PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910853

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910853

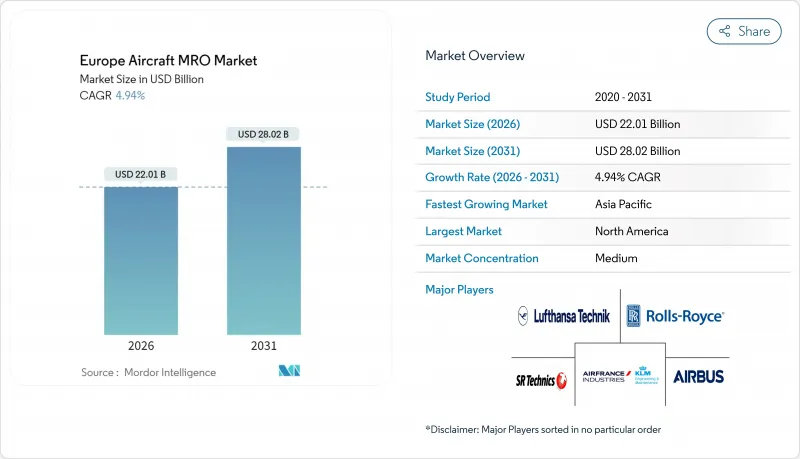

Europe Aircraft MRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe aircraft MRO market size in 2026 is estimated at USD 22.01 billion, growing from 2025 value of USD 20.97 billion with 2031 projections showing USD 28.02 billion, growing at 4.94% CAGR over 2026-2031.

Current momentum is anchored in an aging single-aisle fleet that is now hitting heavy-maintenance milestones, a deliberate shift of wide-body overhauls from the United Kingdom to continental bases, and steady EU defense allocations that earmark more than EUR 1 billion (USD 1.16 billion) for military upkeep projects. Competitive intensity is amplified by engine OEMs expanding captive service networks. At the same time, independent shops leverage cost-effective labor pools in Eastern and Southern Europe to win overflow work from congested German and French hangars. The market's short-term outlook remains constrained by a 19% technician shortfall predicted by 2028 and persistent shortages of LEAP and GTF spare parts, which elongate shop-visit turn-times and inflate work-scope pricing.

Europe Aircraft MRO Market Trends and Insights

Growing Volume of Aging Single-Aisle Aircraft Entering Heavy Maintenance Cycles

Roughly 14,000 A320-family and B737NG aircraft operating in Europe now exceed 15 years of age, pushing them into more expensive structural C-checks that average USD 1 million per airframe annually. Airlines have deferred retirements because new-build delivery slots remain scarce, a trend that prolongs maintenance demand and widens the spare-parts gap projected to reach 40% for A320 components by 2035. Airbus' Extended Service Goal program has lifted the operational life ceiling of A320s to 180,000 flight hours, effectively tripling lifetime maintenance touchpoints. High-cycle operators perform up to four A-checks annually, ensuring uninterrupted work streams for European line-maintenance stations. The longevity push secures a durable pipeline of heavy overhauls that underpins the Europe aircraft MRO market through the next decade.

High Fleet Utilization Rates Among Low-Cost Carriers Driving Service Demand

Low-cost carriers such as Ryanair now fly 11-hour average daily block times on 480-plus 737 family aircraft-an operational profile that accelerates lube-oil inspections and interval-limited tasks. These carriers emphasize quick turns and prioritize dispatch reliability, leading to elevated demand for on-wing support and mobile repair teams at secondary airports scattered across Western Europe. Robust utilization also raises engine flight-cycle counts, pulling LEAP-1A and CFM56-7B engines into hot-section work scopes sooner than OEM manuals initially projected. In response, independent MROs in Poland and Portugal are scaling night-shift capacity to capture urgent AOG events. Elevated utilization, therefore, serves as a volume multiplier for routine jobs that cumulatively buoy the Europe aircraft MRO market.

Shortage of Licensed Maintenance Technicians and Rising Labor Costs

European providers face a looming 19% gap in certified staff by 2028 as retirement outpaces recruitment and the median age of mechanics climbs to 51 years. Labor cost inflation reached 7.3% in 2024, and forward wage agreements signal another 5.8% annual climb, eroding margin on fixed-price power-by-the-hour contracts. Training pipelines lag demand: only 12 European Part-147 schools graduate the avionics specialists needed for next-gen aircraft, while gender diversity remains below 10%, leaving an untapped talent pool unaddressed. Persistent labor undersupply puts a structural drag on the Europe aircraft MRO market growth trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Predictive Maintenance and Data Monetization Models

- Reallocation of Heavy Maintenance Work Within Continental Europe Post-Brexit

- Persistent Supply Chain Constraints for Critical Engine Spare Parts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine overhaul generated 41.28% of Europe aircraft MRO market size in 2025 as operators prioritize propulsion reliability for fleet safety and fuel-burn efficiency. Safran's EUR 1 billion (USD 1.17 billion) network expansion targets 1,200 LEAP shop visits annually by 2028, confirming long-run volume visibility. Component repair and overhaul, growing at 6.01% CAGR, rides widespread adoption of predictive analytics that recommend proactive module swaps before failure, thereby shrinking unscheduled downtime and releasing working capital for airlines. The Europe aircraft MRO industry likewise exhibits resilient demand for airframe structural checks, fueled by corrosion in high-cycle cabins and regulatory mandates for aging aircraft programs.

A parallel uptick in on-wing troubleshooting feeds demand for rapid-response line stations strategically located at mega-hubs such as Frankfurt and Paris. Independent specialists are now introducing mobile borescope pods that cut engine inspection time by 35%, an initiative aligned with airlines' push to maximize aircraft time on wing. Meanwhile, EASA Part-145 revisions tighten record-keeping, compelling digital tool-sets that streamline audit trails and strengthen competitiveness inside the Europe aircraft MRO market.

Commercial platforms accounted for 66.02% of the Europe aircraft MRO market size in 2025, due to a dense intra-European route structure served essentially by narrowbody fleets. Military demand, though smaller, posts 5.83% CAGR on the back of European Defence Fund programs that direct EUR 910 million (USD 1,060.3 million) toward readiness upgrades, including the EUR 4 billion (USD 4.68 billion) Eurofighter Typhoon material-availability contract extension. Regional jet maintenance remains niche, with Austrian Technik Bratislava the sole European shop offering Dash 8 Q400 heavy checks, underscoring capacity shortages in that segment.

Within commercial fleets, the work-scope mix is skewing toward avionics and cabin retrofits aimed at carbon-reduction targets, prompting incremental opportunities for modification specialists. On the military side, cross-border maintenance depots conceived under the European Defence Industrial Strategy promise standardized repair protocols, streamlining logistics and reinforcing the Europe aircraft MRO market.

The Europe Aircraft MRO Market Report is Segmented by MRO Type (Airframe Maintenance, Engine Overhaul, Component Repair and Overhaul, and Line Maintenance), Type (Commercial, Military, and More), End User (Commercial Passenger Airlines, Cargo Operators, and More), Service Provider Type (Airline-Affiliated MROs, and More), and Geography (United Kingdom, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lufthansa Technik AG

- SR Technics Switzerland Ltd.

- Airbus SE

- Rolls-Royce Holdings plc

- MTU Aero Engines AG

- Safran

- TAP Air Portugal (TAP Maintenance & Engineering)

- Sabena technics S.A.S.

- StandardAero Aviation Holdings, Inc.

- BAE Systems plc

- AAR CORP.

- GE Aerospace (General Electric Company)

- RTX Corporation

- Comlux Group

- IBERIA, Lineas Aereas de Espana, S.A.

- Kongsberg Gruppen ASA

- Bombardier Inc.

- Air France Industries KLM Engineering & Maintenance (AIR FRANCE-KLM)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing volume of ageing single-aisle aircraft entering heavy maintenance cycles

- 4.2.2 High fleet utilization rates among low-cost carriers driving service demand

- 4.2.3 Adoption of predictive maintenance and new data monetization models

- 4.2.4 Incentives for sustainability-driven aircraft retrofits and modifications

- 4.2.5 Reallocation of heavy maintenance work within continental Europe post-Brexit

- 4.2.6 Expansion of multi-national military aircraft maintenance depots under EU funding programs

- 4.3 Market Restraints

- 4.3.1 Shortage of licensed maintenance technicians and rising labor costs

- 4.3.2 Persistent supply chain constraints for critical engine spare parts

- 4.3.3 Stricter regulations on VOC emissions in aircraft painting and solvent use

- 4.3.4 Increased compliance costs for EASA Part-IS cybersecurity requirements

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By MRO Type

- 5.1.1 Airframe Maintenance

- 5.1.2 Engine Overhaul

- 5.1.3 Component Repair and Overhaul

- 5.1.4 Line Maintenance

- 5.2 By Type

- 5.2.1 Commercial

- 5.2.1.1 Narrowbody

- 5.2.1.2 Widebody

- 5.2.1.3 Regional Jets

- 5.2.2 Military

- 5.2.2.1 Combat

- 5.2.2.2 Transport

- 5.2.2.3 Special Mission

- 5.2.2.4 Military Helicopters

- 5.2.3 General Aviation

- 5.2.3.1 Business Jets

- 5.2.3.2 Turboprop and Piston Aircraft

- 5.2.3.3 Commercial Helicopters

- 5.2.1 Commercial

- 5.3 By End User

- 5.3.1 Commercial Passenger Airlines

- 5.3.2 Cargo Operators

- 5.3.3 Leasing Companies

- 5.3.4 Charter Operators

- 5.3.5 Military Operators

- 5.4 By Service Provider Type

- 5.4.1 Airline-Affiliated MROs

- 5.4.2 Independent Third-Party MROs

- 5.4.3 OEM-Affiliated MROs

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Russia

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Lufthansa Technik AG

- 6.4.2 SR Technics Switzerland Ltd.

- 6.4.3 Airbus SE

- 6.4.4 Rolls-Royce Holdings plc

- 6.4.5 MTU Aero Engines AG

- 6.4.6 Safran

- 6.4.7 TAP Air Portugal (TAP Maintenance & Engineering)

- 6.4.8 Sabena technics S.A.S.

- 6.4.9 StandardAero Aviation Holdings, Inc.

- 6.4.10 BAE Systems plc

- 6.4.11 AAR CORP.

- 6.4.12 GE Aerospace (General Electric Company)

- 6.4.13 RTX Corporation

- 6.4.14 Comlux Group

- 6.4.15 IBERIA, Lineas Aereas de Espana, S.A.

- 6.4.16 Kongsberg Gruppen ASA

- 6.4.17 Bombardier Inc.

- 6.4.18 Air France Industries KLM Engineering & Maintenance (AIR FRANCE-KLM)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment