PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911467

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911467

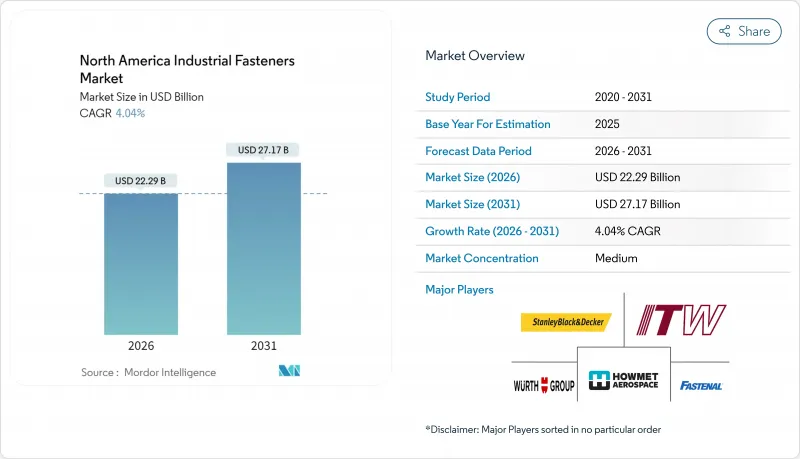

North America Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North America industrial fasteners market size in 2026 is estimated at USD 22.29 billion, growing from 2025 value of USD 21.42 billion with 2031 projections showing USD 27.17 billion, growing at 4.04% CAGR over 2026-2031.

Healthy infrastructure outlays, rising electric-vehicle production, and reshoring programs that prioritize domestic manufacturing sustain momentum despite input-cost volatility. Construction activity across residential, commercial, and civil projects underpins baseline demand, while automotive and aerospace programs add high-value volume. Suppliers that integrate digital traceability, corrosion-resistant coatings, and application-specific designs strengthen pricing power. End-users continue to favor engineered solutions that cut assembly time, extend service life, and ease compliance. Competitive intensity remains moderate as leading incumbents leverage scale, distribution depth, and targeted acquisitions to solidify positions.

North America Industrial Fasteners Market Trends and Insights

Construction sector momentum sustains fastener demand

Construction outlays stemming from the USD 1.2 trillion Infrastructure Investment and Jobs Act maintain a steady pipeline of bridges, transit hubs, and utility projects that rely on high-strength bolts, anchors, and threaded rods. Residential remodeling and multifamily starts in Texas and Florida keep builders' merchants ordering large volumes of bulk screws and nails. Prefabricated and modular building techniques favor precision-engineered fasteners that align quickly and hold tolerances during crane placement. Supply-chain managers increasingly specify coatings that withstand corrosive coastal or cold-climate conditions to cut lifetime maintenance. Distributors stocking certified lots with full traceability win contracts that require Buy-American compliance and immediate delivery.

Automotive electrification reshapes fastener requirements

Battery-electric vehicle platforms include specialized studs, sleeve nuts, and rivets that manage thermal cycles and electrical isolation within battery packs. Automakers expanding U.S. assembly lines mandate aluminum-compatible fasteners that curb galvanic corrosion in lightweight chassis. High-speed robotic assembly drives demand for consistent torque-tension performance, pushing suppliers toward tighter dimensional tolerances. As production of electric pickups and SUVs scales, average fastener content per unit rises, supporting premium pricing for engineered parts certified to APQP and PPAP standards. Collaborations with cell manufacturers accelerate the co-development of fastening methods for next-generation solid-state batteries.

Structural adhesives challenge traditional fasteners

Lightweighting strategies in electric cars, aircraft interiors, and consumer electronics substitute bonded joints for mechanical hardware where serviceability is non-critical. Adhesives distribute loads evenly, lowering stress concentrations and reducing drill-hole preparation. Hybrid joining techniques that pair bonding with fewer bolts cut installation time and part counts, trimming overall fastener demand. Fastener suppliers counteract by promoting removable designs for maintenance and by targeting safety-critical zones where torque-auditable joints remain mandatory. R&D into disassembly-friendly coatings seeks to complement adhesive use rather than compete directly.

Other drivers and restraints analyzed in the detailed report include:

- Advances in corrosion-resistant coatings

- Rapid growth of the North American EV supply chain

- Steel price volatility creates margin pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal fasteners accounted for 76.80% of the North America industrial fasteners market in 2025, reflecting their strength-to-cost advantage in construction, machinery, and transportation. Carbon-steel bolts anchor highway bridges, while stainless grades service food-processing and pharmaceutical plants. Aluminum fasteners support aerospace panels and EV battery enclosures where weight savings offset higher unit prices. Despite dominance, cyclical shifts in steel prices can compress margins, prompting producers to automate secondary operations and tighten scrap control. The segment continues to benefit from standardized specifications that simplify procurement across state and provincial lines.

Composite and specialty materials represent the fastest-growing slice at a 5.14% CAGR through 2031. Glass-fiber reinforced polymers, ceramics, and high-temperature alloys fill performance gaps where metals suffer corrosion, electrical conductivity, or magnetic interference. In offshore wind nacelles, carbon-fiber studs resist seawater attack without sacrificial coatings. Semiconductor fabs specify PEEK screws to avoid particle shedding inside cleanrooms. Growth hinges on continued material-science breakthroughs and expanded molding capacity near end-markets to shorten lead times. Price premiums limit volume penetration today, yet adoption rises steadily as life-cycle cost analyses favor non-metallic options in harsh environments. These dynamics fortify the long-term outlook for the North America industrial fasteners market.

Standard-grade hardware supplied to lumber yards, maintenance shops, and bulk distributors captured 62.10% of the North America industrial fasteners market size in 2025. Large-diameter hex bolts, coarse-thread screws, and nails ship in high-volume keg packs to support routine repair and erection work. Automated cold-heading lines deliver economies of scale, allowing competitive pricing that resists import pressure. Nevertheless, commoditization breeds thin margins and exposes producers to raw-material swings.

High-performance fasteners are projected to grow 4.98% annually as aerospace, defense, and energy sectors specify heat-resistant alloys, close-tolerance threads, and proprietary coatings. Super-alloy studs secure jet-engine casings, while duplex-stainless bolts fasten subsea pipelines subjected to cyclic pressure. Qualification regimes such as AS9100 and NADCAP extend lead times but lock in suppliers once approved, enabling attractive returns. Many firms adopt additive-manufacturing pilots to prototype complex geometries without costly tooling. Expanded use of such specials lifts value density, bolstering revenue even if tonnage lags, and supports the premium tier of the North America industrial fasteners market.

The North America Industrial Fasteners Market is Segmented by Material (Metal, Plastic, and Composite and Specialty), Grade (Standard and High-Performance), Product Type (Externally Threaded, Internally Threaded, and More), End-User Application (OEM, MRO, and Construction), Coating/Finish (Plain, Zinc-Plated, and More), and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Illinois Tool Works Inc.

- Howmet Aerospace Inc.

- Stanley Black and Decker, Inc.

- Wurth Group

- Fastenal Company

- Fontana Gruppo (Acument Global Technologies, Inc.)

- LISI Group

- Nifco Inc.

- Bulten AB

- ARaymond Group

- Marmon Holdings, Inc. (Berkshire Hathaway)

- Hilti Corporation

- KAMAX Holding GmbH and Co. KG

- Bossard Holding AG

- PennEngineering and Manufacturing Corp.

- Simpson Manufacturing Co., Inc.

- Precision Castparts Corp. (SPS Technologies)

- TriMas Corporation

- Agrati Group

- SFS Group AG

- Optimas Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of the Construction Sector

- 4.2.2 Expansion of Automotive and Aerospace Manufacturing

- 4.2.3 Advances in Corrosion-Resistant Coatings

- 4.2.4 Rapid Growth of North American EV Supply Chain

- 4.2.5 Buy-American Acts Driving Local Sourcing

- 4.2.6 Digital Traceability and Smart-Fastener Initiatives

- 4.3 Market Restraints

- 4.3.1 Rising Adoption of Structural Adhesives

- 4.3.2 Volatility in Steel and Non-Ferrous Metal Prices

- 4.3.3 Stringent Environmental Regulations on Plating

- 4.3.4 Reshoring-led Capacity Bottlenecks for Specials

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Plastic

- 5.1.3 Composite and Specialty

- 5.2 By Grade

- 5.2.1 Standard

- 5.2.2 High-Performance

- 5.3 By Product Type

- 5.3.1 Externally Threaded

- 5.3.2 Internally Threaded

- 5.3.3 Non-Threaded

- 5.3.4 Application-Specific/Specialty

- 5.4 By End-User Application

- 5.4.1 OEM

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.1.1.1 ICE Light Vehicles

- 5.4.1.1.2 ICE Medium and Heavy Trucks/Buses

- 5.4.1.1.3 Electric Vehicles

- 5.4.1.2 Aerospace

- 5.4.1.3 Machinery and Capital Goods

- 5.4.1.4 Electrical and Electronics

- 5.4.1.5 Fabricated Metals

- 5.4.1.6 Medical Equipment

- 5.4.1.7 Other OEM Applications

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.2 Maintenance, Repair and Operations (MRO)

- 5.4.3 Construction

- 5.4.1 OEM

- 5.5 By Coating/Finish

- 5.5.1 Plain (Uncoated)

- 5.5.2 Zinc-Plated

- 5.5.3 Hot-Dip Galvanized

- 5.5.4 PTFE and Specialty Coatings

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Illinois Tool Works Inc.

- 6.4.2 Howmet Aerospace Inc.

- 6.4.3 Stanley Black and Decker, Inc.

- 6.4.4 Wurth Group

- 6.4.5 Fastenal Company

- 6.4.6 Fontana Gruppo (Acument Global Technologies, Inc.)

- 6.4.7 LISI Group

- 6.4.8 Nifco Inc.

- 6.4.9 Bulten AB

- 6.4.10 ARaymond Group

- 6.4.11 Marmon Holdings, Inc. (Berkshire Hathaway)

- 6.4.12 Hilti Corporation

- 6.4.13 KAMAX Holding GmbH and Co. KG

- 6.4.14 Bossard Holding AG

- 6.4.15 PennEngineering and Manufacturing Corp.

- 6.4.16 Simpson Manufacturing Co., Inc.

- 6.4.17 Precision Castparts Corp. (SPS Technologies)

- 6.4.18 TriMas Corporation

- 6.4.19 Agrati Group

- 6.4.20 SFS Group AG

- 6.4.21 Optimas Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet Need Assessment