PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911358

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911358

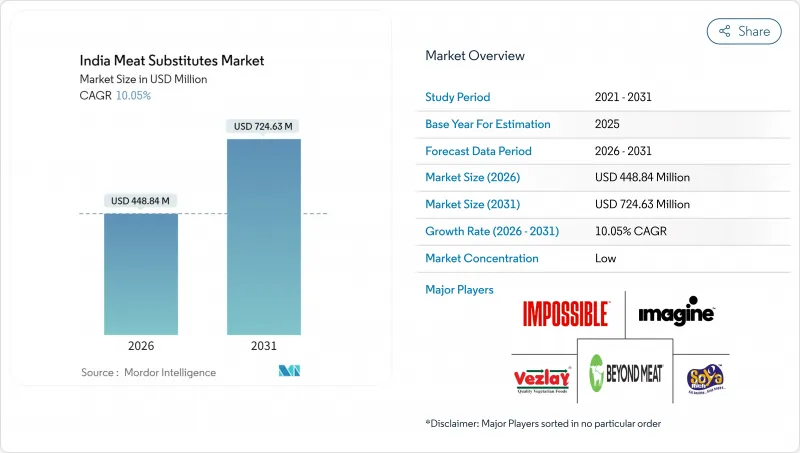

India Meat Substitutes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Indian meat substitutes market size in 2026 is estimated at USD 448.84 million, growing from 2025 value of USD 407.85 million with 2031 projections showing USD 724.63 million, growing at 10.05% CAGR over 2026-2031.

The market growth stems from increasing health consciousness, environmental awareness, and ethical considerations. Indian consumers are choosing plant-based proteins for their health benefits, including lower cholesterol, reduced saturated fats, and high fiber content, particularly in response to prevalent lifestyle diseases such as diabetes and cardiovascular conditions. Environmental concerns about livestock farming emissions and resource consumption are driving the transition to meat substitutes. The market benefits from technological improvements in taste, texture, and nutritional content that better replicate conventional meat. Advancements in protein texturization processes, including high-moisture extrusion and flavor development specific to Indian cuisine, have improved product acceptance. The rise of flexitarian diets alongside traditional vegetarianism has expanded the consumer base. Additionally, consumer education programs and government initiatives supporting sustainable, nutritious diets have helped extend market reach beyond metropolitan areas.

India Meat Substitutes Market Trends and Insights

Health awareness and dietary concerns

Health awareness and dietary concerns are significantly driving the growth of India's meat substitutes market. Indian consumers are actively shifting from traditional meat consumption to plant-based alternatives due to heightened health consciousness. This substantial transition is primarily driven by the increasing prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular conditions, which have strong associations with high consumption of red and processed meats. The International Diabetes Federation reported that India had a concerning diabetes prevalence rate of 10.5% among adults in 2024, emphasizing the critical need for healthier dietary options . Plant-based meat substitutes deliver multiple health benefits, including lower cholesterol levels, significantly reduced saturated fat content, substantially higher fiber content, and comprehensive nutritional profiles. These innovative products effectively align with consumers' intensified focus on nutritional balance, proactive disease prevention, and sustainable weight management while successfully incorporating traditional Indian flavors and culinary practices.

Ethical/animal welfare concerns

Ethical considerations and animal welfare concerns significantly influence the growth of India's meat substitutes market. According to the Plant-Based Foods Industry Association (PBFIA) in 2023, 67% of Indian consumers reported that animal welfare concerns influenced their choice of plant-based products over conventional meat. This consumer preference reflects increased awareness about industrial farming practices and a growing demand for cruelty-free food options. Consumers actively seek alternatives that align with their ethical values, choosing products that avoid animal exploitation. The impact of these ethical considerations has prompted companies to develop plant-based meat substitutes that deliver comparable taste and texture. Indian consumers emphasize transparency in sourcing and production methods, encouraging brands to demonstrate their commitment to ethical and sustainable ingredients. This shift supports both local startups and multinational companies in expanding their plant-based product portfolios, including options that cater to traditional Indian tastes, making ethical food choices more accessible to mainstream consumers.

High production costs/premium pricing

The high production costs and premium pricing of meat substitutes significantly constrain market growth in India. These alternatives typically cost more than traditional animal-based proteins, limiting their accessibility to price-sensitive consumers, particularly in rural and semi-urban areas where affordability and awareness remain challenges. The elevated cost structure stems from expensive raw materials, including soy, pea protein, and mycoprotein, along with the need for advanced processing technologies such as high-moisture extrusion and fermentation that require substantial capital investments. The use of imported technologies and ingredients increases production and logistics costs, creating a notable price difference between meat substitutes and traditional protein sources like lentils, eggs, and paneer. Despite growing consumer interest in plant-based alternatives, the premium pricing restricts widespread adoption. Most consumers perceive meat substitutes as specialty items rather than daily staples, which limits market penetration beyond urban, affluent segments. Companies face the challenge of balancing product innovation and quality while maintaining competitive prices.

Other drivers and restraints analyzed in the detailed report include:

- Urban lifestyle changes and demand for convenience foods

- Innovations in product technology and formulation

- Taste, texture and sensory limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Textured Vegetable Protein (TVP) commands 52.15% market share in India's meat substitutes market in 2025. This significant dominance stems from India's deeply established acceptance and cultural integration of soy-based protein products, particularly soy chunks and granules. Textured Vegetable Protein's market leadership is reinforced by its comprehensive nutritional profile, including high protein content, fiber richness, and absence of cholesterol, which effectively addresses the increasing health awareness among Indian consumers. The product's superior meat-like texture and taste characteristics enable seamless incorporation into diverse Indian culinary applications. Textured Vegetable Protein's strong market position is further strengthened by its cost-effectiveness and widespread availability, supported by robust domestic production capabilities.

Tempeh is projected to grow at a substantial CAGR of 10.64% through 2031 in India's meat substitutes market. This remarkable growth is driven by its enhanced digestibility and beneficial probiotic properties from fermentation, strongly appealing to health-conscious consumers. The product's minimal processing and traditional characteristics align perfectly with consumer preferences for clean-label foods. Tempeh's exceptional nutritional composition, including complete protein, essential vitamins, and vital minerals, attracts vegetarians, vegans, and flexitarians seeking wholesome protein alternatives. Its remarkable adaptability to both traditional Indian and international cooking methods significantly contributes to its increasing market acceptance and consumer adoption.

Soy-based products command a substantial 48.84% market share in India's meat substitutes market in 2025, underpinned by India's strategic position as a major soybean producer. Madhya Pradesh and Maharashtra serve as the primary soybean-producing states. According to the Department of Public Relations, M.P., Madhya Pradesh maintains market leadership with 5.47 million tonnes of soybean production in 2024, constituting 41.92% of India's total output, while Maharashtra contributes 5.23 million tonnes . This well-established domestic supply chain infrastructure ensures reliable availability and competitive pricing of soy-based meat substitutes across India, reinforcing soy's dominant position as the preferred protein source in meat substitutes.

Mycoprotein demonstrates remarkable momentum in the Indian meat substitutes market, projecting a substantial CAGR of 10.78% through 2031. This acceleration reflects increasing consumer preference for sustainable protein alternatives that deliver superior nutritional benefits. Mycoprotein, derived through fungal fermentation, distinguishes itself through its authentic meat-like texture, exceptional protein content, and significantly reduced environmental footprint compared to traditional livestock farming. The growing environmental consciousness among consumers, combined with the expanding distribution network of mycoprotein products across urban centers, propels this impressive growth trajectory.

The India Meat Substitutes Market Report is Segmented by Type (Tofu, Tempeh, Textured Vegetable Protein, Seitan, and Other Meat Substitutes), Source (Soy, Wheat, Mycoprotein, and Others), Form (Frozen, Refrigerated, and Shelf-Stable), and Distribution Channel (On-Trade and Off-Trade). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Beyond Meat Inc.

- Imagine Foods Pvt Ltd

- Impossible Foods Inc.

- Soyarich Foods

- Vezlay Foods Pvt Ltd

- Veggie Champ

- Premium Tofu Mfg Co. LLC

- GoodDot Enterprises Pvt Ltd

- Patanjali Foods Ltd (Nutrela)

- Adani Wilmar Ltd (Fortune Soya Chunks)

- Blue Tribe Foods Pvt Ltd

- Wakao Foods Pvt Ltd

- Nestle S.A.

- Shaka Harry Foods Pvt Ltd

- Urban Platter

- Emami Agrotech Ltd

- ITC Ltd (MasterChef Smart Protein)

- Sonic Biochem Extractions Pvt Ltd

- Ruchi Soya Industries Ltd

- Archer Daniels Midland Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health awareness and dietary concerns

- 4.2.2 Ethical/animal welfare concerns

- 4.2.3 Urban lifestyle changes and demand for convenience foods

- 4.2.4 Innovations in product technology and formulation

- 4.2.5 Greater environmental sustainability awareness

- 4.2.6 Increase in vegetarianism and flexitarian diets

- 4.3 Market Restraints

- 4.3.1 High production costs/premium pricing

- 4.3.2 Taste, texture and sensory limitations

- 4.3.3 Limited consumer awareness and misconceptions

- 4.3.4 Supply chain and raw material issues

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Tofu

- 5.1.2 Tempeh

- 5.1.3 Textured Vegetable Protein

- 5.1.4 Seitan

- 5.1.5 Other Meat Substitutes

- 5.2 By Source

- 5.2.1 Soy

- 5.2.2 Wheat

- 5.2.3 Mycoprotein

- 5.2.4 Others

- 5.3 By Form

- 5.3.1 Frozen

- 5.3.2 Refrigerated

- 5.3.3 Shelf-Stable

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/ Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beyond Meat Inc.

- 6.4.2 Imagine Foods Pvt Ltd

- 6.4.3 Impossible Foods Inc.

- 6.4.4 Soyarich Foods

- 6.4.5 Vezlay Foods Pvt Ltd

- 6.4.6 Veggie Champ

- 6.4.7 Premium Tofu Mfg Co. LLC

- 6.4.8 GoodDot Enterprises Pvt Ltd

- 6.4.9 Patanjali Foods Ltd (Nutrela)

- 6.4.10 Adani Wilmar Ltd (Fortune Soya Chunks)

- 6.4.11 Blue Tribe Foods Pvt Ltd

- 6.4.12 Wakao Foods Pvt Ltd

- 6.4.13 Nestle S.A.

- 6.4.14 Shaka Harry Foods Pvt Ltd

- 6.4.15 Urban Platter

- 6.4.16 Emami Agrotech Ltd

- 6.4.17 ITC Ltd (MasterChef Smart Protein)

- 6.4.18 Sonic Biochem Extractions Pvt Ltd

- 6.4.19 Ruchi Soya Industries Ltd

- 6.4.20 Archer Daniels Midland Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK