PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911830

Europe Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

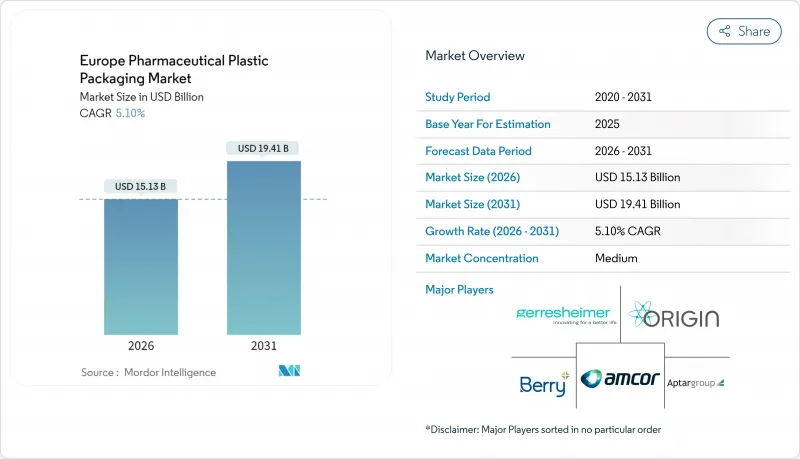

The Europe pharmaceutical plastic packaging market was valued at USD 14.40 billion in 2025 and estimated to grow from USD 15.13 billion in 2026 to reach USD 19.41 billion by 2031, at a CAGR of 5.10% during the forecast period (2026-2031).

Growth pivots on sustainability mandates, biologics proliferation, and home-based therapy expansion, each tightening performance requirements for barrier properties, recyclability, and user-centric design. Leading suppliers are scaling recycled-content lines and RFID-ready formats to satisfy circular-economy goals and hospital automation programs. Meanwhile resin cost swings and stricter extractables protocols are compressing margins, prompting raw-material hedging, supplier diversification, and selective mergers to preserve scale advantages. Competitive intensity remains moderate as incumbents extend vertical integration while specialists seize niches in smart and bio-based solutions, reshaping pricing and collaboration models across the Europe pharmaceutical plastic packaging market.

Europe Pharmaceutical Plastic Packaging Market Trends and Insights

Rising Demand for Child-Resistant and Senior-Friendly Packs

An ageing population and tighter pediatric-safety mandates are steering packaging investments toward closures that combine tactile ease with certified child resistance. European converters spend EUR 2-4 million on every new ergonomic closure platform, a commitment that lifted patient-centric system launches by 18% in 2024. Nemera's torque-reducing closure lowers opening force 30% while exceeding ISO 8317, illustrating how usability and safety can coexist.Regulatory endorsement came via the European Medicines Agency's 2024 guidelines stressing user-friendly packaging for chronic therapies. Early adopters report premium pricing and brand-loyalty gains that offset the initial 15-20% cost uplift, especially for polypropylene caps whose mold precision supports intricate locking mechanisms.

Surge in Biologics Needing Advanced Parenteral Plastics

Biologic drug output in Europe jumped 23% in 2024, with German and Swiss plants ramping monoclonal antibody runs. These high-value molecules require ultra-low extractables and glass-free break-resistance, accelerating demand for cyclic olefin copolymers and cyclic olefin polymers that cost 3-4 times polypropylene yet deliver chemical inertness and clarity. SCHOTT Pharma's EUR 150 million vial-expansion plan underscores supplier commitment to specialized polymer capacity. Biologics-ready packaging is growing nearly twice as fast as the overall Europe pharmaceutical plastic packaging market, reshaping material mix, qualification timelines, and supplier consolidation patterns.

Volatile PP and PET Resin Prices

Petrochemical feedstock disruptions and energy-price swings pushed polypropylene and PET up 15-20% during 2024. Producers such as BASF now quote quarterly, shifting volatility risk to converters who often lock in multi-year supply deals with drugmakers. Smaller firms lacking hedging capacity face squeezes that have triggered consolidation waves, while larger groups diversify supply and invest in in-house recycling to temper pricing shocks. Quarterly adjustment clauses already cover 30-40% of raw-material spend for many mid-tier converters, eroding predictability across the Europe pharmaceutical plastic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- EU Circular-Economy Rules Accelerating Recyclable Plastics

- E-Commerce Pharma Boosting Protective Secondary Packaging

- Stricter Extractables / Leachables Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene retained 35.20% Europe pharmaceutical plastic packaging market share in 2025, supported by cost-efficiency, chemical resistance, and widespread regulatory familiarity. Annual pharmaceutical PP consumption exceeds 180,000 tons, covering closures, blisters, and syringes. However, the Europe pharmaceutical plastic packaging market size is tilting toward high-density polyethylene, advancing at a 5.74% CAGR as its superior moisture and oxygen barrier meets biologics stability requirements while presenting stronger recyclability credentials under PPWR.

Sustainability shifts also elevate medical-grade rPET and spur trials of bio-based grades. Gerresheimer has begun commercial runs of recycled PET dropper bottles that satisfy pharma purity thresholds. Niche polymers-COC, COP, PLA blends-command premiums of 300-400% but win specifications for parenterals where ultra-low extractables are mandatory. SCHOTT Pharma's COC expansion underscores rising demand for these specialty resins. Polypropylene suppliers are responding by piloting post-consumer content streams, yet must overcome technical hurdles in odor, color, and traceability to retain leadership within the Europe pharmaceutical plastic packaging market.

Europe Pharmaceutical Plastic Packaging Market is Segmented by Raw Material (Polypropylene, Polyethylene Terephthalate, Low-Density Polyethylene, High-Density Polyethylene, Others), Product Type (Solid Containers, Liquid and Dropper Bottles, Nasal Spray Bottles, Oral-Care Packs, Pouches/Sachets, Vials and Ampoules, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Gerresheimer AG

- Amcor PLC

- Berry Global Group Inc.

- AptarGroup Inc.

- Origin Pharma Packaging

- Pretium Packaging

- Klckner Pentaplast

- Comar

- Gil Plastic Products Ltd

- Drug Plastics Group

- West Pharmaceutical Services Inc.

- Nemera

- Bormioli Pharma

- Alpla Group

- Sanner GmbH

- Tekni-Plex

- Weener Plastics

- Jabil Healthcare (Nypro)

- Stevanato Group (EZ-fill polymer vials)

- Raumedic AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for child-resistant and senior-friendly packs

- 4.2.2 Surge in biologics needing advanced parenteral plastics

- 4.2.3 EU circular-economy rules accelerating recyclable plastics

- 4.2.4 E-commerce pharma boosting protective secondary packaging

- 4.2.5 Home-injection therapies driving small PP pre-filled syringes

- 4.2.6 Robotics-ready RFID blister packs for hospital automation

- 4.3 Market Restraints

- 4.3.1 Volatile PP and PET resin prices

- 4.3.2 Stricter extractables / leachables limits

- 4.3.3 Glass and aluminum substitution in injectables

- 4.3.4 Short supply of medical-grade recycled resin

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Industry Value-Chain Analysis

- 4.9 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High-Density Polyethylene (HDPE)

- 5.1.5 Others (COP, COC, PVC-free blends, bio-polymers)

- 5.2 By Product Type

- 5.2.1 Solid Containers

- 5.2.2 Liquid and Dropper Bottles

- 5.2.3 Nasal Spray Bottles

- 5.2.4 Oral-care Packs

- 5.2.5 Pouches / Sachets

- 5.2.6 Vials and Ampoules (polymer)

- 5.2.7 Cartridges

- 5.2.8 Prefilled Syringes

- 5.2.9 Caps and Closures

- 5.2.10 Others (unit-dose strips, inhaler canisters)

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Belgium

- 5.3.7 Sweden

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Gerresheimer AG

- 6.4.2 Amcor PLC

- 6.4.3 Berry Global Group Inc.

- 6.4.4 AptarGroup Inc.

- 6.4.5 Origin Pharma Packaging

- 6.4.6 Pretium Packaging

- 6.4.7 Klckner Pentaplast

- 6.4.8 Comar

- 6.4.9 Gil Plastic Products Ltd

- 6.4.10 Drug Plastics Group

- 6.4.11 West Pharmaceutical Services Inc.

- 6.4.12 Nemera

- 6.4.13 Bormioli Pharma

- 6.4.14 Alpla Group

- 6.4.15 Sanner GmbH

- 6.4.16 Tekni-Plex

- 6.4.17 Weener Plastics

- 6.4.18 Jabil Healthcare (Nypro)

- 6.4.19 Stevanato Group (EZ-fill polymer vials)

- 6.4.20 Raumedic AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment