PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910926

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910926

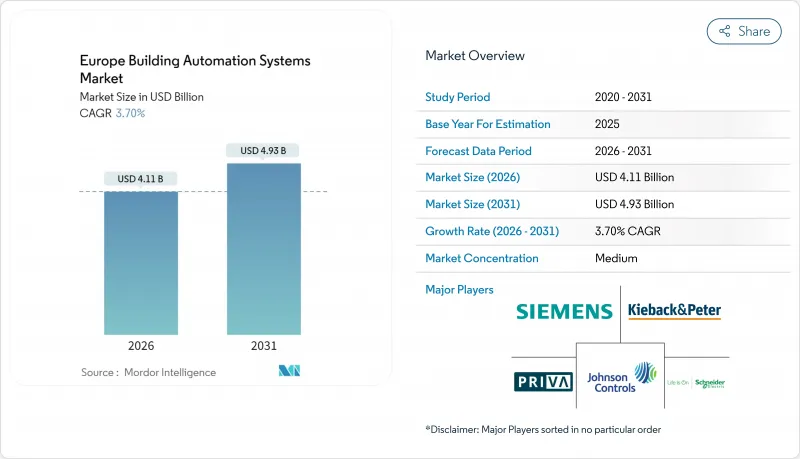

Europe Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Building Automation Systems market was valued at USD 3.96 billion in 2025 and estimated to grow from USD 4.11 billion in 2026 to reach USD 4.93 billion by 2031, at a CAGR of 3.70% during the forecast period (2026-2031).

Growing compliance obligations under the revised Energy Performance of Buildings Directive, rising electricity prices, and corporate net-zero targets guide most investment decisions. Retrofit opportunities dominate because three-quarters of the region's building stock predates 1990, yet innovation centers on cloud-enabled analytics, wireless sensors, and AI-driven optimization. Hardware remains the revenue anchor while Software-as-a-Service introduces recurring income streams and shortens payback periods for mid-sized property portfolios. Competition is moderate: a handful of global manufacturers supply core controllers and field devices, but hundreds of regional integrators shape delivery schedules, project costs, and user training outcomes. Persistent labour bottlenecks and cybersecurity liabilities act as near-term brakes on project velocity, although product standardization and ecosystem partnerships are gradually reducing risk perceptions.

Europe Building Automation Systems Market Trends and Insights

Mandatory BACS in EPBD revision

The 2025 enforcement of the revised Energy Performance of Buildings Directive obliges non-residential facilities above 290 kW heating load to deploy interoperable automation and control systems. Germany and France adopted even stricter thresholds, accelerating tender activity across public offices, schools, and healthcare sites. Open-protocol solutions such as BACnet and KNX receive preferential treatment in grant programs, prompting building owners to replace proprietary networks during planned renovations. Compliance deadlines cluster around 2027, creating pronounced peaks in engineering demand and sparking specialized training initiatives. Enforcement rigor differs by member state, yet the overall mandate locks Europe Building Automation Systems market growth into regulatory timetables. Vendors with local installation partners and multilingual commissioning software gain a visible competitive edge.

Rapid fall in wireless sensor prices

Average selling prices of multi-technology occupancy, temperature, and light sensors dropped by nearly 30% between 2023 and 2025, mainly because of higher 200 mm wafer output in East Asia and a transition to system-on-chip architectures. Nordic property owners were early adopters, using battery-powered sensors to monitor energy-intensive facilities during prolonged heating seasons. Reduced wiring and ceiling core-drilling costs shorten payback periods on small projects, broadening the customer base beyond A-grade office towers. Edge-processing features embedded inside new chips lower latency, screen false positives, and retain sensitive building usage data inside the premises, supporting GDPR compliance. Although component prices are now less volatile than during the 2021-2022 supply crunch, occasional shortages of specialized RF microcontrollers still trigger modest lead-time spikes for integrators.

Fragmented legacy building stock

Historic masonry structures in Paris, Rome, and Barcelona often prohibit core drilling or heavy conduit runs, complicating sensor placement and cabling. Mixed-era mechanical plant - from radiators to variable-air-volume boxes - requires meticulous interface mapping, elevating engineering hours and contingency budgets. Owners sometimes postpone deep automation until major tenancy turnovers, prolonging decision cycles beyond conventional fiscal years. Regional craft guilds enforce preservation norms, curbing invasive retrofits. Consequently, integrators invest in wireless, battery-free actuators and reversible mounting kits that comply with heritage guidelines, yet these specialized components carry price premiums that shrink return-on-investment windows.

Other drivers and restraints analyzed in the detailed report include:

- Corporate net-zero commitments

- Edge-AI analytics boosting OPEX savings

- Cyber-security liability concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 65.58% of 2025 revenue as reliable controllers, actuators, and multi-standard gateways underpin every functional layer of the Europe Building Automation Systems market size. Controllers routinely manage thousands of I/O points, pushing suppliers to refine real-time processing and cyber-hardening. In parallel, sensors migrate to ultra-low-power wireless chips, broadening retrofit feasibility inside pre-1910 buildings where cable trays are scarce.

Cloud-hosted analytics and remote firmware updates explain the 6.02% CAGR in SaaS subscriptions. Building owners favour operating expenses over capital outlays, purchasing AI-based optimization features on rolling contracts. Predictable billing eases budget planning and encourages continuous scope expansion, once a building's HVAC loops are online, lighting, security, and EV-charger modules follow swiftly. Vendors integrate edge-AI inference capabilities into room controllers, shifting computation away from hyperscale data centers and satisfying regional data-sovereignty laws.

Commercial premises held 44.92% of Europe Building Automation Systems market share in 2025, spurred by mandatory energy audits and competitive tenant landscapes. Facility managers prioritize thermal comfort and indoor-air-quality dashboards to attract occupants in hybrid-work environments. Hospitals upgrade critical zones for negative pressure control, whereas the retail sector deploys AI-based refrigeration monitoring to reduce spoilage.

Residential demand grows at a 5.59% CAGR through 2031, catalysed by smart-meter rebates and national electrification incentives. Multi-family dwellings adopt centralized plant control to allocate utility costs precisely, while detached homes lean toward voice-activated scenes and utility-driven demand-response widgets. Despite fewer per-unit points, aggregate household volumes rival small commercial footprints, prompting consumer-electronics brands to forge alliances with traditional BAS suppliers.

The Europe Building Automation Systems Report is Segmented by Component (Hardware - Controllers and Field Devices, Software-As-A-Service), End User (Residential, Commercial, Industrial), Building Life-Cycle (New-Build, Retrofit), Communication Protocol (BACnet, KNX Classic and IoT, Modbus/LonWorks), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Robert Bosch GmbH

- Trane Technologies plc

- Kieback and Peter GmbH and Co. KG

- Priva Holding B.V.

- Belimo Holding AG

- Fr. Sauter AG

- Lynxspring Inc.

- Delta Controls Inc.

- Legrand SA

- Distech Controls Inc.

- Regin AB

- Danfoss A/S

- Beckhoff Automation GmbH and Co. KG

- Somfy SA

- Crestron Electronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory BACS in EPBD revision

- 4.2.2 Rapid fall in wireless sensor prices

- 4.2.3 Corporate net-zero commitments

- 4.2.4 Edge-AI analytics boosting OPEX savings

- 4.2.5 Increasing smart-home retrofits

- 4.2.6 ESG-linked financing incentives

- 4.3 Market Restraints

- 4.3.1 Fragmented legacy building stock

- 4.3.2 Cyber-security liability concerns

- 4.3.3 Vendor-specific protocol lock-in

- 4.3.4 Skilled-labour bottlenecks

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Controllers

- 5.1.1.2 Field Devices

- 5.1.2 Software-as-a-Service

- 5.1.1 Hardware

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Building Life-Cycle

- 5.3.1 New-build

- 5.3.2 Retrofit

- 5.4 By Communication Protocol

- 5.4.1 BACnet

- 5.4.2 KNX (Classic and IoT)

- 5.4.3 Modbus / LonWorks

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Belgium

- 5.5.8 Sweden

- 5.5.9 Finland

- 5.5.10 Denmark

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 Johnson Controls International plc

- 6.4.3 Schneider Electric SE

- 6.4.4 Honeywell International Inc.

- 6.4.5 ABB Ltd

- 6.4.6 Robert Bosch GmbH

- 6.4.7 Trane Technologies plc

- 6.4.8 Kieback and Peter GmbH and Co. KG

- 6.4.9 Priva Holding B.V.

- 6.4.10 Belimo Holding AG

- 6.4.11 Fr. Sauter AG

- 6.4.12 Lynxspring Inc.

- 6.4.13 Delta Controls Inc.

- 6.4.14 Legrand SA

- 6.4.15 Distech Controls Inc.

- 6.4.16 Regin AB

- 6.4.17 Danfoss A/S

- 6.4.18 Beckhoff Automation GmbH and Co. KG

- 6.4.19 Somfy SA

- 6.4.20 Crestron Electronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment