PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911299

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911299

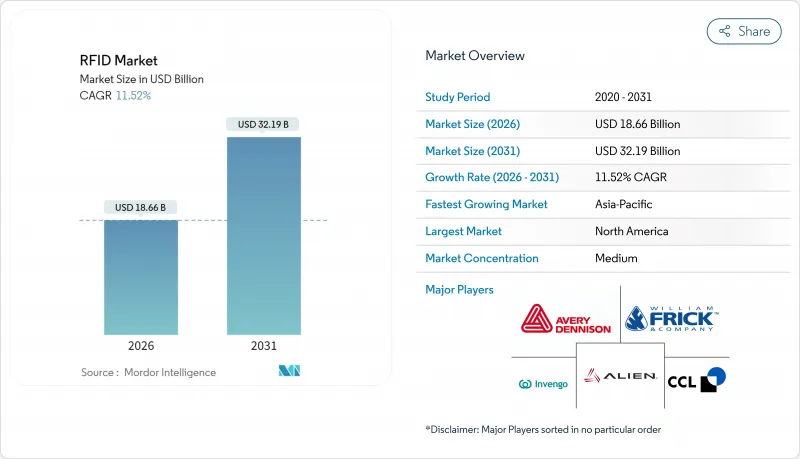

RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The RFID market was valued at USD 16.73 billion in 2025 and estimated to grow from USD 18.66 billion in 2026 to reach USD 32.19 billion by 2031, at a CAGR of 11.52% during the forecast period (2026-2031).

The current upswing reflects the technology's shift from a niche tool into a core enabler of omnichannel retail, regulated healthcare, and government digital-infrastructure programs. Sustained reductions in UHF inlay pricing below USD 0.04 have lowered entry barriers, while improved Gen2v3 protocols enhance read reliability in crowded environments. Government mandates such as the FDA DSCSA and India's FASTag scheme continue to pull large-volume deployments. At the same time, cloud analytics platforms convert raw tag reads into predictive maintenance and inventory-planning data that executive teams use for faster decision making. As a result, the RFID market is on course to penetrate high-growth verticals, reinforcing a multi-year investment cycle in tags, readers, and software ecosystems.

Global RFID Market Trends and Insights

Global Serialization Mandates Accelerating Pharmaceutical Supply-Chain Transformation

Pharmaceutical legislation in the United States and European Union now obliges distributors to maintain end-to-end electronic track-and-trace capabilities. RFID's capacity to house serialized identifiers, expiration data, and aggregation codes inside a single tag has proved superior to 2D barcodes for managing high transaction volumes. Fresenius Kabi's deployment underscores how embedded tag data automates lot-level recalls and strengthens patient-safety checks. With compliance deadlines converging, pharmaceutical executives increasingly regard RFID as a strategic asset rather than a regulatory expense, reinforcing long-term demand in the RFID market.

Item-Level RFID Mandates Transforming Retail Inventory Management

Large retailers are widening RFID requirements from apparel into electronics, stationery, and perishables. Walmart's latest mandate and Kroger's bakery rollout illustrate how accurate, real-time stock visibility lifts on-shelf availability above 95% and reduces stockouts by up to 30%. Faster self-checkout and labor savings enhance store economics, making RFID adoption attractive even for mid-tier retailers. As omnichannel models demand unified inventory views, item-level tagging is set to anchor near-term revenue for the RFID market.

Privacy Regulations Creating Implementation Complexity

GDPR and analogous laws mandate data-minimization principles that complicate RFID projects capturing personal information. Retailers must embed privacy-by-design controls, shift sensitive data to back-end databases, and offer opt-out pathways, adding legal review cycles to implementation roadmaps. The resulting compliance overhead slows deployment decisions and trims near-term growth expectations within the RFID market.

Other drivers and restraints analyzed in the detailed report include:

- Government Infrastructure Programs Driving UHF Volume Growth

- Data-Center and Hospital Asset-Tracking Demands

- Electromagnetic Interference Limiting Industrial Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RFID Tags delivered USD 8.83 billion in 2025 revenue, equating to a 52.78% slice of overall RFID market share thanks to their low unit cost and maintenance-free design. Sub-USD 0.04 UHF inlays unlock high-volume consumer-goods labeling, while pharmaceutical serialization adds defensible premium-tag demand. Readers and interrogators, though lower in shipment numbers, generate higher average-selling prices as enterprises adopt multi-protocol, cloud-connected devices. RFID Antennas and middleware form the integration fabric that converts raw reads into operational data, turning simple identification into end-to-end visibility.

Active RFID and RTLS infrastructure is projected to increase at a 12.52% CAGR, reflecting executive priority on real-time location and environmental monitoring inside data centers and hospitals. The RFID market size for active platforms is forecast to exceed USD 6.45 billion by 2031, benefiting from bundled sensor sales and software subscriptions. Battery-assisted passive tags occupy a hybrid position, expanding viability in warehouse automation where longer read ranges are required without full battery cost. Printed and chipless formats remain at pilot scale, yet breakthroughs in roll-to-roll manufacturing could unlock future price disruption inside the broader RFID market.

UHF captured 40.72% of 2025 revenue, with the RFID market size for this band on track to surpass USD 14.9 billion by 2031 amid a 12.45% CAGR. Retail inventory cycles favor UHF for fast, multi-item reads, while serialization programs value the added data capacity. Recent Gen2v3 improvements boost performance in tag-dense settings, expanding suitability for mixed-material warehouses.

High-Frequency/NFC remains indispensable for contactless payments and consumer-electronics pairing, though its single-digit growth reflects near-saturation in many mature markets. Low-Frequency tags hold niche roles in livestock management and automotive immobilizers where metal penetration is critical. Microwave deployments meet high-speed tolling and industrial automation needs but face cost hurdles. Vendors are now experimenting with frequency-selective antennas capable of reading LF, HF, and UHF tags in parallel, an innovation that could blur segment boundaries in the RFID market.

RFID Market is Segmented by Technology (RFID Tags, RFID Readers/Interrogators, RFID Antennas, RFID Middleware and Software, Active RFID/RTLS Infrastructure), Frequency Band (Low Frequency, High Frequency/NFC, Ultra-High Frequency, Microwave), Application (Retail and Apparel, Healthcare and Medical, and More), End-User Industry (FMCG and CPG, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.15% revenue share in 2025, anchored by DSCSA compliance, aggressive retail mandates, and large-scale data-center footprints. Healthcare providers accelerate RTLS rollouts to cut asset hoarding and enhance patient throughput, while cloud operators expand tag-enabled monitoring across hyperscale campuses. Policy certainty and mature channel partnerships support continued capital allocation toward RFID deployments, keeping the region at the forefront of the RFID market.

Asia Pacific delivers the strongest trajectory at a 12.58% CAGR. India's FASTag program alone introduced more than 60 million tags in the past 18 months, fostering domestic tag assembly lines and lowering regional BOM costs. Chinese OEMs integrate RFID into factory-floor MES systems under the Made-in-China 2025 framework, while Southeast Asian retailers adopt the technology to leapfrog manual inventory methods. These vectors combine to elevate the RFID market across Asia Pacific.

Europe sustains high-single-digit growth powered by the EU Falsified Medicines Directive and emerging Digital Product Passport legislation. Privacy regulation slows consumer-facing deployments but encourages innovation in recyclable labels and secure cloud architectures. Middle East & Africa and South America remain nascent, though government identity and toll projects signal future step-ups in local RFID market demand.

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Impinj Inc.

- NXP Semiconductors N.V.

- Alien Technology LLC

- HID Global (Assa Abloy)

- CCL Industries Inc.

- SML Group Ltd.

- Checkpoint Systems Inc.

- Smartrac Technology GmbH

- Invengo Technology Pte Ltd.

- Honeywell Productivity and Workflow Solutions

- Nedap N.V.

- William Frick and Company

- Trace-Tech ID Solutions SL

- Hangzhou Century Co. Ltd.

- JADAK Technologies Inc.

- SATO Holdings Corp.

- Murata Manufacturing Co. Ltd.

- STMicroelectronics N.V.

- Confidex Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Serialization Mandates (FDA DSCSA, EU FMD) Accelerating RFID Adoption in Pharma Supply Chains

- 4.2.2 Item-level RFID Roll-outs by Retail Majors (Walmart, Inditex) Enabling Omnichannel Visibility

- 4.2.3 Government-backed Toll and Vehicle Tag Programs (India FASTag, China ETC) Expanding UHF Volumes

- 4.2.4 Data-center and Hospital Asset-tracking Demands for Real-time Location Services (RTLS)

- 4.2.5 Sub- USD 0.04 UHF Inlay Pricing Unlocking High-velocity FMCG Use-cases

- 4.2.6 IoT-Cloud Analytics Integration Boosting ROI and Predictive Maintenance

- 4.3 Market Restraints

- 4.3.1 Privacy-surveillance Concerns Triggering Stricter EU GDPR-style RFID Governance

- 4.3.2 Electromagnetic Interference from Metals/Liquids Hindering Industrial Read Accuracy

- 4.3.3 Tag Collision and Dense-read Environment Performance Limitations

- 4.3.4 Low-cost BLE and UWB Alternatives Competing for Indoor Tracking Budgets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 RFID Regulations and Standards (EPC Gen2, ISO 15693/18000, GDPR Article 35)

- 4.5.2 RFID and IoT Convergence Roadmap (5G, NFC, Digital Twins)

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis

- 4.8 Industry Stakeholder Analysis

- 4.9 Critical Success Factors for RFID Implementation

- 4.10 Gap Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 RFID Tags

- 5.1.1.1 Passive (LF, HF, UHF)

- 5.1.1.2 Active

- 5.1.1.3 Battery-Assisted Passive

- 5.1.1.4 Printed / Chipless

- 5.1.2 RFID Readers / Interrogators

- 5.1.2.1 Fixed Portal

- 5.1.2.2 Handheld

- 5.1.2.3 Integrated Mobile

- 5.1.3 RFID Antennas

- 5.1.4 RFID Middleware and Software

- 5.1.5 Active RFID / RTLS Infrastructure

- 5.1.1 RFID Tags

- 5.2 By Frequency Band

- 5.2.1 Low Frequency (125-134 kHz)

- 5.2.2 High Frequency / NFC (13.56 MHz)

- 5.2.3 Ultra-High Frequency (860-960 MHz)

- 5.2.4 Microwave (2.45 GHz)

- 5.3 By Application

- 5.3.1 Retail and Apparel

- 5.3.2 Healthcare and Medical

- 5.3.3 Transportation and Logistics

- 5.3.4 Manufacturing and Industrial IoT

- 5.3.5 Automotive and Passenger Mobility

- 5.3.6 Agriculture and Livestock

- 5.3.7 Data Centers and IT Assets

- 5.3.8 Aerospace and Defence

- 5.3.9 Consumer Electronics and Smart Home

- 5.3.10 Payments and Access Control

- 5.4 By End-User Industry

- 5.4.1 FMCG and CPG

- 5.4.2 Government and Public Sector

- 5.4.3 Hospitality and Entertainment

- 5.4.4 Energy and Utilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Nordics (Sweden, Norway, Finland, Denmark)

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 United Kingdom

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Impinj Inc.

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Alien Technology LLC

- 6.4.6 HID Global (Assa Abloy)

- 6.4.7 CCL Industries Inc.

- 6.4.8 SML Group Ltd.

- 6.4.9 Checkpoint Systems Inc.

- 6.4.10 Smartrac Technology GmbH

- 6.4.11 Invengo Technology Pte Ltd.

- 6.4.12 Honeywell Productivity and Workflow Solutions

- 6.4.13 Nedap N.V.

- 6.4.14 William Frick and Company

- 6.4.15 Trace-Tech ID Solutions SL

- 6.4.16 Hangzhou Century Co. Ltd.

- 6.4.17 JADAK Technologies Inc.

- 6.4.18 SATO Holdings Corp.

- 6.4.19 Murata Manufacturing Co. Ltd.

- 6.4.20 STMicroelectronics N.V.

- 6.4.21 Confidex Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment