PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910905

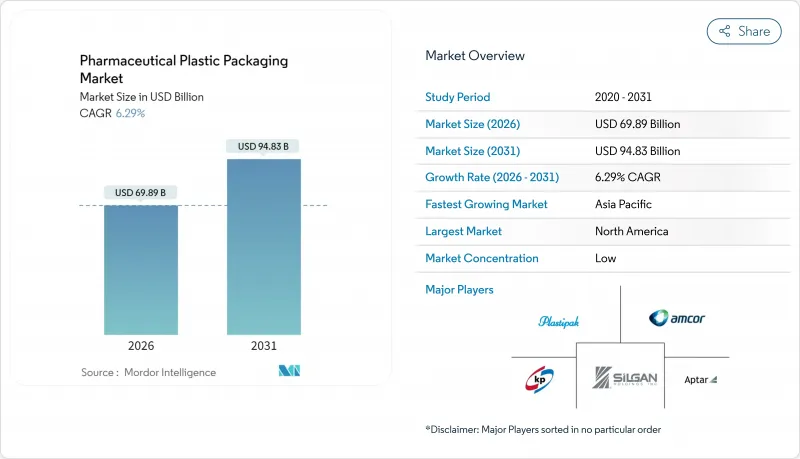

Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pharmaceutical plastic packaging market is expected to grow from USD 65.75 billion in 2025 to USD 69.89 billion in 2026 and is forecast to reach USD 94.83 billion by 2031 at 6.29% CAGR over 2026-2031.

Growth rests on the rising share of biologics and injectables, stricter traceability rules, and fast-maturing sustainability mandates that reward recyclable and bio-based polymers. In February 2025 the EU's Packaging and Packaging Waste Regulation (PPWR) entered into force, requiring full recyclability by 2030 and accelerating material substitution programs.North American demand benefits from the Drug Supply Chain Security Act (DSCSA) deadline in November 2025, which pushes smart, serialization-ready formats. Asia-Pacific manufacturers leverage regulatory harmonization and surging generic output, lifting the region's growth prospects. Consolidation among mid-tier converters, exemplified by Amcor's USD 13.5 billion merger with Berry Global, brings scale to tackle PFAS-free formulations and circular-economy investments.

Global Pharmaceutical Plastic Packaging Market Trends and Insights

Growing Demand for Plastic Packs for Biologics and Injectables

Biologics now account for a rising share of new drug approvals, and their sensitivity to alkali leaching, delamination, and breakage positions advanced polymers as preferred primary containers. Cyclic olefin polymer syringes from Gerresheimer combine glass-like transparency with superior break resistance, helping minimize costly biologic losses. The global biopharmaceutical sector is expected to reach USD 856.1 billion by 2030, reinforcing demand for high-integrity parenteral packaging. Validated blow-fill-seal containers show no potency or pH drift for monoclonal antibodies over nine months, broadening polymer uptake in sterile applications. During the pandemic, shortages of glass vials highlighted supply-chain risks, prompting dual-sourcing policies that now favor plastic options with equivalent regulatory acceptance.

Expansion of Generic Drug Production in Emerging Markets

Regulatory reforms in China, notably the Marketing Authorization Holder system, shorten approval cycles and attract contract manufacturing alliances that boost packaging volumes. Beijing's 2025 guidance contains 24 measures to modernize drug oversight by 2027, creating clear targets for compliant packaging lines. India and ASEAN mutual recognition programs further harmonize specifications, letting converters scale a single design across multiple markets. Price-sensitive generics also prioritize cost-efficient plastics that remain robust during long-distance export shipments.

Extended Plastics-Waste Regulation (EU SUP, EPR etc.)

The PPWR obliges all packs sold in the EU to be recyclable by 2030 and introduces EPR fees plus recycled-content thresholds-30% for PET food packs-adding capital and compliance burdens. Healthcare exemptions exist for immediate drug containers, yet brand owners must still fund collection schemes, redesign multilayer laminates, and phase out PFAS in contact materials by 2026. Harmonized symbols due in 2028 compel artwork changes, while the 5% material-reduction target squeezes already lean wall-thickness specs.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight, Shatter-Proof Logistics Advantage

- Home-Health and E-Commerce Unit-Dose Adoption

- Volatile Polymer Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene retained leadership with 30.12% of pharmaceutical plastic packaging market share in 2025 thanks to its sterilization tolerance and regulatory familiarity. Yet bio-based and recycled grades are set to outpace all incumbents at 9.05% CAGR, reshaping the pharmaceutical plastic packaging market through 2031. Avient's Mevopur range delivers up to 120% carbon-footprint reduction while keeping ISO 10993 and USP VI credentials, illustrating how circularity and compliance now co-exist. EU recycled-content quotas and the FDA's looming dye phase-out intensify demand for renewable feedstocks. UPM's wood-based bottle launch underscores commercial feasibility of lignin-rich chemistries.

Second-generation bio-polyolefins and chemically recycled PET now reach pharmaceutical purity, unlocking drop-in substitution without retooling. However, limited pharma-grade recyclate supplies restrain immediate scale, creating price premiums. Resin majors ramp capacity near European and North American hubs to shorten logistics, while Asian players eye export-grade r-resin certification to capture surging orders. The pharmaceutical plastic packaging market therefore balances legacy PP dominance with measured yet accelerating penetration of renewable polymers that align with PPWR and corporate net-zero pledges.

Bottles and solid containers captured 26.05% of the pharmaceutical plastic packaging market in 2025 owing to oral solid dosage prevalence. Yet pre-fillable syringes and cartridges headline the growth story, advancing at 8.29% CAGR as biologics, GLP-1 injectables, and home-administered drugs proliferate. BD's RFID-enabled iDFill syringe merges device and pack, supplying real-time traceability that dovetails with DSCSA needs.

Digital connectivity, higher viscosity tolerances, and on-body injector compatibility move these containers from commodity to high-value engineered systems. Conversely, vials and ampoules remain essential for hospital compounding, though dose-banded biologics see a shift to polymer-based EZ-fill Smart vials from Gerresheimer that streamline fill-finish operations. Stick packs, sachets, and pouches gain foothold in tele-pharmacy mailers where postage and cushioning costs punish rigid lines.

The Pharmaceutical Plastic Packaging Market Report is Segmented by Raw Material (Polypropylene, Polyethylene Terephthalate, and More), Product Type (Bottles and Solid Containers, Vials and Ampoules, and More), Packaging Format (Rigid, Flexible), Route of Drug Delivery (Oral, Parenteral/Injectable, and More), End-User (Pharma Manufacturers, Cdmos, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.05% of the pharmaceutical plastic packaging market in 2025, supported by advanced GMP plants, DSCSA serialization deadlines, and reshoring incentives. FDA guidance endorses continuous manufacturing and smart sensors, pushing local converters to embed RFID in pack walls and qualify PFAS-free films.Tariffs on imported resins raise domestic capacity utilization and spur investment in bio-based feedstocks, stabilizing supply chains vulnerable to geopolitical shocks.

Europe combines regulatory stringency with sustainability leadership, forging a robust yet evolving market base. The PPWR enforces recyclability, EPR fees, and PFAS bans, forcing redesigns that stimulate R&D budgets among regional converters. Single-Use Plastics Directive restrictions encourage mono-material blister films, while national eco-modulation schemes reward low-carbon formats. Nordic and DACH states lead pilot take-back schemes for used inhalers and injectors, offering closed-loop polypropylene pathways.

Asia-Pacific delivers the highest 9.76% CAGR for the pharmaceutical plastic packaging market through 2031. China accelerates under its 2025 action plan, aligning packaging quality audits with ICH Q9 while funding green factories. India tightens pharmacopoeial tests and digital traceability, creating opportunities for smart-label suppliers. ASEAN mutual recognition saves months of dossier work, letting exporters ship compliant packs across member borders. Japanese EPR schemes extend to medical packs, catalyzing PCR-grade PP sourcing. Together, these tailwinds strengthen the pharmaceutical plastic packaging market across developing and mature APAC nations.

- Amcor PLC

- Gerresheimer AG

- AptarGroup Inc.

- West Pharmaceutical Services Inc.

- Klockner Pentaplast Group

- Comar LLC

- O.Berk Company LLC

- Pretium Packaging LLC

- Drug Plastics and Glass Co. Inc.

- Gil-Pack Ltd.

- Alpla Group

- Silgan Holdings Inc.

- Placon Corporation

- Sealed Air Corporation

- Plastipak Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for plastic packs for biologics and injectables

- 4.2.2 Expansion of generic drug production in EMs

- 4.2.3 Lightweight, shatter-proof logistics advantage

- 4.2.4 Home-health and e-commerce unit-dose adoption

- 4.2.5 On-site BFS and 3-D printed molds for personalized meds

- 4.2.6 Antimicrobial / smart-polymer enabled packs

- 4.3 Market Restraints

- 4.3.1 Extended plastics-waste regulation (EU SUP, EPR etc.)

- 4.3.2 Volatile polymer feedstock pricing

- 4.3.3 Biologic-glass policy shift toward COP vials

- 4.3.4 Scarcity of pharma-grade r-resin supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assessment of Geopolitical Scenario

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 High-Density Polyethylene (HDPE)

- 5.1.4 Low-Density Polyethylene (LDPE)

- 5.1.5 Cyclic Olefin Polymer / Copolymer (COP/COC)

- 5.1.6 Bio-based and Recycled Plastics

- 5.2 By Product Type

- 5.2.1 Bottles and Solid Containers

- 5.2.2 Vials and Ampoules

- 5.2.3 Pre-fillable Syringes and Cartridges

- 5.2.4 Blister Packs and Strip Packs

- 5.2.5 Pouches / Stick Packs / Sachets

- 5.2.6 Closures, Caps and Lids

- 5.2.7 IV Bags and Flexible Bags

- 5.3 By Packaging Format

- 5.3.1 Rigid

- 5.3.2 Flexible

- 5.4 By Route of Drug Delivery

- 5.4.1 Oral

- 5.4.2 Parenteral / Injectable

- 5.4.3 Ophthalmic / Nasal

- 5.4.4 Topical / Transdermal

- 5.5 By End-User

- 5.5.1 Pharma Manufacturers

- 5.5.2 Contract Development and Manufacturing Orgs (CDMOs)

- 5.5.3 Hospitals and Clinics

- 5.5.4 Home-care Settings

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market level overview, core segments, financials as available, strategic info, market rank/share, products and services, recent developments)

- 6.4.1 Amcor PLC

- 6.4.2 Gerresheimer AG

- 6.4.3 AptarGroup Inc.

- 6.4.4 West Pharmaceutical Services Inc.

- 6.4.5 Klockner Pentaplast Group

- 6.4.6 Comar LLC

- 6.4.7 O.Berk Company LLC

- 6.4.8 Pretium Packaging LLC

- 6.4.9 Drug Plastics and Glass Co. Inc.

- 6.4.10 Gil-Pack Ltd.

- 6.4.11 Alpla Group

- 6.4.12 Silgan Holdings Inc.

- 6.4.13 Placon Corporation

- 6.4.14 Sealed Air Corporation

- 6.4.15 Plastipak Holdings

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment