PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911305

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911305

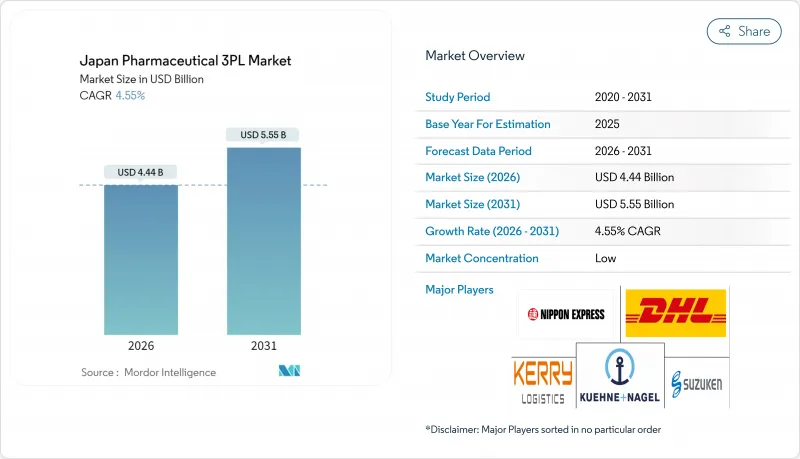

Japan Pharmaceutical 3PL - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Japan Pharmaceutical 3PL Market is expected to grow from USD 4.25 billion in 2025 to USD 4.44 billion in 2026 and is forecast to reach USD 5.55 billion by 2031 at 4.55% CAGR over 2026-2031.

Japan's strict Good Distribution Practice (GDP) rules, an aging population that relies heavily on biologics, and rising demand for cell and gene therapies are steering drug makers toward outsourced logistics partners. Providers able to offer temperature-controlled transport from -196 °C to ambient conditions, real-time shipment monitoring, and nationwide regulatory expertise are gaining share. Service differentiation now hinges on AI-enabled route planning, IoT sensors that verify cold-chain integrity, and carbon-neutral warehousing solutions aligned with Japan's 2050 decarbonization goal. Intensifying investment in biologics plants around Yokohama, Osaka, and Fukuoka keeps domestic transport volumes high while stimulating double-digit growth in cross-border flows of clinical trial materials and high-value finished drugs. Regulatory scrutiny after bid-rigging cases among wholesalers has raised compliance costs, yet it has also strengthened customer preference for logistics specialists with flawless audit records.

Japan Pharmaceutical 3PL Market Trends and Insights

Growing demand for temperature-controlled biologics & vaccines

Biologics now outpace small-molecule drugs in revenue growth, forcing shippers to deploy ultra-low temperature packaging that secures potency from factory to patient. AGC Biologics' USD 350.5 million Yokohama plant dedicated to cell therapies has already spurred contracts for -80 °C storage and dry-vapor dewars on domestic trunk routes. Panasonic's VIXELL containers, certified for <=-70 °C stability over 18 days, enable airlines such as ANA Cargo to obtain IATA CEIV Pharma accreditation, a prerequisite for global biologics traffic. Real-time sensors that log excursions feed analytics engines, allowing carriers to adjust routing before spoilage occurs. As a result, cold-chain premiums often exceed ambient rates by 20-30%, improving margins for GDP-licensed 3PLs.

Outsourcing trend among Japanese pharma manufacturers

Government pricing reforms have squeezed producer margins, and quality lapses at generics firms heightened the risk of managing logistics in-house. Membership in the Japan CMO Association has doubled since 2021 as producers hand off packaging, storage, and compliant shipping to 3PLs. Meiji Seika Pharma's decision to export 3 billion tablets annually from its Indian plant while using GDP-qualified Japanese hubs underscores the new mixed-location model. Capital light strategies free R&D budgets while guaranteeing audit-ready documentation, making outsourcing the norm for both legacy brands and biosimilar challengers.

GDP compliance cost & qualified-labour shortage

PMDA audits require validated chambers, backup generators, and written SOPs, lifting entry investment to nearly USD 12 million for a mid-sized facility. A shortage of GDP-trained technicians pushes median annual wages 18% above general warehouse staff. Smaller regional 3PLs often fail mock inspections, prompting mergers or exits that reduce competitive intensity in niche lanes.

Other drivers and restraints analyzed in the detailed report include:

- Surge in pharma e-commerce & last-mile cold-chain demand

- AI-driven spoilage reduction & route optimization

- Scarcity & cost of urban cold-storage real estate

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Domestic transportation management accounted for 42.15% of the Japan pharmaceutical 3PL third-party logistics market in 2025 thanks to dense production clusters in Kanto and Kansai linked to over 8,000 hospitals and 59,000 pharmacies nationwide. With the Japan pharmaceutical 3PL third-party logistics market size dependent on daily replenishment cycles, carriers operate temperature-segregated box trucks equipped with real-time GPS and door sensors. Same-day lead times have become standard, and regulatory expectations compel providers to maintain onboard printers for tamper-evident labels on every stop.

International transportation management, although smaller, is rising at 5.25% CAGR as Japanese drug makers expand global clinical trials and biologics imports. The segment's premium stems from double-layer packaging, redundant dataloggers, and compliance with EU GDP and U.S. CFR-21. Nippon Express leverages a network of 36 GDP-certified stations across 25 countries to orchestrate lane-temperature profiles before flight booking, minimizing excursion risk. These capabilities attract sponsors shipping investigational cell therapies, where one deviation can annul an entire batch valued at USD 0.5 million.

Pharmaceutical manufacturers contributed 44.10% of the Japanese pharmaceutical 3PL third-party logistics market in 2025, a testament to their legacy dominance and the continued need for bulk distribution to wholesalers. Rising serialization and recall preparedness have made external 3PLs indispensable for batch traceability, leading to multi-year master service agreements covering packaging, warehousing, and reverse logistics.

Biotech and biosimilar producers form the fastest-growing customer group at 6.55% CAGR, reflecting government incentives for regenerative medicine. Start-ups lacking in-house logistics prefer asset-light partnerships, often employing 3PLs as early as Phase I trials to ensure chain-of-identity records. Clinical research sponsors, specialty pharmacies, and direct-to-patient platforms increasingly demand micro-fulfillment capabilities, widening the revenue base for agile providers.

The Japan Pharmaceutical 3PL Third-Party Logistics Market Report is Segmented by Service Type (Domestic Transportation Management, and More), End User (Pharmaceutical Manufacturers, Biotech & Biosimilar Manufacturers, and More), Product Type (Prescription Drugs, OTC & Consumer Health Products, and More), and Geography (Hokkaido & Tohoku, Kanto, Chubu, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nippon Express

- DHL Logistics

- Kuehne + Nagel

- Kerry Logistics

- CEVA Logistics

- FedEx

- Yusen Logistics

- LOGISTEED

- Yamato Transport

- Sagawa Express

- Nissin Corporation

- Suzuyo Co.

- Mitsubishi Logistics

- Sankyu Inc.

- Kintetsu World Express (KWE)

- NNR Global Logistics

- Suzuken Group

- Itochu Logistics

- Nichirei Logistics Group

- Kokusai Express

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for temperature-controlled biologics & vaccines

- 4.2.2 Outsourcing trend among Japanese pharma manufacturers

- 4.2.3 Surge in pharma e-commerce & last-mile cold-chain demand

- 4.2.4 Drone-based rural delivery pilots

- 4.2.5 Carbon-neutral cold-chain investments

- 4.2.6 AI-driven spoilage reduction & route optimisation

- 4.3 Market Restraints

- 4.3.1 GDP compliance cost & qualified-labour shortage

- 4.3.2 Scarcity & cost of urban cold-storage real estate

- 4.3.3 Rising electricity cost for ultra-low temp warehouses

- 4.3.4 Disaster-risk insurance & contingency cost

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pharmaceutical E-Commerce Market in Japan

- 4.9 Spotlight on Pharma Packaging - Global & Japan Trends

- 4.10 Impact of COVID-19 and Geo-Political Events on the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Domestic Transportation Management (DTM)

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Airways

- 5.1.1.4 Waterways

- 5.1.2 International Transportation Management (ITM)

- 5.1.2.1 Roadways

- 5.1.2.2 Railways

- 5.1.2.3 Airways

- 5.1.2.4 Waterways

- 5.1.3 Value-Added Warehousing & Distribution (VAWD)

- 5.1.1 Domestic Transportation Management (DTM)

- 5.2 By Temperature Type

- 5.2.1 Cold Chain

- 5.2.2 Non-cold Chain

- 5.3 By End User

- 5.3.1 Pharmaceutical Manufacturers

- 5.3.2 Biotech & Biosimilar Manufacturers

- 5.3.3 Clinical Research & Trial Sponsors

- 5.3.4 Hospitals & Retail Pharmacies

- 5.3.5 Healthcare Distributors & Wholesalers

- 5.3.6 E-pharmacies & Direct-to-Patient Services

- 5.3.7 Others

- 5.4 By Product Type

- 5.4.1 Prescription Drugs

- 5.4.2 OTC & Consumer Health Products

- 5.4.3 Biopharmaceuticals & Biosimilars (ex-CGT)

- 5.4.4 Cell & Gene Therapies

- 5.4.5 Vaccines & Blood-derived Products

- 5.4.6 Veterinary Pharmaceuticals & Animal Health Products

- 5.4.7 Medical Devices, Diagnostics & Combination Products

- 5.4.8 Clinical-trial Materials (Investigational Medicinal Products)

- 5.4.9 Others

- 5.5 By Region (Japan)

- 5.5.1 Hokkaido & Tohoku

- 5.5.2 Kanto

- 5.5.3 Chubu

- 5.5.4 Kansai

- 5.5.5 Chugoku & Shikoku

- 5.5.6 Kyushu & Okinawa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Investments)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Nippon Express

- 6.4.2 DHL Logistics

- 6.4.3 Kuehne + Nagel

- 6.4.4 Kerry Logistics

- 6.4.5 CEVA Logistics

- 6.4.6 FedEx

- 6.4.7 Yusen Logistics

- 6.4.8 LOGISTEED

- 6.4.9 Yamato Transport

- 6.4.10 Sagawa Express

- 6.4.11 Nissin Corporation

- 6.4.12 Suzuyo Co.

- 6.4.13 Mitsubishi Logistics

- 6.4.14 Sankyu Inc.

- 6.4.15 Kintetsu World Express (KWE)

- 6.4.16 NNR Global Logistics

- 6.4.17 Suzuken Group

- 6.4.18 Itochu Logistics

- 6.4.19 Nichirei Logistics Group

- 6.4.20 Kokusai Express

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment