PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911444

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911444

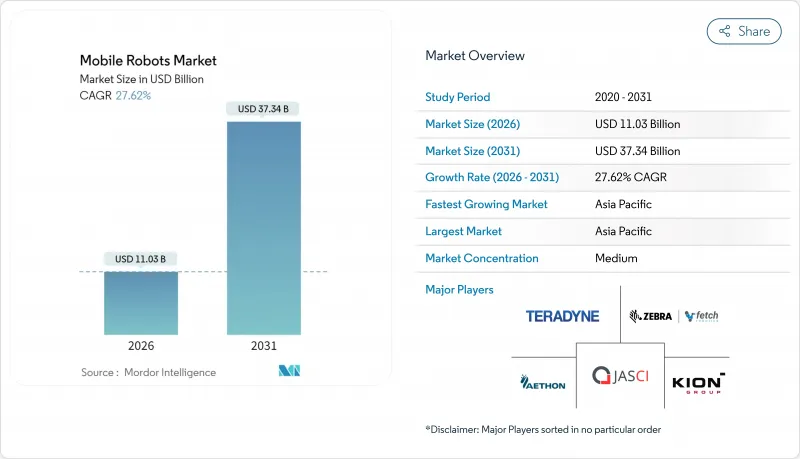

Mobile Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Mobile Robots Market size in 2026 is estimated at USD 11.03 billion, growing from 2025 value of USD 8.64 billion with 2031 projections showing USD 37.34 billion, growing at 27.62% CAGR over 2026-2031.

This steep growth reflected sustained e-commerce order volumes, accelerated 5G roll-outs, and rapid artificial-intelligence improvements that collectively turned mobile robots from pilot projects into core operating assets. Enterprises faced chronic labour shortages and longer operating hours, prompting large-scale fleet deployments that reduced overtime costs and improved fulfilment reliability. Technology vendors responded with lower-cost sensor suites, subscription battery services, and cloud fleet orchestration software, further lowering adoption barriers for midsize facilities. Competitive intensity sharpened as logistics providers raced to standardize on next-generation robots, creating scale advantages for manufacturers with certified navigation, safety, and service capabilities.

Global Mobile Robots Market Trends and Insights

Surge in e-commerce warehouse automation

Larger retailers retrofitted distribution hubs with hundreds of AMRs to process surging online orders. DHL Supply Chain surpassed 500 million collaborative picks after tripling its Locus fleet across Europe, a milestone reached in nearly half the earlier time frame. Walmart committed USD 22 billion to five automated grocery campuses averaging 700,000 ft2, positioning two-thirds of its stores to rely on robotic fulfilment by early 2026. Throughputs rose sharply: GEODIS recorded 98+ picks per hour versus 65 previously, while Saddle Creek Logistics doubled output after integrating AMRs. These productivity gains locked mobile robots market adoption into long-term fulfilment roadmaps, shifting labour to higher-wage supervisory roles and enabling same-day shipping across multi-level facilities.

Rising labour-cost and skilled-worker shortages

Ageing workforces and tight labour markets prompted factories to automate repetitive, high-strain tasks. Bertel O. Steen quadrupled storage capacity and achieved 99.7% uptime with a 47-robot AutoStore grid, easing head-count pressures during peak seasons. Boots Warehouse reported higher employee satisfaction once heavy cart transport duties shifted to AMRs. Around-the-clock robot fleets eliminated overtime premiums and reduced absenteeism, critical in Europe where demographic trends compress the available workforce.

High CAPEX and ROI uncertainty

The total installed cost for an industrial mobile robot averaged USD 150,000 per unit after peripherals and integration, discouraging smaller facilities from immediate upgrades. Midsize warehouses struggled to model intangible benefits such as lower turnover and improved safety, extending evaluation cycles beyond two fiscal years. Subscription financing models emerged but faced scepticism regarding the long-term cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Advances in AI and sensor-fusion cutting autonomy costs

- 5G private networks enabling large-fleet orchestration

- Shortage of safety-certified AMR software frameworks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AMRs retained 51.88% revenue in 2025, reflecting their infrastructure-light deployment model and proven ROI in goods-to-person fulfilment. The mobile robots market size for AMRs is forecast to climb from USD 5.7 billion in 2026 to USD 17.89 billion by 2031 at a 25.7% CAGR. AMMRs, which integrate six-axis manipulators, are projected to achieve a USD 9.15 billion mobile robots market size by 2031 following a 34.1% CAGR, offering value in kitting, machine tending, and clean-room operations.

Dynamics within the mobile robots market emphasised modular hardware and low-code programming that accelerated redeployment between workflows. Standard Bots secured USD 63 million to commercialise arm-equipped platforms capable of line-side replenishment and palletisation, signalling venture confidence in manipulation-plus-mobility solutions . AGVs kept niche relevance in high-throughput, fixed-path settings, while UGVs fulfilled hazardous-area inspection, and UAVs commenced inventory audit pilots in high-bay warehouses.

Self-driving forklifts represented 37.78% of 2025 revenue as brownfield sites retrofitted familiar equipment with autonomy kits to reduce change-management hurdles. This sub-segment is forecast to reach USD 12.49 billion by 2031, equal to 33.45% of the projected mobile robots market size for form factors. Assembly-line mobile platforms are expected to post the quickest gain, expanding at 32.0% CAGR on demand from automakers transitioning to multi-model lines.

Tow-tractor robots found traction in aerospace and airport logistics, where tug capacity and precise queuing mattered more than speed. Unit-load and cart robots expanded rapidly inside micro-fulfilment centres, pairing with advanced racking to shorten walk steps. Hesai's ability to ship 100,000 LiDAR units per month lowered sensor ASPs, making autonomy options viable even for entry-level carts.

The Global Mobile Robots Market Report is Segmented by Product Type (AGV, AMR, and More), Form Factor (Self-Driving Forklifts, Tow/Tractor/Tug Robots, and More), Navigation Technology (LiDAR-Based SLAM, QR/Fiducial Codes, and More), End-Use Industry (Warehousing and Distribution, Manufacturing, Food and Beverage, and More), Payload Capacity (<100 Kg, 100 - 500 Kg, 500 - 1 000 Kg, < 1 000 Kg), and Geography.

Geography Analysis

Asia-Pacific retained 42.85% of 2025 revenue and is forecast to post a 30.4% CAGR through 2031, buoyed by China's industrial policy and the country's aim to reach USD 108 billion robotics output by 2028 . Chinese vendors such as Unitree strengthened export channels, while Japanese and South Korean suppliers refined sensor modules that lowered total cost of ownership. India's Production-Linked Incentive scheme, coupled with rising e-commerce penetration, triggered proof-of-concept fleets in apparel fulfilment centers.

North America ranked second, led by United States deployments across omnichannel retail, parcel sorting, and brownfield manufacturing retrofits. Walmart's automation roadmap, DHL's record pick rates, and GEODIS's Mexico expansion collectively validated scaling strategies for cross-border supply chains. Canadian cold-chain facilities piloted AMMRs for temperature-sensitive pharma packaging, leveraging government incentives for advanced manufacturing.

Europe adopted a measured pace, influenced by stringent CE marking and upcoming EU Machinery Regulation 2023/1230 requirements. German automakers integrated camera-LiDAR fusion platforms within EV battery lines, while Nordic grocery chains mandated carbon-neutral robot fleets to meet 2030 climate targets. Middle East and Africa remained nascent but attracted pilots in petrochemical inspection and free-zone logistics, benefiting from infrastructure corridors that bundled 5G networks with warehouse builds.

- Teradyne Inc

- Geek+ Inc

- KION Group AG

- Toyota Industries Corp

- Daifuku Co Ltd

- Boston Dynamics Inc

- Fetch Robotics Inc (Zebra Technologies)

- 6 River Systems Inc (Shopify)

- AutoStore AS

- GreyOrange Pte Ltd

- Balyo SA

- Locus Robotics Corp

- Vecna Robotics Inc

- Seegrid Corp

- Hikrobot Technology Co Ltd

- Aethon Inc (ST Engineering)

- Clearpath Robotics Inc.

- Magazino GmbH

- Seer Robotics Co Ltd

- Youibot Robotics Co Ltd

- Bastian Solutions LLC

- JASCI LLC

- inVia Robotics Inc

- IAM Robotics LLC

- SCOTT Technology Ltd

- John Bean Technologies Corp

- Murata Machinery Ltd

- Omron Corp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce warehouse automation

- 4.2.2 Rising labour-cost and skilled-worker shortages

- 4.2.3 Advances in AI and sensor-fusion cutting autonomy costs

- 4.2.4 5G private networks enabling large-fleet orchestration

- 4.2.5 Battery-as-a-service lowering upfront CAPEX

- 4.2.6 Carbon-neutral logistics retrofits accelerating deployments

- 4.3 Market Restraints

- 4.3.1 High CAPEX and ROI uncertainty

- 4.3.2 Legacy-site connectivity limitations

- 4.3.3 Shortage of safety-certified AMR software frameworks

- 4.3.4 Semiconductor and LiDAR supply-chain volatility

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Automated Guided Vehicles (AGV)

- 5.1.2 Autonomous Mobile Robots (AMR)

- 5.1.3 Autonomous Mobile Manipulation Robots (AMMR)

- 5.1.4 Unmanned Ground Vehicles (UGV)

- 5.1.5 Unmanned Aerial Vehicles (UAV - indoor logistics)

- 5.2 By Form Factor

- 5.2.1 Self-driving Forklifts

- 5.2.2 Tow / Tractor / Tug Robots

- 5.2.3 Unit-Load and Cart Robots

- 5.2.4 Assembly-Line Mobile Platforms

- 5.3 By Navigation Technology

- 5.3.1 LiDAR-based SLAM

- 5.3.2 QR / Fiducial Codes

- 5.3.3 Camera-Only Vision

- 5.3.4 Hybrid (LiDAR + Vision)

- 5.3.5 Magnetic / Reflector Guidance

- 5.4 By End-use Industry

- 5.4.1 Warehousing and Distribution

- 5.4.2 Manufacturing

- 5.4.3 Food and Beverage

- 5.4.4 Pharmaceuticals and Healthcare

- 5.4.5 Other Industries

- 5.5 By Payload Capacity

- 5.5.1 < 100 kg

- 5.5.2 100 - 500 kg

- 5.5.3 500 - 1 000 kg

- 5.5.4 > 1 000 kg

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Teradyne Inc

- 6.4.2 Geek+ Inc

- 6.4.3 KION Group AG

- 6.4.4 Toyota Industries Corp

- 6.4.5 Daifuku Co Ltd

- 6.4.6 Boston Dynamics Inc

- 6.4.7 Fetch Robotics Inc (Zebra Technologies)

- 6.4.8 6 River Systems Inc (Shopify)

- 6.4.9 AutoStore AS

- 6.4.10 GreyOrange Pte Ltd

- 6.4.11 Balyo SA

- 6.4.12 Locus Robotics Corp

- 6.4.13 Vecna Robotics Inc

- 6.4.14 Seegrid Corp

- 6.4.15 Hikrobot Technology Co Ltd

- 6.4.16 Aethon Inc (ST Engineering)

- 6.4.17 Clearpath Robotics Inc.

- 6.4.18 Magazino GmbH

- 6.4.19 Seer Robotics Co Ltd

- 6.4.20 Youibot Robotics Co Ltd

- 6.4.21 Bastian Solutions LLC

- 6.4.22 JASCI LLC

- 6.4.23 inVia Robotics Inc

- 6.4.24 IAM Robotics LLC

- 6.4.25 SCOTT Technology Ltd

- 6.4.26 John Bean Technologies Corp

- 6.4.27 Murata Machinery Ltd

- 6.4.28 Omron Corp

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment