PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911334

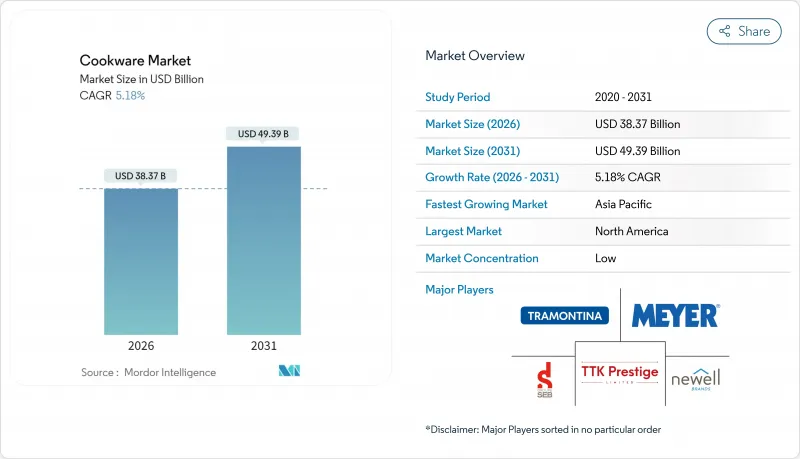

Cookware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The cookware market was valued at USD 36.48 billion in 2025 and estimated to grow from USD 38.37 billion in 2026 to reach USD 49.39 billion by 2031, at a CAGR of 5.18% during the forecast period (2026-2031).

Heightened PFAS restrictions, rapid urbanization, and a visible consumer tilt toward premium, multipurpose products steer this momentum. Regulatory shifts in Minnesota, New York, and the European Union accelerate adoption of ceramic and cast-iron lines, while Asia-Pacific's compact apartments fuel demand for space-saving, induction-compatible sets. North America has the largest regional position yet faces price volatility in steel and aluminum that squeezes margins. Digital channels gain ground as direct-to-consumer models furnish data-rich insights that brick-and-mortar stores cannot, prompting omnichannel overhauls across the cookware market.

Global Cookware Market Trends and Insights

Rising Disposable Incomes & Kitchen Renovations

Kitchen renovation waves tighten replacement cycles as consumers trade basic aluminum for stainless steel and cast iron. National Kitchen & Bath Association professionals observe 72% of homeowners requesting biophilic materials that align with natural cooking philosophies. Induction cooktops increasingly feature in remodels, steering buyers toward magnetic-ready sets that command premium margins. Across emerging Asia-Pacific cities, rising middle-class purchasing power elevates demand for durable collections that double as lifestyle symbols. Premium upgrades generate profit cushions that help manufacturers offset volatile raw-material costs, sustaining steady expansions in the cookware market.

Booming E-commerce Kitchenware Sales

Photo-ready product pages, chef endorsements, and real-time consumer reviews spur online conversion. Web-focused challengers bypass retail mark-ups, making gourmet-grade pans accessible to first-time buyers. E-commerce ecosystems supply granular shopper data, allowing agile releases of limited-edition colors and influencer-curated bundles that resonant with a social-media audience. Strong logistics networks shorten delivery windows, eroding a key advantage of in-store shopping. As subscription-based replenishment models emerge, recurring revenue streams stabilize cash flow for fledgling cookware labels. Social media influence drives purchasing decisions, particularly for aesthetically appealing cookware brands that photograph well for food content creation.

Raw-Material Price Volatility (Steel, Aluminum)

World Bank forecasts sustained high metal prices through 2025 as geopolitical tensions strain ore supplies. Tennessee-based Heritage Steel absorbed USD 75,000 in tariffs and anticipates USD 200,000 more, forcing a 15% list-price jump after 50% cost spikes. In Europe, nickel and chromium scarcities lift stainless premiums while Italian mills battle elevated energy bills, tightening margins. Larger manufacturers hedge with multiyear contracts and captive recycling loops, but smaller labels face profit erosion, stalling innovations and threatening exits from the cookware market. Price volatility creates competitive advantages for vertically integrated manufacturers with captive raw material sources over smaller brands dependent on spot market pricing.

Other drivers and restraints analyzed in the detailed report include:

- Induction-Compatible Cookware Demand Surge

- Urbanization & Nuclear Households in Asia-Pacific

- Mature Markets' Long Replacement Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Specialized vessels captured growing attention even as core lines retained 69.58% share of the cookware market in 2025. Dutch ovens and casserole pans ride a home-baking wave sparked during lockdowns and sustained by social-media recipe challenges. Ethnic tools such as idli steamers or tamagoyaki pans answer the craving for authentic regional flavors, helping the cookware market penetrate culinary niches once served mainly by specialty shops. Integrated accessory sales-replacement lids, silicone grips, and modular organizers-add high-margin baskets, supporting brand ecosystem strategies. Pressure cookers and steamers maintain steady demand in Asian markets where traditional cooking methods emphasize efficiency and nutrient retention, while Western markets rediscover these tools through health-conscious cooking movements and time-pressed lifestyles seeking convenient meal preparation solutions.

Specialized cookware emerges as the fastest-growing segment at 6.97% CAGR through 2026-2031, reflecting consumers' expanding culinary interests and social media influence promoting authentic ethnic cooking techniques. Consumers treat cookware as experiential gear supporting hobbies akin to photography or cycling. Video tutorials propel adoption of task-specific items, while gift shoppers view enamel-coated cast-iron ovens as lifetime presents. IKEA's sol-gel series provides mass-market access to PFAS-free non-stick benefits, democratizing premium technologies previously restricted to boutique labels. Overall, the specialized lane strengthens loyalty and spurs cross-selling, cushioning revenue against commoditization of standard skillets in the cookware market.

Stainless steel anchored 34.12% of cookware market share in 2025, favored for resilience and professional aesthetics, yet cast-iron skillets are set to outpace at 6.12% CAGR to 2031. Heritage branding by Lodge and Le Creuset resonates with Gen Z consumers pursuing sustainability through long-lasting goods. Seasoned cast iron, naturally non-stick when properly maintained, alleviates PFAS concerns and earns viral traction in cooking forums. Ceramic and glass build presence as regulators turn the screws on PTFE, though thermal-shock resistance and price hurdles cap their march. Carbon steel emerges as a midpoint, combining heat retention with lighter weight, attracting restaurant stylings into home kitchens and diversifying the cookware market.

Enameled cast-iron upgrades mitigate rust worries and enable vibrant color palettes that double as tableware. Meanwhile, aluminum retains stronghold in entry-level kits and commercial frying operations thanks to conductivity and cost parity. Fraunhofer's Plaslon(R) promises new PFAS-free coating longevity, opening upgrade paths without sacrificing release performance. This additives race underscores R&D's role in safeguarding differentiation and margin within an otherwise price-sensitive cookware market.

The Cookware Market Report is Segmented by Product Type (Core Cookware, Specialized Cookware, Accessories), Material (Stainless Steel, Aluminium, Cast Iron, Carbon Steel, Copper, Ceramic/Glass, Silicone, Other Coated Substrates), End User (Residential, Commercial), Distribution Channel (Offline Retail, Online, B2B/Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 35.80% hold in 2025 mirrors robust discretionary spending and a renovation culture that revitalizes cookware drawers. Minnesota's PFAS prohibition, effective January 2025, and New York's planned 2026 PTFE curbs compel rapid formula shifts. Domestic makers like Le Creuset invested USD 30 million in South Carolina logistics to quicken roll-outs of compliant lines. Canadian and Mexican middle-class expansion under USMCA terms adds peripheral lift, while tariffs on Chinese steel push some buyers toward locally sourced sets.

Asia-Pacific leads growth at a 7.06% CAGR, standing at the epicenter of urbanization and rising wages that expand the cookware market more than any other region. China's 20.8% jump in 2024 appliance exports underscores manufacturing agility coupled with surging domestic appetite. In India, a swelling youth population embraces induction-ready cookware as household electrification widens; government schemes encouraging clean cooking stoke demand for PFAS-free alternatives. Japanese and Korean consumers, already accustomed to compact kitchens, gravitate to premium multi-layer pans that fit rice cookers and induction hobs alike, bolstering average selling prices.

Europe's steady pace hides divergent undercurrents: Nordic nations pioneer sustainable design cues that ripple outward, while Germany's subdued construction sector dampens stainlessteel s consumption. The European Chemicals Agency's proposal to bar wide PFAS groups adds complexity for continental suppliers, but first movers gain export credibility as regulations spread to other jurisdictions. Italy's escalating energy tariffs pressure local forges, leading some brands to relocate enameling processes to lower-cost neighbors. Eastern European consumers, meanwhile, trade up as incomes rise, cushioning Western softness and helping sustain overall regional contributions to the cookware market.

- Groupe SEB SA

- Meyer Corporation

- Newell Brands (Calphalon)

- Tramontina SA

- TTK Prestige Ltd

- Hawkins Cookers Ltd

- Lodge Manufacturing Co.

- Le Creuset Group

- Fiskars Group (Iittala, Royal Doulton)

- WMF GmbH

- Zwilling J.A. Henckels

- Fissler GmbH

- Gibson Overseas Inc.

- IKEA Group

- BergHOFF Worldwide

- Stanley Black & Decker (Farberware)

- Cuisinart (Conair Corp.)

- Camp Chef (Vista Outdoor)

- Staub (Zwilling)

- Denby Pottery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes & Kitchen Renovations

- 4.2.2 Booming E-Commerce Kitchenware Sales

- 4.2.3 Induction-Compatible Cookware Demand Surge

- 4.2.4 Urbanization & Nuclear Households In Asia-Pacific

- 4.2.5 PFAS Phase-Out Accelerating Ceramic & Cast-Iron Uptake

- 4.2.6 Electrification Policies Favouring Magnetic Cookware

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Steel, Aluminium)

- 4.3.2 Mature Markets Long Replacement Cycles

- 4.3.3 ESG Scrutiny On Ptfe Emissions

- 4.3.4 Slow Adoption Of Smart/Iot Cookware Over Privacy Fears

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Core Cookware

- 5.1.1.1 Pans (Fry/Saute, Grill, Wok/Kadhai, Crepe)

- 5.1.1.2 Pots (Sauce, Stock, Dutch Oven)

- 5.1.1.3 Pressure Cookers & Steamers

- 5.1.1.4 Cookware Sets

- 5.1.2 Specialized Cookware

- 5.1.2.1 Dutch Ovens & Casseroles

- 5.1.2.2 Specialty Cookware (Idli, Appam, BBQ Grill Pan, etc.)

- 5.1.2.3 Bakeware (Ovenware, Muffin trays, Cake tins, etc.)

- 5.1.3 Accessories (Lids, Handles)

- 5.1.1 Core Cookware

- 5.2 By Material (Value)

- 5.2.1 Stainless Steel

- 5.2.2 Aluminium

- 5.2.3 Cast Iron

- 5.2.4 Carbon Steel

- 5.2.5 Copper

- 5.2.6 Ceramic/Glass

- 5.2.7 Silicone

- 5.2.8 Other Coated Substrates

- 5.3 By End User (Value)

- 5.3.1 Residential

- 5.3.2 Commercial (HoReCa, Institutional, Catering)

- 5.4 By Distribution Channel (Value)

- 5.4.1 Offline Retail

- 5.4.1.1 Super/Hypermarkets

- 5.4.1.2 Department Stores

- 5.4.1.3 Specialty Stores

- 5.4.2 Online

- 5.4.2.1 E-commerce Marketplaces

- 5.4.2.2 Brand Webshops

- 5.4.3 B2B / Direct Sales

- 5.4.1 Offline Retail

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Groupe SEB SA

- 6.4.2 Meyer Corporation

- 6.4.3 Newell Brands (Calphalon)

- 6.4.4 Tramontina SA

- 6.4.5 TTK Prestige Ltd

- 6.4.6 Hawkins Cookers Ltd

- 6.4.7 Lodge Manufacturing Co.

- 6.4.8 Le Creuset Group

- 6.4.9 Fiskars Group (Iittala, Royal Doulton)

- 6.4.10 WMF GmbH

- 6.4.11 Zwilling J.A. Henckels

- 6.4.12 Fissler GmbH

- 6.4.13 Gibson Overseas Inc.

- 6.4.14 IKEA Group

- 6.4.15 BergHOFF Worldwide

- 6.4.16 Stanley Black & Decker (Farberware)

- 6.4.17 Cuisinart (Conair Corp.)

- 6.4.18 Camp Chef (Vista Outdoor)

- 6.4.19 Staub (Zwilling)

- 6.4.20 Denby Pottery

7 Market Opportunities & Future Outlook

- 7.1 Rising Shift Toward Health-Oriented & Non-Toxic Cookware

- 7.2 Premiumization & Growth of Cast Iron, Stainless Steel, and Copper Segments