PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910842

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910842

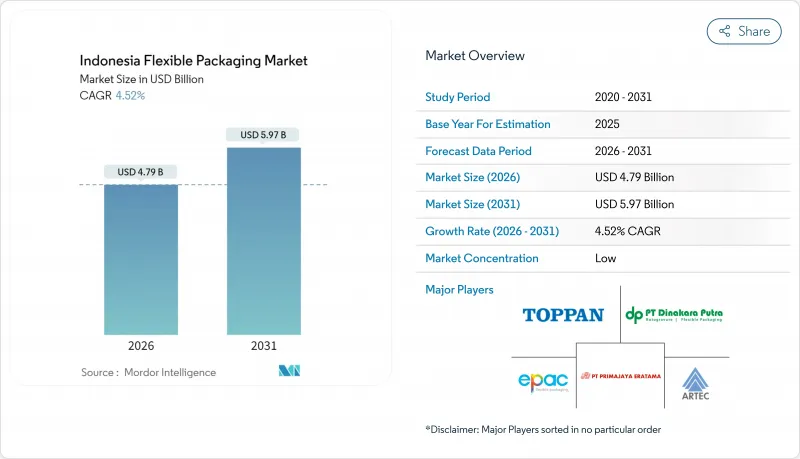

Indonesia Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia flexible packaging market was valued at USD 4.58 billion in 2025 and estimated to grow from USD 4.79 billion in 2026 to reach USD 5.97 billion by 2031, at a CAGR of 4.52% during the forecast period (2026-2031).

This trajectory reflects Indonesia's position as Southeast Asia's largest economy, with an urbanizing population that is steadily shifting toward packaged foods and online retail, both of which rely heavily on flexible formats. Growing demand for small-portion packs, sustained e-commerce activity, and corporate moves toward sustainability are reinforcing material, product, and technology shifts that favor the Indonesia flexible packaging market. Imported finished goods, primarily from China, remain a cost challenge for domestic converters; however, mandatory Extended Producer Responsibility (EPR) regulations, set to take effect in 2025, are expected to accelerate demand for locally recycled feedstock. Competitive responses now center on vertical integration, barrier-film innovation, and digital printing capabilities that enable low minimum-order runs for Indonesia's 25.5 million digitally enabled SMEs.

Indonesia Flexible Packaging Market Trends and Insights

Surging Packaged Food and Beverage Consumption

Packaged foods contributed 6.47% to national GDP in 2024, a share the Indonesian Association of Food and Beverage Entrepreneurs expects to rise as urban households favor ready-to-eat meals and premium snacks. Mandatory halal labels introduced in October 2024 require clear, durable printing, pushing brands toward high-barrier multi-layer films that preserve product integrity across Indonesia's humid, multi-island supply chain. Imported specialty foods and rising disposable incomes further drive demand for premium protective structures. Against this backdrop, converters offering advanced oxygen- and moisture-barrier films are gaining orders from dairy, meat, and confectionery processors. The Indonesia flexible packaging market benefits directly from this steady volume growth and the shift to modern trade channels that prefer merchandisable stand-up pouches.

Accelerating Demand for Sustainable Packaging Solutions

EPR regulations effective 2025 require producers to cut post-consumer plastic waste by 30% by 2029, spurring investments in recyclable mono-material films and certified compostables. Local start-ups Greenhope and Biopac are scaling PHA- and starch-based films, while multinationals such as Danone Indonesia already use 25% recycled content in water bottles, creating pull-through for food-grade rPET. Brands seeking to signal their environmental credentials now specify drop-in substrates that maintain barrier performance while simplifying end-of-life handling. The Indonesian flexible packaging market, therefore, records strong order inflows for films that meet Asian and export-market recyclability standards.

Volatility in Polyolefin Raw Material Prices

Domestic upstream utilization fell below 55% in early 2024 after cheaper imports cut local feedstock competitiveness. Converters cannot reliably hedge costs because spot resin price swings exceed 15% month-on-month, compressing margins on fixed-price packaging contracts. Proposed anti-dumping duties may stabilize the domestic supply; however, uncertainty persists until local crackers increase output or import quotas are tightened. The Indonesia flexible packaging market therefore experiences cautious capacity expansions despite solid end-use demand.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce and Online Grocery Fulfilment

- Rising Urban Middle Class Driving Smaller Pack Sizes

- Inadequate Recycling Infrastructure and Collection Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 67.61% revenue share in 2025 owing to cost efficiency and robust moisture-barrier properties, anchoring the Indonesia flexible packaging market. Polyethylene and polypropylene films remain integral to snacks, frozen food, and agricultural applications; however, import dependence for 605,000 t of PE and 599,000 t of PP limits price stability. Bioplastics and compostables, though starting from a smaller base, log the fastest 7.45% CAGR as EPR deadlines loom.

Competitive responses include PHA-based films by Greenhope and starch blends from Biopac that comply with compostability norms. Brand owners are trialing mono-material PE laminates that simplify recycling while maintaining mechanical strength. Government incentives for biodegradable polymer plants should keep the Indonesian flexible packaging market size for alternative substrates expanding through 2031 despite current cost premiums.

Bags and pouches commanded 46.88% of Indonesia flexible packaging market size in 2025, thanks to versatility across food, personal care, and agrochemical lines. Stand-up formats, zippers, and spouts enhance convenience and shelf appeal in modern retail. Films and wraps serve the meat processing and horticulture industries, whereas labels capture premium branding budgets.

Sachets and stick packs, advancing at 6.35% CAGR, address affordability and sampling needs across archipelagic markets. Digital presses enable region-specific languages and holiday designs without altering tooling, trimming launch cycles to days. Regulatory scrutiny of single-use plastics prompts converters to propose refill pouches and recyclable laminate structures, striking a balance between small-format convenience and environmental compliance.

The Indonesia Flexible Packaging Market Report is Segmented by Material (Paper, Plastic, Metal Foil, Bioplastics and Compostable Materials), Product Type (Bags and Pouches, Films and Wraps, and More), End-User Industry (Food, Beverage, Healthcare and Pharmaceutical, and More), Printing Technology (Flexography, Rotogravure, Digital Printing, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Mondi plc

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PT Argha Prima Industry Tbk

- Sealed Air Corporation

- Huhtamaki Oyj

- PT Primajaya Eratama

- PT ePac Flexibles Indonesia

- PT Indonesia Toppan Printing

- PT Dinakara Putra

- PT Artec Package Indonesia

- PT Lotte Packaging

- PT Karuniatama Polypack

- PT Masplast Poly Film

- PT Polidayaguna Perkasa

- Constantia Flexibles Group GmbH

- UFlex Limited

- Sonoco Products Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Packaged Food and Beverage Consumption

- 4.2.2 Accelerating Demand for Sustainable Packaging Solutions

- 4.2.3 Growth of E-Commerce and Online Grocery Fulfilment

- 4.2.4 Rising Urban Middle Class Driving Smaller Pack Sizes

- 4.2.5 Rapid Adoption of Digital and Flexographic Short-Run Printing

- 4.2.6 Venture-Backed FMCG Startups Scaling Flexible Formats

- 4.3 Market Restraints

- 4.3.1 Volatility in Polyolefin Raw Material Prices

- 4.3.2 Inadequate Recycling Infrastructure AND Collection Systems

- 4.3.3 Escalating Environmental Regulations on Single-Use Plastics

- 4.3.4 High Inter-Island Logistics Costs Limiting Barrier Film Uptake

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Regulatory Landscape and Recycling Policies in Indonesia

- 4.8 Technological Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Paper

- 5.1.2 Plastic

- 5.1.3 Metal Foil

- 5.1.4 Bioplastics and Compostable Materials

- 5.2 By Product Type

- 5.2.1 Bags and Pouches

- 5.2.2 Films and Wraps

- 5.2.3 Sachets and Stick Packs

- 5.2.4 Labels and Sleeves

- 5.3 BY End-user Industry

- 5.3.1 Food

- 5.3.1.1 Baked Goods

- 5.3.1.2 Snacks

- 5.3.1.3 Meat, Poultry and Seafood

- 5.3.1.4 Confectionery

- 5.3.1.5 Pet Food

- 5.3.1.6 Other Food Products

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceutical

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Agriculture and Horticulture

- 5.3.6 Other End-Use Industries

- 5.3.1 Food

- 5.4 By Printing Technology

- 5.4.1 Flexography

- 5.4.2 Rotogravure

- 5.4.3 Digital Printing

- 5.4.4 Other Printing Technologies

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products AND Services, AND Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 PT Trias Sentosa Tbk

- 6.4.4 PT Indopoly Swakarsa Industry Tbk

- 6.4.5 PT Argha Prima Industry Tbk

- 6.4.6 Sealed Air Corporation

- 6.4.7 Huhtamaki Oyj

- 6.4.8 PT Primajaya Eratama

- 6.4.9 PT ePac Flexibles Indonesia

- 6.4.10 PT Indonesia Toppan Printing

- 6.4.11 PT Dinakara Putra

- 6.4.12 PT Artec Package Indonesia

- 6.4.13 PT Lotte Packaging

- 6.4.14 PT Karuniatama Polypack

- 6.4.15 PT Masplast Poly Film

- 6.4.16 PT Polidayaguna Perkasa

- 6.4.17 Constantia Flexibles Group GmbH

- 6.4.18 UFlex Limited

- 6.4.19 Sonoco Products Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment