PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911740

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911740

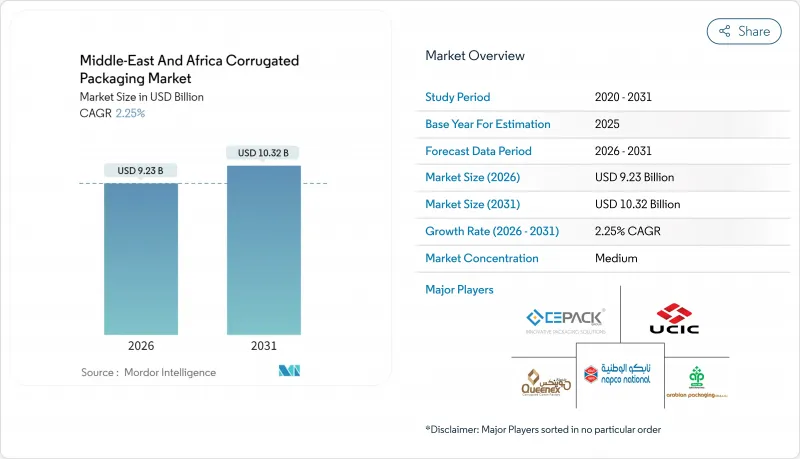

Middle-East And Africa Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa corrugated packaging market was valued at USD 9.03 billion in 2025 and estimated to grow from USD 9.23 billion in 2026 to reach USD 10.32 billion by 2031, at a CAGR of 2.25% during the forecast period (2026-2031).

Current performance mirrors the region's dual character: mature fast-moving consumer goods (FMCG) demand alongside rapidly scaling e-commerce volumes that favor right-sized, print-ready boxes. Saudi Arabia anchors growth through scale, while Turkey's export-oriented plants inject competitive momentum. Government industrial policies, rising recycling capacity, and the African Continental Free Trade Area (AfCFTA) collectively widen addressable demand. At the same time, supply-side friction from kraft paper price swings and water scarcity regulations forces producers to optimize fiber sourcing and mill efficiency.

Middle-East And Africa Corrugated Packaging Market Trends and Insights

E-commerce Boom Driving Last-Mile-Friendly Packaging

E-commerce volumes in the Middle East and Africa corrugated packaging market compel converters to engineer boxes that survive multi-touch urban delivery networks while delighting consumers during unboxing. Saudi and UAE fulfillment centers increasingly specify right-sized die-cut formats that curb void fill and freight waste. Smurfit Kappa's regional digital presses now turn around custom artwork in days, lowering order minimums for seasonal drops.Subscription models elevate repeat-shipment performance requirements, nudging board suppliers toward higher edge-crush and puncture resistance. Brick-and-mortar retailers adopting omnichannel setups replicate these e-commerce-driven specs across click-and-collect programs, accelerating design convergence region-wide.

Rapid Expansion of FMCG and Organised Retail

Modern retail penetration in Egypt, Nigeria, and South Africa fuels volume uptake for shelf-ready corrugated trays that simplify stocking and visual merchandising. Multinational FMCG groups harmonize pack dimensions across regional plants, allowing converters to rationalize tooling and scale output more efficiently. Urban population growth consolidates demand near mega-cities, justifying new corrugator installations that minimize outbound freight. Discount chains and convenience formats prefer shelf-ready systems that slash in-store labor, further embedding corrugated as a primary secondary pack. Elevated graphic standards on outer packs also spur adoption of multi-color flexo and digital printing lines across the Middle East and Africa corrugated packaging market.

Volatility in Kraft Paper Supply and Prices

Temporary shutdowns at European containerboard mills and Red Sea shipping reroutes expose the Middle East and Africa corrugated packaging market to spot-price surges. Smaller converters lacking currency hedges absorb cost spikes that compress already thin margins. Saudi and Turkish integrated producers respond by lifting in-house recycled fiber ratios, yet smaller African converters remain tied to import flows. Any extended ocean freight disruption can delay linerboard arrivals by four weeks, prompting end-users to diversify supply contracts or hold higher safety stocks.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Local Manufacturing and Recycling

- Export-Oriented Fresh-Produce Logistics Growth

- Competition from Flexible Plastic Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Slotted containers commanded 45.35% of the Middle East and Africa corrugated packaging market in 2025 due to their cost-efficient die-cutting, universal dimensions, and favorable board yield. The segment's legacy installed base supports high-speed automation lines that favor predictable blank geometry. Brand owners shipping ambient groceries and industrial parts continue to specify regular slotted containers (RSC) for pallet optimization. Die-cut containers, however, recorded the highest 2.86% CAGR and are set to erode share as direct-to-consumer brands pursue bespoke geometries that minimize void space and elevate unboxing theatre. Retailers also migrate toward five-panel folders that double as shelf-ready units, further enlarging the value pool for specialty converters.

Adoption of water-based digital print heads unlocks shorter run economics on die-cut formats, while upgraded flat-bed plotters slash lead times on new designs. Sustainability messaging is more prominent on top-printed die-cuts, supporting premium price realization even at low order volumes. Conversely, telescopic boxes remain niche but gain ground in delicate fresh-produce exports where height variability accommodates heterogeneous crop sizing. Across the Middle East and Africa corrugated packaging market, successful converters balance high-volume slotted production with agile digital lines capable of on-demand die-cut runs.

Single-wall board captured 53.40% share of the Middle East and Africa corrugated packaging market size in 2025 because FMCG freight routes inside national borders rarely exceed 500 km. As AfCFTA trade intensifies, triple-wall demand rises at 3.03% CAGR, enabling longer haul protection for whitegoods and automotive sub-assemblies. Double-wall offerings cater to mid-weight loads where savings on freight outweigh incremental material cost. Solid fiber board is ordered by chemical exporters that need maximum puncture resistance and leak containment, though it remains a specialist niche.

Integrated mills in Saudi Arabia and Turkey debottleneck fluting section capacity to keep pace with triple-wall enquiries, while recycled liner content climbs above 55% thanks to better collection networks. Customers increasingly ask vendors to validate board grade performance in hot-box and humidity tests reflecting desert trans-shipment conditions. The Middle East and Africa corrugated packaging market therefore tilts toward engineered board recipes that blend virgin kraft top liners with recycled medium to meet both cost and compression targets.

The Middle East and Africa Corrugated Packaging Market Report is Segmented by Box Type (Slotted Containers, Die-Cut Containers, and More), Board Grade (Single-Wall Board, Double-Wall Board, and More), Flute Size (A-Flute, B-Flute, C-Flute, E-Flute, and More), End-User Industry (Food, Beverage, Consumer Electronics and Electrical Appliances, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arabian Packaging Co. LLC

- Queenex Corrugated Carton Factory LLC

- United Carton Industries Company (JSC)

- Napco National CJSC

- Cepack Group SARL

- Falcon Pack IND LLC

- World Pack Industries LLC

- Universal Carton Industries Group LLC

- Express Pack Print LLC

- Green Packaging Boxes Industries LLC

- Tarboosh Packaging Co. LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging LLC

- NBM Pack LLC

- Mondi plc

- Smurfit Kappa Group plc

- International Paper Company

- Middle East Paper Company (SASE:1202)

- INDEVCO Paper Containers SAL

- Obeikan Paper Industries Co.

- National Paper Company SAE

- RAK Packaging LLC

- Al Bayader International LLC

- Hadera Paper Ltd. (Amnir Corrugated)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Value / Supply-Chain Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Market Drivers

- 4.5.1 E-commerce boom driving last-mile-friendly packaging

- 4.5.2 Rapid expansion of FMCG and organised retail

- 4.5.3 Government incentives for local manufacturing and recycling

- 4.5.4 Export-oriented fresh-produce logistics growth

- 4.5.5 Inter-African trade surge under AfCFTA (under-the-radar)

- 4.5.6 Digital printing adoption for micro-brands (under-the-radar)

- 4.6 Market Restraints

- 4.6.1 Volatility in kraft paper supply and prices

- 4.6.2 Competition from flexible plastic packaging

- 4.6.3 Import-dependent raw-material logistics risk

- 4.6.4 Water-scarcity-driven mill regulations (under-the-radar)

- 4.7 Pricing Analysis

- 4.8 Import and Export Analysis

- 4.9 PESTLE Analysis

- 4.10 Capital Expenditure Trends

- 4.11 Environmental Impact of Corrugated Box Production

- 4.12 Industry Ecosystem Analysis

- 4.13 Porter's Five Forces

- 4.13.1 Bargaining Power of Suppliers

- 4.13.1.1 Bargaining Power of Buyers

- 4.13.1.2 Threat of New Entrants

- 4.13.1.3 Threat of Substitute Products

- 4.13.1.4 Intensity of Competitive Rivalry

- 4.13.1 Bargaining Power of Suppliers

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Box Type

- 5.1.1 Slotted Containers

- 5.1.2 Die-cut Containers

- 5.1.3 Five-panel Folder Boxes

- 5.1.4 Telescopic Boxes

- 5.1.5 Other Box Types

- 5.2 By Board Grade

- 5.2.1 Single-wall Board

- 5.2.2 Double-wall Board

- 5.2.3 Triple-wall Board

- 5.2.4 Solid Fiber Board

- 5.3 By Flute Size

- 5.3.1 A-Flute

- 5.3.2 B-Flute

- 5.3.3 C-Flute

- 5.3.4 E-Flute

- 5.3.5 F-Flute

- 5.3.6 Other Flutes

- 5.4 By End-User Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Consumer Electronics and Electrical Appliances

- 5.4.4 Personal Care and Household Care

- 5.4.5 Industrial and Chemicals

- 5.4.6 Agriculture and Fresh Produce

- 5.4.7 E-commerce and Retail

- 5.4.8 Other End-Users

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Egypt

- 5.5.4 South Africa

- 5.5.5 Nigeria

- 5.5.6 Turkey

- 5.5.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arabian Packaging Co. LLC

- 6.4.2 Queenex Corrugated Carton Factory LLC

- 6.4.3 United Carton Industries Company (JSC)

- 6.4.4 Napco National CJSC

- 6.4.5 Cepack Group SARL

- 6.4.6 Falcon Pack IND LLC

- 6.4.7 World Pack Industries LLC

- 6.4.8 Universal Carton Industries Group LLC

- 6.4.9 Express Pack Print LLC

- 6.4.10 Green Packaging Boxes Industries LLC

- 6.4.11 Tarboosh Packaging Co. LLC

- 6.4.12 Unipack Containers & Carton Products LLC

- 6.4.13 Al Rumanah Packaging LLC

- 6.4.14 NBM Pack LLC

- 6.4.15 Mondi plc

- 6.4.16 Smurfit Kappa Group plc

- 6.4.17 International Paper Company

- 6.4.18 Middle East Paper Company (SASE:1202)

- 6.4.19 INDEVCO Paper Containers SAL

- 6.4.20 Obeikan Paper Industries Co.

- 6.4.21 National Paper Company SAE

- 6.4.22 RAK Packaging LLC

- 6.4.23 Al Bayader International LLC

- 6.4.24 Hadera Paper Ltd. (Amnir Corrugated)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-needs Assessment