PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910859

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910859

France Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

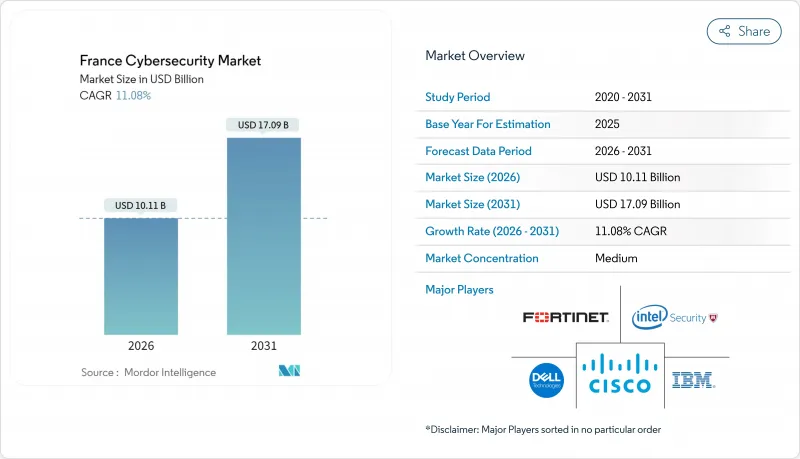

The France cybersecurity market was valued at USD 9.10 billion in 2025 and estimated to grow from USD 10.11 billion in 2026 to reach USD 17.09 billion by 2031, at a CAGR of 11.08% during the forecast period (2026-2031).

Rapid regulatory expansion under NIS2, heavier public-sector funding, and a sharp rise in cloud migration are synchronizing to widen the addressable opportunity for vendors. Enterprises continue to consolidate security stacks, channeling spending toward integrated platforms that ease compliance and talent pressures. Managed security services are surging as buyers offset a persistent shortage of skilled practitioners, while AI-driven analytics are becoming standard in French security operations centers. Heightened Olympic-period cyber activity has permanently recalibrated domestic threat awareness, prompting long-term investment in threat-monitoring infrastructure across critical sectors such as healthcare, energy, and transportation.

France Cybersecurity Market Trends and Insights

Accelerated NIS2 adoption and French Government cyber funding

NIS2 widens the compliance net from 500 to roughly 15,000 French entities, tripling the number of regulated sectors and intensifying demand for governance, risk, and compliance tooling. France 2030 earmarked EUR 39 million (USD 42 million) for 17 cybersecurity projects, anchoring sovereign capability development. ANSSI's phased roll-out stresses enablement over sanction, spurring advisory services as firms race to close gaps. Government interest in acquiring Atos' cybersecurity assets for EUR 700 million (USD 748 million) further underlines the strategic value of domestic IP. Together these moves inject capital, enlarge the client base, and reinforce the France cybersecurity market as a continental compliance hub.

Ransomware surge on French critical infrastructure and healthcare

ANSSI logged 4,386 security incidents in 2024, up 15% year on year, with healthcare representing 10% of ransomware filings. Hospitals at Armentieres and Corbeil-Essonnes endured emergency shutdowns, driving urgency around endpoint detection and incident-response retainer services. Cultural landmarks such as the Louvre and Grand Palais also faced disruptions, proving no sector is immune. Spending is pivoting toward XDR platforms and crisis-management consulting, reinforcing the France cybersecurity market as a responsive services arena.

Acute cyber-talent shortage inflating SOC costs

Roughly 15,000 cybersecurity vacancies persist nationwide, despite an 89% workforce expansion since 2020. Salary inflation reaches EUR 90,000 (USD 96,300) for senior analysts, squeezing provider margins and stimulating automation. Thales responded with GenAI4SOC to improve case triage efficiency by 40%. Such initiatives temper, but do not erase, the talent gap that restrains the France cybersecurity market's ability to scale fully.

Other drivers and restraints analyzed in the detailed report include:

- Paris 2024 Olympics-driven threat-monitoring investments

- SME cloud-migration boom under "France Num" digital vouchers

- Budget aversion among SMEs viewing cyber as OPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 52.10% of 2025 revenue, with unified threat-management suites and XDR gaining traction as enterprises rationalize tool sprawl. The managed-services slice is growing at 12.85% CAGR as clients contract out 24/7 monitoring to compensate for staffing gaps. Identity-and-access tools, especially privileged-access management, underpin Zero-Trust rollouts. Wallix, for example, leverages its ANSSI qualification to court regulated clients. Professional services complement software spend, delivering assessment and remediation projects tied to NIS2 milestones. Hardware appliances remain foundational but are increasingly bundled with AI-driven analytics, illustrating the convergence that defines the France cybersecurity market.

The integration trend is fostering hybrid consumption models in which buyers license core platforms and overlay retained services for incident response. This approach expands lifetime value for vendors while providing flexibility in tight budget cycles. As ransomware campaigns intensify, incident-response retainers are now a baseline requirement across BFSI and healthcare, pushing the France cybersecurity market size for services steadily upward.

Cloud deployments accounted for 59.78% of 2025 spending, reflecting widespread SaaS preference and rapid SME onboarding. The France cybersecurity market size attached to cloud solutions is forecast to rise at a 14.25% CAGR, outpacing the on-premise base as more critical workloads move to hybrid environments. SecNumCloud certification accelerates trust in domestic hosting, benefiting players such as OVHcloud and Outscale.

On-premise models persist in defense and heavily regulated utilities where data residency and latency demands outweigh elasticity. Yet even these sectors adopt cloud-based analytics to augment legacy controls. Multi-cloud orchestration platforms that normalize policy across providers are gaining lift, mitigating vendor lock-in risks for enterprises expanding beyond a single hyperscaler. As a result, the France cybersecurity market continues to blur traditional deployment lines, pivoting toward control-plane-centric architectures.

The France Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises)

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc. (SecureWorks)

- Fortinet Inc.

- Intel Security (McAfee LLC)

- F5 Networks Inc.

- AVG Technologies (Gen Digital)

- IDECSI Enterprise Security

- Trellix (Formerly FireEye)

- Thales Group

- Orange Cyberdefense

- Atos SE (Eviden)

- Capgemini SE

- Sopra Steria Group SA

- Airbus Defence & Space CyberSecurity

- Stormshield

- Wallix Group

- Exclusive Networks SA

- Check Point Software Technologies Ltd.

- Palo Alto Networks Inc.

- CrowdStrike Holdings Inc.

- Trend Micro Inc.

- Okta Inc.

- Darktrace plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated NIS2 adoption and Increasing French Government Cyber Plan funding

- 4.2.2 Ransomware surge on French critical infrastructure and healthcare

- 4.2.3 Paris 2024 Olympics-driven threat-monitoring investments

- 4.2.4 SME cloud-migration boom under "France Num" digital vouchers

- 4.2.5 Campus Cyber ecosystem catalysing local solution innovation

- 4.2.6 Remote-work shift demanding Zero-Trust and IAM upgrades

- 4.3 Market Restraints

- 4.3.1 Acute cyber-talent shortage inflating SOC service costs

- 4.3.2 Budget aversion among French SMEs viewing cyber as OPEX

- 4.3.3 Regulatory overlap (GDPR, NIS2, ANSSI sector rules) delaying buys

- 4.3.4 Tool-sprawl and integration complexity across fragmented stack

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Dell Technologies Inc. (SecureWorks)

- 6.4.4 Fortinet Inc.

- 6.4.5 Intel Security (McAfee LLC)

- 6.4.6 F5 Networks Inc.

- 6.4.7 AVG Technologies (Gen Digital)

- 6.4.8 IDECSI Enterprise Security

- 6.4.9 Trellix (Formerly FireEye)

- 6.4.10 Thales Group

- 6.4.11 Orange Cyberdefense

- 6.4.12 Atos SE (Eviden)

- 6.4.13 Capgemini SE

- 6.4.14 Sopra Steria Group SA

- 6.4.15 Airbus Defence & Space CyberSecurity

- 6.4.16 Stormshield

- 6.4.17 Wallix Group

- 6.4.18 Exclusive Networks SA

- 6.4.19 Check Point Software Technologies Ltd.

- 6.4.20 Palo Alto Networks Inc.

- 6.4.21 CrowdStrike Holdings Inc.

- 6.4.22 Trend Micro Inc.

- 6.4.23 Okta Inc.

- 6.4.24 Darktrace plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment