PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911280

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911280

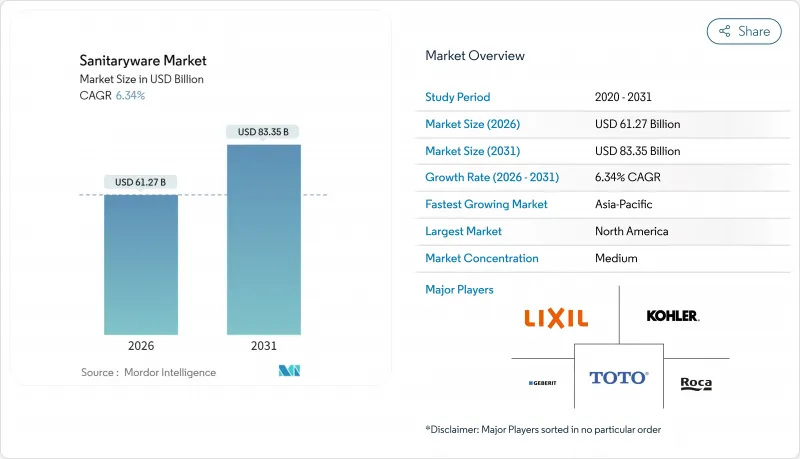

Sanitaryware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The sanitaryware market is expected to grow from USD 57.62 billion in 2025 to USD 61.27 billion in 2026 and is forecast to reach USD 83.35 billion by 2031 at 6.34% CAGR over 2026-2031.

Rising urban populations, large infrastructure projects in emerging regions, and premium bathroom upgrades in mature economies combined to lift unit demand while supporting higher average selling prices. Water-efficient and smart fixtures gain traction as regulators tighten flow-rate rules and consumers seek convenience, driving manufacturers to embed IoT connectivity and antimicrobial glazing in core lines. The Middle East & Africa shows the strongest regional trajectory on the back of USD 1.5 trillion worth of mega-projects, while Asia-Pacific retains the largest regional foothold as housing starts and renovation cycles continue at scale. Margin resilience hinges on vertical integration in raw materials, energy-saving kiln technologies, and omnichannel distribution that blends direct-to-consumer platforms with project-based partnerships.

Global Sanitaryware Market Trends and Insights

Premium and Water-Efficient Product Uptake

Growing emphasis on water conservation and wellness drives a rapid pivot toward premium fixtures across the sanitaryware market. TOTO's 2025 WASHLET S5 showcases tankless heating that reduces energy use by 38%, verifying how design advances can meet sustainability goals while commanding higher price points. A 2024 Houzz survey of 1,247 U.S. homeowners found 41% installing specialty toilet features, including 23% with bidet seats and 19% with self-cleaning functionality . Regulatory frameworks such as WaterSense labeling and regional drought policies encourage builders to specify low-flow toilets and faucets, thereby accelerating premium substitution. IoT-enabled smart toilets help facilities teams monitor usage and predict maintenance, cutting life-cycle costs for institutional buyers. Higher margins on technologically advanced models compensate for slower volume growth in price-sensitive segments, supporting overall profitability across the sanitaryware market.

Modular, Space-Saving Prefabricated Bathroom Pods

Developers in high-density cities require faster project cycles, making prefabricated pods an attractive alternative that embeds sanitaryware in fully finished modules. Asia-Pacific construction firms have deployed standardized bathroom pods at scale to shorten on-site labor time, address skilled-trade shortages, and improve defect rates. Mega-developments such as Saudi Arabia's NEOM integrate industrialized construction techniques, creating opportunities for suppliers that can deliver pod-optimized toilets, basins, and plumbing assemblies. Factory-controlled environments also enable stricter quality checks and facilitate advanced coatings that are harder to apply consistently in field settings. The shift forces sanitaryware producers to design collections compatible with modular frames, reshaping supply chains and broadening after-sales service requirements across the sanitaryware market.

Volatile Energy and Raw-Material Prices (Clay, Zircon)

Zircon sand provides critical opacity in ceramic glazes and accounts for over half of global zircon output dedicated to ceramics, leaving producers exposed to supply swings and price spikes. Natural gas costs for tunnel kilns soared across Europe in 2024, amplifying operating expenses and squeezing margins. Smaller regional manufacturers often lack hedging tools or long-term contracts, raising the risk of production stoppages. Vertical integration and recycled-material substitution offer partial relief but require capital outlays and technological know-how. Persistent volatility could accelerate consolidation as financially stronger firms secure raw-material pipelines in the sanitaryware market.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce-Led Direct-to-Consumer Expansion

- Renovation Surge in Mature Economies

- Stringent Kiln-Emission and Wastewater Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Toilets and cisterns accounted for 41.89% of the sanitaryware market share in 2025 as their essential nature secures baseline demand in every build class. Wash basins and sinks register the highest 6.71% CAGR through 2031, reflecting consumer desire for statement pieces and hygienic touch-free sensor taps that elevate everyday routines. Accelerating design iterations, thin-rimmed basins, matte finishes, and rimless toilets drive up average selling prices and reinforce brand differentiation. Bathtubs approach maturity in North America and Europe, yet gain ground in Southeast Asia, where rising disposable incomes foster spa-like bathroom aspirations. Smart toilet penetration further widens revenue streams through app-based analytics subscriptions, adding service income to core hardware sales within the sanitaryware market.

Smart toilets equip instantaneous water heaters and occupancy sensors that cut standby losses, turning energy savings into a tangible selling proposition. Urinals benefit from hybrid flush valves that use just 0.5 L per cycle, fulfilling stringent building-code mandates. Bidet seats, once a niche in Western homes, gain mainstream acceptance post-pandemic as hygiene narratives take hold. Accessory categories such as ceramic soap dispensers and matching toilet brush holders help brands capture full-suite contracts, especially in hospitality and multifamily housing. Consistent product refresh cycles keep the sanitaryware market dynamic and innovation-driven.

Ceramic sanitary ware retained 77.05% share of the market in 2025 and remains the reference standard due to cost efficiency, mechanical strength, and a well-developed global supplier base. Solid-surface and engineered mineral composites grow 6.45% CAGR as architects seek seamless, color-integrated fixtures that can be repaired on-site, an attribute prized in luxury hospitality. High-pressure cast ceramic allows sharper lines that echo minimalist architectural trends, closing the aesthetic gap with composites. Pressed metal and stainless-steel stay relevant for high-abuse public washrooms where vandal resistance prevails over design. Recycled-content glazes and vitrified waste aggregates emerge in line with circular-economy directives, narrowing environmental performance differentials and broadening material choice in the sanitaryware market.

Composite adoption remains cost-sensitive, yet project budgets in premium multifamily and boutique hotels support the premium. Manufacturers highlight life-cycle cost savings through scratch repair kits and lower weight, which reduces transport emissions. Acrylic continues to dominate shower bases but faces competition from thin-profile porcelain-enamel steel pans that boast better recyclability. Material R&D efforts concentrate on antibacterial nanoparticles and low temperature sintering that curbs kiln energy use. These advances deepen supply-chain resilience while fostering brand narratives anchored in sustainability.

The Global Sanitaryware Market Report is Segmented by Product Type (Toilets & Cisterns, Wash Basins & Sinks, Bathtubs & Whirlpool Tubs, Urinals, Bidets, Other Products), Material (Ceramic, Pressed Metal, and More), End-User (Residential, Commercial, Institutional), Distribution Channel (B2C/Retail, B2B/Project), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 39.72% of the sanitaryware market share in 2025, buoyed by vigorous residential projects in India, Indonesia, and Vietnam, along with robust renovation cycles in Japan and South Korea. China's slowdown after 2024 tempered regional growth but did not offset gains elsewhere. Local manufacturers leverage proximity to cost-competitive raw materials and rising mid-tier consumption to sustain capacity utilization. Government housing schemes and urban redevelopment plans underpin a stable base-volume demand.

The Middle East & Africa region registers the fastest 6.95% CAGR through 2031 as giga-projects, NEOM, Red Sea Global, and Dubai 2040, mobilize thousands of residential and hospitality units, each demanding comprehensive bathroom packages. Prefabricated bathroom pods gain special traction given the harsh on-site conditions and skilled labor scarcity. Local content mandates encourage joint ventures, pushing global brands to establish warehousing and light assembly in Saudi Arabia and the UAE to accelerate delivery timelines within the sanitaryware market.

North America benefits from sustained renovation spending, spurred by an aging housing stock and record home-equity levels that fund bath remodels. Federal infrastructure spending filters into public facilities and affordable housing developments, boosting institutional demand. Europe remains subdued due to higher borrowing costs and cautious developer sentiment, yet pockets of resilience appear in Poland and Ireland, where public investment persists. Carbon regulations incentivize low-flow fixtures and recycled ceramic content, nudging product portfolios toward sustainability. Latin America and the rest of Africa present mixed dynamics tied to macro-economic volatility, but gradual urbanization and infrastructure commitments keep a floor under volume demand. The geographic mosaic necessitates calibration of product features, price points, and distribution models across the sanitaryware market.

- TOTO Ltd.

- Kohler Co.

- LIXIL Corporation (incl. American Standard, GROHE)

- Roca Sanitario S.A.

- Geberit AG

- Hansgrohe SE

- Villeroy & Boch AG

- Duravit AG

- Jaquar Group

- Ideal Standard International

- RAK Ceramics PJSC

- Huida Sanitary Ware Co.

- Guangdong Faenza Ceramics

- CERA Sanitaryware Ltd.

- Hindware Home Innovation Ltd.

- VitrA (EczacIbasI)

- Lecico Egypt

- H & R Johnson (Prism Johnson)

- Oras Group

- Colavene S.p.A.

- Globe Union Industrial Corp.

- Jabra Sanitary

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premium-segment and water-efficient product uptake

- 4.2.2 Modular, space-saving & prefabricated bathroom pods

- 4.2.3 E-commerce-led D2C sanitaryware sales expansion

- 4.2.4 Renovation-driven bathroom remodel surge in mature economies

- 4.2.5 Rapid urbanization & residential construction boom

- 4.2.6 Smart, antimicrobial ceramic-coating innovations

- 4.3 Market Restraints

- 4.3.1 Volatile energy & raw-material prices (clay, zircon)

- 4.3.2 Stringent kiln-emission & wastewater regulations

- 4.3.3 Plumbing labour shortages delaying installations

- 4.3.4 Refurbishment/reuse trend under circular-economy pressure

- 4.4 Industry Value Chain Analysis

- 4.5 Porter'ss Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations in the Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Toilets & Cisterns (Water Closets)

- 5.1.2 Wash Basins & Sinks (incl. Pedestal Basins)

- 5.1.3 Bathtubs & Whirlpool Tubs

- 5.1.4 Urinals

- 5.1.5 Bidets

- 5.1.6 Other Products (such as ceramic soap trays, soap dispensers, etc.)

- 5.2 By Material

- 5.2.1 Ceramic

- 5.2.2 Pressed Metal

- 5.2.3 Acrylic & Plastics

- 5.2.4 Solid Surface & Composite

- 5.3 By End-User

- 5.3.1 Residential (New-build and Renovation)

- 5.3.2 Commercial (Hospitality, Offices, Retail)

- 5.3.3 Institutional (Healthcare, Education, Public)

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Multi-brand Stores

- 5.4.1.2 Exclusive Brand Outlets

- 5.4.1.3 Local Hardware Stores

- 5.4.1.4 Online

- 5.4.2 B2B/Project (developers, architects, interior designers, contractors, etc.)

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 TOTO Ltd.

- 6.4.2 Kohler Co.

- 6.4.3 LIXIL Corporation (incl. American Standard, GROHE)

- 6.4.4 Roca Sanitario S.A.

- 6.4.5 Geberit AG

- 6.4.6 Hansgrohe SE

- 6.4.7 Villeroy & Boch AG

- 6.4.8 Duravit AG

- 6.4.9 Jaquar Group

- 6.4.10 Ideal Standard International

- 6.4.11 RAK Ceramics PJSC

- 6.4.12 Huida Sanitary Ware Co.

- 6.4.13 Guangdong Faenza Ceramics

- 6.4.14 CERA Sanitaryware Ltd.

- 6.4.15 Hindware Home Innovation Ltd.

- 6.4.16 VitrA (EczacIbasI)

- 6.4.17 Lecico Egypt

- 6.4.18 H & R Johnson (Prism Johnson)

- 6.4.19 Oras Group

- 6.4.20 Colavene S.p.A.

- 6.4.21 Globe Union Industrial Corp.

- 6.4.22 Jabra Sanitary

7 Market Opportunities & Future Outlook

- 7.1 Ultra-Low-Flush & Water-Recycling Technologies

- 7.2 Circular-Economy Repair, Reuse & Take-Back Programs

- 7.3 Digital-First Procurement: E-commerce & Virtual Showrooms