PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910815

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910815

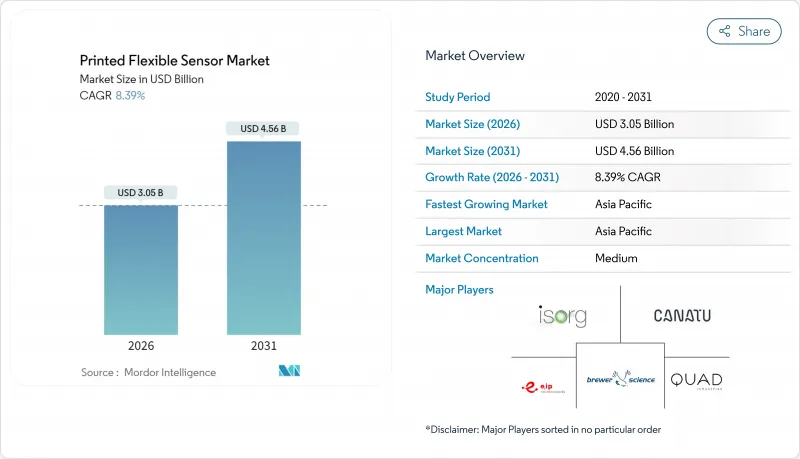

Printed Flexible Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The printed flexible sensor market is expected to grow from USD 2.81 billion in 2025 to USD 3.05 billion in 2026 and is forecast to reach USD 4.56 billion by 2031 at 8.39% CAGR over 2026-2031.

This steady expansion results from converging advances in roll-to-roll additive manufacturing, policy incentives supporting domestic semiconductor capacity, and rising demand for conformable sensing solutions across consumer electronics, medical wearables, automotive systems, and defense platforms. Cost optimization remains a pivotal growth lever as new printing processes shave more than 40% from capital expenditure outlays, thereby lowering entry barriers for both incumbents and start-ups. Government programs such as the Biden-Harris Administration's USD 1.6 billion allocation for advanced packaging underscore the strategic relevance of flexible electronics infrastructure.Asia-Pacific's scale advantage, particularly in flexible OLED capacity build-out, positions the region to supply nearly half of all printed sensors by 2030, while regulatory moves in Europe foster demand for recyclable sensor architectures.

Global Printed Flexible Sensor Market Trends and Insights

Rising Demand for Energy-Efficient, Ultra-Thin Consumer Electronics

Smartphone and wearable OEMs embed printed flexible sensors to deliver foldable displays and pressure-sensitive housings that conventional rigid components cannot support. Ultra-low-power architectures extend device battery life, meeting user expectations for energy efficiency while enabling slim form factors. Research at Penn State produced self-assembling conductive networks that remove secondary activation steps, trimming manufacturing energy budgets. Gaming peripherals increasingly rely on pressure-mapped surfaces, widening the printed flexible sensor market beyond mobile hardware. The same thin, bendable films are migrating into industrial monitoring where sensors must conform to curved equipment without adding bulk.

Increasing Adoption in Medical Wearables and Biosensing

Healthcare providers deploy printed biosensors for real-time vital-sign tracking, accelerating the shift toward preventive, remote care. Covestro's partnership with accensors yielded breathable, skin-friendly patch sensors that leverage Baymedix adhesives and Platilon TPU films. The Korea Institute of Materials Science demonstrated ammonia-gas detectors with 1 ppm sensitivity, opening non-invasive diagnostics for renal disease monitoring. Regulatory pathways are streamlining as flexible devices build clinical evidence, positioning biosensors to capture the fastest growth trajectory within the printed flexible sensor market.

Accuracy and Stability Gap vs. Silicon Sensors

Printed gauges still trail micro-machined silicon alternatives on long-term stability, especially when exposed to temperature swings or mechanical fatigue. Microcrystalline silicon devices achieve gauge factors of 31 with minimal drift, whereas printed films can deviate beyond acceptable thresholds in precision-critical deployments. Clinical evaluations report accuracy spreads of 88-94% for flexible pressure sensors, sufficient for indicative monitoring yet below invasive-grade benchmarks. Ongoing research into encapsulation layers and nanocomposite inks seeks to narrow the performance delta.

Other drivers and restraints analyzed in the detailed report include:

- Automotive In-Cabin HMI and Battery Monitoring Integration

- Defense R&D for Conformal Avionics and Structural Health Monitoring

- Lack of Fabrication Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Printed pressure sensors controlled 27.95% of the overall printed flexible sensor market share in 2025, supplying haptic interfaces to smartphones, gaming controllers, and automotive touch-surfaces. Parallel momentum in biosensors, expanding at a 9.03% CAGR, reflects healthcare's drive toward non-invasive, always-on patient monitoring. The biosensor surge widens the printed flexible sensor market as diagnostics migrate from clinic to consumer spheres. Robust demand intersects with AI-enabled analytics, where high-resolution strain gauges map biomechanics for rehabilitation feedback loops. Furthermore, gas sensors detecting 1 ppm ammonia open agricultural and environmental-health use-cases, illustrating portfolio diversification within the printed flexible sensor industry.

Market adjacencies amplify differentiation: photodetectors for smart packaging authenticate freshness, while strain sensors woven into e-textiles capture ergonomic metrics for industrial safety programs. The printed flexible sensor market size for biosensors is forecast to outgrow legacy segments as polymer substrates coupled with nano-engineered inks deliver clinically relevant sensitivity without sacrificing wearer comfort. Intensifying R&D in enzyme-functionalized electrodes and self-healing conductors will likely sustain the segment's outperformance against conventional pressure and temperature counterparts.

Screen printing retained 35.55% revenue in 2025 thanks to its thick-film capability and low-unit cost, but inkjet printing's anticipated 8.78% CAGR underscores industry migration toward higher pattern resolution and multi-material flexibility. As line widths approach the sub-20 µm threshold, inkjet platforms enable dense routing on limited real-estate, thereby advancing miniaturization roadmaps within the printed flexible sensor market. Emergent aerosol-jet and 3D printing modalities further extend the design envelope by depositing conductive pastes on non-planar geometries, a requirement for conformal avionics and medical implants.

Gravure and flexographic lines remain staples for million-unit consumer-electronics volumes, yet inkjet's digital nature curtails changeover time, permitting mass-customization of sensor layouts. Capillary-flow printing of submicron CNT transistors demonstrated by academic groups showcases feature parity with photolithography, marking a decisive competitive inflection. The printed flexible sensor market size tied to inkjet systems is projected to accelerate as ink suppliers commercialize oxide-free copper nanofluids that sinter via photonic flashes, achieving bulk-silver conductivities without the precious-metal price drag.

The Printed Flexible Sensor Market Report is Segmented by Sensor Type (Biosensors, Touch Sensors, Photodetectors, and More), Printing Technology (Screen Printing, Inkjet Printing, Gravure Printing, Fand More), Substrate Material (Polyimide, PET, PEN, Paper and More), End-User Industry (Consumer Electronics, Medical and Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 46.35% printed flexible sensor market share in 2025 and is anticipated to grow at 8.71% CAGR to 2031. China leads capacity additions, with BOE projected to surpass Samsung Display in flexible OLED throughput by 2028, a development that secures upstream material demand and localizes printed sensor supply chains. Japan's precision-manufacturing heritage and South Korea's material-science depth add regional resilience, while Southeast Asian economies provide cost-efficient assembly for high-volume consumer electronics.

North America ranks second by revenue. Federal incentives such as the USD 1.6 billion advanced packaging program and the USD 179 million DOE microelectronics centers stimulate domestic printed flexible sensor industry capability. Defense budgets catalyze early adoption of conformal avionics sensors, and the robust medical-device ecosystem accelerates biosensor commercialization.

Europe leverages automotive leadership and stringent eco-design mandates to shape global specifications for recyclable sensors. The Reform Project's initiative to forge a regional functional electronics supply chain reduces reliance on Asian imports and channels R&D funding toward sustainable substrate technologies. Latin America and the Middle East & Africa currently command small shares, yet industrial modernization and telecom infrastructure upgrades signal latent demand, particularly in smart-grid and building-automation sensing.

- Canatu Oy

- Brewer Science

- ISORG

- E2IP Technologies

- Quad Industries

- Pressure Profile Systems Inc.

- Butler Technologies Inc.

- Tekscan Inc.

- PST Sensors

- PolyIC GmbH and Co. KG

- Memtronik

- Linepro Controls Pvt. Ltd.

- Forciot

- Nissha Co. Ltd.

- TactoTek

- Interlink Electronics

- FlexEnable

- Heraeus Nexensos

- Molex

- 3M

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for energy-efficient, ultra-thin consumer electronics

- 4.2.2 Increasing adoption in medical wearables and biosensing

- 4.2.3 Automotive in-cabin HMI and battery monitoring integration

- 4.2.4 Defense R&D for conformal avionics and structural health monitoring

- 4.2.5 Roll-to-roll additive manufacturing cutting CapEx >40 %

- 4.2.6 EU eco-design policies favouring recyclable printed sensors

- 4.3 Market Restraints

- 4.3.1 Accuracy and stability gap vs. silicon sensors

- 4.3.2 Lack of fabrication standardisation

- 4.3.3 Volatile supply of silver nanoparticle inks

- 4.3.4 Limited reliability data for high-temperature use-cases

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Sensor Type

- 5.1.1 Biosensors

- 5.1.2 Touch Sensors

- 5.1.3 Photodetectors

- 5.1.4 Temperature Sensors

- 5.1.5 Pressure Sensors

- 5.1.6 Gas Sensors

- 5.1.7 Strain and Force Sensors

- 5.2 By Printing Technology

- 5.2.1 Screen Printing

- 5.2.2 Inkjet Printing

- 5.2.3 Gravure Printing

- 5.2.4 Flexographic Printing

- 5.2.5 3D / Aerosol-Jet Printing

- 5.3 By Substrate Material

- 5.3.1 Polyimide (PI)

- 5.3.2 PET

- 5.3.3 PEN

- 5.3.4 Paper and Cellulose

- 5.3.5 Others (Glass, Metal Foils)

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Medical and Healthcare

- 5.4.3 Automotive

- 5.4.4 Industrial and Manufacturing

- 5.4.5 Aerospace and Defense

- 5.4.6 Others (Smart Packaging, Building Automation)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Canatu Oy

- 6.4.2 Brewer Science

- 6.4.3 ISORG

- 6.4.4 E2IP Technologies

- 6.4.5 Quad Industries

- 6.4.6 Pressure Profile Systems Inc.

- 6.4.7 Butler Technologies Inc.

- 6.4.8 Tekscan Inc.

- 6.4.9 PST Sensors

- 6.4.10 PolyIC GmbH and Co. KG

- 6.4.11 Memtronik

- 6.4.12 Linepro Controls Pvt. Ltd.

- 6.4.13 Forciot

- 6.4.14 Nissha Co. Ltd.

- 6.4.15 TactoTek

- 6.4.16 Interlink Electronics

- 6.4.17 FlexEnable

- 6.4.18 Heraeus Nexensos

- 6.4.19 Molex

- 6.4.20 3M

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment