PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910941

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910941

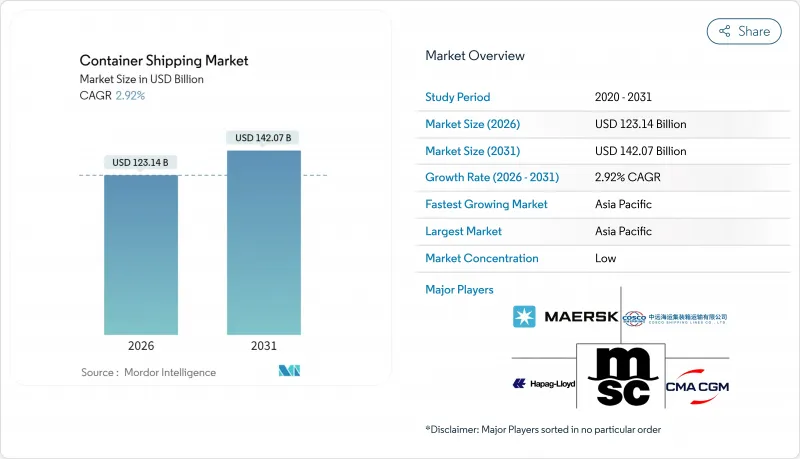

Container Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Container Shipping Market is expected to grow from USD 119.65 billion in 2025 to USD 123.14 billion in 2026 and is forecast to reach USD 142.07 billion by 2031 at 2.92% CAGR over 2026-2031.

Slower fleet-wide speed, ongoing Red Sea diversions, and an expanded regulatory cost base are moderating supply even as trade agreements and e-commerce replenish underlying demand. Carriers are concentrating on network reliability, with new alliance formations targeting on-time performance above 90% while reallocating capacity toward the most resilient corridors. Terminal ownership continues to rise as a defensive hedge against landside congestion and as a lever to capture new revenue pools. Fuel cost volatility remains the primary profitability swing factor, yet dual-fuel newbuild orders and incremental efficiency upgrades are gradually lowering per-unit emissions and bunker consumption. Against this backdrop, the container shipping market is transitioning from rate-driven earnings to efficiency-driven returns as technology adoption and environmental compliance reshape operating models.

Global Container Shipping Market Trends and Insights

Rising Volume of International Trade

World merchandise trade is recovering on the back of stabilizing consumer spending and restocking cycles, prompting carriers to redeploy idle capacity onto North American and Mediterranean gateways. Longer voyage distances caused by Red Sea detours have temporarily absorbed excess tonnage, protecting rate integrity even as new vessels deliver. Port call data show double-digit throughput rebounds at U.S. East Coast hubs, highlighting the flexibility of the container shipping market to redirect flows quickly. Equipment repositioning costs have increased, yet higher backhaul utilization is offsetting part of the burden. The durability of trade growth remains linked to household purchasing power and to how swiftly geopolitical flashpoints normalize.

Expansion of Free-Trade Agreements

The EU-Mercosur deal, concluded in December 2024, is set to unlock EUR 56 billion (USD 61.80 billion) in additional goods trade and reshape South Atlantic services. Carriers that already control terminals in Santos and Buenos Aires are preparing dedicated loops to capture origin-destination volumes that were traditionally transshipped in the Caribbean. Simultaneously, USMCA provisions are reinforcing North American near-shoring, a trend visible in the rising share of Mexican gateways handling U.S.-bound cargo. Broader regionalization is nudging fleet planners to design shorter, high-frequency strings instead of relying solely on long-haul east-west trunk routes. Over the long term, the container shipping market benefits from lower tariff barriers as well as harmonized customs processes that reduce dwell times and enhance service predictability.

Volatile Bunker Fuel Prices

Very-Low-Sulfur Fuel Oil averaged USD 630 / t in 2024, and the inclusion of shipping in the EU Emissions Trading System has added USD 170-210 / t for intra-European voyages. Price gyrations compel carriers to adjust freight rates through bunker adjustment factors that often lag market swings, eroding margins. Wide spreads between LNG, methanol, and conventional bunkers complicate multi-fuel procurement strategies. Hedging offers partial relief but demands financial sophistication that not all operators possess. Consequently, energy efficiency retrofits and slow steaming remain immediate tools to absorb cost shocks within the container shipping market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid E-commerce Containerization

- IMO 2023 Carbon Regulations Drive Fleet Renewal

- Escalating Geopolitical Trade Tensions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 40-foot segment held 50.62% of 2025 revenue, reflecting its status as the industry's workhorse unit that maximizes vessel stowage and aligns with rail and truck dimensions. The container shipping market size for 40-foot boxes is projected to grow alongside equipment replacement cycles and inland infrastructure upgrades that favor high-cube variants. Robust demand from electronics and apparel shippers reinforces fleet utilization, while sustained production of high-cube designs lifts per-unit load factors. Port-side investments in double-lift crane spreaders further cement the operational preference for this size. The 20-foot segment remains vital for dense commodities and infrastructure-limited terminals in developing economies, though its relative share is expected to edge lower as shippers consolidate loads to reduce per-tonne carbon footprints. Specialized sizes such as 45-foot units cater to pallet-wide cargo niches, yet their uptake is restricted by limited backhaul demand and compatibility gaps in certain rail corridors.

Growth in the 40-foot category is also supported by digitized container tracking, which improves door-to-door visibility and enables leaner inventory planning for high-volume retailers. Leasing companies are accelerating fleet renewal to incorporate smart-box technology, a move that enhances asset rotation and reduces idle time. Combined, these factors should keep the 40-foot segment at the core of the container shipping market through 2031.

General-purpose containers accounted for 63.40% of 2025 throughput, underpinning the bulk of consumer and industrial trade flows. However, reefer units are forecast to log a 3.36% CAGR, outpacing standard boxes on the back of sustained demand for temperature-controlled pharmaceuticals and perishables. Enhanced insulation, integrated telemetry, and lower power draw raise the profitability of refrigerated services despite higher capital costs. Pharmaceutical firms are shifting high-value biologics from air to ocean freight, lured by validated cold-chain corridors that deliver cost savings without compromising product integrity. In food supply chains, the push to cut waste is increasing the share of fresh produce shipped in high-accuracy reefers with continuous monitoring. Consequently, carriers are dedicating larger reefer plugs on newbuild designs, signaling confidence in sustained premium demand. The general-purpose segment, while mature, remains central to the container shipping market, with incremental innovation focused on theft-resistant locks and end-to-end tracking rather than on transformative design changes.

A parallel trend involves the retro-fitting of CO2-based refrigeration systems, improving energy efficiency and reducing global warming potential relative to older HFC units. These technology upgrades, combined with regulatory drivers in food and pharma, are likely to keep reefers at the forefront of revenue growth.

The Container Shipping Market Report is Segmented by Container Size (20-Foot TEU, 40-Foot FEU, Others), Container Type (General, Reefer), Service (Full-Container-Load FCL, Less-Than-Container-Load LCL), End-User Industry (FMCG & Retail, Manufacturing and Automotive, and More), and Geography (North America, South America, Asia-Pacific, Europe, Middle East and Africa). The Market Forecasts are Provided in Terms of Value USD.

Geography Analysis

Asia-Pacific commanded 40.55% of 2025 revenue, reinforcing its status as the manufacturing and export engine of the container shipping market. Chinese GDP expansion near 5% and accelerated port automation in Shanghai, Ningbo-Zhoushan, and Busan are sustaining the region's slot demand. Intra-Asian trade lanes are registering some of the highest frequency growth, propelled by ASEAN supply-chain integration and electronics component flows. The emergence of the Northern Sea Route as a summer alternative for Asia-Europe cargo offers an additional resilience layer, though uptake remains constrained by ice-class fleet scarcity and geopolitical risk. Continued investment in hinterland rail networks and free-trade zones supports a robust outlook, with the region projected to deliver a 4.12% CAGR through 2031.

North America experienced a 13.1% rebound in loaded container imports during 2024, led by retail restocking and e-commerce fulfillment demand. East Coast gateways such as Savannah and New York-New Jersey benefited from shipper diversification away from West Coast labor uncertainties and from deeper channel dredging that accommodates larger neo-Panamax vessels. Mexico's west-coast port of Lazaro Cardenas is attracting direct Asia services, offering rail connectivity into the U.S. Midwest. Long-beach terminal retrofits emphasizing zero-emission yard equipment align with state regulations and bolster the environmental credentials of the container shipping market in the region. While potential labor negotiations pose near-term volatility, the structural trend toward onshore inventory buffers and near-shoring supports medium-term growth.

Europe's picture is mixed. Northern hubs such as Rotterdam and Antwerp-Bruges posted modest gains after a soft 2023, whereas Mediterranean transshipment hubs enjoyed volume windfalls of about 30% as carriers bypassed the Suez Canal. The container shipping market size in Southern Europe therefore expanded even as regulatory costs rose under the FuelEU Maritime and ETS frameworks. Investments in port community systems and intermodal rail corridors are improving hinterland connectivity, yet congestion risk lingers when Mediterranean hubs become overflow valves during crisis reroutes. Brexit-related customs friction has stabilized, although UK gateways continue to handle lower direct Far East services than before 2021.

- MSC Mediterranean Shipping Company

- A.P. Moller - Maersk

- CMA CGM

- COSCO Shipping Lines

- Hapag-Lloyd

- ONE (Ocean Network Express)

- Evergreen Marine

- Yang Ming

- HMM Co.

- PIL (Pacific International Lines)

- ZIM Integrated Shipping

- OOCL

- Wan Hai Lines

- Matson

- X-Press Feeders

- SITC International

- Zhonggu Logistics

- Antong Holdings

- Hyundai Merchant Marine

- IRISL Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising volume of international trade

- 4.2.2 Expansion of free-trade agreements

- 4.2.3 Rapid e-commerce containerization

- 4.2.4 IMO 2023 carbon regulations drive fleet renewal

- 4.2.5 Arctic route viability (Northern Sea Route)

- 4.2.6 AI-enabled predictive routing and scheduling

- 4.3 Market Restraints

- 4.3.1 Volatile bunker fuel prices

- 4.3.2 Escalating geopolitical trade tensions

- 4.3.3 Chronic port-side congestion bottlenecks

- 4.3.4 Cyber-attacks on digital ship-to-shore systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size and Growth Forecasts (Value, USD Bn)

- 5.1 By Container Size

- 5.1.1 20-Foot (TEU)

- 5.1.2 40-Foot (FEU)

- 5.1.3 Others

- 5.2 By Container Type

- 5.2.1 General

- 5.2.2 Reefer

- 5.3 By Service

- 5.3.1 Full-Container-Load (FCL)

- 5.3.2 Less-Than-Container-Load (LCL)

- 5.4 By End-User Industry

- 5.4.1 FMCG and Retail

- 5.4.2 Manufacturing and Automotive

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Electronics and Electrical Equipment

- 5.4.5 Industrial Chemicals and Raw Materials

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.4.8 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab of Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East And Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 MSC Mediterranean Shipping Company

- 6.4.2 A.P. Moller - Maersk

- 6.4.3 CMA CGM

- 6.4.4 COSCO Shipping Lines

- 6.4.5 Hapag-Lloyd

- 6.4.6 ONE (Ocean Network Express)

- 6.4.7 Evergreen Marine

- 6.4.8 Yang Ming

- 6.4.9 HMM Co.

- 6.4.10 PIL (Pacific International Lines)

- 6.4.11 ZIM Integrated Shipping

- 6.4.12 OOCL

- 6.4.13 Wan Hai Lines

- 6.4.14 Matson

- 6.4.15 X-Press Feeders

- 6.4.16 SITC International

- 6.4.17 Zhonggu Logistics

- 6.4.18 Antong Holdings

- 6.4.19 Hyundai Merchant Marine

- 6.4.20 IRISL Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment