PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911425

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911425

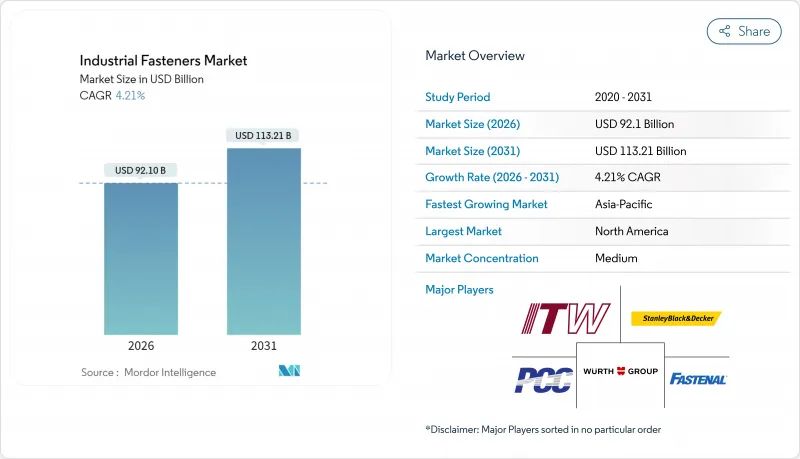

Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The industrial fasteners market is expected to grow from USD 88.38 billion in 2025 to USD 92.1 billion in 2026 and is forecast to reach USD 113.21 billion by 2031 at 4.21% CAGR over 2026-2031.

Demand is supported by manufacturing automation, heavy-machinery upgrades, and precision-assembly requirements that call for reliable, high-strength joints across complex equipment. Adoption of Industry 4.0 platforms is accelerating the use of smart, sensor-enabled fasteners that capture torque and preload data, helping manufacturers cut downtime and enhance traceability. Reshoring and localization strategies are reinforcing the industrial fasteners market by shortening lead times and reducing exposure to global logistics risks. Meanwhile, rising investment in infrastructure renewal and industrial capacity expansions in Asia and North America underpins a steady flow of large-volume orders for structural and specialty products.

Global Industrial Fasteners Market Trends and Insights

Industrial Automation Equipment Requiring Precision Micro-Fasteners

Electronics, medical-device, and semiconductor plants now specify micro-screws that weigh a fraction of a gram yet must deliver repeatable clamp loads at cycle times below one second. Integrators such as JR Automation report micron-level placement accuracy, and this drives demand for bespoke fastening geometries, torques under 1 N*m, and advanced coatings that mitigate galling under rapid load cycles. Power-tool suppliers are responding with cordless transducer-controlled wrenches that log every tightening event and transmit data wirelessly to MES dashboards, a capability showcased in Panasonic's AccuPulse platform. Manufacturers cite immediate quality-cost benefits, including fewer rework stations and shorter takt times, reinforcing the industrial fasteners market trajectory in high-volume automated lines. As more plants digitize, specifiers increasingly insist on fasteners that integrate ID chips for traceability and can be fed through bowl feeders without jamming. The trend has already migrated from electronics to automotive battery modules and collaborative-robot joints, ensuring sustained growth over the next two years

Manufacturing Reshoring Driving Domestic Industrial Fastener Demand

Geopolitical uncertainty and pandemic-era port congestion have prompted US and EU OEMs to reevaluate total landed costs rather than unit price alone. Roughly two-thirds of fasteners consumed in the United States are now produced domestically, a reversal of the offshoring trend observed a decade earlier. Local suppliers benefit from closer engineering collaboration, lower inventory buffers, and compliance with Buy-America clauses embedded in public-infrastructure awards. Capital investment in cold-heading lines, heat-treatment furnaces, and automated sorting cells is accelerating at both regional job shops and multinational firms, lifting utilization rates across the industrial fasteners market. While labor costs remain higher than in Asia, OEMs cite freight savings and reduced obsolescence risk as decisive advantages. The reshoring dynamic is expected to maintain a positive thrust on market volumes through at least 2028, especially for medium-to-high-strength grades that favor short supply chains.

Advanced Joining Technologies Substituting Traditional Industrial Fasteners

High-volume equipment producers are trialing structural adhesives, laser welding, and friction-stir welding for enclosures and chassis where permanent bonds are acceptable. Hybrid designs that combine a rivet or bolt with adhesive fillets reduce component counts and improve load distribution, compelling some OEMs to specify fewer mechanical fasteners per assembly. Aluminum extrusion manufacturers are particularly active in adopting friction-stir welding for lightweight frames, eroding bolt consumption in select applications. Nonetheless, maintenance-heavy environments such as pumps, gearboxes, and process-valve assemblies still require removable joints, preserving a large core base for the industrial fasteners market. The balance between removability and weight savings will define this restraint's real-world impact over the next three years.

Other drivers and restraints analyzed in the detailed report include:

- Heavy Machinery Modernization in Emerging Industrial Markets

- Industry 4.0 Implementation Requiring Smart Fastening Solutions

- Raw Material Cost Volatility Affecting Industrial Fastener Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal fasteners held 91.45% of 2025 revenue as heavy-duty machinery, industrial robots, and press lines demanded tensile strengths above 800 MPa. Stainless-steel grades such as AISI 316 captured a premium niche in food processing and pharmaceutical autoclaves where corrosion resistance is paramount. Alloy-steel and carbon-steel bolts remain the default choices for structural frames, gearbox casings, and furnace doors, underpinning the industrial fasteners market. Titanium and nickel-alloy specialty items serve turbine housings and petrochemical reactors, yet supply constraints tied to sponge production cause periodic lead-time extensions. These dynamics underpin a metal segment that, while mature, continues to accrue incremental gains from capacity expansions in emerging economies.

Plastic fasteners, though only 8.55% of volume, are scaling quickly on a 6.72% CAGR through 2031. Nylon screws are now routine in PLC cabinets and LED driver housings, where dielectric strength and chemical inertness add value. Polycarbonate clips secure sensor modules in AGV fleets because they resist impact and allow simplified recycling at end-of-life. Fast-growing demand for lightweight enclosures in smart-meter assemblies further propels polymer uptake. As automation spreads across clean-room industries, engineers are turning to PVDF and PEEK fasteners to eliminate particulate shedding. Consequently, the industrial fasteners market size for plastic variants is projected to approach USD 9.7 billion by 2031, highlighting a clear diversification trend across material portfolios.

Externally threaded products-bolts, screws, studs-delivered 44.30% of industrial fasteners market revenue in 2025. Bolts exceeding M24 diameter dominate crane, press, and extruder assemblies, while machine screws below M6 secure servo-motor mounts and linear actuators. The segment benefits from International Organization for Standardization (ISO) harmonization, which simplifies stocking strategies for multinational OEMs. Interchangeability also supports automatic bin-filling systems that underpin lean manufacturing, reinforcing high-volume growth in the industrial fasteners market.

Aerospace-grade fasteners, although a small slice of shipments, are advancing at 5.88% CAGR. In industrial gas turbines and high-precision machine tools, super-alloy bolts resist cyclical thermal loads exceeding 650 °C. Vibration-resistant configurations-such as shank-grip bolts with prevailing-torque nuts-bring transfer value from aerospace to high-cycle press slides. As defense contracts ramp, suppliers with NADCAP-certified heat-treatment and lab facilities enjoy premium pricing. The industrial fasteners market size for aerospace-grade variants is projected to add USD 1.53 billion by 2031, reflecting broader acceptance of high-performance joints in mission-critical industrial settings.

The Industrial Fasteners Market Report is Segmented by Raw Materials (Metal, Plastic), Products (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, Aerospace Grade Fasteners), by Application (Automotive, Aerospace, Building and Construction, Industrial Machinery, Home Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia generated 44.60% of global revenue in 2025 and is projected to expand at 7.38% CAGR on the back of manufacturing upgrades across China, India, and ASEAN nations. Fiscal incentives for robotics adoption, combined with large-scale industrial park developments, funnel steady orders into both high-volume carbon-steel and premium stainless-steel categories. China's localization of semiconductor equipment drives specialty demand for ultra-clean, particle-free fasteners, while India's Make-in-India policy pushes local production of heavy machinery that relies on large-diameter bolts. Collectively, these projects elevate the industrial fasteners market across tier-one and regional suppliers.

North America remains a critical node, supported by defense procurement, energy-infrastructure modernization, and reshoring of automotive and electronics assembly. US OEMs have ramped domestic fastener sourcing to mitigate logistics shocks and currency swings. Emerging hubs in Mexico supply fasteners for light-vehicle platforms and consumer-electronics final assembly, leveraging proximity to US buyers. Canada retains momentum through resource extraction equipment that demands extreme-temperature fasteners in mining shovels and oil-sands processing lines. Overall, stable project pipelines maintain mid-single-digit gains in the regional industrial fasteners market.

Europe contributes robust value through Germany's precision-machinery sector, Italy's machine-tool exports, and France's aerospace supply chain. Regulatory frameworks that prioritize sustainability encourage material traceability and closed-loop recycling, motivating suppliers to adopt QR-coded identification and reclaimed-metal content. Post-Brexit complexity has redirected some supply flows toward continental hubs, but UK offshore-wind installations sustain niche demand for galvanized structural bolts. With Industry 4.0 adoption accelerating, the region's industrial fasteners market is forecast to register a 3.74% CAGR through 2031.

- Acument Global Technologies, Inc.

- Arconic Corporation

- LISI Group

- Nifco Inc.

- Hilti Corporation

- Stanley Black and Decker, Inc.

- MacLean-Fogg Company

- MISUMI Group Inc.

- Precision Castparts Corp.

- SFS Group

- Illinois Tool Works Inc.

- Fastenal Company

- Wurth Group

- Bossard Group

- PennEngineering

- Bulten AB

- KAMAX Holding GmbH

- Sundram Fasteners Ltd.

- Shanghai Prime Machinery Co. Ltd.

- TriMas Corporation

- Nitto Seiko Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive Electrification Boosting Demand for Battery-Ready Fasteners

- 4.2.2 Seismic-Resistant Building Codes Driving High-Strength Structural Bolts

- 4.2.3 Offshore Wind Installations Requiring Large-Diameter Corrosion-Resistant Bolts

- 4.2.4 Localization of Aerospace Fastener Supply Chains

- 4.2.5 Precision Micro-Fasteners for Industrial Automation Equipment

- 4.2.6 Infrastructure Stimulus Programs in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Adhesives and Tapes Substituting Metal Fasteners in Interior Modules

- 4.3.2 Volatile Nickel/Molybdenum Prices Inflating Stainless-Steel Costs

- 4.3.3 Certification Burden (AS9100, IATF 16949) for Small Manufacturers

- 4.3.4 Titanium Alloy Shortages Limiting Aerospace Fastener Capacity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD BN)

- 5.1 By Raw Material

- 5.1.1 Metal

- 5.1.1.1 Carbon Steel

- 5.1.1.2 Alloy Steel

- 5.1.1.3 Stainless Steel

- 5.1.1.4 Non-Ferrous (Aluminum, Titanium, Copper)

- 5.1.2 Plastic

- 5.1.2.1 Nylon

- 5.1.2.2 Polycarbonate

- 5.1.2.3 PVC and Others

- 5.1.1 Metal

- 5.2 By Product

- 5.2.1 Externally Threaded Fasteners

- 5.2.1.1 Bolts

- 5.2.1.2 Screws

- 5.2.1.3 Studs

- 5.2.2 Internally Threaded Fasteners

- 5.2.2.1 Nuts

- 5.2.2.2 Inserts

- 5.2.3 Non-Threaded Fasteners

- 5.2.3.1 Rivets

- 5.2.3.2 Washers

- 5.2.3.3 Pins and Clips

- 5.2.4 Aerospace-Grade Fasteners

- 5.2.4.1 Titanium Fasteners

- 5.2.4.2 Super-Alloy Fasteners

- 5.2.1 Externally Threaded Fasteners

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Building and Construction

- 5.3.4 Industrial Machinery and Robotics

- 5.3.5 Home Appliances and Electronics

- 5.3.6 Plumbing and HVAC Products

- 5.3.7 Other Industrial Applications

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket / MRO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acument Global Technologies, Inc.

- 6.4.2 Arconic Corporation

- 6.4.3 LISI Group

- 6.4.4 Nifco Inc.

- 6.4.5 Hilti Corporation

- 6.4.6 Stanley Black and Decker, Inc.

- 6.4.7 MacLean-Fogg Company

- 6.4.8 MISUMI Group Inc.

- 6.4.9 Precision Castparts Corp.

- 6.4.10 SFS Group

- 6.4.11 Illinois Tool Works Inc.

- 6.4.12 Fastenal Company

- 6.4.13 Wurth Group

- 6.4.14 Bossard Group

- 6.4.15 PennEngineering

- 6.4.16 Bulten AB

- 6.4.17 KAMAX Holding GmbH

- 6.4.18 Sundram Fasteners Ltd.

- 6.4.19 Shanghai Prime Machinery Co. Ltd.

- 6.4.20 TriMas Corporation

- 6.4.21 Nitto Seiko Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment