sharpen, audited traceability becomes a product differentiator in the Humic Acid market, favoring firms with standardized testing and digital reporting platforms. Medium-term uptake accelerates in North America and the EU before spreading to APAC as regional carbon schemes mature.

Rising Adoption in Regenerative Agriculture

Regenerative systems emphasize microbial activity, permanent ground cover, and diversified rotations-all practices that thrive when humic substances elevate cation-exchange capacity and foster root-zone microbiomes. India illustrates institutional momentum: its National Mission on Natural Farming backs 10,000 Bio-Input Resource Centers targeting 750,000 ha for bio-input adoption, ensuring stable offtake for local humic producers. In North America, food companies commit to regenerative acreage targets, embedding humic inputs in supply-chain contracts that offer price premiums to compliant growers. Long-term demand becomes structural as certification programs such as Regenerative Organic validate humic acid's contribution to soil-organic-matter metrics. Technology firms integrate soil-health dashboards into farm-management software, translating laboratory organic-carbon data into actionable dosing guides that drive repeat purchases.

Product Adulteration and Quality Variance

Colorimetric tests and divergent extraction protocols yield humic readings that can vary by 40%, undermining buyer confidence. When growers cannot compare label claims across brands, price becomes the sole differentiator, eroding margins for authentic producers. The AOAC (Association of Official Analytical Communities) Lamar method and HPTA (Humic Products Trade Association) guidelines offer robust baselines, yet adoption lags due to testing fees and a lack of enforcement outside the EU. Short-term market drag intensifies in regions where regulators lack resources to police labeling, allowing synthetic urea blends masquerading as humic concentrates to flood distribution channels. Premium brands respond with QR-code traceability and third-party lab certificates, but scale-up of these safeguards remains uneven, limiting near-term volume gains for the Humic Acid market.

Other drivers and restraints analyzed in the detailed report include:

- EU Limits on Synthetic Fertilizer Usage

- Vertical-farm Nutrient Optimization

- Limited Mechanized Application Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid concentrates logged the fastest trajectory at 6.68% CAGR through 2031, propelled by integration with fertigation and foliar-spray platforms. The Humic Acid market for liquids is projected to rise amid rising adoption by vertical farms and precision-ag operations. Granular and powdered forms remain staples for extensive cereal cropping, but their price-led positioning limits upside on margins. Competitive differentiation in the liquid tier hinges on stability at high concentrations (>= 12% humic fraction) and compatibility with calcium-rich waters. Manufacturers invest in chelation technology to suppress sedimentation, allowing 1,000-L tote shipments that slash per-hectare logistics costs.

Powdered formulations, while retaining 33.75% Humic Acid market share in 2025, face incremental erosion as liquids gain favor with large-scale horticulture. Powder remains cost-effective for cooperatives in emerging economies that lack drip-system infrastructure, where manual broadcasting prevails. Blending houses in the United States add micronized humic powder to urea-based NPK, achieving distribution efficiencies that keep this segment resilient. However, lifecycle analyses illustrate lower carbon footprints for liquids, as their efficacy per kilogram surpasses powders, a metric increasingly scrutinized under scope-3 emissions reporting. Producers counter by deploying solar-powered drying lines to market carbon-neutral powder, bridging the sustainability narrative gap.

The Humic Acid Market Report is Segmented by Form (Powdered, Granular, and Liquid), Application (Organic Fertilizer, Animal Feed, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific's Humic Acid market accelerates at 7.18% CAGR, fueled by public-sector programs institutionalizing bio-input adoption. India's Rs 19,744 crore PM-PRANAM scheme reimburses states based on reductions in synthetic-fertilizer subsidies, prompting agriculture departments to distribute humic granules via cooperatives. China's 14th Five-Year Plan earmarks soil-health R&D (research and development) funding, and provincial governments subsidize drip-fertigation kits bundled with liquid humic concentrates. Data-platform pilots in Karnataka integrate soil-test results with QR-coded humic product recommendations, lowering extension-service bottlenecks. The region's vast smallholder base adopts humic inputs through micro-pack sachets, a packaging model pioneered in Vietnam. These structural interventions establish reliable offtake, driving scale production and localized formulation plants that reduce import dependency.

Europe commands 32.10% Humic Acid market share owing to harmonized CE marking and entrenched organic-farming acreage exceeding 16 million ha in 2024. Retailer private-label programs stipulate biostimulant usage to earn "Planet Score" shelf labels, amplifying demand in the fruit and vegetable sectors. Carbon-farming pilots under the EU (European Union) Innovation Fund monetize humic-induced organic-carbon gains, positioning humic suppliers as verifiers alongside remote-sensing platforms. Low-carbon food branding expands revenue pools, and premium-priced fruit categories use humic foliar sprays to enhance Brix and color indices, forging quality-linked pricing. European distributors, however, face rising import costs after 2024 maritime freight disruptions, prompting investment in regional peat-bog extraction and lignite-processing facilities to secure supply resilience.

North American demand grows steadily but faces fragmentation. The United States deploys Conservation Innovation Grants to fund state-level pilots that evaluate humic blends in carbon-smart supply chains. Large cooperatives in Iowa and Illinois integrate humic dosing modules into in-house variable-rate platforms, creating bundled service packages. Canadian greenhouse operators drive concentrated demand for liquids with purity guarantees below 100 ppm heavy metals to comply with CFIA (Canadian Food Inspection Agency) standards. South America's export soybean complexes in Brazil incorporate humic enrichments to support regenerative-certified export contracts. Meanwhile, Middle East & African growers adopt humic products to mitigate saline-soil challenges, especially in Egypt's million-feddan reclamation project, reinforcing drought-resilience positioning. Each region's specific agronomic pressures carve distinct value propositions, requiring adaptive marketing in the global Humic Acid market.

- Agbest Technology Co., Ltd.

- Arctech Inc.

- Cifo Srl

- Desarrollo Agricola y Minero, S.A.

- Grow More, Inc.

- HGS BioScience

- Humintech

- Jiloca Industrial SA

- Minerals Technologies Inc.

- Nutri-Tech Solutions Pty Ltd

- SAINT HUMIC ACID

- Sichuan Green Microbial Biotechnology Co., Ltd.

- The Andersons, Inc.

- WestMET LLC

- ZHENGZHOU SHENGDA KHUMIC AGRI TECH CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soil-health Regulations and Carbon-credit Incentives

- 4.2.2 Rising Adoption in Regenerative Agriculture

- 4.2.3 EU Limits on Synthetic Fertilizer Usage

- 4.2.4 Vertical-farm Nutrient Optimization

- 4.2.5 Humic-acid-based Biostimulants for Drought Resilience

- 4.3 Market Restraints

- 4.3.1 Product Adulteration and Quality Variance

- 4.3.2 Limited mechanized application infrastructure

- 4.3.3 Competing Microbial Consortia Products

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Overview

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Form

- 5.1.1 Powdered

- 5.1.2 Granular

- 5.1.3 Liquid

- 5.2 By Application

- 5.2.1 Organic Fertilizer

- 5.2.2 Animal Feed

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 South Africa

- 5.3.5.5 Nigeria

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Agbest Technology Co., Ltd.

- 6.4.2 Arctech Inc.

- 6.4.3 Cifo Srl

- 6.4.4 Desarrollo Agricola y Minero, S.A.

- 6.4.5 Grow More, Inc.

- 6.4.6 HGS BioScience

- 6.4.7 Humintech

- 6.4.8 Jiloca Industrial SA

- 6.4.9 Minerals Technologies Inc.

- 6.4.10 Nutri-Tech Solutions Pty Ltd

- 6.4.11 SAINT HUMIC ACID

- 6.4.12 Sichuan Green Microbial Biotechnology Co., Ltd.

- 6.4.13 The Andersons, Inc.

- 6.4.14 WestMET LLC

- 6.4.15 ZHENGZHOU SHENGDA KHUMIC AGRI TECH CO., LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment