PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911417

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911417

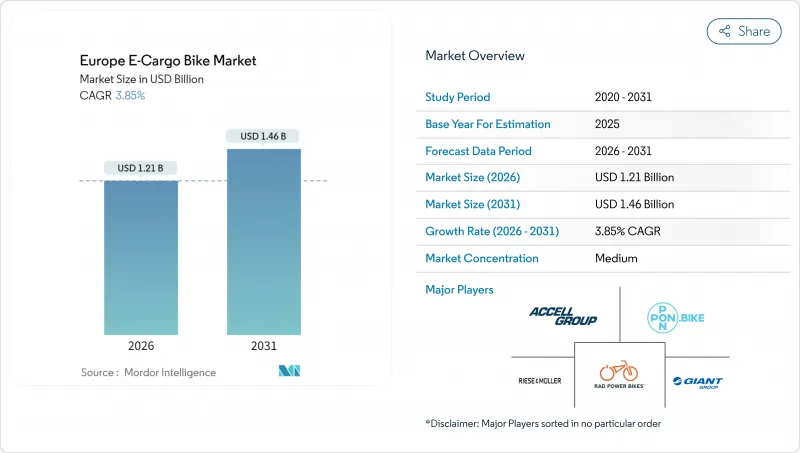

Europe E-Cargo Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe e-cargo bike market size in 2026 is estimated at USD 1.21 billion, growing from 2025 value of USD 1.16 billion with 2031 projections showing USD 1.46 billion, growing at 3.85% CAGR over 2026-2031.

This outlook captures a maturing demand curve in which supportive regulation, falling lithium-ion battery costs, and urban logistics restructuring continue to nudge adoption forward without the explosive jumps seen in earlier years. City-level zero-emission delivery zones, generous commercial fleet subsidies, and dense micro-fulfillment networks collectively reinforce the business case, while the rapid drop in battery USD/kWh has erased a key cost barrier. Competitive intensity remains moderate: established bicycle brands leverage vertical integration and service networks, yet digital-first entrants add pricing pressure as procurement shifts online. Meanwhile, segment dynamics reveal that pedal-assisted drivetrains, lithium-ion batteries, mid-drive motors, and mid-premium price points define the mainstream commercial specification across Western European hubs.

Europe E-Cargo Bike Market Trends and Insights

Urban-Logistics Zero-Emission Mandates

European municipalities are steadily enlarging zero-emission delivery zones, forcing logistics operators to reassess vehicle economics. Amsterdam's ban on fossil-fuel vans inside the city core from 2025 has already triggered forward purchases of e-cargo bikes. London's Ultra Low Emission Zone exposes diesel vans to daily fees that can surpass a threshold that tilts total cost of ownership decisively toward electrically assisted cargo cycles. Regulatory convergence across Germany, France, and the Netherlands compounds these cost signals, prompting pan-European fleets such as Amazon Logistics to standardize on micromobility depots in Berlin, Paris, and Milan. As more cities publish phase-out timelines for internal-combustion vans, operators view the Europe e-cargo bike market as a compliance hedge that preserves route flexibility across jurisdictions.

Subsidies for Commercial E-Cargo Fleets

National and municipal incentive programs now target business buyers rather than consumers. Germany's BAFA scheme reimburses up to 25% of acquisition cost and can be stacked with local grants that raise subsidy coverage. France's EUR 55 million (~USD 64 million) bicycle investment fund extends grants to commercial e-cargo fleets . The Netherlands adds significant cargo bike plus tax deductions for small enterprises. These incentives compress payback periods for high-utilization services, explaining why corporate buyers dominate order books in Western Europe.

Limited Secure On-Street Charging

Most European cities lack purpose-built curbside chargers for commercial e-cargo cycles. Fleet operators therefore tether operations to depots, incurring real-estate and downtime costs when 800 Wh batteries require up to six hours for a full cycle on 4 A chargers. The absence of open standards forces mixed fleets to install proprietary docks from multiple vendors, straining capital budgets. Southern European hubs-Madrid, Rome, Athens-show the largest gaps because shared micromobility policies focus on scooters rather than commercial cargo bikes. Until city councils mandate curbside charging in loading bays, scaling above pilot fleets remains arduous for courier start-ups eyeing the Europe e-cargo bike market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Drop in Battery USD/KWH Below EUR 100

- Dense Micro-Fulfilment Network Growth

- Payload and Range Trade-Offs Versus Vans

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pedal-assisted drivetrains held 92.58% of the Europe e-cargo bike market share in 2025, reflecting their classification as bicycles under EU Regulation 168/2013, which exempts them from motor-vehicle insurance and licensing. The comfort of regulatory certainty keeps corporate buyers entrenched in this category for mainstream parcel delivery, where average loads hover near 120 kg. The Europe e-cargo bike market size for pedal assist is set to grow steadily as large couriers standardize fleets to minimize training and compliance overhead.

Throttle-assisted alternatives will, however, clock a 4.35% CAGR because heavy grocery, furniture, and municipal waste applications require continuous power unaffected by rider stamina. As Germany, France, and Italy align power-class definitions up to 25 km/h, fleet managers can integrate throttle-assisted units without increasing liability insurance lines. Manufacturers accordingly release dual-mode controllers that let operators toggle between compliance classes, future-proofing assets against evolving city statutes.

Lithium-ion technology captured 89.65% share of the Europe e-cargo bike market size in 2025 and continues rising at a 4.02% CAGR as kilowatt-hour costs freefall. Pack lifespans now reach significant full cycles, aligning with corporate fleet replacement timelines. LFP chemistry absorbs most volume due to intrinsic thermal stability and a notable cycle durability, a critical trait for high-turnover courier missions.

Lead-acid persists only in entry-level consumer cargo bikes where purchase price trumps total cost of ownership. Solid-state prototypes attract headlines but remain four years from commercial costing parity. In the interim, OEM focus shifts to smart battery management systems with cell-level monitoring, Bluetooth diagnostics, and geofenced immobilization-capabilities that enhance residual value at fleet resale.

Hub motors still hold 55.72% share yet mid-drive units will grow above the market at 5.05% CAGR through 2031. The torque multiplication afforded by integrating with bicycle gearing proves invaluable on gradients common in Lisbon or Lyon. Bosch's Performance Line CX Cargo motor delivers 85 Nm, enabling 200 kg payload starts on inclines without rider strain .

Higher maintenance complexity once deterred buyers, but expanding service networks and predictive diagnostic apps reduce downtime. Some fleet operators now benchmark hub versus mid-drive total cost of ownership at near parity after year two, tipping the specification mix toward the latter for utility-intensive routes.

The Europe E-Cargo Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Throttle Assisted), Battery Type (Lead Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems (Chain Drive, Belt Drive), Motor Power (Below 250W, 251-350W, and More), Price Band, Sales Channel, End Use, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Bakfiets.nl

- CUBE Bikes

- Douze Factory SAS

- Giant Manufacturing Co. Ltd.

- Pon Holdings B.V. (incl. Urban Arrow)

- Rad Power Bikes Inc.

- Riese & Muller GmbH

- RYTLE GmbH

- Yubabikes Inc.

- Tern Bicycles

- Benno Bikes

- Larry vs Harry

- Butchers & Bicycles (EventyrCykler)

- Triobike A/S

- CARLA CARGO Engineering GmbH

- ONOMOTION GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts (Imports/Exports)

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 Commuters with 5-15 km One-Way Trips (%)

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile (Hyper-Local) Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 E-Bike Battery Capacity (Wh)

- 4.12 Urban Traffic Congestion Index

- 4.13 Regulatory Framework

- 4.13.1 Homologation & Certification of E-Bicycles

- 4.13.2 Export-Import and Trade Regulation

- 4.13.3 Classification, Road Access and User Rules

- 4.13.4 Battery, Charger and Charging Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Urban-Logistics Zero-Emission Mandates

- 5.2.2 Subsidies for Commercial E-Cargo Fleets

- 5.2.3 Rapid Drop in Battery USD/KWH Below EUR 100

- 5.2.4 Dense Micro-Fulfilment Network Growth

- 5.2.5 Corporate ESG Procurement Targets

- 5.2.6 Insurance Incentives for Low-Speed EVs

- 5.3 Market Restraints

- 5.3.1 Limited Secure On-Street Charging

- 5.3.2 Payload and Range Trade-Offs Versus Vans

- 5.3.3 Fragmented Component Standards

- 5.3.4 Skilled-Mechanic Shortage for Mid-Drive Systems

- 5.4 Value / Supply-Chain Analysis

- 5.5 Technological Outlook

- 5.6 Porter's Five Forces

- 5.6.1 Threat of New Entrants

- 5.6.2 Bargaining Power of Suppliers

- 5.6.3 Bargaining Power of Buyers

- 5.6.4 Threat of Substitutes

- 5.6.5 Competitive Rivalry

6 Market Size & Growth Forecasts (Value & Volume)

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Throttle Assisted

- 6.2 By Battery Type

- 6.2.1 Lead Acid Battery

- 6.2.2 Lithium-ion Battery

- 6.2.3 Others

- 6.3 By Motor Placement

- 6.3.1 Hub (Front/Rear)

- 6.3.2 Mid-drive

- 6.4 By Drive Systems

- 6.4.1 Chain Drive

- 6.4.2 Belt Drive

- 6.5 By Motor Power

- 6.5.1 Below 250 W

- 6.5.2 251-350 W

- 6.5.3 351-500 W

- 6.5.4 501-600 W

- 6.5.5 Above 600 W

- 6.6 By Price Band

- 6.6.1 Up to USD 1,000

- 6.6.2 USD 1,000-1,499

- 6.6.3 USD 1,500-2,499

- 6.6.4 USD 2,500-3,499

- 6.6.5 USD 3,500-5,999

- 6.6.6 Above USD 6,000

- 6.7 By Sales Channel

- 6.7.1 Online

- 6.7.2 Offline

- 6.8 By End Use

- 6.8.1 Commercial Delivery

- 6.8.1.1 Retail and Goods Delivery

- 6.8.1.2 Food and Beverage Delivery

- 6.8.2 Service Providers

- 6.8.3 Others

- 6.8.1 Commercial Delivery

- 6.9 By Geography

- 6.9.1 Western Europe

- 6.9.1.1 Germany

- 6.9.1.2 France

- 6.9.1.3 United Kingdom

- 6.9.1.4 Netherlands

- 6.9.1.5 Belgium

- 6.9.1.6 Luxembourg

- 6.9.2 Southern Europe

- 6.9.2.1 Italy

- 6.9.2.2 Spain

- 6.9.2.3 Portugal

- 6.9.2.4 Greece

- 6.9.3 Northern Europe

- 6.9.3.1 Denmark

- 6.9.3.2 Sweden

- 6.9.3.3 Norway

- 6.9.3.4 Finland

- 6.9.4 Eastern Europe

- 6.9.4.1 Poland

- 6.9.4.2 Czech Republic

- 6.9.4.3 Hungary

- 6.9.4.4 Slovakia

- 6.9.5 Switzerland

- 6.9.6 Rest of Europe

- 6.9.1 Western Europe

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.4.1 Accell Group

- 7.4.2 Bakfiets.nl

- 7.4.3 CUBE Bikes

- 7.4.4 Douze Factory SAS

- 7.4.5 Giant Manufacturing Co. Ltd.

- 7.4.6 Pon Holdings B.V. (incl. Urban Arrow)

- 7.4.7 Rad Power Bikes Inc.

- 7.4.8 Riese & Muller GmbH

- 7.4.9 RYTLE GmbH

- 7.4.10 Yubabikes Inc.

- 7.4.11 Tern Bicycles

- 7.4.12 Benno Bikes

- 7.4.13 Larry vs Harry

- 7.4.14 Butchers & Bicycles (EventyrCykler)

- 7.4.15 Triobike A/S

- 7.4.16 CARLA CARGO Engineering GmbH

- 7.4.17 ONOMOTION GmbH

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-need Assessment

9 Key Strategic Questions for E-Bikes CEOs