PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910869

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910869

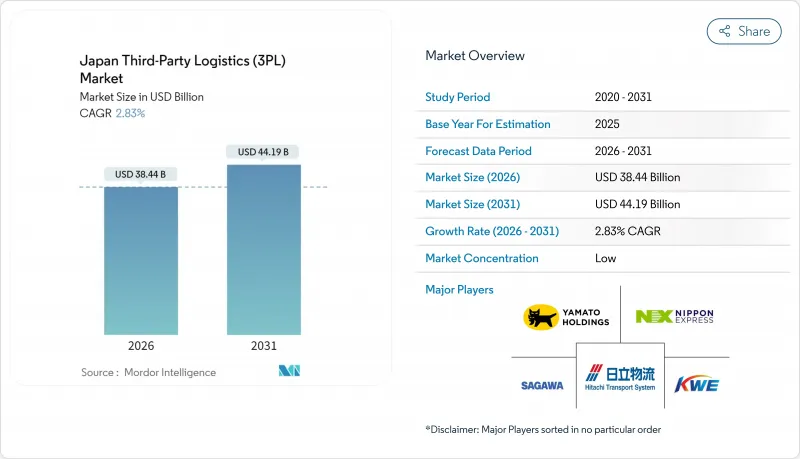

Japan Third-Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan Third-Party Logistics Market size in 2026 is estimated at USD 38.44 billion, growing from 2025 value of USD 37.38 billion with 2031 projections showing USD 44.19 billion, growing at 2.83% CAGR over 2026-2031.

New driver-overtime limits, sweeping digitalization grants, and rising decarbonization targets are forcing every logistics provider to rethink network design. Asset-heavy operators now balance automation budgets against rent inflation, while digital platforms let asset-light newcomers grow without owning fleets. Retailers, healthcare firms, and semiconductor manufacturers are asking for nationwide coverage and real-time visibility, lifting demand for integrated solutions that cut lead times and carbon footprints. As a result, the Japan 3PL market is quietly shifting from single-function transport toward data-enabled orchestration that keeps shipments moving despite deep labor and land constraints.

Japan Third-Party Logistics (3PL) Market Trends and Insights

Same-Day/Next-Day E-commerce Culture Forcing Retailers Toward Nationwide 3PL Networks

Accelerating consumer demand for rapid delivery is compelling retailers to engage 3PL partners that operate distributed fulfillment nodes across the Japan 3PL market. After Yamato Transport exited Amazon's same-day service, challengers such as Maruwa Transport committed to 10,000 new light trucks to capture the business, underscoring the opportunity for agile players. Retailers are shifting away from single-site inventory models toward multi-DC strategies that shorten final-mile distances and protect service standards despite driver-hour caps. Within densely populated metros, 3PLs now deploy micro-fulfillment centers and integrate real-time routing software to absorb demand spikes. As a result, nationwide network coverage has become a prerequisite for winning large e-commerce contracts, solidifying the strategic importance of fast-response capabilities across the Japan 3PL market.

National Supply-Chain Digitalization Mandates (Green Logistics Act & Open-API Initiatives)

Japan's Green Logistics Act and Open-API directives are accelerating digital adoption throughout the Japan 3PL market. Public funding totaling USD 88 billion supports load-matching platforms, common data standards, and carbon-tracking tools overseen by the Ministry of Land, Infrastructure, Transport, and Tourism. Collaborative delivery pilots measure CO2 savings that can translate into tradable credits, giving early movers a tangible incentive to share capacity and data. Leading providers are rolling out API-first transport management systems, while midsize operators join consortium platforms to access digital freight brokerage. Over the medium term, standardized data flows are expected to lift average truck load factors and partially offset the capacity loss triggered by new labor rules.

Chronic Truck-Driver Shortage

New overtime caps slice weekly driving hours, yet delivery counts keep climbing. Four out of five carriers report open seats even after pay bumps. Robots now shuttle pallets inside depots, letting scarce drivers focus on road miles, while some firms target younger recruits through sports-based hiring drives. Despite creative fixes, the talent gap remains the single most immediate brake on growth.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Neutral Commitments & Emissions-Trading Pilots Driving Modal Shift to Green 3PLs

- Reshoring & Supply-Chain Resilience Subsidies

- Warehouse Land Scarcity & Rent Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Warehousing Space that stores and sorts now accounts for the fastest revenue line, expanding at 4.35% CAGR. Demand comes from omnichannel retailers and vaccine distributors that need temperature-zoned rooms, automated shuttles, and item-level scanning. Domestic transportation management still carries the largest volume, yet driver-hour rules and fuel volatility cap its growth. Providers that blend both-transport plus smart storage-capture higher wallet share and longer contract tenures.

Investments flow into goods-to-person robots, mezzanine pick modules, and voice-directed receiving stations. Nippon Express opened a universal design warehouse where autonomous carts free staff to handle value-adding tasks. These upgrades help operators overcome labor shortages and keep regional rents under control by squeezing more turns from every square meter.

The Japan Third-Party Logistics (3PL) Market Report is Segmented by Service (Domestic Transportation Management, International Transportation Management, and More), by End User (Automotive, Energy and Utilities, and More), by Logistics Model (Asset-Light, Asset-Heavy, and Hybrid), by Region (Kanto, Kansai, Chubu, Kyushu and Okinawa, Chugoku, Shikoku, Hokkaido, Tohoku). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nippon Express Co., Ltd.

- Yamato Holdings Co., Ltd.

- Kintetsu World Express, Inc.

- SG Holdings Co., Ltd.

- LOGISTEED, Ltd.

- NYK Line (Including Yusen Logistics)

- Mitsui-Soko Holdings Co., Ltd.

- Sankyu Inc.

- Nichirei Corporation

- Marubeni Logistics Corporation

- Kokusai Express Co., Ltd.

- Toyotsu Logistics Service Co., Ltd.

- Senko Group Holdings Co., Ltd.

- Japan Post Holdings Co., Ltd.

- Sumitomo Corporation

- Meitetsu Group

- DHL Group

- SBS Holdings, Inc.

- Kuehne+Nagel

- Samsung SDS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Same-Day / Next-Day E-commerce Culture Forcing Retailers Toward Nationwide 3PL Networks

- 4.2.2 National Supply-Chain Digitalization Mandates (Green Logistics Act and Open-API Initiatives)

- 4.2.3 Carbon-Neutral Commitments and Emissions-Trading Pilots Driving Modal Shift to Green 3PLs

- 4.2.4 Supply-Chain Resilience Subsidies and China-plus-One Reshoring Fueling Domestic Plant Logistics Demand

- 4.2.5 Ageing Consumer Base Expanding Home-Delivery Grocery and Healthcare Channels Requiring Temperature-Stable 3PL Networks

- 4.2.6 5G & IoT Roll-Out Elevating Real-Time Visibility Expectations and Forcing Tech-Heavy 3PL Investments

- 4.3 Market Restraints

- 4.3.1 Chronic Truck-Driver Shortage and Aging Workforce

- 4.3.2 Warehouse Land Scarcity and Rent Inflation

- 4.3.3 Hyper-Competitive Last-Mile Parcel Market Compressing Margins and Discouraging Innovation Investment

- 4.3.4 Cultural Preference for In-House Logistics among Mid-Size Manufacturers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Key Government Regulations & Initiatives

- 4.6 Technological Trends and Automation

- 4.7 General Trends in Warehousing Market

- 4.8 Demand from CEP, Last-Mile Delivery and Cold-Chain Segments

- 4.9 Insights on E-Commerce Business

- 4.10 Impact of Geopolitical Events on the Market

- 4.11 Porter's Five Forces

- 4.11.1 Threat of New Entrants

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Bargaining Power of Suppliers

- 4.11.4 Threat of Substitute Products

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Billion)

- 5.1 By Service

- 5.1.1 Domestic Transportation Management

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Inland Waterway

- 5.1.2 International Transportation Management

- 5.1.2.1 Air

- 5.1.2.2 Sea

- 5.1.2.3 Others

- 5.1.3 Value-Added Warehousing and Distribution (VAWD)

- 5.1.1 Domestic Transportation Management

- 5.2 By End-User Industry

- 5.2.1 Automotive

- 5.2.2 Energy and Utilities

- 5.2.3 Manufacturing

- 5.2.4 Life Sciences and Healthcare

- 5.2.5 Technology and Electronics

- 5.2.6 Retail and E-commerce

- 5.2.7 Consumer Goods and FMCG

- 5.2.8 Food and Beverages

- 5.2.9 Others

- 5.3 By Logistics Model

- 5.3.1 Asset-Light (Management-Based)

- 5.3.2 Asset-Heavy (Own Fleet and Warehouses)

- 5.3.3 Hybrid

- 5.4 By Region (Japan)

- 5.4.1 Kanto

- 5.4.2 Kansai

- 5.4.3 Chubu

- 5.4.4 Kyushu and Okinawa

- 5.4.5 Chugoku

- 5.4.6 Shikoku

- 5.4.7 Hokkaido

- 5.4.8 Tohoku

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Nippon Express Co., Ltd.

- 6.4.2 Yamato Holdings Co., Ltd.

- 6.4.3 Kintetsu World Express, Inc.

- 6.4.4 SG Holdings Co., Ltd.

- 6.4.5 LOGISTEED, Ltd.

- 6.4.6 NYK Line (Including Yusen Logistics)

- 6.4.7 Mitsui-Soko Holdings Co., Ltd.

- 6.4.8 Sankyu Inc.

- 6.4.9 Nichirei Corporation

- 6.4.10 Marubeni Logistics Corporation

- 6.4.11 Kokusai Express Co., Ltd.

- 6.4.12 Toyotsu Logistics Service Co., Ltd.

- 6.4.13 Senko Group Holdings Co., Ltd.

- 6.4.14 Japan Post Holdings Co., Ltd.

- 6.4.15 Sumitomo Corporation

- 6.4.16 Meitetsu Group

- 6.4.17 DHL Group

- 6.4.18 SBS Holdings, Inc.

- 6.4.19 Kuehne+Nagel

- 6.4.20 Samsung SDS

7 Market Opportunities and Future Outlook