PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911483

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911483

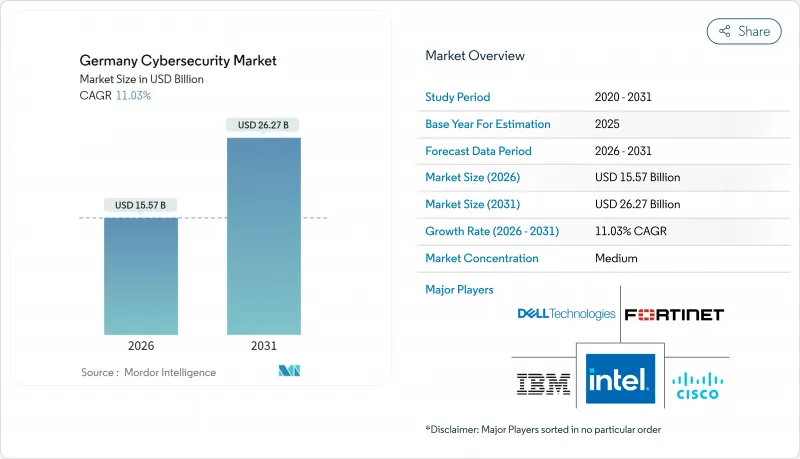

Germany Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The German Cybersecurity market size in 2026 is estimated at USD 15.57 billion, growing from 2025 value of USD 14.02 billion with 2031 projections showing USD 26.27 billion, growing at 11.03% CAGR over 2026-2031.

Across 2024, the Federal Office for Information Security (BSI) logged 72,000 incident reports, a 21% jump on the prior year, while its Produkt-KOMPASS registered 24,531 published vulnerabilities, 15% of which were labelled critical . Fresh statutes-most notably the NIS2 Implementation and Cyber Security Strengthening Act, the Digital Operational Resilience Act and BaFin's updated IT requirements-unlock EUR 7.4 billion of compulsory outlays between 2025 and 2027. Oversight is tightening in parallel; 68% of DAX constituents created a board-level cybersecurity committee in 2024, up from 42% in 2022. These governance moves encourage earlier budget sign-off and embed protection lines within core IT capex across the German Cybersecurity market.

The Federal Statistical Office reported cloud use by 69% of companies in 2024, compared with 54% in 2021. Sovereign-cloud contracts inside public agencies expanded 27% last year as ministries tightened domestic-data-residency rules. Organizations also fuse AI and protection budgets under single steering committees, and that integration is expected to reinforce spending momentum across the German Cybersecurity market.

Germany Cybersecurity Market Trends and Insights

Cloud-native application expansion in public sector and healthcare

Germany's Online Access Act mandates digital delivery of 575 federal and municipal services by 2026. By December 2024, 41% of those services already ran on Open Telekom Cloud. University hospitals raised hybrid-cloud storage to 94 petabytes over the year to archive imaging datasets. All new workloads must conform to the BSI C5 security framework, whose list of certified providers grew from 23 to 34 during 2024. Faster certification lowers procurement friction and fuels additional migrations, translating directly into higher license and consulting demand across the German Cybersecurity market.

OT/ICS security urgency amid Industrie 4.0 roll-outs

The VDMA reported that smart-sensor adoption reached 71% of production lines in 2024. IW Cologne pegged average downtime costs at EUR 290,000 per hour in automotive plants. Asset-discovery platforms now map 2.3 million critical industrial components nationwide, underpinning passive-monitoring adoption. By integrating cyber safeguards in overall-equipment-effectiveness calculations, manufacturers shift budgets from discretionary IT to mandatory operational protection, tilting revenue towards industrial-grade solutions inside the German Cybersecurity market.

Shortage of qualified cybersecurity professionals

Germany entered 2025 with 96,300 open IT-security positions, 25% higher than a year earlier. Senior SOC analysts in Munich command average pay of EUR 96,000, 57% above 2019 levels. Although 28 universities award specialist degrees, only 3,400 graduates enter the workforce annually, covering 7% of demand. Scarcity hardwires elevated wage floors into corporate budgets and directs spending towards automation, SOC-as-a-service and managed detection, which tempers margins yet supports service-provider revenues in the German Cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- 5G and connected-mobility infrastructure growth

- Cyber-insurance requirements

- Budget limitations across the Mittelstand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 66.05% of 2025 German Cybersecurity market share, equal to USD 9.26 billion, while managed security services produced USD 3.71 billion and are pacing an 18.12% expansion curve. Companies also bought 164,000 BSI-certified next-generation firewalls, a 14% shipment gain. Service revenue is increasingly usage-based; Deutsche Telekom said that 42% of 2024 security bookings were metered rather than fixed-fee. Aligning provider incentives with live threat conditions ensures continuous optimisation and long-term stickiness across the German Cybersecurity market.

MSS engagement is further fuelled by central government placing EUR 680 million of SOC framework orders in 2024, which broadens vendor scale. The growing reliance on software-defined perimeters and zero-trust pilots requires 24/7 policy tuning unavailable in most internal teams, accelerating demand for outsourced SOC capacity.

On-premise and private-cloud instances retained 52.85% of the German Cybersecurity market size in 2025, or USD 7.41 billion, even as public-cloud security exhibits a 16.52% CAGR. Eurostat shows 46% of German firms storing some data in the public cloud, yet only 11% entrust core financial records. Capgemini measured an 18% premium for locally hosted services, but 58% of adopters accept the higher price.

Eco e.V. estimates that 72% of enterprises operate two SIEM platforms during transition phases. Vendors that unify on-premise and cloud telemetry registered 41% new ARR growth in 2024. This dual-stack reality entrenches complexity, favouring extensible platforms over point products and reinforcing the sovereign-first ethos guiding the German Cybersecurity market.

The Germany Cyber Security Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (Cloud, and On-Premise), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises).

List of Companies Covered in this Report:

- Deutsche Telekom (T-Systems)

- SAP SE

- Siemens AG

- IBM Deutschland GmbH

- Cisco Systems Germany

- Fortinet Germany GmbH

- Palo Alto Networks

- Check Point Software Tech

- Trend Micro Deutschland

- Kaspersky Labs DE

- Arctic Wolf

- CrowdStrike Germany

- Sophos Ltd

- Thales DIS Germany

- Atos Eviden

- Rheinmetall Cyber Solutions

- Deutsche Bahn Cyberservice

- Signal Iduna Cyber Protect

- Airbus Defence & Space Cybersecurity

- Rohde & Schwarz Cybersecurity

- IONOS Cloud Security

- CGI Deutschland

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native Application Growth in Germany's Public Sector & Healthcare

- 4.2.2 OT/ICS Security Urgency amid Industrie 4.0 Roll-outs

- 4.2.3 Expansion of 5G and Connected Mobility Infrastructure

- 4.2.4 Rise of Cyber-Insurance Requirements Driving Security Spending

- 4.2.5 Regulatory compliance mandates (NIS2, DORA, BaFin IT rules)

- 4.2.6 AI-driven threat detection and response automation

- 4.3 Market Restraints

- 4.3.1 Severe Shortage of German-speaking Cybersecurity Professionals

- 4.3.2 Budget Limitations across SME-dominated Mittelstand

- 4.3.3 Data-Sovereignty Concerns Limiting Adoption of Global SaaS Security Tools

- 4.3.4 Federal Procurement Fragmentation Slowing Large-scale Roll-outs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Deutsche Telekom (T-Systems)

- 6.4.2 SAP SE

- 6.4.3 Siemens AG

- 6.4.4 IBM Deutschland GmbH

- 6.4.5 Cisco Systems Germany

- 6.4.6 Fortinet Germany GmbH

- 6.4.7 Palo Alto Networks

- 6.4.8 Check Point Software Tech

- 6.4.9 Trend Micro Deutschland

- 6.4.10 Kaspersky Labs DE

- 6.4.11 Arctic Wolf

- 6.4.12 CrowdStrike Germany

- 6.4.13 Sophos Ltd

- 6.4.14 Thales DIS Germany

- 6.4.15 Atos Eviden

- 6.4.16 Rheinmetall Cyber Solutions

- 6.4.17 Deutsche Bahn Cyberservice

- 6.4.18 Signal Iduna Cyber Protect

- 6.4.19 Airbus Defence & Space Cybersecurity

- 6.4.20 Rohde & Schwarz Cybersecurity

- 6.4.21 IONOS Cloud Security

- 6.4.22 CGI Deutschland

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment