PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911301

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911301

Digital Textile Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

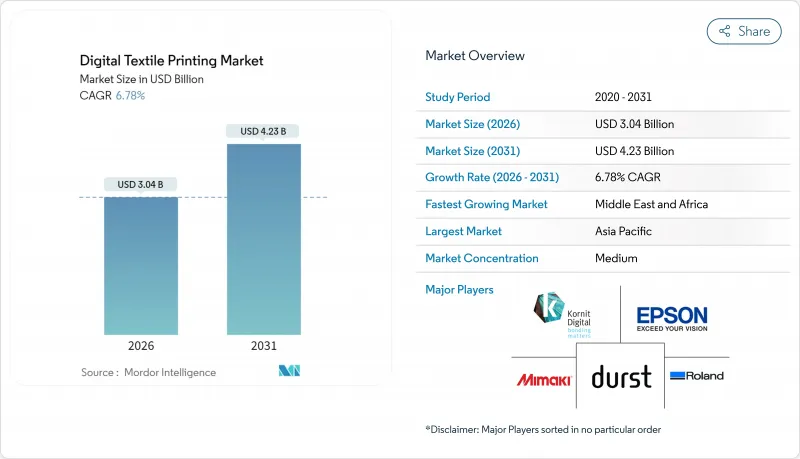

Digital textile printing market size in 2026 is estimated at USD 3.04 billion, growing from 2025 value of USD 2.85 billion with 2031 projections showing USD 4.23 billion, growing at 6.78% CAGR over 2026-2031.

Expanding e-commerce channels, regulatory pressure to reduce water use in finishing operations, and rapid progress in single-pass inkjet technology together create a durable demand curve that outperforms legacy analog printing. Brands now blend micro-collections with on-demand manufacturing to cut inventory risk, while compliance mandates in the European Union and California accelerate the shift toward low-water pigment solutions. Asia-Pacific dominates production because of established supply chains and competitive input costs, yet Middle East and Africa records the fastest adoption as governments diversify away from hydrocarbons and invest in export-oriented manufacturing. On the competitive front, hardware specialists combine proprietary inks, workflow software, and service contracts to lock in recurring revenue and deepen client stickiness.

Global Digital Textile Printing Market Trends and Insights

Personalisation-led micro-collections boom

Labels now pilot capsule lines in weekly drops, eliminating minimum order quantities and monetising higher margins on customised apparel. Kornit Digital's Apollo platform enables companies such as T-Formation to release same-day designs that meet shifting consumer tastes. Print-on-demand players consolidate capacity-as seen in the 2024 Printful/Printify merger-to serve this surge in bespoke garments. Lower inventory risk, premium price points, and dramatically shorter design-to-shelf cycles collectively lift throughput across the digital textile printing market. The trend also supports circular economy objectives by reducing surplus stock and related waste. Demand for design-to-garment workflows therefore remains a central accelerator for the next phase of market expansion.

Single-pass inkjet productivity leap

Single-pass printers lay down an entire image in one motion, reaching speeds 10-20 times faster than classic multi-pass systems. Delta Group's third EFI Nozomi 14000 SD installation underscores how brands replace analog lines to cut lead times for display graphics. Mimaki's Tiger600-1800TS, launched in February 2025 for MEA users, offers similar gains in dye-sublimation throughput. Machine-learning-driven calibration ensures colour consistency at industrial scale. As cost per square metre falls in parallel with cycle times, single-pass adoption widens the addressable base for the digital textile printing market, especially where weekly or daily product refreshes are the norm.

High capex for industrial systems

Entry-level single-pass lines cost USD 500,000-USD 2 million, placing them beyond the reach of many SMEs. Financing barriers are more acute in regions with under-developed capital markets, extending payback horizons and slowing equipment refresh cycles. Leasing programmes and print-as-a-service contracts from OEMs help amortise costs, yet the burden of consumables-which can equal 40-60% of operating expenditure-remains. The digital textile printing market therefore advances unevenly until capital hurdles are offset by lower per-unit costs and quicker order-to-cash timelines.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce print-on-demand fulfilment

- Water-saving compliance mandates

- PFAS-linked pigment regulatory risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Roll-to-Roll systems delivered 64.92% of the digital textile printing market size in 2025, supported by their compatibility with high-volume apparel, soft-signage, and home-textile runs. Continued improvements in printheads and inline fixation keep cost per square metre attractive, ensuring enduring relevance for bulk orders. Concurrently, Single-Pass Line platforms are scaling fastest at a 10.22% CAGR, bringing industrial throughput to low-run jobs and enabling brands to merge sampling and mass production on one line. Hybrid configurations that marry analog under-bases with digital overprints now help converters maximise uptime while flexibly deploying screens or inkjets to match artwork complexity.

The digital textile printing market benefits when converters adopt direct-to-garment options that share single-pass heads, reducing equipment redundancy and inventory. EFI, Mimaki, and Kornit Digital each package colour management, maintenance analytics, and workflow automation in their ecosystems, raising switching costs. For enterprises still amortising legacy screens, modular retrofits offer a transitional path, mitigating capex risk without stalling digital transition.

Disperse inks captured 41.88% of the digital textile printing market share in 2025, cemented by polyester's reigning material dominance. Sublimation chemistries, however, notch the quickest 9.12% CAGR because sportswear, promotional flags, and backlit displays prize vivid, durable colour that sublimates into fibre with minimal post-treatment. Pigment sets gain favour as waterless workflows and one-step finishing address tightening environmental codes; OEM introductions such as DuPont's Artistri(R) PN1000 series illustrate the pivot from reactive dyes toward greener, cross-substrate options.

Reactive inks hold sway in cotton-heavy regions where deep shade penetration and wash resistance are mission-critical, while acid inks cater to silk and wool, sustaining premium segments. Ink innovation continues to revolve around lowering curing temperatures and improving nozzle open time, factors that directly influence uptime economics in the digital textile printing market.

The Digital Textile Printing Market Report is Segmented by Printing Method (Roll-To-Roll Printing, Direct-To-Garment (DTG), and More), Ink Type (Sublimation, Pigment, Reactive, Acid, Disperse), Application (Garment and Apparel, Home Textiles, Technical Textiles, Display and Signage), Substrate (Cotton, Polyester, Silk, Nylon, Blends), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 42.10% of global shipments in 2025, anchored by China's USD 77.9 billion yarn and fabric exports and India's aggressive policy packages, including seven PM MITRA parks backed by USD 2.2 billion in incentives. Lower labour rates, dense supplier clusters, and deep port networks keep landed costs competitive even as energy and environmental rules tighten. Regional OEM partnerships funnel single-pass equipment into vertically integrated mills, lowering the adoption barrier for niche brands entering the digital textile printing market.

Middle East & Africa registers the sharpest 10.75% CAGR to 2031 as governments pursue diversification. The UAE and Saudi Arabia leverage free-zone incentives while Egypt teams with Turkish producers to supply US buyers, taking advantage of USD 103 monthly minimum wages. Infrastructure projects such as industrial parks in Morocco and Ethiopia attract foreign direct investment that positions the region as an agile, tariff-hedged alternative to Asian sourcing.

Europe emphasises ecological compliance under the ESPR, prompting mills to adopt water-saving pigment workstreams and recycled fibre blends. Brands near-shore micro-capsule runs to shorten delivery windows, a strategy aligned with the continent's mature consumer base demanding transparency and sustainable credentials. North America's reshoring renaissance advances at 2.8% annual growth since 2020, with players like Shawmut Infinite investing USD 8 million to modernise integrated knit-to-finish lines. South American growth is steady yet hampered by logistics gaps and macro volatility, limiting its share of the digital textile printing market despite favourable raw-material availability.

- Kornit Digital

- Seiko Epson Corporation

- Mimaki Engineering

- Durst Group

- Electronics For Imaging

- D.Gen Inc.

- Aeoon Technologies

- Roland DG

- Ricoh Company

- ColorJet

- ATP Color

- SPGPrints

- HP Inc.

- Brother International

- Mutoh Industries

- MS Printing Solutions

- Kyocera Corp.

- FujiFilm Dimatix

- ROQ International

- Shenzhen Homer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Personalisation-led micro-collections boom

- 4.2.2 Single-pass inkjet productivity leap

- 4.2.3 E-commerce print-on-demand fulfilment

- 4.2.4 Water-saving compliance mandates

- 4.2.5 Near-shoring for resilient supply chains

- 4.2.6 On-garment sustainable pigment advances

- 4.3 Market Restraints

- 4.3.1 High capex for industrial systems

- 4.3.2 Ink-fabric compatibility hurdles

- 4.3.3 Colour-fastness QA bottlenecks

- 4.3.4 PFAS-linked pigment regulatory risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Macroeconomic Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Method

- 5.1.1 Roll-to-Roll Printing

- 5.1.2 Direct-to-Garment (DTG)

- 5.1.3 Single-Pass Line

- 5.1.4 Hybrid (Analog + Digital)

- 5.1.5 Other Printing Method

- 5.2 By Ink Type

- 5.2.1 Sublimation

- 5.2.2 Pigment

- 5.2.3 Reactive

- 5.2.4 Acid

- 5.2.5 Disperse

- 5.3 By Application

- 5.3.1 Garment and Apparel

- 5.3.2 Home Textiles

- 5.3.3 Technical Textiles

- 5.3.4 Display and Signage

- 5.4 By Substrate

- 5.4.1 Cotton

- 5.4.2 Polyester

- 5.4.3 Silk

- 5.4.4 Nylon

- 5.4.5 Blends

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 Italy

- 5.5.2.3 United Kingdom

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Turkey

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 United Arab Emirates

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kornit Digital

- 6.4.2 Seiko Epson Corporation

- 6.4.3 Mimaki Engineering

- 6.4.4 Durst Group

- 6.4.5 Electronics For Imaging

- 6.4.6 D.Gen Inc.

- 6.4.7 Aeoon Technologies

- 6.4.8 Roland DG

- 6.4.9 Ricoh Company

- 6.4.10 ColorJet

- 6.4.11 ATP Color

- 6.4.12 SPGPrints

- 6.4.13 HP Inc.

- 6.4.14 Brother International

- 6.4.15 Mutoh Industries

- 6.4.16 MS Printing Solutions

- 6.4.17 Kyocera Corp.

- 6.4.18 FujiFilm Dimatix

- 6.4.19 ROQ International

- 6.4.20 Shenzhen Homer

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment