PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910890

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910890

North America Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

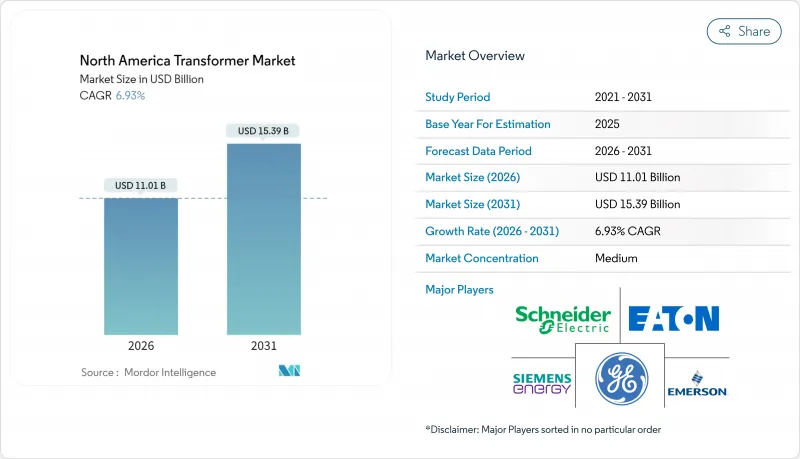

The North America Transformer Market was valued at USD 10.29 billion in 2025 and estimated to grow from USD 11.01 billion in 2026 to reach USD 15.39 billion by 2031, at a CAGR of 6.93% during the forecast period (2026-2031).

Grid-modernization mandates, renewable build-outs, and the pressing need to update aging assets are the three forces most clearly widening order books across every voltage class. Federal support-headlined by the Infrastructure Investment and Jobs Act's USD 65 billion grid allocation-has opened a new wave of utility capital spending that favors large-capacity power transformers and digitally enabled monitoring options. A growing population of hyperscale data centers in Virginia, Texas, and Oregon is driving demand for custom step-up units, while offshore wind transmission plans are increasing orders for 525 kV HVDC converter transformers. Material cost volatility remains a key concern, yet local manufacturing expansions by incumbents such as Siemens Energy and Hitachi Energy are helping to shorten lead times, improve supply-chain resilience, and keep North America's transformer market deliveries on schedule. Competitive positioning is shifting toward software-driven asset-health analytics, giving suppliers with strong IoT portfolios an edge in the procurement process.

North America Transformer Market Trends and Insights

Grid Modernization Programs Across US & Canada

Utilities are now specifying bidirectional power-flow capability, online dissolved-gas analysis, and cyber-secure communications in every medium and high-voltage tender. The Department of Energy's 2024 Grid Resilience and Innovation Partnerships disbursed USD 3.5 billion, with ICF securing a USD 250 million package that mandates the use of transformer-health sensors and storm-hardening features. Canadian counterparts mirror this push: BC Hydro earmarked USD 200 million for cold-climate upgrades compliant with NERC standard EOP-012-2, obliging manufacturers to validate performance at -40 °C. The interplay between resilience goals and smart-grid requirements is driving the North American transformer market toward modular, software-rich designs rather than commodity iron-core products. Manufacturers investing in integrated IoT stacks are therefore outpacing rivals on new-build awards. Digital readiness has become a deal-breaker rather than a differentiator, elevating R&D budgets across the supplier landscape.

Renewable Build-out Requiring Step-up Transformers

Offshore-wind majors are locking in 525 kV HVDC converter transformers that exceed 3,000 MW rating, as seen in SunZia's intertie contracts awarded to Hitachi Energy in 2025. These bespoke units must handle harmonic filtering, fault ride-through, and stringent grid-code synchronization-all capabilities that exceed those of standard distribution transformers. Supply is limited to a small circle of global experts, resulting in premium pricing resilience. Contracting authorities now prioritize proven HVDC track records, thereby reducing the likelihood of low-cost entrants disrupting this tier of the North American transformer market. Over the forecast horizon, each new offshore-wind tranche multiplies demand for large power units, reinforcing the shift toward higher-voltage equipment and software-assisted condition monitoring.

Rising Distributed Energy Resources (DER) Penetration

California's net-energy-metering regime has exposed how bi-directional power flows can overload legacy step-down transformers, occasionally forcing utilities to curtail rooftop solar output. Similar patterns are emerging in Texas and Hawaii, tempering utility appetite for traditional unit replacements. While DERs suppress aggregate demand for mid-range distribution transformers, they also encourage deployment of smart, bidirectional devices, signaling an evolution rather than a decline in the North America transformer market. Vendors equipped with grid-edge voltage regulation and remote update firmware are best positioned to offset volume pressure with higher average selling prices.

Other drivers and restraints analyzed in the detailed report include:

- Replacement of Aging Transmission Infrastructure

- Federal Funding via IIJA & Canadian Green Infrastructure

- Volatility in Copper & Grain-Oriented Steel Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large transformers above 100 MVA are expected to capture a growing portion of the North American transformer market as utilities accelerate HVDC interconnection and offshore wind tie-in projects. In contrast, small units, up to 10 MVA, still accounted for 47.92% of 2025 revenue due to their sheer volume in the distribution network. The premium for extra-high voltage designs remains durable because only a handful of plants worldwide can produce them, and transportation constraints further limit supply. Over the 2026-2031 period, the large-unit class is projected to log an 7.74% CAGR-outstripping the overall North American transformer market growth profile-as federal matching funds shorten approval timelines for regional transmission upgrades.

Utilities also face tighter NERC ride-through requirements, prompting a shift away from piecemeal uprating toward wholesale replacement with higher-rated gear. Medium-power segments (10-100 MVA) benefit from industrial electrification; however, funding favoritism often skews toward headline-grabbing bulk-power projects. As economies of scale mature in large cores and advanced insulation systems, delivered costs per MVA are expected to soften modestly, enlarging addressable demand. Consequently, the North America transformer market share of large-rating units is on track for steady expansion through the decade.

Oil-immersed designs retained 67.98% market dominance in 2025, primarily due to their superior thermal margin and overload endurance in transmission applications. Even so, air-cooled alternatives are gaining at a 7.52% CAGR, propelled by environmental liability concerns and easier maintenance in commercial real-estate retrofits. Data centers favor dry-type units to minimize fire suppression complexity, a trend that dovetails with the industrial boom shaping overall North American transformer market demand. Utilities remain cautious; many specify oil as the default for installations above 69 kV, citing proven dielectric stability.

Regulators are tightening spill-containment and fire-risk rules, nudging segments such as hospitals, airports, and semiconductor fabs toward dry-type purchases. Manufacturers are responding with cast-resin and forced-air configurations that now approach 25 MVA ratings, eroding historical size limitations. Provided insulation-system breakthroughs continue, the North America transformer market size attributable to dry-types could reach double-digit share by 2031, although outright replacement of oil technology remains unlikely in the high-voltage domain.

The North America Transformer Market Report is Segmented by Power Rating (Large, Medium, and Small), Cooling Type (Air-Cooled and Oil-Cooled), Phase (Single-Phase and Three-Phase), Transformer Type (Power and Distribution), End-User (Power Utilities, Industrial, Commercial, and Residential), and Geography (United States, Canada, and Mexico). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hitachi Energy

- Siemens Energy

- GE Vernova (Prolec GE)

- Eaton Corp PLC

- Schneider Electric SE

- WEG SA

- Mitsubishi Electric Corp

- Toshiba Corp

- ABB Trafo US (ABB until 2020)

- SPX Transformer Solutions

- Northern Transformer Corp

- Howard Industries

- SGB-SMIT Group

- CG Power & Industrial Solutions

- Royal SMIT Transformers

- ERMCO Inc.

- Pennsylvania Transformer Tech

- Valard Construction (EPC)

- K-Factor Transformers (Hammond Power)

- Delta-Star Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Grid modernization programs across US & Canada

- 4.2.2 Renewable build-out requiring step-up transformers

- 4.2.3 Replacement of aging transmission infrastructure

- 4.2.4 Federal funding via IIJA & Canadian Green Infrastructure

- 4.2.5 HVDC converter transformers for offshore wind links

- 4.2.6 Data-center electrification of on-site substations

- 4.3 Market Restraints

- 4.3.1 Rising distributed energy resources (DER) penetration

- 4.3.2 Volatility in copper & grain-oriented steel prices

- 4.3.3 Emergence of solid-state transformers

- 4.3.4 Long lead-times delaying cap-ex decisions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Power Rating

- 5.1.1 Large (Above 100 MVA)

- 5.1.2 Medium (10 to 100 MVA)

- 5.1.3 Small (Up to 10 MVA)

- 5.2 By Cooling Type

- 5.2.1 Air-cooled

- 5.2.2 Oil-cooled

- 5.3 By Phase

- 5.3.1 Single-Phase

- 5.3.2 Three-Phase

- 5.4 By Transformer Type

- 5.4.1 Power

- 5.4.2 Distribution

- 5.5 By End-User

- 5.5.1 Power Utilities (includes, Renewables, Non-renewables, and T&D)

- 5.5.2 Industrial

- 5.5.3 Commercial

- 5.5.4 Residential

- 5.6 By Geography

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Hitachi Energy

- 6.4.2 Siemens Energy

- 6.4.3 GE Vernova (Prolec GE)

- 6.4.4 Eaton Corp PLC

- 6.4.5 Schneider Electric SE

- 6.4.6 WEG SA

- 6.4.7 Mitsubishi Electric Corp

- 6.4.8 Toshiba Corp

- 6.4.9 ABB Trafo US (ABB until 2020)

- 6.4.10 SPX Transformer Solutions

- 6.4.11 Northern Transformer Corp

- 6.4.12 Howard Industries

- 6.4.13 SGB-SMIT Group

- 6.4.14 CG Power & Industrial Solutions

- 6.4.15 Royal SMIT Transformers

- 6.4.16 ERMCO Inc.

- 6.4.17 Pennsylvania Transformer Tech

- 6.4.18 Valard Construction (EPC)

- 6.4.19 K-Factor Transformers (Hammond Power)

- 6.4.20 Delta-Star Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment