PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910828

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910828

North America Mining Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

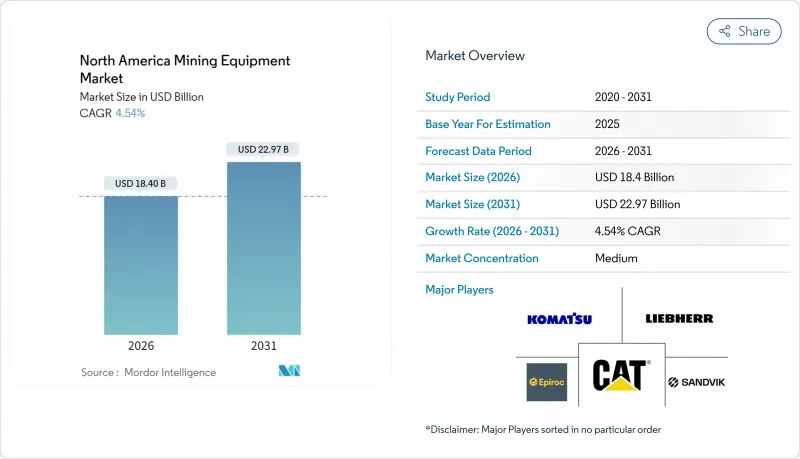

The North American mining equipment market was valued at USD 17.6 billion in 2025 and estimated to grow from USD 18.4 billion in 2026 to reach USD 22.97 billion by 2031, at a CAGR of 4.54% during the forecast period (2026-2031).

Ongoing electrification of fleets, accelerated automation roll-outs, and energy-transition-driven demand for critical minerals underpin this steady expansion, even as operators temper capital spending and focus on overall equipment efficiency. Heightened regulatory scrutiny on diesel emissions and a push for lower ventilation costs in underground mines are hastening the adoption of battery-electric haulage solutions. At the same time, digital mine platforms unlock productivity gains through predictive maintenance and real-time ore tracking. Mining companies are extending fleet lifecycles and embracing flexible ownership models to navigate metals-price volatility, creating resilient, albeit measured, sales pipelines for OEMs. Competitive intensity is expected to sharpen as global machinery leaders integrate autonomous technologies and emission-free powertrains into a single service envelope, giving buyers more apparent total-cost-of-ownership advantages.

North America Mining Equipment Market Trends and Insights

Electrification of Mine Fleets

Lower ventilation costs, a 65% reduction in cost per tonne moved, and 10-15% maintenance savings make battery-electric haul trucks a compelling alternative to diesel, even without regulatory pressure . Lithium-iron-phosphate batteries now support 24-hour duty cycles, allowing electric units to match diesel uptime. Canada's 30% refundable tax credit for zero-emission heavy-duty vehicles further accelerates uptake, positioning early adopters for operational and ESG advantages. Despite the upside, a limited number of active machines are electric today, underscoring a vast runway for growth as fast-charge infrastructure is rolled out at mine sites across Ontario, Quebec, and Nevada. OEMs are therefore prioritizing modular battery packs and on-board energy-management software to reduce swap times and improve powertrain longevity.

Automation and Digital-Mine Transition

Autonomous haulage fleets have scaled from pilot projects to mission-critical production assets. Operators report productivity gains and a complete elimination of human-operator injury events after deploying driverless trucks. Digital twins synthesize data from drilling, haulage, and processing in real-time, enabling a reduction in unplanned downtime through predictive maintenance analytics . Labor shortages in remote regions further validate autonomous solutions, with the United States Midwest and Canada's North struggling to fill skilled roles. Cloud-linked IoT sensors now continuously monitor bearing vibration, hydraulic pressure, and payload distribution, feeding AI algorithms that optimize routes and prolong asset life.

Stringent Emission and Safety Regulations

Proposed Tier 5 diesel standards from the United States Environmental Protection Agency mandate advanced after-treatment systems, raising unit costs and complicating capital budgeting for mid-tier miners. Underground operators must also increase airflow to meet lower diesel particulate limits, elevating power demand and eroding margins. Varied timelines across the United States and Canadian provinces add compliance uncertainty, pushing multi-jurisdictional companies to standardize on zero-emission fleets where feasible. Larger corporations are better positioned to spread these costs across broader asset bases, potentially accelerating consolidation in the North American mining equipment market. Conversely, smaller firms lean toward rental agreements or component retrofits to remain compliant without large upfront outlays.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Critical Minerals for Energy Transition

- Replacement Cycle of Aging Machinery

- Metals-Price Volatility Impacting Capex Plans

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, surface mining gear accounted for 44.86% of the North America mining equipment market share, while mineral processing units are projected to capture the highest 8.14% CAGR to 2031. This momentum reflects a strategic shift toward downstream value capture as miners confront volatile commodity pricing and lower ore grades. End users are ordering high-capacity crushers, energy-efficient SAG mills, and modular flotation cells to maximize metal recovery. Autonomous drilling rigs and real-time ore-sensing technologies are also gaining traction, allowing operators to improve fragment size and reduce energy per tonne milled.

Processing equipment's rise boosts the North American mining equipment market as miners expand leverage over the value chain rather than relying solely on raw-ore exports. OEMs respond with plug-and-play digital modules that integrate grinding, classification, and dewatering into a single control environment. Surface equipment demand remains robust, underpinned by copper and lithium projects in Nevada, Arizona, and northern Quebec. Underground loaders and drills are experiencing steady interest as operations move deeper, necessitating stronger, more compact machinery with autonomous capability.

Diesel platforms dominate the North American mining equipment market with a 71.88% share in 2025, yet electric units are forecast to grow at an 8.66% CAGR to 2031. Battery-electric haul trucks deliver higher instantaneous torque and eliminate fuel-cost variability, which resonates with operators seeking cost stability. Underground mines benefit most, reducing ventilation requirements and improving worker health metrics, while surface operations adopt hybrid drivetrain retrofits as a transitional step.

Charging infrastructure remains the principal bottleneck. To offset grid-permitting delays, stakeholders are trialing on-site solar arrays coupled with battery-storage microgrids. OEMs focus on interoperable charging standards to ensure fleet flexibility across brands. The expanding installed base of electric light vehicles inside mines lays the groundwork for broader high-power equipment deployment, creating a virtuous circle of utilization data and investment confidence throughout the North American mining equipment market.

The North American Mining Equipment Market is Segmented by Equipment Type (Surface Mining Equipment, Underground Mining Equipment, Mineral Processing Equipment, and More), Power Source (Diesel, Electric, and Hybrid), Application (Metal Mining, Industrial Mineral Mining, and More), Ownership Model (New Equipment Sales, Rental/Leasing, and More) and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Liebherr Group

- Epiroc AB

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment Ltd.

- Terex Corporation

- SANY Group

- FLSmidth & Co. A/S

- Metso Corporation

- Joy Global Inc. (Komatsu Mining Corp.)

- Mining Equipment Ltd.

- Deere & Company

- Doosan Bobcat (HD Hyundai)

- Astec Industries Inc.

- The Weir Group PLC

- J C Bamford Excavators Ltd

- Wirtgen Group (John Deere)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Mine Fleets

- 4.2.2 Automation and Digital-Mine Transition

- 4.2.3 Demand For Critical Minerals for Energy Transition

- 4.2.4 Replacement Cycle of Aging Machinery

- 4.2.5 Ultra-Low-Ground-Pressure Equipment for Arctic Permafrost Sites

- 4.2.6 United States IRA-Linked Exploration Capex Surge

- 4.3 Market Restraints

- 4.3.1 Stringent Emission and Safety Regulations

- 4.3.2 Metals-Price Volatility Impacting Capex Plans

- 4.3.3 High Upfront Equipment Costs and Financing Gaps

- 4.3.4 Grid-Permitting Bottlenecks for High-Power Electrified Mines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Equipment Type

- 5.1.1 Surface Mining Equipment

- 5.1.2 Underground Mining Equipment

- 5.1.3 Mineral Processing Equipment

- 5.1.4 Drills, Breakers & Crushing Tools

- 5.1.5 Support & Ancillary Equipment

- 5.1.6 Other Specialized Equipment

- 5.2 By Power Source

- 5.2.1 Diesel

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.3 By Application

- 5.3.1 Metal Mining

- 5.3.2 Industrial Mineral Mining

- 5.3.3 Coal Mining

- 5.3.4 Aggregates & Quarrying

- 5.3.5 Others

- 5.4 By Ownership Model

- 5.4.1 New Equipment Sales

- 5.4.2 Rental & Leasing

- 5.4.3 Refurbished/Rebuilt Equipment

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Liebherr Group

- 6.4.4 Epiroc AB

- 6.4.5 Sandvik AB

- 6.4.6 Hitachi Construction Machinery Co., Ltd.

- 6.4.7 Volvo Construction Equipment Ltd.

- 6.4.8 Terex Corporation

- 6.4.9 SANY Group

- 6.4.10 FLSmidth & Co. A/S

- 6.4.11 Metso Corporation

- 6.4.12 Joy Global Inc. (Komatsu Mining Corp.)

- 6.4.13 Mining Equipment Ltd.

- 6.4.14 Deere & Company

- 6.4.15 Doosan Bobcat (HD Hyundai)

- 6.4.16 Astec Industries Inc.

- 6.4.17 The Weir Group PLC

- 6.4.18 J C Bamford Excavators Ltd

- 6.4.19 Wirtgen Group (John Deere)

7 Market Opportunities & Future Outlook