PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911318

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911318

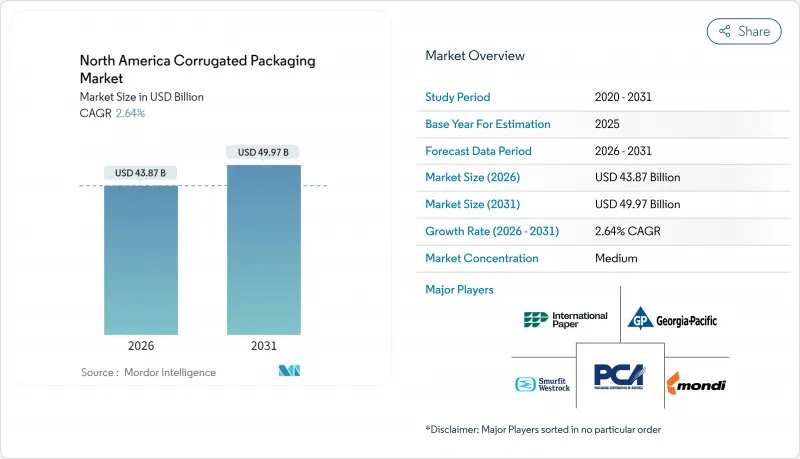

North America Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America Corrugated Packaging Market is expected to grow from USD 42.74 billion in 2025 to USD 43.87 billion in 2026 and is forecast to reach USD 49.97 billion by 2031 at 2.64% CAGR over 2026-2031.

Recycled containerboard captures 49.54% of the corrugated boxes market share in 2024, demonstrating how corporate sustainability mandates favor recycled inputs over virgin fiber. E-commerce fulfillment remains the strongest structural driver as right-sizing initiatives heighten demand for varied flute profiles, while nearshoring of manufacturing shifts box flows closer to the United States and Mexican production hubs. Semi-chemical and specialty grades grow fastest at 3.65% CAGR, reflecting investments in barrier coatings that unlock higher margin food and pharmaceutical applications. Cost pressures persist due to volatile prices of old corrugated cardboard and virgin pulp; however, greater plant automation and AI-enabled demand forecasting help leading producers defend margins and service levels.

North America Corrugated Packaging Market Trends and Insights

Surge in E-commerce Parcel Volumes

E-commerce shipping has shifted demand from palletized replenishment to direct-to-consumer parcels that require stronger, yet lighter, packaging solutions. Amazon's Package Decision Engine now executes over 1 billion dimensional decisions a year, cutting material usage by 15-20 % while still lifting value per box as designs become more complex. Subscription commerce adds stability because recurring orders allow corrugators to optimize run lengths and glue setups. Smaller but more frequent shipments intensify demand for high edge crush strength at low grammage, favoring advanced flute geometries. Automated case erectors and pack stations tie directly into box plants' ERP systems, shrinking buffer inventories and shortening lead times. Collectively, these operating model shifts underpin the corrugated boxes market by translating parcel growth into higher-margin SKU proliferation.

Regulatory Shift toward Recyclable Packaging and Plastic Bans

California's SB 54 mandates a 65% cut in single-use plastic by 2032, catalyzing brand commitments to "paperization" strategies that amplify corrugated uptake. The United States EPA framework to curb plastic pollution aligns state-level extended producer responsibility programs and incentivizes post-consumer content in shipping materials. Multinational firms harmonize global specifications, so EU policy pressure spills into North American packaging briefs. Corrugated plants with in-house recycling assets gain cost and compliance advantages over plastic converters that must retrofit new collection infrastructures. Procurement policies specifying recycled percentages directly elevate demand for recycled containerboard, supporting stable fiber demand even as overall tonnage growth moderates.

Volatility in OCC and Virgin Pulp Prices

Old corrugated cardboard values fell 28% year-over-year in 2024, yet virgin pulp held firm due to shipping disruptions and mill downtime, squeezing integrated producers' spreads. Packaging Corporation of America lifted linerboard prices by USD 70 per ton in early 2025 to offset cost swings, but the increases risk demand elasticity in the price-sensitive segment. Recycled fiber availability correlates with municipal collection efficiency, which fluctuates with consumer behavior. Currency shifts complicate Canadian sourcing as pulp imports settle in U.S. dollars. To hedge volatility, converters carry higher stock levels, tying up working capital and diluting return on invested capital, thereby tempering the corrugated boxes market momentum.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight High-Strength Micro-Flutes and Material Savings

- AI-Enabled Right-Sizing and On-Demand Box Production

- Substitution Threat from Flexible and Rigid Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recycled containerboard generated the largest 2025 revenue, commanding 49.02% of the corrugated boxes market share. The corrugated boxes market size for semi-chemical and specialty grades is projected to climb at a 3.50% CAGR owing to rising demand for moisture-resistant liners in ready-to-eat meals. Brands embed recycled-content targets into procurement scorecards, encouraging mills to back-integrate into material recovery facilities to secure fiber streams. The Cascades Greenpac refinance of USD 250 million widens recycled lightweight output and highlights lender appetite for circular-economy assets.

Virgin Kraft linerboard remains indispensable where edge crush strength and wet strength matter for export crates and heavy industrial engines. Specialty coatings that add grease resistance let recycled substrates encroach on formerly kraft-dominated applications, but supply chain reliability still dictates virgin usage in high-risk shipments. In the future, regulatory thresholds around recycled percentages will anchor market share, though value-added specialty boards will outpace commodity grades in margin contribution.

Single-wall formats accounted for 39.10% of sales in 2025, favored for streamlined converting and lower material costs. Triple-wall designs, however, are set for a 4.08% CAGR through 2031 as cold-chain networks scale and machine tool exports rise. The corrugated boxes market size for triple-wall is buoyed by thicker boards that resist puncture during multi-day reefer hauls. Automation on single-wall lines allows rapid changeovers, meeting e-commerce variability.

Raised labor costs push converters to invest in equipment that can handle heavier triple-wall grades without manual assists, and adhesive vendors respond with fast-set formulations to maintain line speeds. Despite higher input costs, triple-wall demand grows where risk management outweighs price sensitivity, such as high-value biologics and industrial machinery. Conversely, lightweight programming on single-wall units sustains share by mitigating freight surcharges linked to dimensional weight.

The North America Corrugated Packaging Market Report is Segmented by Board Grade (Recycled Containerboard, and More), Wall Type (Single Wall, Double Wall, and Triple Wall), Flute Type (A-Flute, B-Flute, and More), Product Type (Slotted Boxes, and More), End-User Industry (Processed Foods, and More), Printing Technology (Flexographic Printing, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- International Paper Company

- Smurfit WestRock

- Packaging Corporation of America

- Georgia-Pacific LLC

- Mondi plc

- Pratt Industries, Inc.

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Limited

- Oji Holdings Corporation

- Graphic Packaging Holding Company

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Orora Limited

- Rengo Co., Ltd.

- Viking Packaging, LLC

- Sealed Air Corporation

- Menasha Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in E-commerce Parcel Volumes

- 4.2.2 Regulatory Shift toward Recyclable Packaging and Plastic Bans

- 4.2.3 Lightweight High-Strength Micro-Flutes and Material Savings

- 4.2.4 AI-Enabled Right-Sizing and On-Demand Box Production

- 4.2.5 Cold-Chain Expansion for Meal-Kit and Pharma Logistics

- 4.2.6 Nearshoring of Manufacturing Boosting Domestic Box Demand

- 4.3 Market Restraints

- 4.3.1 Volatility in OCC and Virgin Pulp Prices

- 4.3.2 Substitution Threat from Flexible and Rigid Plastics

- 4.3.3 Labor Shortages Driving Automation Capex Burden

- 4.3.4 Rising Energy and Transportation Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitutes

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 The Impact Of Macroeconomic Factors On The Market

- 4.6 Industry Value Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

6 ;'By Board Grade

- 6.1 Recycled Containerboard

- 6.1.1 Virgin Kraft Linerboard

- 6.1.2 Semi-Chemical and Specialty Grades

- 6.2 By Wall Type

- 6.2.1 Single Wall

- 6.2.2 Double Wall

- 6.2.3 Triple Wall

- 6.3 By Flute Type

- 6.3.1 A-Flute

- 6.3.2 B-Flute

- 6.3.3 C-Flute

- 6.3.4 E-Flute

- 6.3.5 F/N Microflute

- 6.4 By Product Type

- 6.4.1 Slotted Boxes

- 6.4.2 Rigid Boxes

- 6.4.3 Telescope Boxes

- 6.4.4 Folder Boxes

- 6.4.5 Bulk Bins and Octabins

- 6.5 By End-user Industry

- 6.5.1 Processed Foods

- 6.5.2 Fresh Food and Produce

- 6.5.3 Beverages

- 6.5.4 Paper Products

- 6.5.5 Electrical and Electronics

- 6.5.6 Personal Care and Cosmetics

- 6.5.7 Other End-user Industries

- 6.6 By Printing Technology

- 6.6.1 Flexographic Printing

- 6.6.2 Digital Printing

- 6.6.3 Litho-lamination

- 6.6.4 Other Printing Technologies

- 6.7 By Country

- 6.7.1 United States

- 6.7.2 Canada

- 6.7.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 International Paper Company

- 7.4.2 Smurfit WestRock

- 7.4.3 Packaging Corporation of America

- 7.4.4 Georgia-Pacific LLC

- 7.4.5 Mondi plc

- 7.4.6 Pratt Industries, Inc.

- 7.4.7 Cascades Inc.

- 7.4.8 Sonoco Products Company

- 7.4.9 Nine Dragons Paper (Holdings) Limited

- 7.4.10 Oji Holdings Corporation

- 7.4.11 Graphic Packaging Holding Company

- 7.4.12 Stora Enso Oyj

- 7.4.13 Nippon Paper Industries Co., Ltd.

- 7.4.14 Orora Limited

- 7.4.15 Rengo Co., Ltd.

- 7.4.16 Viking Packaging, LLC

- 7.4.17 Sealed Air Corporation

- 7.4.18 Menasha Corporation

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-need Assessment